- Home

- »

- Homecare & Decor

- »

-

U.S. Cat Litter Products Market Size, Industry Report, 2030GVR Report cover

![U.S. Cat Litter Products Market Size, Share & Trends Report]()

U.S. Cat Litter Products Market Size, Share & Trends Analysis Report By Product Type (Clumping, Conventional), By Raw Material (Clay, Silica), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-232-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Cat Litter Products Market Trends

The U.S. cat litter products market size was estimated at USD 4.36 billion in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. The rising cat ownership rates along with rising pet expenditures in the U.S. are predicted to have a beneficial effect on market expansion. In a 2022 American Pet Products Association (APPA) survey of pet owners, two thirds of participants stated they considers their animals when setting financial objectives. Pet owners show a commitment to giving their animals the necessary care, such as food (75%) and brand loyalty (56%).

In the U.S., adopting pets became more popular, particularly during the pandemic when people stayed at home more often. American Pet Products Association (APPA) data shows that the percentage of homes with pets climbed from 67% in 2019 to 70% in 2020. It is anticipated that the demand for cat litter in the U.S. would rise further as pet owners place a higher priority on the health, cleanliness, and welfare of their animals. In this industry, businesses who provide premium, environmentally friendly cat litter products could anticipate steady development and success.

Spending by consumers on their dogs has increased more than in the past. The American Pet Products Association (APPA) reports that pet owners in the United States spent a record USD 103.6 billion on high-quality items for their cats in 2020, setting a new record for pet spending. Additionally, as cats get older, scented cat litter products can cause allergies in them more frequently. As a result, customers frequently choose for odor-reducing and artificially odorless items.

U.S. enterprises are reaching a wider audience worldwide by supplying cat litter goods through partnerships with online or offline distribution channels. For example, Purina Tidy Cats introduced LightWeight Free & Clean cat litter on Loop, a global marketplace for household goods and consumables, in November 2020. The product was first offered for sale in ten states such as, New York, New Jersey, Maryland, Pennsylvania, Connecticut, Vermont, Rhode Island, Massachusetts, Delaware, and the District of Columbia, through Loop's online store.

The industry is growing as a result of the growing number of people choosing cats as their preferred pets in different parts of the world. For example, according to data released by the American Pet Product Association, 42.7 million cats were owned in the US in 2019 and 2020. The demand is also being driven up by the growing number of millennial pet owners who are knowledgeable about the different pet products available on the market. For example, the American Veterinary Medical Association announced in May 2019 that millennials account for over 80% of pet owners in the U.S.

However, the use of ecologically unfavorable raw materials to make cat litter is impeding the market's expansion. For example, silica-based crystal cat litter has been shown to be detrimental to the environment.

Market Concentration & Characteristics

Technological innovations in cat litter products include the incorporation of moisture-activated indicators and dust-free formulae, which improve convenience and solve typical problems with conventional litters. Businesses are spending money creating cat litters with alternative materials including paper, corn, walnut shells, and natural wood in order to satisfy consumers who care about the environment and sustainability.

The market for cat litter products has seen a significant amount of merger and acquisition activity as leading firms look to broaden their product lines and market share. To improve distribution networks, obtain access to new technology, and take advantage of synergies, businesses have made strategic mergers and acquisitions.

The three main areas of regulation in the cat litter product market are product safety, environmental effect, and labeling regulations. Regulation organizations keep a close check on the materials used in cat litters, enforcing strict rules on potentially dangerous compounds to protect pet and environmental safety. Furthermore, labeling requirements require precise and unambiguous information on product composition, safety warnings, and usage instructions.

In the market for cat litter goods, natural fibers including corn, wheat, and walnut shells, as well as wood pellets and paper-based litters, are the most common product substitutes. Furthermore, because of their high absorbency and ability to manage odors, silica gel and crystal-based litters are becoming more and more well-liked alternatives.

Product Type Insights

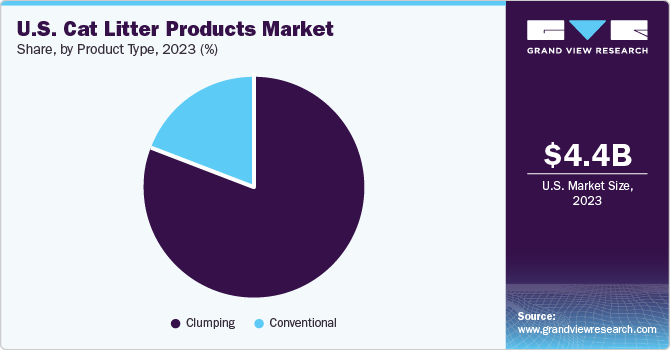

The clumping cat litter products market in the U.S. accounted for 81.4% of the market share in 2023. Customers are becoming more interested in clumping litter since it makes it simple to remove cat waste and pee without needing to empty the litter box. Furthermore, during the course of the projection period, clumping cat litter's growing popularity due to its usefulness and many advantages would probably attract buyer attention and upsurge product sales. Cat owners generally prefer hard-clumping cat litter.

The U.S. conventional cat litter products market is projected to grow at a CAGR of 3.1% from 2024 to 2030. Growing customer preference for completely eliminating the smell of cat poop and pee is driving demand for traditional litter products. The increasing preference of consumers for inexpensive litter products due to their frequent use is driving up sales of traditional cat litter. Conventional cat litter is made of wood chips and non-biodegradable clay matter, calcium silicate, and clay crystals. Blue Buffalo Naturally Fresh offers non-clumping cat litter made from walnut shells. The litter is environmentally friendly, biodegradable, and offers superior odor control. It is free from harmful chemicals and synthetic fragrances.

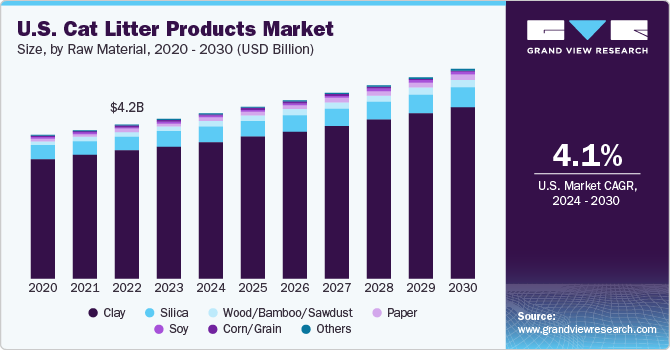

Raw Material Insights

The U.S. clay cat litter market held 82.7% of the market share in 2023. The rise in the market can be attributed to the growing use of clay in cat litter products, as its high absorbency and solid-formation properties support this trend. In addition, clay-based products are more affordable than other materials, which is why middle-class and multi-cat households favor them. These products also have no smell and no dust, which decreases the prospect of respiratory problems.

The demand for wood/bamboo/sawdust-based cat litter products is anticipated to grow at a CAGR of 7.1% from 2024 to 2030. The market for wood-based cat litter products is expanding as customers place a higher value on eco-friendly and sustainable options. The environmentally friendly, multipurpose, and effectively generated pellets are made from reclaimed softwood. A variety of ökocat wood-based clumping and non-clumping cat litters are available from the pet care product brand Healthy Pet. The specifically crafted micro wood pellets in the line of environmentally friendly and biodegradable cat litter are well-known for their superior moisture-absorbing capabilities.

Distribution Channel Insights

Cat litter sales through supermarkets and hypermarkets channels accounted to the market share of 40.1% in 2023. Due to numerous retail discounts and offers, pet owners choose to buy pet care, food, and grooming supplies through these channels because they are less expensive than prescription-based products. Based on study results that were featured in a February 2020 post by Global Pet Industry, 37% of cat owners chose Walmart as their place to buy litter between 2019 and 2020, making it clear that Walmart was the top option for cat owners. Apart from Walmart, big stores such as Target and Kmart were also popular places for buying cat litter, with around 25% of cat owners choosing them for litter shopping.

The online sales of cat litter products is expected to grow at a CAGR of 5.0% from 2024 to 2030. In the upcoming years, there will likely be a significant demand for cat litter products through the online/E-commerce channel. Online platforms have made it possible for manufacturers to check finances, expand their consumer base, communicate better, and increase brand awareness at a reasonable cost. The cat litter market now offers multiple development paths and an engaged customer base that wants to shop online thanks to digitalization. Customers can buy cat litter directly from several manufacturers' websites, including Arm & Hammer, World's Best Cat Litter, and Purina Tidy Cats.

Key U.S. Cat Litter Products Company Insights

There are both fresh entrants and a few established businesses in the industry. In order to preserve market share, industry participants are growing and diversifying their businesses, launching new products, and using other tactics.

Key U.S. Cat Litter Products Companies:

- Nestlé S.A.

- The Clorox Company

- Mars, Incorporated

- Oil-Dri Corporation of America

- Church & Dwight Co., Inc.

- Kent Corporation

- Intersand

- Dr. Elsey's

- Weihai Pearl Silica Gel Co., Ltd.

- Pettex Limited

Recent Developments

-

In August 2023, OdourLock MaxCare is a health-monitoring cat litter that Intersand brought to the UK market. This premium litter helps cat owners recognize common health conditions including diabetes and urinary disorders by including diagnostic Blücare granules, which change color when they are exposed to blood or glucose in the urine. The litter is also dust-free and has ammonia-blocking properties to eliminate odors.

-

In April 2023, Dr. Elsey's took part in the US-hosted Global Pet Expo. The well-liked The pine tree litter, which is composed entirely of kiln-dried pine pellets, and Ultra+ litter, which is intended to suppress strong aromas, are among the company's new goods for 2023.

U.S. Cat Litter Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.52 billion

Revenue forecast in 2030

USD 5.74 billion

Growth Rate

CAGR of 4.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, raw material, distribution channel

Country scope

U.S.

Key companies profiled

Nestlé S.A.; The Clorox Company; Mars, Incorporated; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cat Litter Products Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. cat litter products market on the basis of product type, raw materials, and distribution channel.

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clumping

-

Conventional

-

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clay

-

Silica

-

Wood/Bamboo/Sawdust

-

Paper

-

Soy

-

Corn/Grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Retail Stores

-

Convenience Stores

-

Online/E-commerce

-

Frequently Asked Questions About This Report

b. Clumping cat litter products dominated the U.S. cat litter products market with a share of around 81.4% in 2023. Customers are becoming more interested in clumping litter since it makes it simple to remove cat waste and pee without needing to empty the litter box.

b. Some of the key players operating in the U.S. cat litter products market include Nestlé S.A.; The Clorox Company; Mars, Incorporated; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

b. The market growth is being significantly influenced by the recent trend of pet humanization, which involves giving pets more attention and cleanliness. In addition, rising cat owners' spending on pet supplies is another reason that is contributing to an increase in the market for cat litter.

b. The U.S. cat litter products market was estimated at USD 4.36 billion in 2023 and is expected to reach USD 4.52 billion in 2024.

b. The U.S. cat litter products market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 5.74 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."