- Home

- »

- Advanced Interior Materials

- »

-

U.S. Composite Railing & Decking Market Size Report, 2033GVR Report cover

![U.S. Composite Railing And Decking Market Size, Share & Trends Report]()

U.S. Composite Railing And Decking Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Capped Composite Decking & Railing, Uncapped Composite Decking & Railing), By Material And Segment Forecasts

- Report ID: GVR-4-68040-620-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Composite Railing And Decking Market Summary

The U.S. composite railing and decking market size was estimated at USD 0.99 billion in 2024 and is projected to reach USD 2.87 billion by 2033, growing at a CAGR of 11.0% from 2025 to 2033. Rising consumer preference for low-maintenance and aesthetically appealing outdoor living solutions is significantly fueling the demand for composite railing and decking products across the United States.

Key Market Trends & Insights

- By product, the uncapped composite decking & railing segment is expected to grow significantly at a CAGR of 9.9% over the forecast period.

- By material, the PVC & recycled wood composite decking & composite railing segment is expected to grow at the fastest CAGR of 11.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 0.99 Billion

- 2033 Projected Market Size: USD 2.87 Billion

- CAGR (2025-2033): 11.0%

Unlike traditional wood materials, composites offer superior durability, resistance to moisture, fading, and insect damage, which appeals strongly to homeowners seeking long-lasting and visually consistent structures. The increasing inclination toward home improvement and backyard enhancement, particularly post-pandemic, has led to a surge in demand for premium, easy-to-maintain decking options that offer the natural look of wood without its upkeep burden.

Growth in residential construction activities, especially in suburban and exurban areas, has emerged as a key factor driving market expansion. The development of single-family homes with larger outdoor spaces has created a favorable environment for the adoption of composite decks and railings, which are often installed to enhance both functional space and property aesthetics. Builders and developers are increasingly specifying composite materials in new housing projects to meet the expectations of modern homeowners regarding quality, longevity, and visual appeal, while also complying with evolving building codes that prioritize sustainability and fire resistance.

An increasing focus on sustainability and the use of recycled materials is also propelling the U.S. composite railing and decking industry forward. Most composite products are manufactured using recycled plastics and reclaimed wood fibers, aligning with growing consumer awareness and regulatory support for environmentally responsible construction. Government incentives and green building certifications, such as LEED (Leadership in Energy and Environmental Design), are further encouraging the use of composite materials in both new constructions and renovation projects, providing a strong push for market growth across eco-conscious segments.

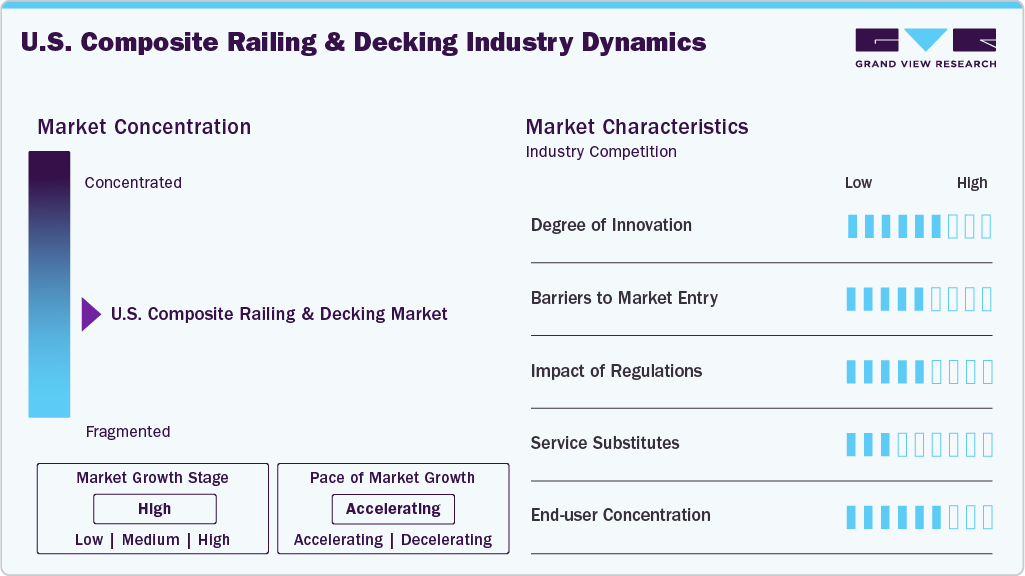

Market Concentration & Characteristics

The U.S. composite railing and decking industry is moderately concentrated, with a few key players such as Trex Company, Azek Building Products, and Fiberon holding significant market shares due to their established brand presence, advanced product portfolios, and extensive distribution networks. The degree of innovation within the market is relatively high, with manufacturers investing in research and development to enhance material durability, aesthetic versatility, and environmental performance. Notable innovations include capped composites, multi-color grain patterns, and advanced fastening systems that improve ease of installation and product longevity.

While organic growth remains a priority, the U.S. composite railing and decking industry has also witnessed strategic mergers and acquisitions aimed at expanding production capabilities, optimizing supply chains, and strengthening regional footprints. For instance, consolidation among raw material suppliers and decking manufacturers has enabled companies to manage costs better and achieve vertical integration, thereby enhancing competitiveness in both residential and commercial segments.

Regulations play an influential role in shaping the dynamics of the U.S. composite railing and decking industry, particularly those related to fire safety standards, environmental certifications, and building codes. Compliance with ASTM and ICC standards has become essential for product acceptance in large-scale construction projects, especially in wildfire-prone or coastal regions. In addition, growing consumer emphasis on sustainability is supported by regulatory frameworks promoting recycled content and low-VOC (volatile organic compounds) materials.

However, the presence of service substitutes-such as traditional wood, PVC decking, or aluminum railing systems-poses moderate competition, especially in cost-sensitive segments. Despite this, the market benefits from relatively low end-user concentration, as demand is broadly spread across individual homeowners, contractors, builders, and property developers. This diversified customer base reduces dependency on a limited number of buyers and ensures consistent demand across new construction and renovation cycles.

Product Insights

The capped composite decking & railing segment led the market with the largest revenue share of 53.68% in 2024. Strong consumer demand for high-performance, low-maintenance outdoor building materials is a primary driver of growth in the capped composite decking and railing segment. These products feature a durable outer polymer shell that encapsulates the core, offering enhanced protection against moisture, UV exposure, staining, and fading compared to uncapped alternatives. As homeowners increasingly prioritize longevity and ease of maintenance over initial cost, capped composites have become the preferred choice for decking and railing installations, particularly in regions with harsh weather conditions or high humidity levels.

The uncapped composite decking & railing segment is expected to grow at the fastest CAGR of 9.9% over the forecast period, driven by its cost-effectiveness and suitability for basic outdoor applications. These products, typically made from a blend of wood fibers and recycled plastics without an additional protective polymer shell, offer an economical alternative to premium capped composites. For price-sensitive homeowners and developers working on entry-level or mid-range residential projects, uncapped composites provide a viable balance between performance and affordability. Their ability to mimic the appearance of wood, combined with improved resistance to rot and insects compared to natural timber, makes them a compelling choice in budget-conscious renovation and construction activities.

Material Insights

The polyethylene composite decking & composite railing segment led the market with the largest revenue share of 34.1% in 2024, driven by its excellent balance of durability, flexibility, and cost-effectiveness. PE-based composites are widely recognized for their resistance to moisture, mildew, and insects, making them an ideal choice for outdoor applications in varying climatic conditions.

The PVC & recycled wood composite decking & composite railing segment is expected to grow at the fastest CAGR of 11.5% over the forecast period, driven by its balance of durability, cost-effectiveness, and environmental appeal. These materials offer a wood-like appearance while providing superior resistance to moisture, mold, and insect damage, making them ideal for diverse climate conditions across the country. The segment is largely driven by growing consumer preference for low-maintenance alternatives to traditional wood, especially among homeowners seeking long-term value and aesthetic consistency.

Key U.S. Composite Railing And Decking Company Insights

Some of the key players operating in the market include Trex Company, Fiberon

-

Trex Company is a leading manufacturer in the U.S. composite decking and railing market, widely recognized for pioneering wood-alternative decking. The company offers a comprehensive range of composite decking boards made from 95% recycled wood and plastic film, along with railing systems, fascia, and outdoor lighting solutions. Trex products are known for their durability, fade resistance, and ease of maintenance, and they are marketed through a wide network of home improvement retailers and contractors.

-

Fiberon, a subsidiary of Fortune Brands Innovations, provides a broad selection of composite decking and railing systems that integrate recycled content and advanced composite technology. The company’s product range includes various finishes and textures designed to mimic the look of natural wood while offering superior resistance to staining, fading, and mold.

MoistureShield, Certain Teed are some of the emerging market participants in the U.S. composite railing and decking industry.

-

Moisture Shield, a division of Oldcastle APG, offers durable composite decking made with Solid Core technology, which provides resistance to moisture absorption and decay. Its product portfolio includes decking lines that can be installed on the ground, in the ground, or even underwater, making it unique in the market. MoistureShield decking is often chosen for its ruggedness and performance in extreme environmental conditions.

-

Certain Teed, a brand under Saint-Gobain, produces a range of exterior building products, including composite and vinyl railing systems. While its focus leans more toward railing rather than full decking systems, CertainTeed offers durable, low-maintenance railings that meet stringent building codes and aesthetic preferences. Its products are widely used in residential and light commercial construction across the U.S.

Key U.S. Composite Railing And Decking Companies:

- Trex Company

- Azek Building Products

- Fiberon

- TimberTech

- MoistureShield

- CertainTeed

- Barrette Outdoor Living

- Envision Building Products

- Deckorators

U.S. Composite Railing And Decking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.09 billion

Revenue forecast in 2033

USD 2.87 billion

Growth rate

CAGR of 11.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Tons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material

Country scope

U.S

Key companies profiled

Trex Company, Azek Building Products, Fiberon, TimberTech, MoistureShield, CertainTeed, Barrette Outdoor Living, Envision Building Products, Deckorators

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Composite Railing And Decking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. composite railing and decking market report based on product, material:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Capped Composite Decking & Railing

-

Uncapped Composite Decking & Railin

-

-

Material Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene Composite Decking & Composite Railing

-

Polypropelene Composite Decking & Composite Railing

-

Poly vinyl Chloride Composite Decking & Composite Railing

-

PVC & Recycled wood Composite Decking & Composite Railing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. composite railing and decking market size was estimated at USD 0.99 billion in 2024 and is expected to reach USD 1.09 billion in 2025.

b. The U.S. composite railing and decking market is expected to grow at a compound annual growth rate of 11.0% from 2025 to 2033 to reach USD 2.87 billion by 2033.

b. The polyethylene composite decking & composite railing segment dominated the market and accounted for the largest revenue share of 34.1% in 2024, driven by its excellent balance of durability, flexibility, and cost-effectiveness.

b. Some of the prominent companies in the composite railing and decking market include Trex Company, Azek Building Products, Fiberon, TimberTech, MoistureShield, CertainTeed, Barrette Outdoor Living, Envision Building Products, Deckorators.

b. Key factors driving the U.S. composite railing and decking market include rising demand for low-maintenance materials, growth in residential construction, increasing focus on sustainability, product innovations, and expanding DIY home improvement trends.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.