- Home

- »

- Healthcare IT

- »

-

U.S. Clinical Trials Management System Market, Report 2030GVR Report cover

![U.S. Clinical Trials Management System Market Size, Share & Trends Report]()

U.S. Clinical Trials Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution Type, By Delivery Mode (Web & Cloud-based, On-premise), By Component (Software, Services), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-680-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Clinical Trials Management System Market Summary

The U.S. clinical trials management system market size was estimated at USD 831.22 million in 2024 and is expected to grow at a CAGR of 13.5% from 2025 to 2030. The rapid growth of healthcare IT, a preference for decentralized clinical trials, initiatives by key industry players, and a rising number of clinical studies are expected to fuel market growth. For instance, in November 2024, the FDA finalized its guidance on decentralized clinical trials (DCTs), emphasizing integrating remote elements like telehealth visits and digital health technologies to enhance trial accessibility and efficiency. This approach aims to broaden participation, especially among underrepresented populations, by reducing geographic and economic barriers to clinical trial involvement.

The current scenario for global research and development activities and the need for several new treatment options have also led to the adoption of fast-track clinical trials. Thus, the factors above are estimated to offer new avenues for the clinical trials market growth. Favorable government support and initiatives are another aspect boosting the market growth potential. For instance, the WHO launched Solidarity, an international clinical trial to determine effective treatment against COVID-19. It includes comparing four treatment options against the standard of care to evaluate their effectiveness against the coronavirus.

Government initiatives and investments by biotechnology and pharmaceutical firms are driving medical research activities. Combined with technological advancements, these factors are expected to propel market growth. For example, in October 2023, the Advanced Research Projects Agency for Health (ARPA-H), a U.S. Department of Health and Human Services (HHS) agency, announced plans to enhance the country's ability to conduct clinical trials rapidly, safely, and equitably. This initiative aims to promote technological advancements and insights to establish a robust national clinical trial infrastructure, thereby fostering the adoption of CTMS and strengthening the market growth.

Moreover, market players are introducing tailored solutions or optimizing existing ones to cater to the requirements of Decentralized Clinical Trials (DCTs). For instance, Cloudbyz offers a cloud-based CTM solution with features like ePRO, remote monitoring & SDV, eConsent, and eCRF, supporting virtual trials. Parexel International Corporation, a key player, has conducted over 250 fully virtual or hybrid DCTs and has experience with various remote patient engagement strategies incorporated into trials.

Increasing R&D investments by life science and medical device companies, coupled with the growing prevalence of acute & chronic disorders, are driving the surge in clinical trials. This trend is expected to boost the demand for solutions like CTMS, facilitating efficient management of diverse clinical trials and ultimately improving patient outcomes.

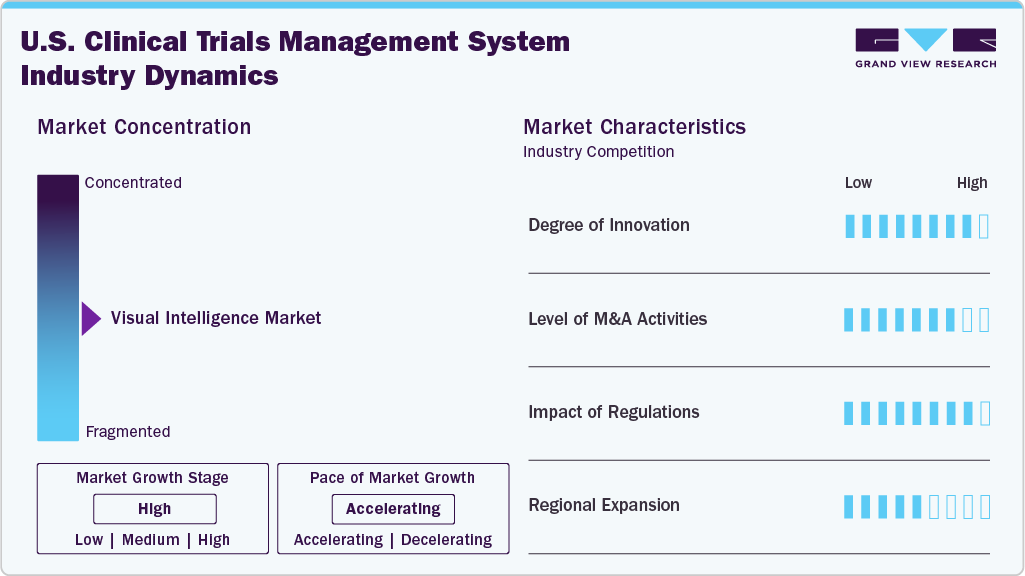

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. clinical trial management system market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high. Market players are investing in technological advancements, such as software upgrades, software and service integration, adoption of AI, and advanced analytics, to enhance their market presence and revenue. For example, in June 2023, Saama introduced an AI/ML-powered SaaS-based solution to automate clinical development processes and provide a comprehensive view of trial processes and patient progress in one platform.

The level of partnerships & collaboration activities by key players in the industry is high. Companies are acquiring local or small players to increase their capabilities, expand product portfolios, and improve competencies. For instance, in December 2022, RealTime Software Solutions, LLC acquired Complion, Inc., a move to enhance clinical study site management for Academic Medical Centers (AMCs), clinics, health systems, sponsors, and Contract Research Organizations (CROs).

The impact of regulations on the market is high. CTMS industry players in the U.S. must adhere to various regulations to ensure the safety and security of clinical trials. Key guidelines include FDA 21 Code of Federal Regulations (CFR) Part 11, and HIPAA. Compliance with these regulations expedites the approval process for any software or system used in clinical trials.

The level of regional expansion in industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

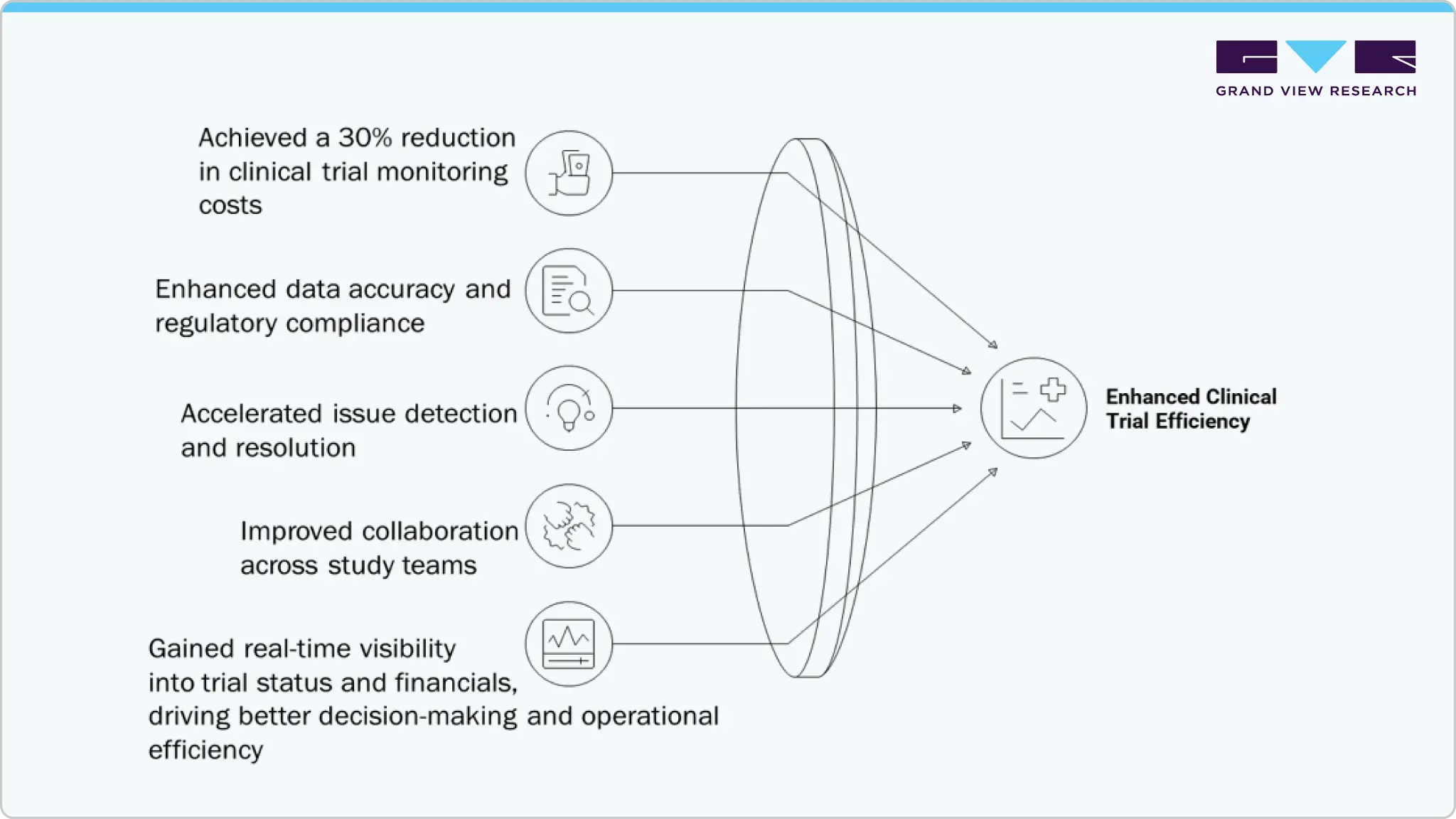

Case Study

Background: This case study highlights how a leading medical device company modernized its clinical trial operations by transitioning from manual, fragmented processes to a unified digital platform using Cloudbyz CTMS. The transformation significantly enhanced trial efficiency, oversight, and cost-effectiveness.

Challenge: The company faced operational inefficiencies due to reliance on legacy systems and manual tracking for clinical trial monitoring. These issues led to delayed site oversight, a lack of centralized data, limited visibility into trial progress, and difficulties in managing budgets and compliance.

Solution: To address these challenges, the company adopted Cloudbyz CTMS, a cloud-native clinical trial management solution built on the Salesforce platform. The CTMS enabled centralized data management, automated workflows for site monitoring and issue tracking, real-time performance dashboards, and seamless financial oversight.

Results

Solution Type Insights

The enterprise segment led the market with the largest revenue share of 74.8% in 2024. The market growth is attributed to key benefits, including providing comprehensive insights into deviations and accruals, robust reporting capabilities, scalable solutions, streamlined regulatory process management, and enhanced billing compliance. Enterprise software solutions are designed to integrate multiple facets or application packages, allowing organizations to handle various challenging tasks using a single software platform. For instance, Real Time's Enterprise CTMS offers comprehensive solutions for centralized recruitment, resource management, accounting, regulatory compliance, and aggregate reporting across universities and other large site networks.

Site segment is expected to grow at a CAGR of 11.4% over the forecast period, due to the associated benefits of onsite CTMS solutions. Site clinical trial management software solutions manage onsite contracts and payments, study subject rosters, calendar tracking, and document maintenance for small or medium-sized businesses. Some pharmaceutical companies prefer onsite software solutions to maintain complete control and access over the trial process. The use of local servers and VPN connections with onsite solutions further enhances data security, thereby contributing to the segment's growth.

Component Insights

The software segment led the market with the largest revenue share in 2024. CTMS software is a user-friendly tool designed to streamline clinical trial management by overseeing regulatory procedures, trial planning, site and country progress, activity monitoring, finance, and supplies. It is commonly deployed at the site and enterprise levels, often through subscription-based models. In addition, CTMS software helps optimize and simplify clinical document management processes, ensuring data security and quality. Consequently, leading players in the industry are introducing products leveraging CTMS software to address various needs within healthcare organizations. For instance, in October 2023, Signant Health launched Signant Biotech, a clinical research methodology that utilizes software and services to meet the evolving requirements of small and medium-sized biopharmaceutical companies.

Services segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by increasing demand for training and assistance in software installation and system upgrades to keep pace with advancing IT technology. CTMS service providers offer cost-effective solutions to establish or enhance the technological infrastructure for efficient trial management.

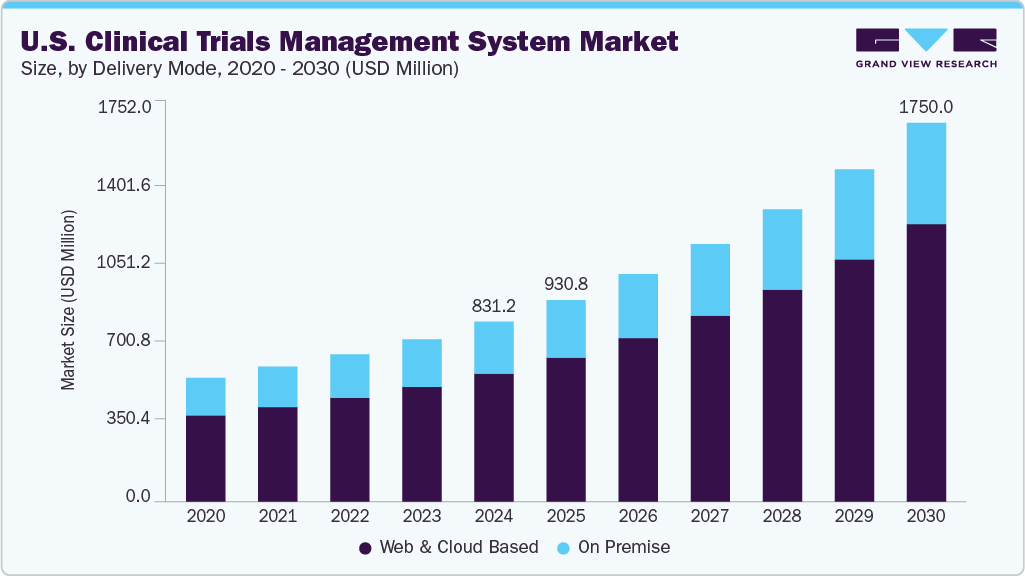

Delivery Mode Insights

The web & cloud-based segment led the market with the largest revenue share in 2024. With widespread adoption among end users, this segment is projected to maintain its dominance and exhibit rapid growth throughout the forecast period. These solutions facilitate clinical trial data management through third-party providers, offering scalable hosting options. In addition, cloud-based technologies offer the advantage of seamless data accessibility from various devices, including laptops, mobiles, workstations, and tablets, via CTMS software. Moreover, the introduction of cloud-based CTMS solutions by companies further fuels the market growth of this segment. For instance, in April 2021, Calyx launched Calyx CTMS v15.0, an enhanced CTMS on the Azure cloud platform, aimed at minimizing risks in clinical trial processes.

On-premise segment is expected to grow at a significant CAGR over the forecast period. On-premise delivery involves installing solutions on computers or hardware within the organization. Despite requiring installation within the organization's premises, these solutions offer remote access, leading to reduced costs associated with power consumption and system maintenance. Furthermore, established companies often find it challenging to transition all their healthcare IT applications to the cloud. Consequently, some organizations opt for a hybrid approach, combining both on-premise and cloud-based services to create a flexible working environment.

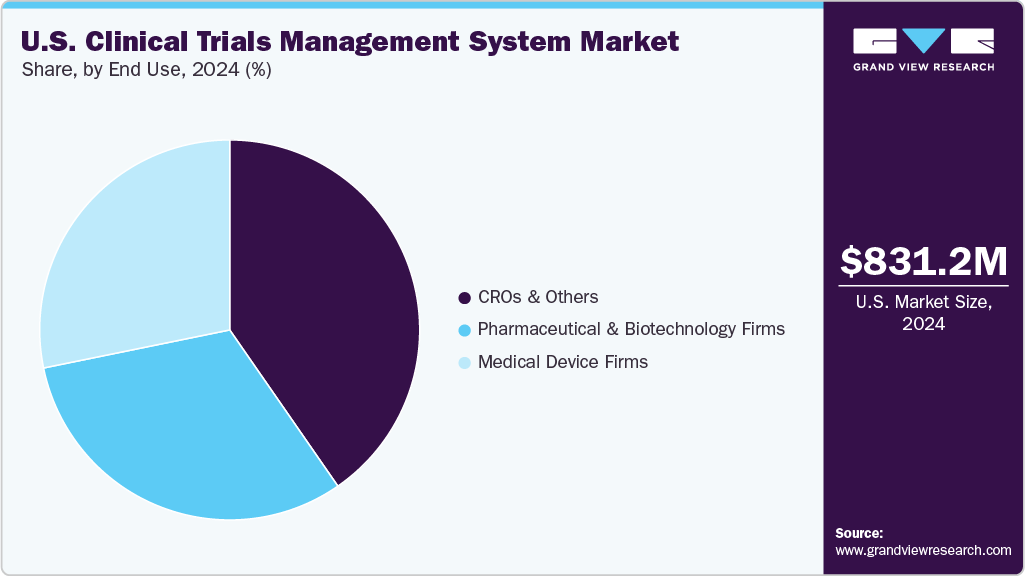

End Use Insights

The CRO and other segments held the market with the largest revenue share in 2024 and are anticipated to experience the fastest CAGR throughout the forecast period. The market growth can be attributed to the rising number of partnerships, the outsourcing of clinical trials to contract research organizations, and the increasing prevalence of decentralized trials. For example, in September 2023, MedRhythms collaborated with Curavit Clinical Research, a CRO, for its decentralized clinical trial focusing on chronic stroke.

The medical device firms’ segment is expected to grow at a substantial CAGR during the forecast period. This growth is from the increased significance of enterprise CTMS within leading medical diagnostic and device organizations, aiming to streamline workflows, proactively address performance issues, and efficiently deploy critical resources. In addition, various governments have initiated efforts to promote the safe and effective conduct of clinical trials for medical devices.

Key U.S. Clinical Trial Management System Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key U.S. Clinical Trial Management System Companies:

- IQVIA, Inc.

- Medidata (Dassault Systèmes)

- Oracle

- DATATRAK International, Inc.

- Clario

- SimpleTrials

- Calyx (formerly Parexel Informatics)

- RealTime Software Solutions, LLC

- Laboratory Corporation of America Holdings

- Veeva Systems

- Wipro Limited

- MedRhythms

Recent Developments

- In April 2025, Veeva Systems introduced SiteVault CTMS, a cloud-based clinical trial management system designed for research sites. Integrated with SiteVault eISF and eConsent, it facilitates comprehensive trial management and seamless data exchange with sponsors.

“We are excited to bring Veeva SiteVault CTMS to the industry. High-quality cloud software and seamless sponsor integration will help sites be more efficient”.

-Nick Frenzer, general manager site solutions at Veeva

- In January 2024, BSI Life Sciences showcased demo of its latest client, Ocular Therapeutix, for its cloud-based Clinical Trial Management System

“When our team first saw a demo of BSI CTMS, we were very much impressed by the software’s comprehensiveness and immediately recognized the potential in streamlining our day-to-day workflows.”

-Alet van Beek, Head of Clinical Operations at Ocular Therapeutix.

- In April 2022, Bristol Myers Squibb globally implemented Veeva Systems CTMS to drive end-to-end trial management. The implementation enabled Bristol Myers Squibb to establish agile, unified, and simple trial processes to make clinical trials swift and more efficient

We’re thrilled to expand on our longstanding partnership with Veeva across R&D.

-Greg MeyersBristol Myers Squibb chief digital and technology officer

U.S. Clinical Trial Management Systems Market Report Scope

Report Attribute

Details

Market Size for 2025

USD 930.81 million

Revenue forecast in 2030

USD 1,750.01 million

Growth rate

CAGR of 13.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution type, component, delivery mode, and end use

Key companies profiled

IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Clario; SimpleTrials; Calyx (formerly Parexel Informatics); RealTime Software Solutions, LLC; Laboratory Corporation of America Holdings; Veeva Systems; Wipro Limited; MedRhythms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clinical Trial Management System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. clinical trial management systems market report based on solution type, component, delivery mode, and end use:

-

Solution Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise

-

Site

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud Based

-

On Premise

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Firms

-

Medical Device Firms

-

CROs & Others

-

Frequently Asked Questions About This Report

b. The U.S. clinical trials management system market size was estimated at USD 831.22 million in 2024 and is expected to reach USD 930.81 million in 2025.

b. The U.S. clinical trials management system market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 1,750.01 million by 2030.

b. The enterprise segment dominated the market with the largest revenue share of 74.8% in 2024. This is attributable to key features including providing comprehensive insights into deviations and accruals, robust reporting capabilities, scalable solutions, streamlined regulatory process management, and enhanced billing compliance.

b. Some key players operating in the U.S. clinical trials management system market include IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Clario; SimpleTrials; Calyx (formerly Parexel Informatics); RealTime Software Solutions, LLC; Laboratory Corporation of America Holdings; Veeva Systems; Wipro; MedRhythms

b. Key factors that are driving the market growth include rapid growth of healthcare IT, a preference for decentralized clinical trials, initiatives by key industry players, and a rising number of clinical studies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.