- Home

- »

- Consumer F&B

- »

-

Wheat Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![Wheat Market Size, Share & Trends Report]()

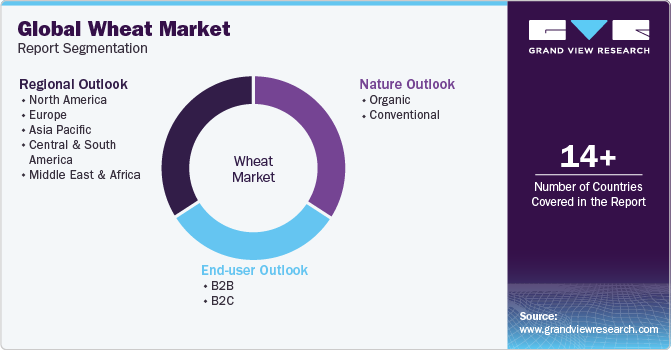

Wheat Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By End-user (B2B, B2C), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-162-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wheat Market Summary

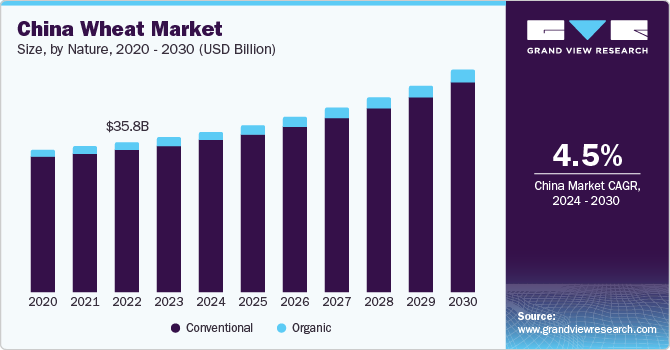

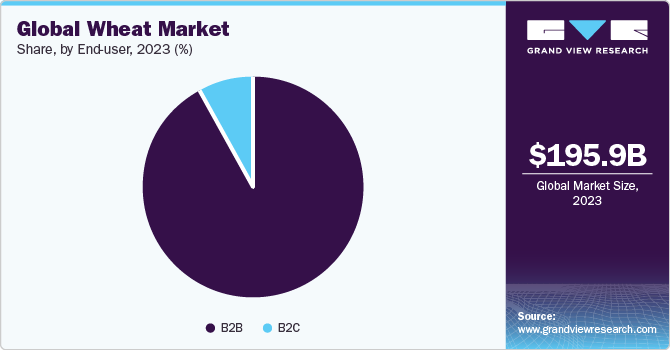

The global wheat market size was estimated at USD 195.99 billion in 2023 and is projected to reach USD 270.88 billion by 2030, growing at a CAGR of 4.28% from 2024 to 2030. Wheat is a popular ingredient in many global cuisines and is a primary source of carbohydrates and essential nutrients.

Key Market Trends & Insights

- Asia Pacific dominated the overall market for wheat in 2023 with largest revenue share of 50.7%.

- China is a leading wheat producer globally and possesses extensive agricultural land suitable for wheat cultivation.

- By nature, conventional wheat dominated with a market revenue share of 94.88% in 2023.

- By end use, the B2B segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 195.99 Billion

- 2030 Projected Market Size: USD 270.88 Billion

- CAGR (2024-2030): 4.28%

- Asia Pacific: Largest market in 2023

It is a staple crop across Asia Pacific, and its adaptability makes it suitable for a variety of dishes. It is generally used to produce flour, which is a key ingredient in bakery and pastry products. It is also used to create beverages, including wheat beers, which have gained widespread popularity globally. The strong wheat demand across the food processing industry drives wheat production globally and plays a vital role in market growth.

Nowadays, changing dietary preferences and consumption habits contribute to an increased demand for organic food products, further driving wheat demand. Also, a steadily rising demand for processed and convenience food items drives the demand for wheat products, which has resulted in an increase in its global production. According to the Second Advanced Estimates on major crop production issued by the Ministry of Agriculture and Farmers Welfare, wheat production in India was anticipated to reach 112.18 million tons in the 2022-23 period. This represents a 4.12% growth compared to the 107.74 million tons recorded in the 2021-22 period.

Global trade and accessibility play a significant role in the distribution of wheat products. Countries with different climatic conditions and changing seasons can access wheat throughout the year. The popularity of craft beer has spiked in recent years, which in turn is driving the demand for wheat beer. Sales from craft breweries have experienced a noticeable growth in recent years. In 2021, in the U.S., total beer sales by volume experienced a marginal growth of 1 percent. Meanwhile, sales from craft breweries demonstrated a more substantial growth, rising by 8 percent to reach 24.8 million barrels, as per the Brewers Association.

Also, wheat is a valuable feed for cattle as it is a critical source of protein and energy, making it a crucial component in livestock diets. The protein content of wheat is generally higher than corn, and its energy value ranges from 3.0 to 3.5 Mcal ME. With such a higher protein content, it is one of the most widely used cattle feed for dairy and poultry. Moreover, wheat farming associations and innovation centers are significant in supporting wheat farmers by providing them with valuable resources and support.

These organizations contribute significantly to enhancing wheat production, supporting farmer livelihoods, and ensuring the sustainability of wheat farming practices.For example, the Australian Export Grains Innovation Centre (AEGIC) works with Australian grain growers and researchers to develop meaningful solutions that improve the quality and marketability of the Australian grain. AEGIC also assists in developing new wheat varieties with enhanced disease resistance.

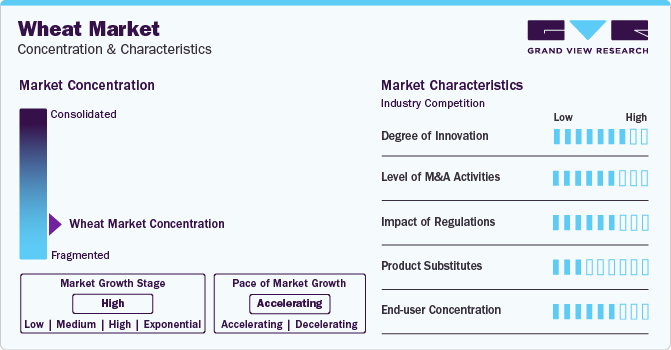

Market Concentration & Characteristics

The degree of innovation in the wheat industry is high. There is a constant stream of new technologies, practices, and varieties being developed to improve the efficiency, sustainability, and quality of wheat production. Plant breeders are continuously developing new wheat varieties with improved yield, disease resistance, and quality. They are using new technologies such as marker-assisted selection and gene editing to accelerate the breeding process.

Several market players such as Archer-Daniels-Midland (ADM), Cargill, Inc., and CHS Inc. are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Food safety regulations ensure wheat product safety and protect customers from potential health risks. These regulations establish standards for pesticide residues, mycotoxin levels, and other contaminants in wheat. Wheat cultivation and processing are subject to environmental restrictions to reduce their impact. These regulations cover water resource management, pesticide use, and garbage disposal.

In many recipes, rice flour can be used instead of wheat flour. It has a neutral flavor and texture and is created from ground rice. Corn flour is another suitable wheat flour replacement. It has a slightly sweet taste and texture and is prepared from ground corn.

Nature Insights

Conventional wheat dominated with a market revenue share of 94.88% in 2023. Conventional wheat production is widely popular, accounting for a bulk of the global wheat production. The traditional nature utilizes synthetic fertilizers and pesticides to deliver high yields, meeting global wheat requirements. Also, efficient distribution and market access for wheat products are established through conventional wheat farming as it focuses on a well-established supply chain. Moreover, traditional wheat products, such as bread and pasta, are staples in many cultures, making them a familiar choice among customers.

Meanwhile, organic wheat is anticipated to witness the fastest market growth over the forecast period. This segment is experiencing rapid growth owing to increasing consumer health concerns and growing awareness regarding organically produced food crops. Organic wheat has higher fiber, minerals, proteins, and antioxidant concentrations. The growing demand for organic wheat flour to create organic bakery products has created strong demand for organic wheat. The rising consumer preference for organic and clean-label products have driven the popularity of organic wheat flour for various health benefits.

According to Organic Trade Association (OTA) estimates, in the aftermath of the COVID-19 pandemic-induced quarantines and closure of restaurants and other food service businesses, expenditures on organic flour, pasta, and bread in the U.S. saw a growth of over 12% as compared to 2020. The expenditure on such food products reached USD 6.4 billion in 2021.

End-user Insights

The B2B segment accounted for the largest revenue share in 2023. This segment is essential since it involves B2B transactions related to producing food and beverage products. The food & beverages industry is a key contributor to the B2B segment’s growth, as wheat is a fundamental ingredient in various food items such as pasta, bread, pastries, and breakfast cereals. Food processors such as bakeries engage in B2B relationships to secure a consistent and quality source of essential ingredients.

Also, the animal feed sector involves wheat as a key component in animal feed for livestock and poultry. Farms and feed mills in the animal husbandry sector engage in B2B transactions to source wheat for producing animal feed. Wheat is used in the B2B segment for various industrial applications, including producing biofuels, starch for industrial processes, and pharmaceuticals. Companies in this sector use B2B transactions to procure wheat for these specific applications.

The others category in the B2B segment encompasses diverse applications of wheat, which include cosmetics, personal care products, and construction materials. Wheat-based ingredients are used in cosmetics and personal care items, and wheat starch is used in construction materials. Wheat suppliers and companies engage in B2B transactions to source wheat.

The B2C segment is also anticipated to grow at a considerable pace during the forecast period.It comprises online and offline modes of distribution. This segment plays a crucial role in the market for wheat, serving as a direct link between wheat producers and consumers. This segment encompasses various channels through which wheat and wheat-based products reach end consumers, influencing purchasing decisions and shaping consumer perceptions of wheat.

Regional Insights

Asia Pacific dominated the overall market for wheat in 2023 with largest revenue share of 50.7%. The animal husbandry sector is one of the key contributors and extensively uses wheat as a crucial ingredient in livestock feed. Wheat is a valuable energy source for poultry, cattle, and swine. Livestock farmers and feed producers depend on wheat to create a balanced and nutritional animal feed. The Asia-Pacific region has a thriving poultry and dairy industry, and the demand for wheat for poultry feeds is driving regional market growth. As per the U.S. Department of Agriculture, the aggregate wheat consumption in key Asian nations reached 337 million tons in 2021, marking a 34% increase from the levels recorded in 2010.

China is a leading wheat producer globally and possesses extensive agricultural land suitable for wheat cultivation. The Chinese government supports wheat production through agricultural policies, subsidies, and initiatives. Also, the country has adopted modern farming practices and technologies to enhance wheat productivity. The use of improved seeds, fertilizers, and farming equipment has contributed to the overall wheat production in the economy. According to the latest Grain Market Report published in June 2023, the International Grains Council (IGC) projected China's wheat production to reach 139 million tons for the 2023-24 period, indicating a 1% y-o-y increase.

Europe held a significant market share in 2023. The consumption of ready-to-eat food and beverages in Europe has experienced a notable increase. This surge has led to a significant rise in the demand for convenience foods, consequently driving the demand for wheat.The recent rise of new micro and small breweries is a crucial indicator of the industry's potential for innovation and has led to the expansion of home beer brewing practices in the region. According to The Brewers of Europe, beer consumption in Europe in 2021 was 342,212 thousand hectoliters, a 0.25% increase over 2020.

North America is expected to expand at a steady growth rate during the forecast period. New technologies, such as precision agriculture and gene editing, are expected to be adopted by wheat farmers in North America in the coming years. These technologies are expected to help to improve wheat yields and reduce environmental impact. Consumers are increasingly interested in healthier food options, and this is driving demand for organic and whole wheat products.

Key Companies & Market Share Insights

China National Cereals, Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); and Cargill, Inc. are some of the dominant players operating in wheat market.

-

China National Cereals, Oils and Foodstuffs Corporation (COFCO) is a leading food and agriculture multinational corporation headquartered in China. It is one of the largest food companies in the world, with operations in over 160 countries and territories.

-

Archer-Daniels-Midland (ADM) is an American multinational food and agriculture corporation headquartered in Chicago, Illinois. It is the world's largest agricultural processor and food ingredient provider.

-

Cargill, Incorporated is an American multinational corporation that specializes in trading, processing, and distribution of agricultural products and commodities.

The Scoular Company and Adani Wilmar are some of the emerging market players functioning in wheat market.

-

Scoular has expanded its operations into new markets around the world, including China, India, and Brazil.

-

Adani Wilmar is an emerging player in the global edible oil and agri-business industry. The company has a strong presence in India and Indonesia, and it is expanding its operations

-

into other markets around the world.

Key Wheat Companies:

- China National Cereals, Oils and Foodstuffs Corporation (COFCO)

- Archer-Daniels-Midland (ADM)

- Cargill, Inc.

- CHS Inc.

- Bunge

- Glencore

- Louis Dreyfus Company

- Ardent Mills

- The Scoular Company

- Munsa

- Nisshin Seifun Group Inc.

- SENSAKO

- The Soufflet Group

- Adani Wilmar

- Adecoagro

Recent Developments

-

In June 2022, the University of Minnesota introduced a hard red spring variety of wheat named 'MN-Rothsay.' The new wheat variety features an excellent blend of yield, protein content, disease resistance, and robust straw strength.

-

In May 2022, the Gujarat Co-operative Milk Marketing Federation (GCMMF) entered the organic whole wheat flour market by introducing the Amul organic atta. This expansion into the organic atta segment represents a strategic move by GCMMF to cater to the growing consumer demand for organic and health-conscious food options.

-

In February 2022, Inari, a SEEDesign company, and InterGrain, a prominent Australian cereal breeding company, forged a strategic collaboration aimed at enhancing the yield potential of wheat. This partnership seeks to improve the long-term viability of the crop in the face of a progressively variable climate.

Wheat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 202.01 billion

Revenue forecast in 2030

USD 270.88 billion

Growth rate

CAGR of 4.28% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Indonesia; Brazil; South Africa

Key companies profiled

China National Cereals, Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); Cargill, Inc.; CHS Inc.; Bunge; Glencore; Louis Dreyfus Company; Ardent Mills; The Scoular Company; Munsa; Nisshin Seifun Group Inc.; SENSAKO; The Soufflet Group; Adani Wilmar; Adecoagro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wheat Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wheat market report on the basis of nature, end-user, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Food & Beverages

-

Animal Feed

-

Industrial Use (Biofuels, Starch, Adhesives, Pharmaceuticals)

-

Others (Cosmetics, Personal care products, and Construction materials)

-

-

B2C

-

Offline

-

Online

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wheat market was estimated at USD 195.99 billion in 2023 and is expected to reach USD 202.01 billion in 2024.

b. The global wheat market size was valued at USD 195.99 billion in 2023 and is anticipated to grow at a CAGR of 4.28% over the forecast period.

b. Conventional wheat segment accounted for the largest revenue share of over 80% in 2023. Conventional wheat production is a widely popular wheat cultivation, accounting for most global wheat production. The traditional nature of wheat production utilizes synthetic fertilizers and pesticides to deliver high yields, meeting the increased wheat requirement worldwide.

b. China National Cereals, Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); and Cargill, Inc. are some of the dominant players operating in wheat market.

b. Wheat is a popular ingredient in many global cuisines and is a primary source of carbohydrates and essential nutrients. It is a staple crop across the Asia Pacific region, and its adaptability makes it suitable for various dishes. It is generally used to produce flour, a key ingredient for bakery and pastry products. It is also used to create beverages, including wheat beers, which have gained widespread popularity worldwide. The overall demand for wheat across the food processing industry drives wheat production globally and plays a key role in market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.