- Home

- »

- Next Generation Technologies

- »

-

U.S. Commercial Drone Market Size & Share Report, 2030GVR Report cover

![U.S. Commercial Drone Market Size, Share & Trends Report]()

U.S. Commercial Drone Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By End Use, By Propulsion Type, By Range, By Operating Mode, By Endurance, By Maximum Take-off Weight, And Segment Forecasts

- Report ID: GVR-4-68040-090-7

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

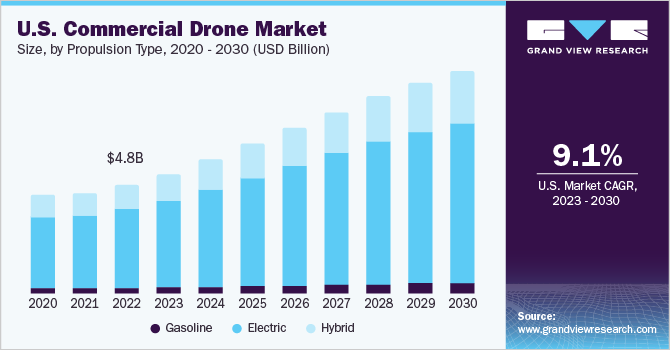

The U.S. commercial drone market size was valued at USD 4.79 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. The commercial drone industry is witnessing rapid growth and transforming various sectors such as agriculture, delivery and logistics, and energy among others. Advancements in drone technologies have led to increased demand and utilization in industries such as filming, emergency response, construction, and real estate. Additionally, drone software solution providers and manufacturers are continuously innovating and upgrading their offerings to cater to diverse market needs. As governments establish regulatory frameworks, the integration of drones into industries is expected to accelerate. This, in turn, is likely to create lucrative opportunities for market expansion over the forecast period.

Furthermore, favorable legislations and rising use of commercial drones by authorities in the U.S. is expected to attract various industries to utilize drones for different processes. Similarly, government authorities across the region are constantly working on framing new regulations for the commercial applications of drones. This is attributed to increased focus on the adoption of commercial drones due to their economic potential, while prioritizing the safety and security of the country. This, in turn, is anticipated to drive the U.S. commercial drone market growth over the forecast period.

Moreover, the U.S. is expected to witness a convergence of technologies, societal acceptance as well as a favorable regulatory landscape that is further expected to increase demand for commercial drones in various industries. The continuous development in drone technological capabilities and related software, their commercial applications, as well as the associated benefits, are anticipated to experience steady expansion as it offers added features and easy control to drone operators. Such type of developments by market players are expected to drive the U.S. commercial market growth.

Additionally, the introduction of updated drone regulations has optimized the procedure for legally conducting commercial drone operations. The positive regulations are expected to attract entrepreneurs to use commercial drones. For instance, in the U.S., some of the significant changes in the Federal Aviation Administration (FAA) regulation’s Part 107 update includes the removal of “section 333 exception” and relaxed standards for pilots. This change in regulations that are required for commercial operations of drones, is anticipated to drive the market growth over the forecast period.

The market demand for commercial drones in the U.S. is expected to be boosted by the integration of advanced technologies, including thermal cameras and AI capabilities. These advancements enhance drones' capabilities in areas such as extended flight time, surveillance, mapping, and disaster management. The U.S. has made significant investments in research and development to create commercial drones that effectively support sectors like agriculture, law enforcement, real estate, and construction. As a result, these advancements are anticipated to drive the market demand for commercial drones.

Product Insights

The rotary blade segment accounted for the highest market share of around 78% in 2022. The demand for rotary blade drones is anticipated to surge due to their use in inspection activities and their unique capability to hover and maneuver with agility, while maintaining visual observation of specific targets for prolonged periods. In addition, these drones can be used in small and confined spaces with no special requirement for take-off and landing as these drones possess the ability to do vertical take-off and landing. Moreover, rotary blade drones offer easier control than hybrid and fixed-wing counterparts that is anticipated to be a key factor for the segment growth.

The hybrid segment is expected to witness fastest CAGR of more than 11% during the forecast period from 2023 to 2030. This segment growth is attributed to hybrid commercial drones having features of both fixed-wing and rotary-blade drones, making them more advantageous in terms of efficiency and practicality. Moreover, the demand for hybrid commercial drones is high as it can enhance drone efficiency and can be powered by integrating the capabilities of batteries and fuel. Moreover, these drones can fly for long periods with heavier payloads, even in severe weather conditions, which is expected to drive the segment growth over the forecast period.

Application Insights

The commercial segment accounted for the largest market share of over 75% in 2022. The segment demand is attributed to the growing applications of commercial drones that include filming and photography, inspection & maintenance, mapping & surveying, precision agriculture, and surveillance & monitoring, among others. The drones used in surveillance and monitoring are in trend as they are equipped with infrared sensors and cameras that help in easy monitoring and surveying against potential threat. Moreover, the precision capabilities of these drones are expected to be widely in demand for infrastructure inspection, power line inspection, wind turbine inspection, and building inspections.

The government and law enforcement segment is anticipated to expand at the fastest CAGR over the forecast period from 2023 to 2030. The segment growth is attributed to growing applications of drones that include firefighting & disaster management, search & rescue, maritime security, border patrol, police operations, and traffic monitoring, among others. For instance, the drones can assist emergency responders with quick responses and safe evacuations processes. In addition, drones are increasingly being deployed in complex rescue and emergency operations as they offer safety and timely response options.

End-use Insights

The media and entertainment segment reported for the largest market share of over 24% in 2022, owing to the growing demand of drones for their stable movement capabilities in shooting content. Moreover, the trend of professional drones being used by filmmakers for cost-effective and exact frame capture is expected to drive demand for drones. In addition, the increasing demand from clients and owners for aerial photography to advertise amusement parks, public spaces, tourist attractions, hotels, and resorts is expected to drive the segment's expansion.

The delivery and logistics segment is expected to expand at the fastest CAGR of around 13% over the forecast period from 2023 to 2030. This is attributed to several advantages offered by drones, such as reduced shipping and operational costs, faster delivery, among others. Moreover, key players in this segment are partnering with other companies of different industries to add to their offerings and increase geographical presence. For instance, in December 2022, Zipline International Inc., an American company that manufactures, designs, and operates delivery drones, extended its partnership with the government of Rwanda for last mile delivery of key medicinal supplies and equipment. Such type of initiatives by companies are expected to drive the segment growth in the U.S. commercial drone market.

Propulsion Type Insights

The hybrid propulsion type segment is expected to expand at the highest CAGR of around 10% over the forecast period. The segment growth is attributed to the drones utilizing a combination of different power sources for momentum. These drones typically combine an electric motor with an additional power system, such as a combustion engine or fuel cell, to provide a cost-effective power and flight solution. This results in improved flight performance along with increased operational efficiency that is expected to drive the segment growth over the forecast period.

The electric propulsion type segment accounted for the largest market share of around 72% in 2022. The segment dominance is attributed to the popularity of electric drones using rechargeable batteries. These drones have gained widespread adoption due to numerous advantages such as quiet operations, flight efficiency, longer flight times, and easy maintenance, among others. This, in turn, is expected to further drive the segment growth over the forecast period.

Range Insights

The Visual Line of Sight (VLOS) segment accounted for the largest market share of over 69% in 2022. The segment growth is attributed to legislation regarding the operations of drones for commercial purposes. In addition, drones flown in visual line of sight are easy to operate and guide due to the visual aid factor. Similarly, the segment demand can be attributed to drone operators being able to visually see obstacles and avoid them to ensure safe drone flying.

The Beyond Visual Line of Sight (BVLOS) segment is anticipated to expand at the fastest CAGR over the forecast period. Factors such as the availability of high-performance drones with autonomous capabilities are expected to be the primary factors driving the segment growth. Moreover, the integration of modern communication systems and tracking software to safely monitor and operate drones is another key factor for the segment’s growth. Similarly, the increase in long range operations that require operators to stay a safe distance is anticipated to add to the segment growth.

Endurance Insights

The less than 5 hours segment accounted for the largest market share of over 70% in 2022. The segment growth is attributed to drones equipped with heavy and modern equipment which include high-resolution cameras used in various industries such as construction, manufacturing, among others. Similarly, the portability factor of low endurance drones is anticipated to augment segment growth as operators can carry drones to distant locations. Also, the low cost of such drones is expected to further boost the demand for the segment.

The 5-10 hours segment is anticipated to expand at the fastest CAGR of over 10% over the forecast period.The segment growth is attributed drones becoming more capable and efficient due to continuous development and technical updates. Moreover, the demand for this segment is expected to grow as these drones offer several benefits in the commercial sector that include the ability to carry a larger payload, getting more comprehensive data, safe and stable in real use, among others. Therefore, the segment is expected to add to the growth of the U.S. commercial drone market.

Maximum Take Off Weight Insights

The <25 kg segment accounted for the largest market share of over 80% in 2022. The growth of the segment is attributed to advantages of drones with up to 25 kg takeoff weight such as flexibility, affordability, and convenience. Moreover, the takeoff weight makes the drone suitable for a wide range of applications while adhering to stringent regulations. Similarly, the drones are capable of maneuverability in compact areas while maintaining efficient flight capabilities that is expected to add to the segment demand.

The 25 – 500 kg segment is expected to expand at a CAGR of over 10% during the forecast period. The segment growth is attributed to the capability of these drones to carry and operate heavy equipment, such as thermal and LiDAR sensors, cameras, packages, commercial, and agricultural payloads. In addition, the popularity of these drones increased during the pandemic as they were used in delivering medical and healthcare supplies. These drones are used to carry emergency equipment and supplies during critical operations such as search & rescue and disaster relief operations. This, in turn, is expected to fuel the segment's growth further.

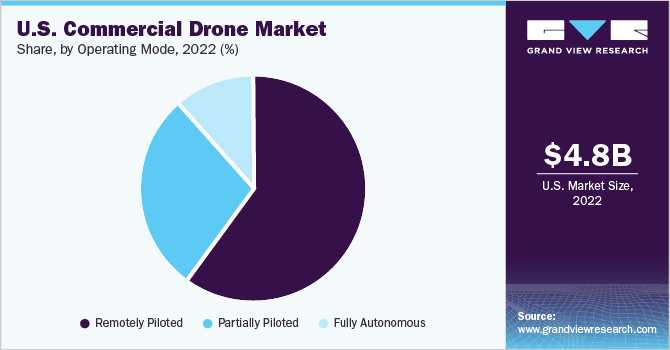

Operating Mode Insights

The remotely piloted segment accounted for the largest market share of around 60% in 2022. The segment dominance is attributed to its popularity across various commercial or industrial purposes, such as aerial photography and videography, agriculture applications, delivery services, and infrastructure monitoring, among others. Moreover, the trend of manual drone operation is anticipated to drive the segment growth as a pilot operates the device remotely using a console.

The fully autonomous segment is anticipated to expand at the fastest CAGR of over 10% over the forecast period, owing to the rising trend of autonomous drone operation. The segment is expected to grow as fully autonomous operated drones can perform operations with no human intervention from take-off to landing entirely on their own, relying on onboard sensors, algorithms, and the implementation of artificial intelligence. This, in turn, is anticipated to drive the segment growth over the forecast period.

Key Companies & Market Share Insights

The key players in the market use strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies are also focusing on improving their product offerings to better suit the changing needs of users to stay competitive. For instance, in April 2023, Skydio, Inc. partnered with gNext Labs, an emerging infrastructure inspection platform. The aim of the partnership is to improve speed and efficiency in infrastructure inspections. Some of the prominent players in the U.S. commercial drone market include:

-

AeroVironment, Inc.

-

Intel Corporation

-

PrecisionHawk, Inc.

-

Skydio, Inc.

-

Freefly Systems Inc.

-

Elroy Air, Inc.

-

ULC Technologies, LLC

-

Vantage Robotics Atmos UAV B.V.

-

Intel Corporation

-

Parrot Drones SAS

-

SZ DJI Technology Co., Ltd.

U.S. Commercial Drone Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.30 billion

Revenue forecast in 2030

USD 9.78 billion

Growth Rate

CAGR of 9.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand units, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight

Country scope

U.S.

Key companies profiled

AeroVironment, Inc.; Intel Corporation; PrecisionHawk, Inc.; Skydio, Inc.; Freefly Systems Inc.; Elroy Air, Inc.; ULC Technologies, LLC; Vantage Robotics Atmos UAV B.V.; Parrot Drones SAS; SZ DJI Technology Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Drone Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. commercial dronemarket report on the basis of product, application, end-use, propulsion type, range, operating mode, endurance, and maximum takeoff weight:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Fixed wing

-

Rotary Blade

-

Hybrid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Others

-

-

Government & Law Enforcement

-

Firefighting & Disaster Management

-

Search & Rescue

-

Maritime Security

-

Border Patrol

-

Police Operations

-

Traffic Monitoring

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Delivery & Logistics

-

Energy

-

Media & Entertainment

-

Real Estate & Construction

-

Security & Law Enforcement

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operating Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Endurance Outlook (Revenue, USD Billion, 2018 - 2030)

-

<5 Hours

-

5 – 10 Hours

-

>10 Hours

-

-

Maximum Takeoff Weight Outlook (Revenue, USD Billion, 2018 - 2030)

-

<25 Kg

-

25 – 500 Kg

-

>500 Kg

-

Frequently Asked Questions About This Report

b. The global U.S. commercial drone market size was valued at USD 4.79 billion in 2022 and is expected to reach USD 5.30 billion in 2023.

b. The global U.S. commercial drone market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 9.78 billion by 2030.

b. The rotary blade segment registered the highest revenue share of over 78% in 2022 in the U.S. commercial drone market and is expected to continue dominating the industry over the forecast period.

b. The key players in U.S. commercial drone market includes AeroVironment, Inc., Intel Corporation, PrecisionHawk, Inc., Skydio, Inc., Freefly Systems Inc., Elroy Air, Inc., ULC Technologies, LLC, Vantage Robotics Atmos UAV B.V., Aero Systems West, AguaDrone Innovations LLC

b. The U.S. commercial drone market growth is attributed to increasingly growing applications of drones across the commercial sectors, such as entertainment, agriculture, and energy. In addition, integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML) in drones is expected to offer significant growth prospects to the commercial drone industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.