- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Duct Smoke Detector Market Report, 2030GVR Report cover

![U.S. Commercial Duct Smoke Detector Market Size, Share & Trends Report]()

U.S. Commercial Duct Smoke Detector Market Size, Share & Trends Analysis Report By Type (Photoelectric Duct Smoke Detector, Ionization Duct Smoke Detector), By Sales Channel (OEM Companies, HVAC Distributors), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-058-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

The U.S. commercial duct smoke detector market size was estimated at USD 169.4 million in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. The growth of the U.S. commercial duct smoke detector industry is primarily driven by the increasing focus on safety and compliance with stringent fire safety regulations. As commercial buildings, including offices, schools, and healthcare facilities, are required to meet updated fire protection standards, the demand for advanced smoke detection systems has risen.

Another factor contributing to the market’s expansion is the increasing awareness about fire safety in commercial and industrial settings. Businesses are investing in fire prevention technologies to protect both their assets and employees, driven by both legal requirements and the potential cost savings from minimizing fire-related damage.

Drivers, Opportunities & Restraints

Technological advancements in smoke detection, such as the integration of IoT (Internet of Things) capabilities, have further fueled market growth. These modern systems offer real-time monitoring, remote access, and early warning alerts, improving building safety and enabling faster responses to potential fire hazards. The growing trend toward smart buildings and automation also supports the adoption of more sophisticated fire detection systems.

A key restraint for the U.S. commercial duct smoke detector industry is the high upfront cost associated with purchasing and installing advanced detection systems. In addition, the complexity of installation and integration with existing HVAC systems can lead to increased costs and time delays, further limiting adoption in certain commercial sectors.

An opportunity for growth in the U.S. market lies in the increasing demand for smart building technologies. As more commercial buildings incorporate automation and IoT-enabled systems, duct smoke detectors that integrate with these technologies provide significant value. Real-time data collection, remote monitoring, and predictive maintenance features offer building managers greater control over fire safety, creating a strong market opportunity for advanced smoke detection solutions.

Type Insights

The growing preference for photoelectric duct smoke detectors is largely driven by their superior sensitivity to smoldering fires, which are more common in commercial environments. Photoelectric detectors are particularly effective in detecting smoke from slow-burning fires, which are harder to detect with ionization-based systems.

The ionization duct smoke detector segment accounted for 25.0% market share due to their sensitivity to fast-burning fires, which are typically associated with the rapid spread of flames in commercial spaces. This capability is crucial for detecting fires in their early stages, allowing for quicker responses and enhanced safety. Ionization detectors are also generally more affordable than photoelectric alternatives, making them an attractive option for businesses seeking cost-effective fire detection solutions.

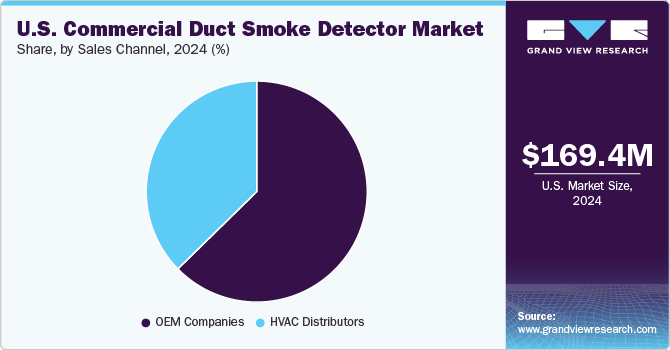

Sales Channel Insights

As retrofitting older buildings and upgrading existing HVAC systems becomes more common, HVAC distributors are growing in popularity. They provide a wide network to reach end-users, such as facility managers, contractors, and building owners, who are looking to enhance the fire safety of their HVAC systems. In addition, HVAC distributors often offer technical expertise and installation support, which can influence customers’ purchasing decisions, further promoting market growth.

The OEM companies segment held a 62.6% market share in 2024. OEM manufacturers are performing well in the distribution of commercial duct smoke detectors due to their strategic position in the supply chain and their ability to integrate these systems directly into new commercial construction projects. As commercial real estate development continues to expand, especially in the healthcare industry, education industry, and others, there is a rising demand for advanced fire safety systems that comply with local and national fire safety codes.

Country Insights

U.S. Commercial Duct Smoke Detector Market Trends

The U.S. commercial duct smoke detector market is experiencing robust growth due to an increasing focus on safety regulations and fire prevention technologies across various sectors. As commercial buildings, including offices, hospitals, schools, and shopping centers, expand and modernize, there is a growing need to comply with stringent fire safety codes and regulations set by authorities like the National Fire Protection Association (NFPA) and local fire departments

The commercial duct smoke detector market in the west region is expected to grow at a CAGR of 6.2% over the forecast period. States like California, Washington, and Oregon are investing heavily in green building standards and energy-efficient construction, which often come with stringent fire safety requirements. With many of these buildings adopting advanced HVAC systems, the market in the region is growing.

The northeast commercial duct smoke detector dominated the U.S. market in 2024, accounting for a market share of 26.7%. In the Northeast region, market growth for commercial duct smoke detectors is driven by the region's dense population, older building stock, and a strong regulatory environment focused on building safety. Cities such as New York, Boston, and Philadelphia have extensive commercial infrastructures, many of which require retrofitting to meet modern safety standards. With many older buildings needing upgrades to comply with newer fire safety regulations, duct smoke detectors are becoming a vital part of HVAC system renovations.

Key U.S. Commercial Duct Smoke Detector Company Insights

Some of the players operating in the market include Potter Electric Signal Company, LLC. and National Time & Signal.

-

Potter Electric Signal Company, LLC is a company based in Missouri, U.S. operating in the industry for more than 120 years. The company is engaged in manufacturing and offering products such as fire sprinklers, duct detectors, and several other HVAC products and technologies for commercial applications. It also offers commissioning, installation, maintenance, and other service support to its customers.

-

National Time & Signal is a company operating in the U.S. since the 1870s and is engaged in the production of time systems, outdoor clocks, and HVAC systems. The company is involved in technologies such as WiFi, GPS, and LAN/WAN. Its detection systems include various features and capabilities, such as interactive graphic displays, maintenance manager, and emergency communication.

Key U.S. Commercial Duct Smoke Detector Companies:

- Potter Electric Signal Company, LLC

- Honeywell International Inc.

- Hochiki America Corporation

- Kiddie (Carrier)

- Apollo America Inc.

- National Time & Signal

- Space Age Electronics, Inc.

- Greystone Energy Systems Inc.

- GENTEX CORPORATION

- Johnson Controls

Recent Developments

-

In April 2024, Kidde (Carrier) launched the Optica Duct Smoke Detector, setting a new benchmark in HVAC smoke detection. The Optica Duct Smoke Detector is specially engineered for use in HVAC systems, providing increased reliability for site managers and end-users who have faced difficulties in finding effective smoke detection solutions that can handle the moisture and dust challenges typical of HVAC environments.

-

In July 2024, Calectro AB introduced the Uniguard 8, an advanced duct smoke detector that enhances installation ease and detection capabilities. This model features a compact design with a single venturi tube that combines both airflow inlet and outlet, allowing for a simplified installation process requiring only one hole to be drilled in the duct.

U.S. Commercial Duct Smoke Detector Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 177.3 million

Revenue forecast in 2030

USD 226.0 million

Growth Rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Regional Scope

Northeast; Southeast; West; Southwest; Midwest

Key companies profiled

Potter Electric Signal Company, LLC; Honeywell International Inc.; Hochiki America Corporation; Kiddie (Carrier); Apollo America Inc.; National Time & Signal; Space Age Electronics, Inc.; Greystone Energy Systems Inc.; GENTEX CORPORATION; Johnson Controls

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Duct Smoke Detector Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. commercial duct smoke detector market report based on type, sales channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Photoelectric Duct Smoke Detector

-

Ionization Duct Smoke Detector

-

-

Sales Channel (Revenue, USD Million, 2018 - 2030)

-

OEM Companies

-

HVAC Distributors

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southeast

-

West

-

Southwest

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. commercial duct smoke detector market size was estimated at USD 169.4 million in 2024 and is expected to reach USD 177.3 million in 2025.

b. The U.S. commercial duct smoke detector market , in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 226.0 million by 2030.

b. The photoelectric duct smoke detector segment dominated the market in 2024 accounting for 76.4% of overall revenue share. As businesses become more conscious of the need for early fire detection to prevent damage and ensure safety, photoelectric duct smoke detectors are increasingly favored.

b. Some of the key players operating in the U.S. commercial duct smoke detector market are Potter Electric Signal Company, LLC, Honeywell International Inc., Hochiki America Corporation, Kiddie (Carrier), Apollo America Inc., National Time & Signal, Space Age Electronics, Inc., Greystone Energy Systems Inc., GENTEX CORPORATION, and Johnson Controls.

b. Key factors driving the U.S. commercial duct smoke detector market include stringent fire safety regulations and the growing demand for advanced, integrated smoke detection systems in modern, smart buildings. Additionally, the increasing focus on early fire detection and prevention in commercial and industrial spaces fuels market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."