- Home

- »

- Healthcare IT

- »

-

U.S. Clinical Decision Support Systems Market Report, 2030GVR Report cover

![U.S. Clinical Decision Support Systems Market Size, Share & Trends Report]()

U.S. Clinical Decision Support Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Standalone CDSS, Integrated CPOE With CDSS), By Application, By Delivery Mode, By Component, And Segment Forecasts

- Report ID: GVR-4-68040-671-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

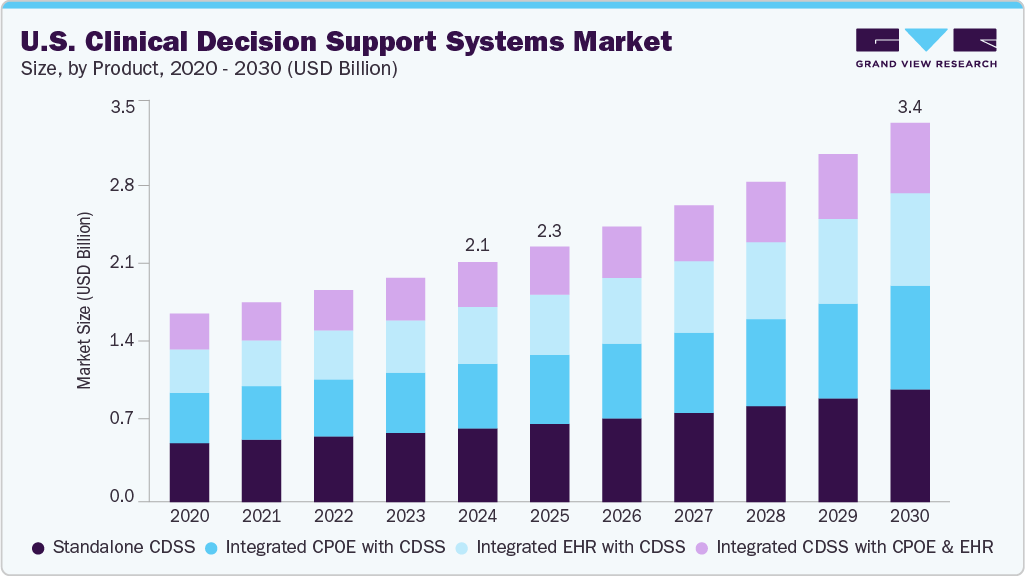

The U.S. clinical decision support systems market size was valued at USD 2.14 billion in 2024 and is projected to reach USD 3.40 billion by 2030, growing at a CAGR of 8.17% from 2025 to 2030. The widespread adoption of Electronic Health Records (EHRs) across U.S. hospitals and office-based physicians is significantly driving the market growth. According to Simbo AI, as of 2021, approximately 88% of office-based physicians in the U.S. had implemented an Electronic Health Record (EHR) system, more than doubling the adoption rate from just 42% in previous years, has paved the way for seamless integration of CDSS tools that offer real-time alerts, treatment recommendations, and drug interaction checks at the point of care. Moreover, strong policy support through initiatives like the HITECH Act, Meaningful Use incentives, certification programs from HHS, and provisions in the 21st Century Cures Act created a regulatory environment that incentivizes CDSS adoption and ensures interoperability while encouraging innovation.

Artificial intelligence (AI) and machine learning (ML) technologies are revolutionizing the clinical decision support systems (CDSS) market by providing enhanced features like predictive analytics, pattern recognition, and personalized recommendations. AI-powered CDSS processes large volumes of data, identifies trends, forecasts outcomes, and recommends the best treatment options. For instance, in December 2022, researchers at the University of Texas at Austin’s Dell Medical School developed an AI-based CDSS designed to help clinicians engage patients in conversations about nutrition and support decision-making regarding dietary improvements.

Personalized medicine is on the rise, with CDSSs playing a key role. To create customized treatment plans, these systems evaluate patient information, such as genetic data and medical histories. By delivering personalized recommendations, CDSSs improve treatment outcomes and minimize the chances of adverse effects, contributing to the market's growth.

The COVID-19 pandemic has significantly driven the growth of the U.S. clinical decision support systems market, driving wider adoption of these tools. CDSSs were crucial in supporting patient care and resource management by aiding real-time clinical diagnosis and triage of COVID-19 cases. The expansion of online healthcare services across the country further accelerated this trend. Market leaders introduced specialized CDSS solutions for managing COVID-19 data and insights; for instance, in May 2022, Epocrates launched an advanced tool focused on long-term COVID, incorporating the latest clinical guidelines. This increased adoption has been a key factor in market growth during the pandemic.

Case Study and Survey Insights

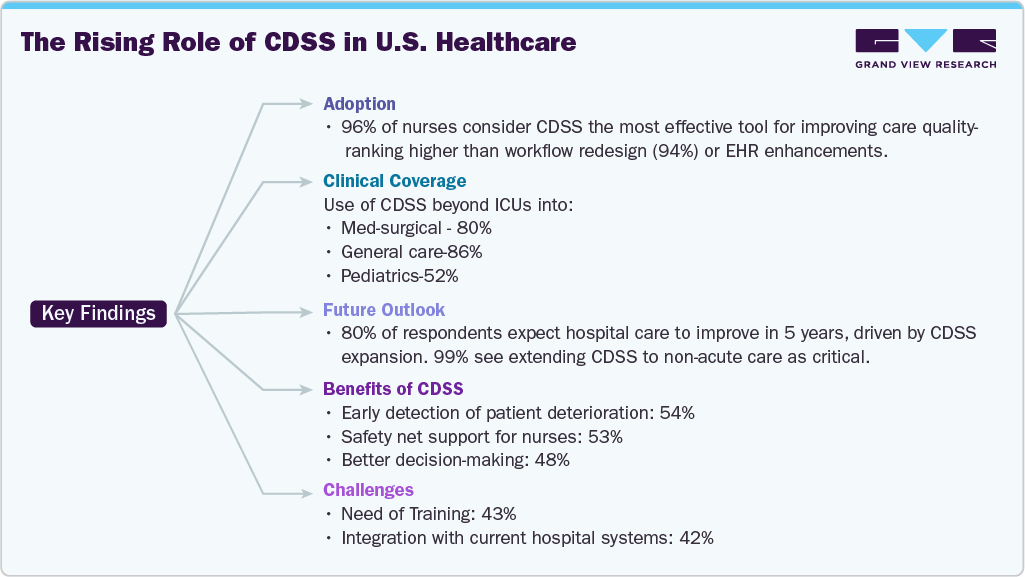

In June 2023, Ascom conducted a nationwide survey (via OnePoll) with 950 U.S. nurses across general care and ICU settings to assess the usage, impact, and perception of Clinical Decision Support Systems (CDSS).

“Analyst Takeaways: The Ascom CDSS Report 2023 highlights growing confidence in clinical decision support systems, with 96% of nurses ranking it as the top tool for improving care. Its expanding use beyond ICUs shows market maturity, but challenges like integration and training remain. The shift toward real-time, mobile “push” alerts reflects a broader move to intelligent, proactive care-creating clear opportunities for agile, user-friendly CDSS platforms.”

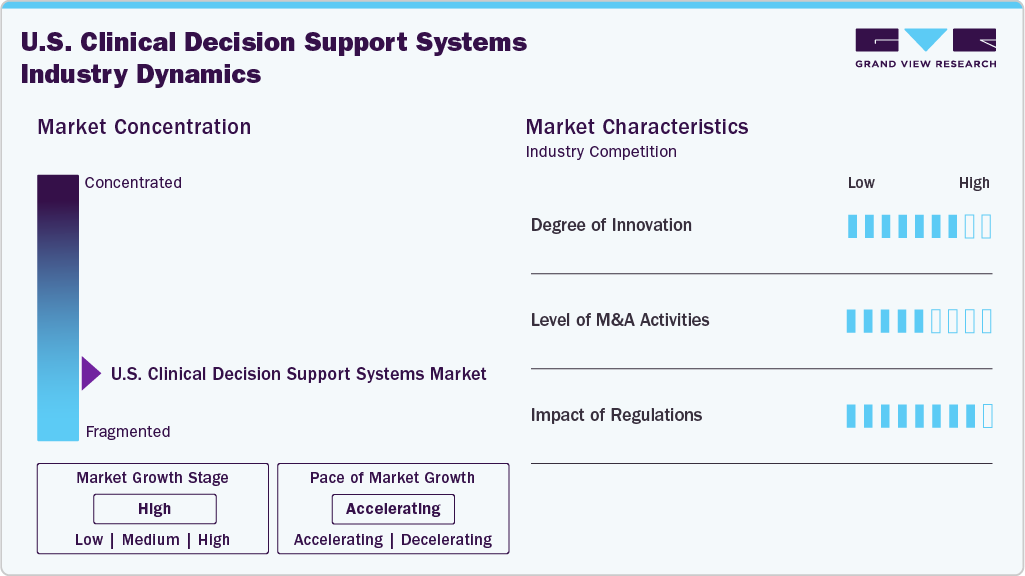

Market Concentration & Characteristics

The U.S. clinical decision support systems industry exhibits a high level of innovation driven by the incorporation of cutting-edge technologies such as AI and ML. For instance, in May 2024, GE HealthCare introduced AI models designed to predict patient responses to immunotherapies, which are anticipated to support clinical decision-making and pharmaceutical drug development.

The market has experienced a high level of M&A activity. Companies actively pursue M&A, partnerships, and new product launches to enhance their product offerings and drive market expansion. For instance, in October 2022, Beckman Coulter Diagnostics acquired StoCastic, LLC, a provider of evidence-based decision support tools for hospital emergency departments. This acquisition strengthens Beckman Coulter Diagnostics' presence in the CDSS space.

The clinical decision support systems (CDSS) industry is overseen by regulatory agencies like the U.S. Food and Drug Administration (FDA). In September 2022, the FDA issued finalized and updated guidance documents, including the Final CDS Guidance, which clarifies the regulation of clinical decision support software and other digital health-related topics.

Product Insights

The standalone CDSS segment held the largest revenue share of 30.68% in 2024, due to its versatility and ease of integration across various healthcare settings. These systems operate independently of electronic health records (EHRs), making them accessible to smaller practices and institutions with limited IT infrastructure. Key drivers include the growing demand for decision-making tools that improve diagnostic accuracy and treatment efficiency.

The integrated EHR with CDSS segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing EHR adoption in multi-specialty healthcare facilities. Integrated systems enable CDSSs to access patient records and medical histories, helping automate clinical workflows. In April 2023, the U.S. government proposed a rule to give healthcare providers broader access to data within EHR systems, allowing them to assess CDSS algorithms and outcomes more effectively. Integrating CDSSs with EHR platforms helps standardize clinical processes and utilize existing data sources. In addition, the growing inclusion of CDSS functionalities directly within EHR systems contributes to this segment's expansion.

Application Insights

The drug allergy alerts segment accounted for the largest market share of 25.7% in 2024. This growth is attributed to the increasing prevalence of reported drug allergies-as more patients and clinicians recognize and document adverse drug reactions has heightened demand for CDSS tools that safely screen for hypersensitivities In addition, the expanding formulary of medications, including newer biologics and specialty drugs, increases the risk of allergic events, reinforcing the need for reliable alert systems that can flag potential risks at the point of prescribing. Moreover, technological evolution, such as integration of drug allergy alert modules with EHRs and CPOE systems, along with cloud‑based and AI‑driven solutions, enhances usability, scalability, and interoperability, ensuring that allergy alerts become a standard, automated step in the clinical workflow.

The clinical guidelines segment is expected to grow at the fastest CAGR during the forecast period. Clinical Decision Support (CDS) systems offer diagnostic and treatment guidelines by delivering critical, real-time information, mainly at the point of care. They help automate routine tasks, alert clinical teams to problems, and provide recommendations for healthcare providers and patients. According to the American Medical Informatics Association (AMIA), CDS is a tool designed to enhance health-related decision-making and actions, enabling clinicians, patients, and other stakeholders to improve clinical decisions, ultimately leading to better healthcare quality and patient outcomes.

Delivery Mode Insights

The on-premise segment dominated the U.S. clinical decision support systems market with the largest share in 2024. Many healthcare organizations, especially large hospitals and academic medical centers, continue to prefer on-premise solutions due to the greater control they offer over sensitive patient data and system security. With growing concerns about data breaches and cybersecurity risks in cloud-based systems, on-premise setups are often seen as a safer option for managing confidential health information. In addition, some healthcare providers have already invested heavily in on-site IT infrastructure and prefer to build on their existing systems rather than shift to the cloud, which can involve significant migration costs and operational disruptions. On-premise systems also offer better customization and integration with legacy applications, which is essential for organizations with complex clinical workflows. Such factors are expected to drive the demand for on-premise CDSS systems over the forecast period.

The cloud-based systems segment is expected to grow at the fastest CAGR over the forecast period. Representing a significant IT advancement, they offer reliability and cost-effectiveness. Enhanced accessibility via mobile platforms and robust data protection mechanisms drive their adoption. Unlike web-based systems, cloud solutions are not dependent on web browsers, enhancing security and usability.

Component Insights

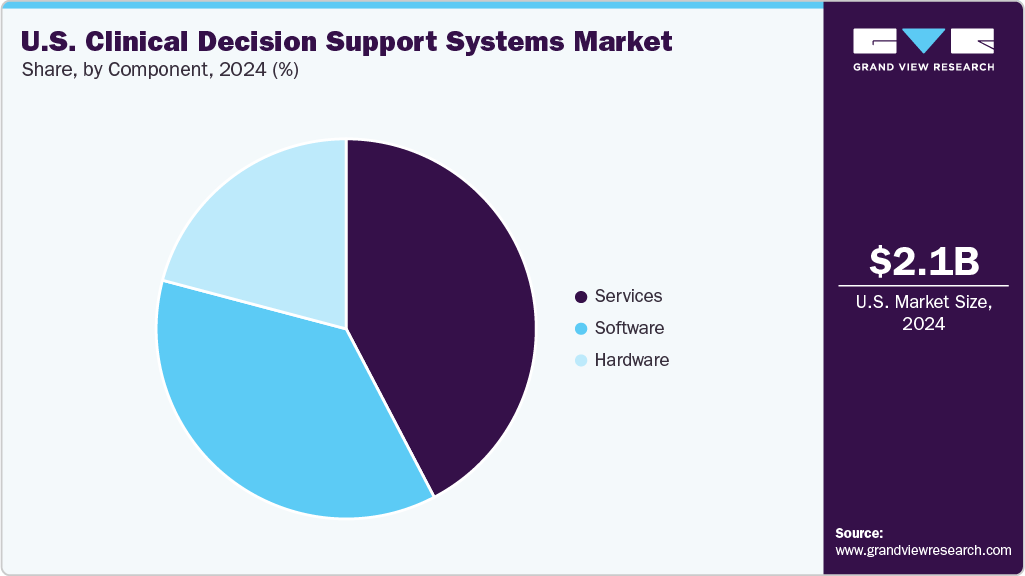

The CDSS services segment commands the largest revenue share of the U.S. clinical decision support systems industry, driven by the growing need for implementation, integration, and maintenance support. Healthcare providers rely on expert services to ensure seamless CDSS deployment and optimize system performance. In addition, ongoing training and consulting services help maximize user adoption and effectiveness.

The software applications segment is expected to grow at the fastest CAGR over the forecast period, driven by advancements in AI and ML. These technologies enable more accurate diagnostics, predictive analytics, and personalized treatment recommendations. For instance, QIAGEN's Clinical Insights platform analyzed over three million patient molecular profiles for oncology and hereditary diseases, demonstrating the power of AI in clinical decision-making. In addition, integrating CDSS with electronic health records (EHRs) and computerized physician order entry (CPOE) systems enhances real-time clinical insights, further accelerating the adoption of software applications in healthcare.

Key U.S. Clinical Decision Support Systems Company Insights

Major companies are implementing various strategies to enhance their market presence and broaden the availability of their products and services. Expansion efforts and strategic partnerships are key drivers fueling the market growth.

Key U.S. Clinical Decision Support Systems Companies

- McKesson Corporation

- Cerner Corporation (now Oracle Health)

- Siemens Healthineers GmbH

- Allscripts Healthcare, LLC (now Veradigm)

- athenahealth, Inc.

- NextGen Healthcare Inc.

- IBM Corporation

- GE HealthCare

- Nordic

- BeeKeeperAI

Recent Developments

-

In April 2025, Becton, Dickinson and Company launched the next-generation HemoSphere Advanced Monitoring Platform, integrating AI-driven clinical decision support to enhance real-time hemodynamic monitoring.

-

In March 2024, Wolters Kluwer Health announced the launch of its next-generation Clinical Decision Support (CDS) solutions, designed to deliver an integrated, interoperable experience that combines point-of-care decision-making, workflow optimization, and patient-centered care.

“Through our investments in harmonizing our market-leading and innovative solutions, we are delivering what our customers need most today-a comprehensive and unified set of clinical solutions they know they can trust to help them provide the best care for their patients.”

-Greg Samios, President & CEO of Clinical Effectiveness, Wolters Kluwer Health-

In December 2023, EBSCO Information Services launched the Dyna Innovation Center in the U.S. to promote advancements like the integration of AI in clinical decisions.

U.S. Clinical Decision Support System Market Report Scope

Report Attribute

Details

Revenue Forecast in 2025

USD 2.29 billion

Revenue Forecast in 2030

USD 3.40 billion

Growth rate

CAGR of 8.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, delivery mode, and component

Key companies profiled

McKesson Corporation; Cerner Corporation (now Oracle Health); Siemens Healthineers GmbH; Allscripts Healthcare, LLC (now Veradigm); athenahealth, Inc.; NextGen Healthcare Inc.; IBM Corporation; GE HealthCare; Nordic; BeeKeeperAI

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clinical Decision Support Systems Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. clinical decision support systems market report based on product, application, delivery mode, and component:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone CDSS

-

Integrated CPOE with CDSS

-

Integrated EHR with CDSS

-

Integrated CDSS with CPOE and EHR

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug-Drug Interactions

-

Drug Allergy Alerts

-

Clinical Reminders

-

Clinical Guidelines

-

Drug Dosing Support

-

Others

-

-

Deliver Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-Based Systems

-

Cloud-Based Systems

-

On-Premise Systems

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Frequently Asked Questions About This Report

b. The U.S. clinical decision support systems market size was estimated at USD 2.14 billion in 2024 and is expected to reach USD 2.29 billion in 2030.

b. The U.S. clinical decision support systems market is expected to grow at a compound annual growth rate of 8.17% from 2025 to 2030 to reach USD 3.40 billion by 2030.

b. Standalone CDSS segment held the largest revenue share of 30.68% in 2024. This is attributable to its versatility and ease of integration across various healthcare settings. These systems operate independently of electronic health records (EHRs), making them accessible to smaller practices and institutions with limited IT infrastructure

b. Some key players operating in the U.S. clinical decision support systems market include McKesson Corporation, Cerner Corporation (now Oracle Health), Siemens Healthineers GmbH, Allscripts Healthcare, LLC (now Veradigm), athenahealth, Inc., NextGen Healthcare Inc., IBM Corporation, GE HealthCare, Nordic, BeeKeeperAI

b. Key factors that are driving the market growth include the widespread adoption of Electronic Health Records (EHRs) across U.S. hospitals and office-based physicians, strong policy support through initiatives, adoption of AI and ML technologies, and rise on the personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.