- Home

- »

- Medical Devices

- »

-

U.S. Cochlear Implants Market Size, Industry Report, 2030GVR Report cover

![U.S. Cochlear Implants Market Size, Share & Trends Report]()

U.S. Cochlear Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Age Group (Adult, Pediatric), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-281-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cochlear Implants Market Size & Trends

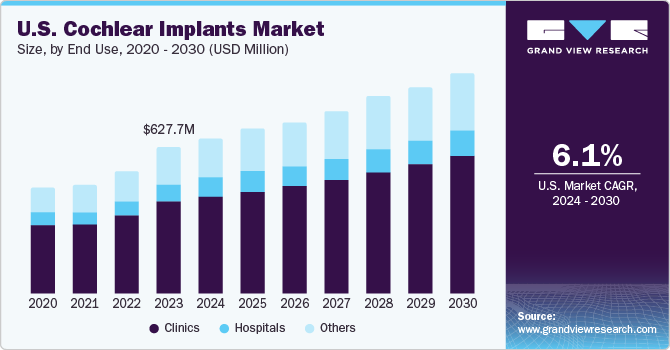

The U.S. cochlear implants market size was estimated at USD 627.7 million in 2023 and is projected to grow at a CAGR of 6.08% from 2024 to 2030. The U.S. has seen a surge in the use of cochlear implants, primarily due to greater public knowledge of the device's therapeutic benefits and federal and state legislation, such as the Americans with Disabilities Act that prohibits discrimination against people with disabilities. It is expected to drive market expansion and increase demand for cochlear implants in the U.S.

In addition, several implants and sound processors have also been introduced, along with helpful government regulations, private insurance coverage, and increased public knowledge of hearing aids. As per the study conducted by Otology & Neurotology, Inc. in July 2023, 350 cochlear implant procedures were performed on adults over 20, up from 244 per 100,000 in 2019.

Moreover, those over 65 are the fastest-growing demographic in the U.S., and approximately 25% of those in this age group have fatal hearing loss. That percentage rises to 50% for those 75 years of age and above who have a debilitating hearing loss. These elements would propel the U.S. market's expansion.

However, introducing cutting-edge products by the major competitors in the market and government approvals encourage market expansion. For instance, in November 2022, the Cochlear Nucleus 8 Sound Processor received FDA approval from Cochlear Limited, a global pioneer in implantable hearing solutions. With its compact and lightweight design, the Nucleus 8 is the most comfortable and discrete cochlear implant sound processor. The first cochlear implant sound processor capable of supporting Bluetooth LE Audio is the Nucleus 8 Sound Processor. These developments would make cochlear implants more accessible and available to people needing them, raising demand and accelerating market expansion.

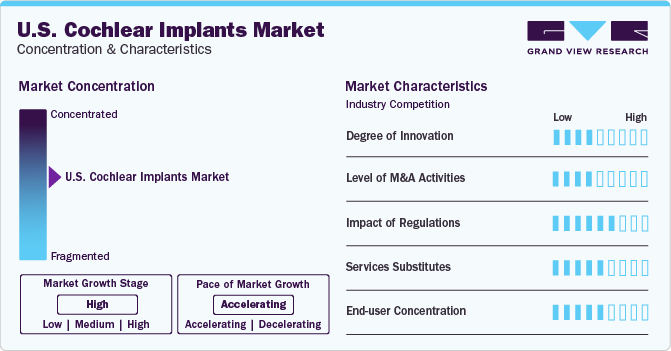

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The U.S. cochlear implants market is characterized by a high degree of innovation. Launching several technologically advanced products in the market to increase the revenue share. For instance, in December 2023, the FDA approved Advanced Bionics' cochlear implant technology, and the company added new capabilities to its Marvel CI sound processor line of products to enhance patient results and the provision of hearing care.

Mergers and acquisitions (M&A) are a prominent feature of the U.S. cochlear implants market due to several factors, including the regional expansion and the numerous government programs and initiatives that support the treatment of hearing loss in various nations, such as Argentina. For instance, in September 2022, WS Audiology expanded its regional footprint by opening a manufacturing and distribution facility in Mexico to better service Signia customers in Latin America, Canada, and the U.S.

Regulatory monitoring of the cochlear implant sector in the U.S. is also growing. The FDA oversees the production and distribution of cochlear devices in the country. Furthermore, producers need FDA approval for efficacy and safety to cochlear implants work and a Furthermore, such as of its significant risk, the implant is categorized as a class III device. Therefore, strict approval requirements are probably going to limit market expansion.

There is a significant demand for service substitution for U.S. cochlear implants. Thus, companies are entering the market with several high-tech items to gain market dominance. Advanced sound processing, wireless connectivity, rechargeable implants, hybrid implants, better surgical methods, and implant materials are only a few examples of the technological services available nowadays.

The end-user focus of the U.S. cochlear implants market is a significant factor. Most cochlear implant end users are hospitals and clinics offering surgical implantation services and post-operative care. These medical centers provide comprehensive services, such as audiological assessments, surgical procedures, and rehabilitation programs, to adult and children patients with severe hearing loss.

Age Group Insights

The adult segment dominated the market and accounted for a revenue share of 64.2% in 2023. The U.S. is expected to witness an expansion in the field of speech therapy due to several variables, including a rising number of speech therapy clinics, advancements in adult cochlear implants, and a large patient pool with severe to profound hearing loss. According to NIDCD, more than 15% of persons over 18 have hearing loss in the U.S. As cochlear implant technology has developed, better hearing results and a more comprehensive range of users have been drawn in, and propelling market expansion.

The pediatric segment is anticipated to register the fastest CAGR from 2024 to 2030. This growth is expected to be driven by children using cochlear implants more frequently, as they are a cost-effective option. Children older than 12 months have been able to use cochlear implants since 2000. In March 2024, the National Institute on Deafness and Other Communication Disorder (NIDCD) reported that two out of every three American children are born deaf in one or both ears. Furthermore, parents without hearing impairment give birth to nearly 90% of children with hearing loss.

End-use Insights

The clinics segment accounted for the largest revenue share in 2023. Instead of hospitals, outpatient clinics are increasingly the site of cochlear implant surgery. This is due to smaller, more portable cochlear implant devices, and improved surgical techniques have led to this. The National Institutes of Health (NIH) and the Centers for Medicare & Medicaid Services (CMS) are two examples of U.S. government programs that support cochlear implant and hearing health research and projects. These initiatives may facilitate the expansion of clinics and medical facilities offering cochlear implant services in the market.

The other segment is anticipated to register the fastest CAGR from 2024 to 2030. This growth is driven by research institutions, non-profit organizations, government policies, training and educational programs, media and public awareness campaigns, and international collaborations. These factors collectively contribute to the growth and development of the cochlear implants market in the U.S.

The U.S. government plays a crucial role in shaping the cochlear implants market through policies, regulatory frameworks, and funding initiatives. For instance, the FDA (Food and Drug Administration) regulates the approval process for cochlear implant devices, ensuring their safety and efficacy. In addition, government policies that support research, insurance coverage, and accessibility contribute to the market's growth.

Key U.S. Cochlear Implant Company Insights

Some key players operating in the market include Cochlear Ltd, MED-EL Medical Electronics, Oticon Medical, and Advanced Bionics Corporation.

-

Cochlear Ltd. is a company that develops and sells acoustic, bone conduction, and cochlear implants to treat hearing impairments.

-

MED-EL Medical Electronics (MED-EL) is a privately held business prioritizing research and development to build a robust product pipeline. It creates and markets hearing implants for the middle ear, auditory brainstem, cochlear, bone conduction, and electric-acoustic stimulation.

Key U.S. Cochlear Implant Companies:

- Cochlear Ltd

- MED-EL Medical Electronics

- Oticon Medical

- Advanced Bionics Corporation

- Sonova Holding AG

- Medtronic

- Nurotron Biotechnology Co., Ltd.

- ZPower, LLC

- Widex A/S

Recent Developments

-

In January 2022, Cochlear Limited's Nucleus Implants, manufactured by the company, received authorization from the U.S. Food and Drug Administration (FDA) to treat single-sided deafness (SSD) and unilateral hearing loss (UHL). This approval marks the first time Cochlear can offer cochlear implants as a treatment solution for individuals suffering from UHL/SSD.

-

In January 2022, TODOC, a Korean company focused on neural prostheses and neuromodulation devices, announced the launch of 'SULLIVAN' - an innovative artificial cochlear implant. This product features an easy-to-wear external ear-mounted vagus nerve regulator, TODOC's artificial cochlear implant offers customizable neuromodulation and audio streaming services, ultimately enhancing its overall usability.

-

In January 2019, Cochlear Ltd. raised customer awareness of its full product line by introducing its product at the Customer Electronics Show (CES) in Las Vegas. In the future, this product advertisement would help Cochlear Ltd. grow its revenue and sales.

U.S. Cochlear Implants Market Report Scope

Report Attribute

Details

Market Size Value in 2024

USD 659.8 million

Revenue forecast in 2030

USD 940.1 million

Growth rate

CAGR of 6.08% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, end-use, region

Country scope

U.S.

Key companies profiled

Cochlear Ltd; MED-EL Medical Electronics; Oticon Medical; Advanced Bionics Corporation,; Sonova Holding AG; Medtronic, Nurotron Biotechnology Co., Ltd.; ZPower; LLC & Widex A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cochlear Implants Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cochlear implants market report based on age group, end-use, and region:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult (by Type of Fitting)

-

Adult Unilateral Implants

-

Adult Bilateral Implants

-

-

Pediatric (by Type of Fitting)

-

Pediatric Unilateral Implants

-

Pediatric Bilateral Implants

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. cochlear implants market size was valued at USD 627.7 million in 2023 and is expected to reach USD 659.8 million in 2024.

b. The U.S. cochlear implants market is projected to grow at a compound annual growth rate (CAGR) of 6.08% from 2024 to 2030 to reach USD 940.1 million by 2030.

b. The adult segment dominated the market and accounted for 64.2% in 2023. The U.S. is expected to witness an expansion in the field of speech therapy due to several variables, including a rising number of speech therapy clinics, advancements in adult cochlear implants, and a large patient pool with severe to profound hearing loss.

b. Some of the key players operating in the market include Cochlear Ltd, MED-EL Medical Electronics, Oticon Medical & Advanced Bionics Corporation.

b. The U.S. has seen a surge in the use of cochlear implants, primarily due to greater public knowledge of the device's therapeutic benefits and federal and state legislation, such as the Americans with Disabilities Act, that prohibits discrimination against people with disabilities. It is expected to drive market expansion and increase demand for cochlear implants in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.