- Home

- »

- Homecare & Decor

- »

-

Cat Litter Products Market Size, Share, Industry Report, 2030GVR Report cover

![Cat Litter Products Market Size, Share & Trends Report]()

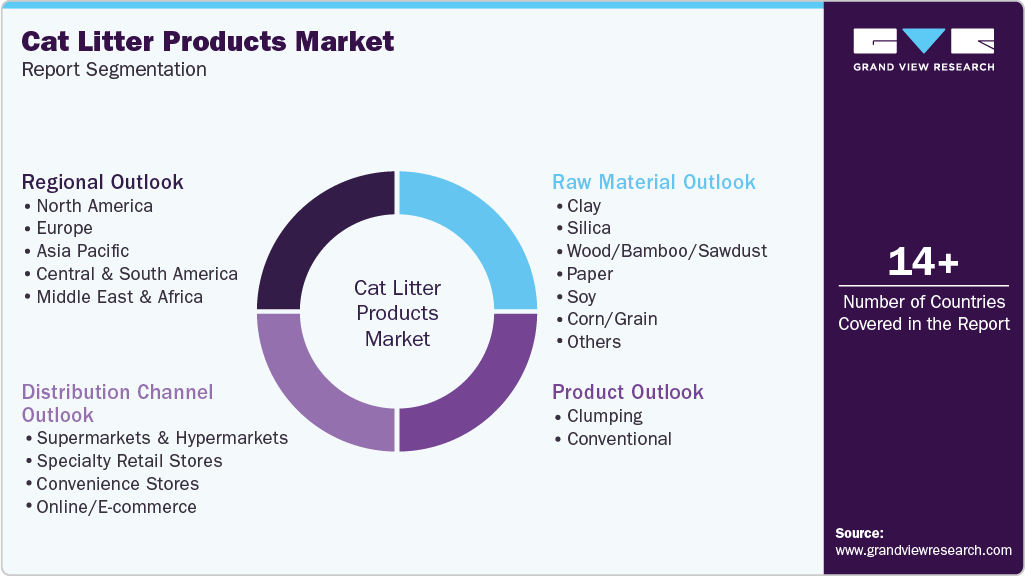

Cat Litter Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Clumping, Conventional), By Raw Material (Clay, Silica, Wood/Bamboo/Sawdust), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-134-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cat Litter Products Market Summary

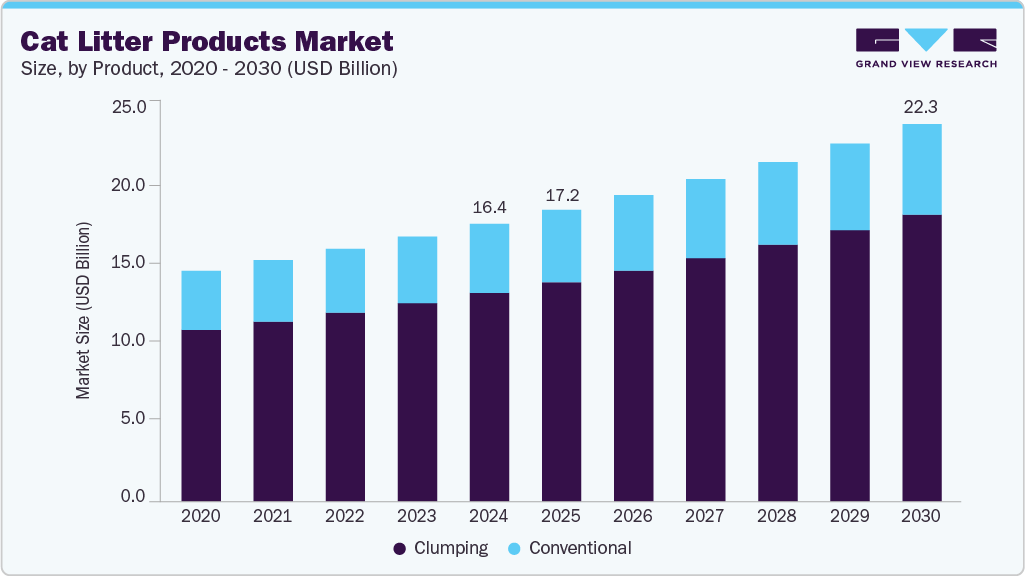

The global cat litter products market size was estimated at USD 16.41 billion in 2024 and is projected to reach USD 22.31 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The increasing cat population and rising cat ownership are key factors driving the growth of this market.

Key Market Trends & Insights

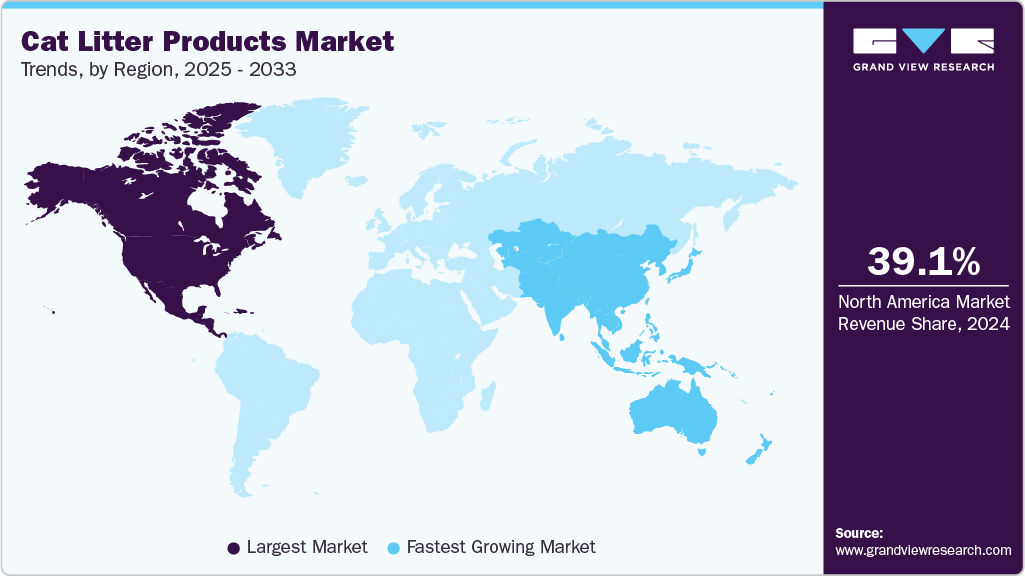

- The North America cat litter products industry accounted for a share of about 39.1% of the global revenue in 2024.

- The Asia Pacific market for cat litter products is projected to grow at a CAGR of 7.0% from 2025 to 2030.

- By product, the clumping segment accounted for a market share of around 75.0% in 2024.

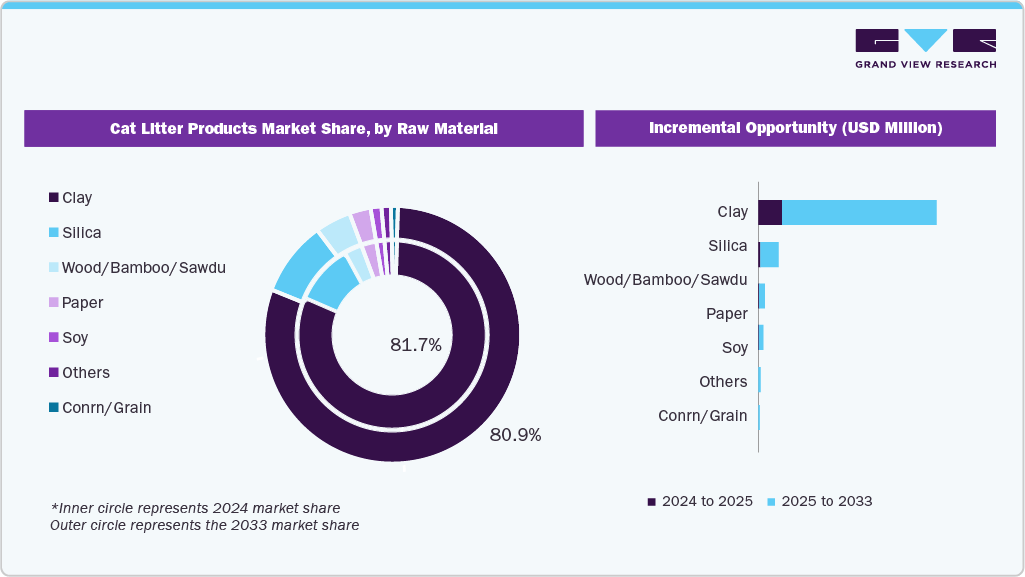

- By raw material, the clay segment accounted for a market share of 81.7% in 2024.

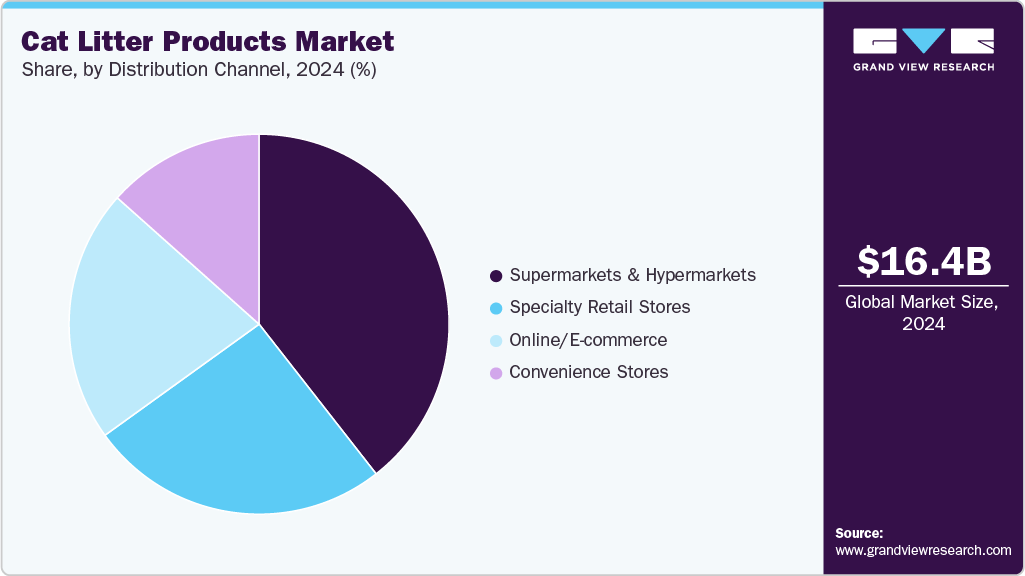

- By distribution channel, the supermarkets and hypermarkets segment dominated the market with a revenue share of 39.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.41 Billion

- 2030 Projected Market Size: USD 22.31 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the rapidly growing trend of pet humanization has strongly fueled the demand for high-quality and premium cat litter products. Innovations in cat litter products, such as clumping litter, scented options, lightweight formulations, and alternative litter materials, are driving the market growth.Another key driver is the shift toward premium and specialized cat litter products. Consumers increasingly seek eco-friendly, natural, and low-dust options that are safer for pets and the environment. This has encouraged manufacturers to develop new materials and designs with better performance, longer usage, and minimal environmental impact.

The cat litter products industry is experiencing growth due to the introduction of innovative products, such as paper-based and scented cat litter. Traditional cat litter products require cat owners to collect and dispose of the litter in plastic bags, which can be inconvenient. However, paper-based cat litter, made from materials similar to toilet paper, offers the advantage of easy disposal in the toilet. In addition, scented cat litter is gaining traction in the market, benefiting from the overall increase in demand for scented consumer products. With convenience being a priority for pet owners, the online retail channel has witnessed a surge in cat litter sales.

Consumers prefer cat litter that is biodegradable, renewable, and does not contain chemicals or any fragrances. Companies are therefore investing in research and development (R&D) to introduce new natural products that are safe and efficient at the same time. Consumers want natural cat litter with functions and features similar to clay-based litter. This means the product should be easy to clean and scoop and offer efficient odor control. Sustainably Yours, a U.S.-based natural cat litter brand, mixes cassava and corn to develop sustainable and renewable cat litter with exceptional performance. The unique formulation results in cat litter with outstanding odor-control and clumping properties, making it easy to scoop and clean.

Pet adoption initiatives are pivotal in promoting pet ownership and boosting revenue for pet care product manufacturers. These initiatives raise awareness about the benefits of pet adoption, encourage responsible pet ownership, and provide resources to prospective pet owners. According to a report published by Shelter Animals Count, in 2024, 4,192,443 dogs and cats were adopted, about 2 million of each representing a modest 0.4% increase (17,153 more adoptions) compared to 2023. Cat adoptions increased by 2% in 2024, adding nearly 39,000 more adoptions compared to 2023, and exceeded 2019 levels by 3%, or approximately 57,000 additional adoptions.

Market players have been expanding their offerings to capitalize on the prevailing trends, enabling them to meet growing demand. According to a report published by BridgeTower Media, in September 2025, Minerals Technologies Inc. announced its investment in upgrades at three of its plants to expand its pet care business, SIVO. The upgrades, expected to be completed by the end of 2025, will create facilities to produce high-quality cat litter and meet growing customer demand.

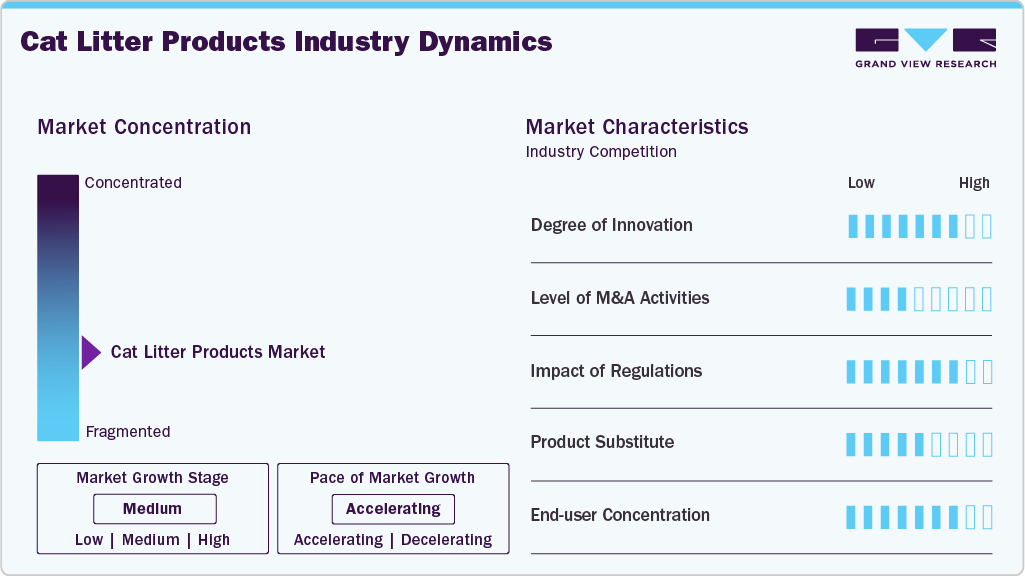

Market Concentration & Characteristics

The innovation in cat litter products includes the integration of technologies such as moisture-activated indicators and dust-free formulas, enhancing convenience and addressing common issues associated with traditional litter. Companies are investing in developing cat litter using alternative materials, such as natural wood, paper, corn, and walnut shells, to cater to eco-conscious consumers and address concerns about sustainability.

Merger and acquisition activities in the market have been notable, with major players seeking to expand their product portfolios and market presence. Companies have engaged in strategic mergers and acquisitions to gain access to new technologies, enhance distribution networks, and capitalize on synergies. In July 2022, Kent Corporation acquired two Australian players-Our Bird, a manufacturer of high-quality bird seed and cat litter based in Queensland, and Lovitts, a manufacturer of high-quality companion animal nutrition based in Melbourne.

Regulation in the cat litter products industry primarily focuses on product safety, environmental impact, and labeling requirements. Regulatory bodies oversee the use of materials in cat litters to ensure they are safe for pets and the environment, with stringent guidelines on potentially hazardous substances. In addition, there are labeling regulations that mandate clear and accurate information regarding usage instructions, safety warnings, and the composition of the product.

Product substitutes in the cat litter products industry predominantly include alternatives such as paper-based litters, wood pellets, and natural fibers such as corn, wheat, and walnut shells. In addition, silica gel and crystal-based litters are emerging as popular substitutes due to their high absorbency and odor control properties.

Product Insights

The clumping segment accounted for the largest share of 75.0% of the global revenue in 2024 and is projected to grow at the fastest CAGR from 2025 to 2030. Clumping litter is increasingly gaining consumer attention as cat urine and feces can be removed easily without emptying the litter box. Moreover, the increasing prominence of clumping cat litter owing to its functionality and various benefits will likely draw consumer attention and boost product sales over the forecast period. In September 2025, Litter Genie, North America’s top-selling cat litter disposal brand, launched Litter Genie Light, a Canadian-made clumping clay litter. Made from natural Canadian clay, this premium litter offers strong clumping and excellent odor control at an affordable price, providing cat owners with reliable performance without the higher cost of leading national brands.

The conventional cat litter segment is projected to grow at a significant CAGR of 4.6% from 2025 to 2030. The demand for traditional litter products is driven by increased consumer preference toward entirely removing the odor associated with cat urine and feces. Rising consumer inclination toward low-priced litter products, owing to their repeated usage, is boosting the sales of conventional cat litter. Non-clumping litter is less dusty than clumping cat litter, which has smaller particles. Dust-free non-clumping litters have become more sought after as cat owners become more aware of the potential health risks of dust particles.

Raw Material Insights

The clay segment accounted for the largest share, 81.7%, in 2024. This is attributable to the increasing usage of clay in creating cat litter products, owing to its high absorbency and solid-formation qualities, boosting the segment's expansion. Furthermore, clay-based products are less expensive than other materials, making them popular among middle-income and multi-cat homes. Furthermore, such items are dust-free and odorless, lowering the risk of respiratory problems.

The wood/bamboo/sawdust segment is anticipated to grow at the fastest CAGR of 8.2% from 2025 to 2030. As consumers increasingly prioritize sustainable and eco-friendly choices, there is a growing demand for bamboo, sawdust, and wood-based cat litter products. In addition, such natural and safe ingredients attract pet owners concerned about chemicals or synthetic additives, which drives the growth of the cat litter products industry.

Distribution Channel Insights

The cat litter product sales through the supermarkets and hypermarkets segment accounted for the largest share of 39.4% in 2024. Pet owners prefer purchasing pet care, pet food, and pet grooming products from these channels as these are less expensive than prescription-based products due to various discounts & sales offered at the stores. These stores provide wide product availability, competitive pricing, and convenient one-stop shopping for consumers. Customers prefer buying cat litter from supermarkets and hypermarkets due to easy access, frequent promotions, and the ability to purchase larger quantities for multi-cat households.

The cat litter product sales through the online/E-commerce segment are projected to grow at the fastest CAGR of 6.3% from 2025 to 2030. Online platforms have enabled manufacturers to gain potential customers, improve communication, track finances, and boost brand awareness cost-effectively. Digitalization has offered the cat litter industry several growth avenues and an active consumer base that prefers shopping online. Many cat litter manufacturers Purina Tidy Cats, World’s Best Cat Litter, and Arm & Hammer, have their own websites where customers can purchase them directly.

Regional Insights

The North American cat litter products industry accounted for about 39.1% of the global revenue in 2024. The trend of adopting pets gained momentum in the region, especially during the pandemic, when people were spending more time at home. According to the American Pet Products Association (APPA), the number of pet-owning households increased from 67% in 2019 to 70% in 2020. A surge in the utilization of technology in cat litter products has also been pushing the market. For instance, in April 2023, HHOLOVE announced the launch of the iPet Smart Litter Box on Kickstarter, a global crowdfunding platform, for North American consumers.

U.S. Cat Litter Products Market Trends

The U.S. cat litter products industry led the North American region in 2024. The market is driven by high pet ownership, strong consumer spending on pet care, and easy access to products through supermarkets, hypermarkets, and online platforms. Continuous product innovation has also supported market growth, offering a wide range of clumping, non-clumping, natural, and scented options that meet diverse consumer preferences. In January 2024, Eco-Shell, LP launched Harmony Lavender and Bamboo Scented Litter, its first formula to promote well-being. Developed in collaboration with Givaudan using MoodScentz technology, the litter is infused with lavender and bamboo essential oils to create a calming environment for cats while leaving homes smelling fresh.

Europe Cat Litter Products Market Trends

Europe's cat litter products industry is projected to grow significantly from 2025 to 2030. This is attributable to cat adoption among consumers. Moreover, the increasing cat population in Europe over the past few years has resulted in a rising need for more than one cat in numerous households. According to a report published by Hangzhou Tianyuan Pet Products Company in July 2025, Europe’s cat population has grown to 108 million, increasing by 2.26 million compared to the previous year, with the EU accounting for 80.97 million cats, up by 1.879 million. According to the Pet Food Manufacturers’ Association (PFMA), in April 2022, more than 12 million cats were adopted as pets in UK households. Furthermore, in April 2022, 28% of the households in the UK had at least one cat as a pet, further driving the demand for cat litter in the country.

Asia Pacific Cat Litter Products Market Trends

The Asia Pacific cat litter products industry is projected to grow at the fastest CAGR of 7.0% from 2025 to 2030. The growth is primarily attributed to increased nuclear households and disposable income. Moreover, increasing pet ownership in the region, coupled with growing spending on healthcare, food, and litter products, is expected to positively impact the business over the forecast period.

Asia Pacific countries are following the global trend of pet humanization, where consumers increasingly regard their pets as integral family members. This trend is especially pronounced in the more westernized regions of these countries, fueled by the influence of social media platforms like Instagram. As a result, the pet products market is predicted to increase significantly in terms of both value and volume throughout the forecast period. The expanding population of pet owners will drive the demand for pet products, including cat litter, presenting significant sales opportunities in the market.

The cat litter products industry in China is witnessing significant growth owing to an increase in the pet adoption rate in the country. According to the 2021 White Paper on China’s Pet Consumption Trends, Chinese cities witnessed an almost 50% increase in pets since 2015, demonstrating the market's enormous potential. Consumers spend an average of 6,600 Chinese Yuan (USD 959.37) yearly on pets. With the growth of pet ownership, the cat litter market in China has expanded, leading to increased availability and a wider range of cat litter products. This includes various types of litter, such as clumping clay, silica gel, natural materials, and more. Product innovation and advancements cater to the evolving needs of pet owners, further driving the adoption of cat litter products.

In February 2023, Xiaomi introduced the Xiaowan Intelligent Automatic Cat Litter Box, a cutting-edge solution for simplifying and improving cat owners' litter box cleaning process. This innovative product has obtained the "Pet Safety" China-mark certification from TUV Rheinland Greater China, highlighting its adherence to stringent safety standards.

The cat litter products industry in India is driven by the surge in cat ownership in India, which has directly contributed to a significant rise in pet product sales. Cats have proven to be valuable companions for individuals experiencing isolation, particularly during the pandemic lockdowns. According to a blog by Pet Keen, in 2023, cats have become the second most preferred choice for pets. This trend has fueled the demand for cat-specific products, presenting a lucrative opportunity for businesses operating in the market.

The growing preference for clay cat litter is gaining traction in the country. This is because clay cat litter is highly absorbent and affordable. Moreover, clay cat litter is dust-free and unscented, thus causing little to no harm to cats with respiratory ailments. Additionally, in January 2022, TABPS-owned FiloMilo introduced a line of cat litter available in two variations: scented and unscented. The scented option features a fruity floral fragrance. Both variants are crafted using 100% Bentonite clay and are easily scoopable.

Central & South America Cat Litter Products Market Trends

The cat litter products industry in Central & South America is driven by the growing pet ownership and increasing demand for pet products in the region, companies recognize the market potential and strategically expand their operations. They are establishing distribution networks, partnering with local retailers, and improving their online presence to cater to the growing customer base in Central & South America.

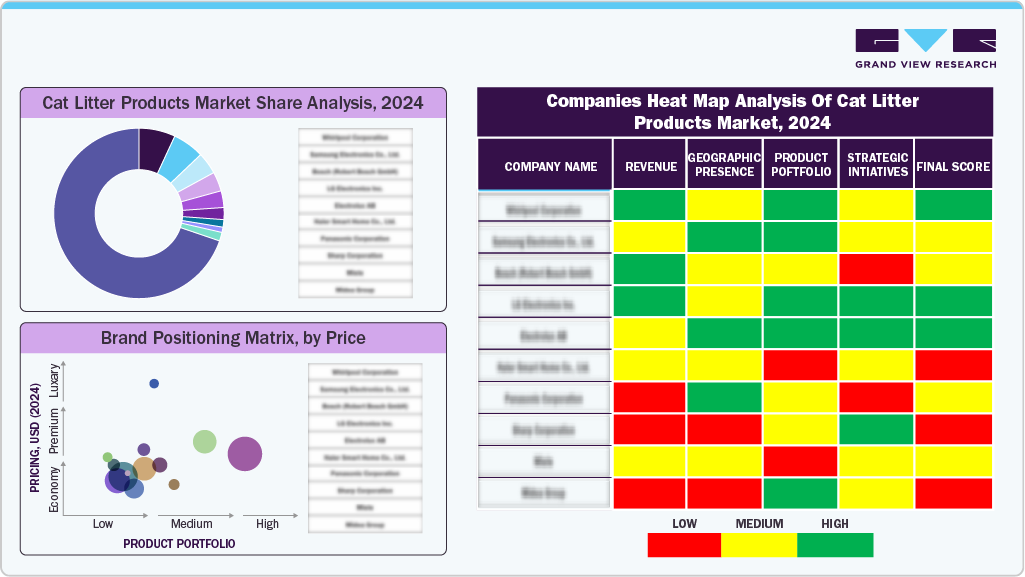

Key Cat Litter Products Company Insights

The industry is characterized by the presence of a few established players and new entrants. Players in the market are diversifying and expanding their operations, adopting product launches, and other strategies to maintain market share.

Key Cat Litter Products Companies:

The following are the leading companies in the Cat Litter Products market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- The Clorox Company

- Mars, Incorporated and its Affiliates.

- Oil-Dri Corporation of America.

- Church & Dwight Co., Inc.

- Kent Corporation

- Intersand

- Dr. Elsey's

- Weihai Pearl Silica Gel Co., Ltd

- Pettex Limited

Recent Developments

-

In March 2025, Eco-Shell, LP, launched a new, improved Ultra Odor Control formula featuring Fresh Shield Probiotic technology. Made from renewable ingredients, the upgraded formula uses probiotics to neutralize odor-causing bacteria from waste and ammonia, offering up to 40% better odor control than previous versions.

-

In February 2024, PetSafe introduced ScoopFree Premium Natural Litter, a 100% natural, high-performance cat litter with strong odor control without added chemicals, fragrances, or dyes. Made from U.S.-sourced fossilized algae (diatomaceous earth) and shaped into patent-pending pebbles, it outperforms clay and other natural litters while reducing waste and environmental impact.

- In April 2023, Kent Corporation commenced the construction of its manufacturing plant in Muscatine, Iowa. Spanning 113,000 square feet, the facility will be situated on 70 acres of land adjacent to the KENT Distribution Center. It will be equipped with cutting-edge manufacturing machinery, dedicated research and development (R&D) spaces, and ample room for future expansion initiatives.

Cat Litter Products Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 17.23 billion

Revenue Forecast in 2030

USD 22.31 billion

Growth Rate (Revenue)

CAGR of 5.3% from 2025 to 2030

Actuals

2021 - 2024

Forecast period

2025 - 2030

Quantitative (Revenue) units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, distribution channel, region

Regional Scope

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Spain; Italy; China; India; South Korea; Japan; Taiwan; Brazil; South Africa

Key companies profiled

Nestlé.; The Clorox Company; Mars, Incorporated and its Affiliates; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Cat Litter Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cat litter products market report based on product, raw material, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Clumping

-

Conventional

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Clay

-

Silica

-

Wood/Bamboo/Sawdust

-

Paper

-

Soy

-

Corn/Grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Retail Stores

-

Convenience Stores

-

Online/E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cat litter products market was estimated at USD 16.41 billion in 2024 and is expected to reach USD 17.23 billion in 2025.

b. The global cat litter products market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 22.31 billion by 2030.

b. North America region dominated the cat litter products market with a share of around 39.1% in 2024. This is owing to its high pet ownership rates and a strong preference for convenient and odor-controlling litter solutions, driving a robust demand for innovative cat litter products.

b. Some key players operating in the cat litter products market include Nestlé.; The Clorox Company; Mars, Incorporated and its Affiliates; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

b. Key factors that are driving the cat litter products market growth include a rising number of pet owners, growing awareness of hygiene and odor control, and a shift towards environmentally friendly and sustainable litter options.

b. The clay segment accounted for the maximum revenue share of more than 81.7% in 2024 and is expected to grow at a significant CAGR from 2025 to 2030 in the cat litter products market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.