- Home

- »

- Advanced Interior Materials

- »

-

U.S. Cellular Foam Concrete Market, Industry Report, 2030GVR Report cover

![U.S. Cellular Foam Concrete Market Size, Share & Trends Report]()

U.S. Cellular Foam Concrete Market (2025 - 2030) Size, Share & Trends Analysis Report By Foaming Agent (Synthetic, Natural), By End-use (Residential, Commercial, Industrial, Infrastructure), And Segment Forecasts

- Report ID: GVR-4-68040-626-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cellular Foam Concrete Market Trends

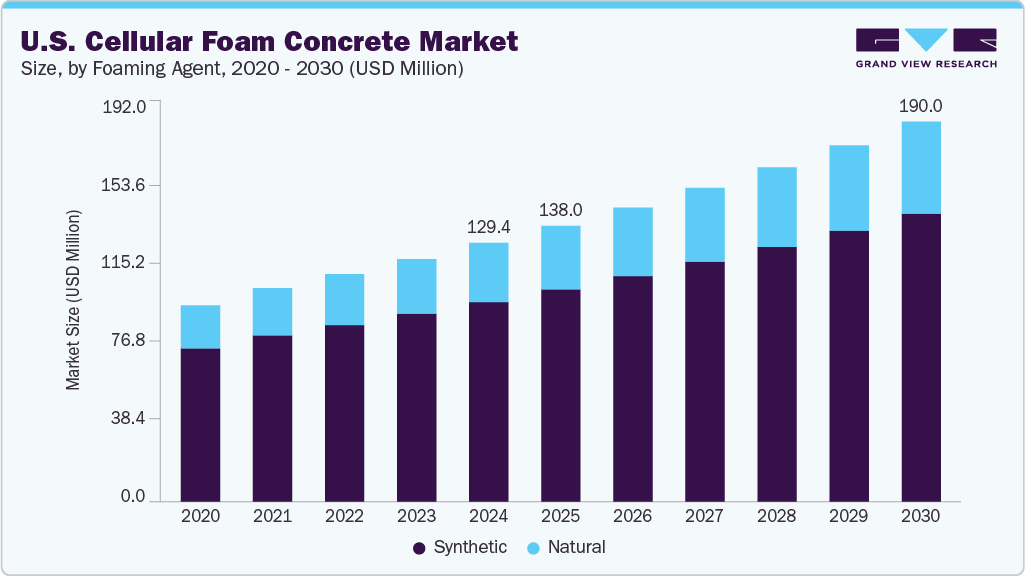

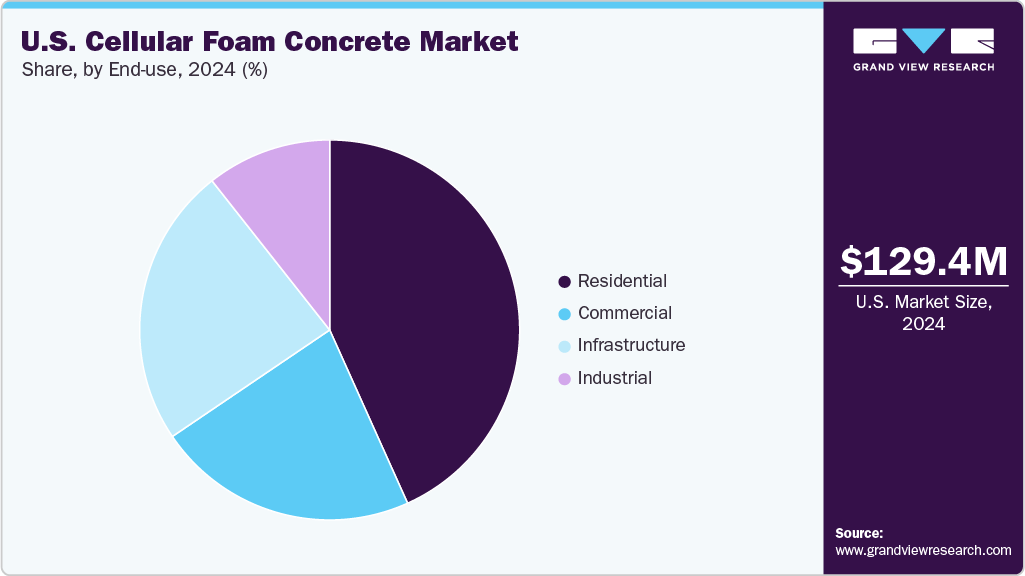

The U.S. cellular foam concrete market size was valued at USD 129.4 million in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. This market is growing steadily, driven by its lightweight, insulating properties, and cost efficiency in construction. Cellular foam concrete’s use in infrastructure, geotechnical fill, and sustainable building projects is increasing due to its ease of application and design flexibility.

As urbanization accelerates, there is a rising need for cost-effective, versatile building materials. Cellular foam concrete meets this demand by offering excellent thermal insulation, fire resistance, and acoustic performance. It is an ideal solution for residential and infrastructure projects owing to the ease of use and reduced construction time, especially for builders looking to improve efficiency and reduce labor costs. Several factors are driving the interest of market participants in cellular foam concrete.

The construction sector is under pressure to lower its environmental impact, and cellular concrete's ability to incorporate recycled materials and reduce cement usage makes it a popular choice. Governments and organizations are encouraging the use of sustainable building materials through regulations and incentives, which are expected to favor the growth of the cellular foam concrete industry in the U.S. over the coming years. In addition, the material's natural resistance to fire, pests, and moisture positions it as a durable option in areas prone to climate-related risks and natural disasters.

Innovations in cellular foam concrete further enhance its appeal and broaden its scope of application. Advances in foam generation technology and mixing processes have improved consistency, strength, and workability. Researchers and manufacturers are also experimenting with new additives, such as fibers and eco-friendly binders, to increase structural performance and sustainability. Automation and digitalization in production methods help streamline manufacturing processes and reduce waste. These continuous innovations make cellular foam concrete a modern, adaptable solution for future-ready construction projects.

Market Concentration & Characteristics

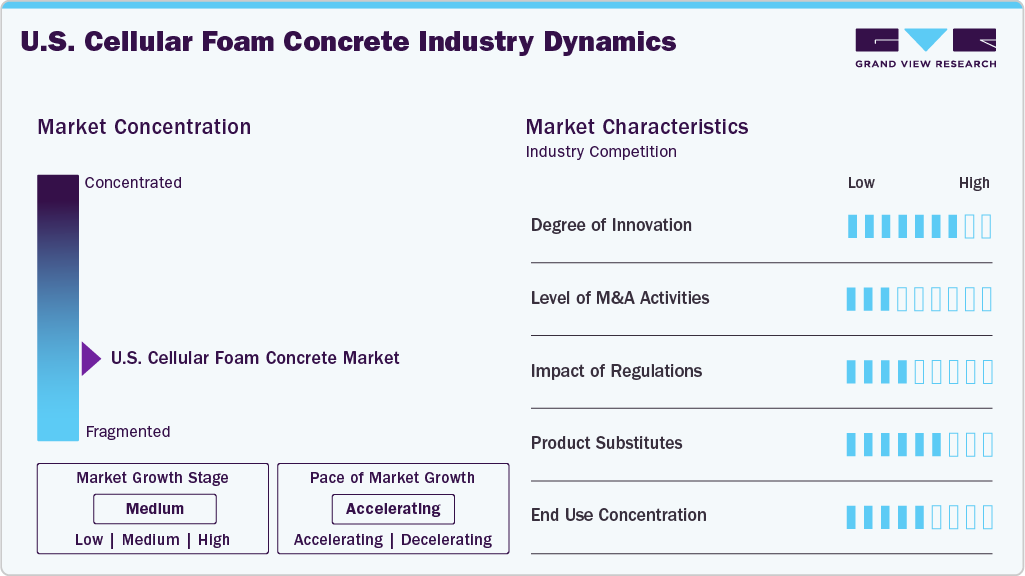

The U.S. cellular foam concrete market growth is moderate, and the pace of growth is accelerating. The market is characterized by a high degree of innovation, driven by the demand for lightweight, eco-friendly, and efficient construction materials. Companies are investing in advanced foam technologies, mobile mixing units, and application-specific formulations that offer improved flow, set time, and strength. Innovation is particularly strong in geotechnical and infrastructure segments, where precision and durability are critical.

The level of mergers and acquisitions in the U.S. cellular foam concrete industry is currently low. Most players operate independently or through strategic partnerships and alliances at project level rather than through formal consolidation. Substitution risk is moderate, as traditional materials like granular fills, polystyrene blocks, and standard concrete can replace cellular foam concrete. However, cellular foam concrete often has a clear performance advantage in projects requiring lightweight, self-compacting fill, or thermal insulation.

The impact of regulations is moderate. While there are no specific regulations related to cellular foam concrete, the material must comply with broader construction, safety, and environmental standards set by bodies, such as the ASTM, EPA, and local building codes. The growing focus on sustainable construction indirectly benefits the market, as cellular foam concrete contributes to LEED certification and meets green building requirements. The market shows moderate end-use concentration, with key demand originating from infrastructure projects (e.g., roads, bridges, tunnels), commercial building foundations, and geotechnical applications.

Foaming Agent Insights

The synthetic cellular foam concrete segment held the largest revenue share of 77.2% in 2024, driven by its consistency, easy availability, and proven performance in large-scale construction applications. Synthetic agents offer better control over foam density and stability, which is essential for producing uniform and reliable concrete mixes. Their compatibility with automated mixing systems and industrial-scale production makes them a preferred choice among large manufacturers. Furthermore, synthetic foaming agents have a longer shelf life and are easy to store and transport, which enhances their practicality in commercial use.

The natural segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing environmental awareness and the push for sustainable construction materials. Derived from plant-based or biodegradable sources, natural foaming agents reduce the environmental footprint of concrete production and align with green building certifications and eco-friendly regulations. Technological advancements are improving the product performance and narrowing the gap with synthetic alternatives. As builders and developers seek more sustainable solutions, the demand for natural foaming agents is expected to rise rapidly, especially in regions prioritizing low-carbon construction practices.

End-use Insights

The residential segment dominated the market and accounted for the largest revenue share in 2024, driven by its suitability for non-load-bearing walls, insulation layers, and infill applications in housing projects. Its lightweight nature, ease of application, and cost-effectiveness make it ideal for low- to mid-rise buildings, particularly in regions with rapid urbanization and affordable housing initiatives. In addition, its thermal and sound insulation properties align well with the increasing demand for energy-efficient and comfortable residential spaces.

The commercial segment is expected to grow at the fastest CAGR from 2025 to 2030. The demand for innovative, quick-to-install, and sustainable materials is accelerating, with a surge in commercial infrastructure projects such as offices, malls, educational institutions, and hospitals. Cellular concrete’s fire resistance, design flexibility, and compatibility with modular construction methods make it attractive for large-scale commercial developments. As green building certifications and performance standards become more critical in the commercial sector, the adoption of cellular foam concrete is expected to rise rapidly.

Key U.S. Cellular Foam Concrete Company Insights

The U.S. cellular foam concrete market features a mix of specialized manufacturers and solution providers focused on infrastructure, geotechnical, and lightweight fill applications. Key players such as CCT, Aerix Industries, and Cell-Crete Corporation are driving innovation through proprietary mix technologies, mobile production units, and tailored project solutions. These companies serve sectors ranging from highways and tunnels to commercial buildings, often partnering with contractors for large-scale deployment.

-

Cellular Concrete Technologies (CCT): CCT offers customizable cellular concrete solutions for load-reducing fill, trench backfill, and void filling. The company focuses on high-quality foam generators and equipment to support efficient onsite production, catering especially to infrastructure and utility projects across the U.S.

-

Aerix Industries: Aerix Industries stands out for its proprietary foam liquid concentrates like AERLITE and AERFLOW, which are widely used in engineered lightweight fill and insulation. The firm emphasizes sustainable construction, technical support, and research-driven solutions to serve clients in the transportation, commercial, and environmental sectors.

Key U.S. Cellular Foam Concrete Companies:

- Cellular Concrete Technologies

- Aerix Industries

- Conco Services LLC.

- Richway Industries, Ltd

- Pacific International Grout Company

- Cell-Crete Corporation

Recent Developments

-

In June 2025, Giatec received a strategic minority investment from Sika AG to support its mission of transforming concrete construction through data-driven innovation and sustainability. The partnership aims to accelerate global adoption of Giatec’s smart concrete technologies, expand into international markets, and reduce the construction industry's carbon footprint through advanced digital solutions.

-

In March 2025, Big 7 Ventures acquired Modern Concrete Inc., a provider known for its remote concrete pouring solutions using volumetric trucks. The deal aims to support Modern Concrete’s expansion into new markets while strengthening Big 7 Ventures’ presence in the construction materials sector through strategic, long-term investment.

-

In August 2024, Heidelberg Materials entered into an agreement to acquire Carver Sand & Gravel, the leading aggregates producer in the Albany (NY) region. Since cellular concrete relies heavily on high-quality lightweight aggregates, this acquisition strengthens Heidelberg’s material supply chain, potentially benefiting its foam concrete offerings.

U.S. Cellular Foam Concrete Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 190.0 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Foaming agent, end-use

Key companies profiled

Cellular Concrete Technologies, Aerix Industries, Conco Services LLC., Richway Industries, Ltd, Pacific International Grout Company, Cell-Crete Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cellular Foam Concrete Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cellular foam concrete market report based on foaming agent, and end use:

-

Foaming Agent Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Infrastructure

-

Frequently Asked Questions About This Report

b. The U.S. cellular foam concrete market size was estimated at USD 129.4 million in 2024 and is expected to reach USD 138.0 million in 2025.

b. The U.S. cellular foam concrete market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 190.0 million by 2030.

b. The synthetic cellular foam concrete segment led the market and accounted for the largest revenue share, 77.2%, in 2024, due to their consistency, availability, and proven performance in large-scale construction applications.

b. SCellular Concrete Technologies (CCT), Aerix Industries, The Conco Companies, Richway Industries, Pacific International Grout Company (PIGCO), and Cell-Crete Corporation are prominent companies in the U.S. cellular foam concrete market.

b. Rising environmental awareness, government regulations, circular economy initiatives, and growing consumer demand for sustainable products are key factors driving the U.S. cellular foam concrete market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.