- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Concrete Superplasticizer Market, Industry Report, 2033GVR Report cover

![U.S. Concrete Superplasticizer Market Size, Share & Trends Report]()

U.S. Concrete Superplasticizer Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Polycarboxylate Ether-based, Modified Lignosulfonates), By Form (Liquid, Powder), By Application (Ready Mix-Concrete, Precast Concrete), And Segment Forecasts

- Report ID: GVR-4-68040-623-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. concrete superplasticizer market size was estimated at USD 2,059.6 million in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2033. The market is primarily driven by the increasing demand for high-performance and durable concrete across infrastructure, commercial, and residential construction projects.

Key Market Trends & Insights

- By product, the polycarboxylate ether (PCE)-based segment is expected to grow at a CAGR of 6.4% from 2025 to 2033 in terms of revenue.

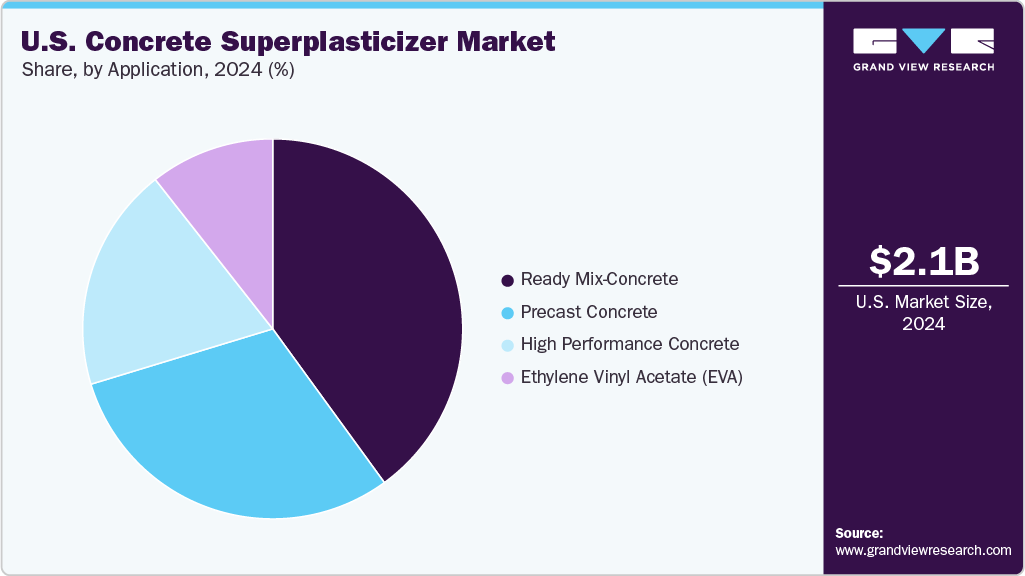

- By application, the ready mix-concrete segment held the largest revenue share of 40.0% in 2024 in terms of value.

- By form, the liquid segment held the largest revenue share of 75.9% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 2,059.6 Million

- 2033 Projected Market Size: USD 3,714.7 Million

- CAGR (2025-2033): 6.2%

Government initiatives such as the Infrastructure Investment and Jobs Act (IIJA) are fueling large-scale developments in highways, bridges, and public transit, thereby boosting consumption of advanced concrete admixtures. Additionally, the growing emphasis on sustainable construction practices and energy-efficient buildings is accelerating the adoption of polycarboxylate ether (PCE)-based superplasticizers due to their superior water-reducing capabilities and lower environmental impact.The market presents significant growth opportunities driven by advancements in admixture chemistry and the rising adoption of green building materials. The growing preference for polycarboxylate ether (PCE)-based superplasticizers in sustainable construction aligns with increasing regulatory and industry focus on reducing carbon footprints. Emerging trends such as 3D concrete printing, high-performance concrete for resilient infrastructure, and expanding precast and modular construction techniques offer untapped potential for tailored superplasticizer formulations. Moreover, the ongoing renovation and modernization of aging infrastructure in urban and semi-urban regions open new avenues for the deployment of high-efficiency admixtures that enhance the strength, durability, and workability of concrete.

Despite strong market potential, the market faces key challenges, including volatile raw material prices and supply chain disruptions, particularly for petrochemical-based inputs used in PCE and SNF formulations. Environmental regulations surrounding formaldehyde emissions pose compliance hurdles for manufacturers using SNF and SMF-based products, potentially increasing production costs. Additionally, inconsistent product performance due to varying cement chemistries and the need for on-site technical support can impede wider adoption, especially among small and mid-sized contractors.

Market Concentration & Characteristics

The market is moderately fragmented, with a few prominent players, such as Arkema, MBCC Group, Fosroc Inc., Kao Corporation, Magpei SpA, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Top players in the market are adopting a combination of product innovation, strategic partnerships, and capacity expansion to strengthen their market position. Companies are heavily investing in R&D to develop advanced, eco-friendly superplasticizer formulations, particularly polycarboxylate ether (PCE)-based products, to meet evolving performance and sustainability standards. Strategic collaborations with ready-mix producers, construction firms, and infrastructure developers are being leveraged to enhance market reach and customer loyalty.

Product Insights

The polycarboxylate ether (PCE)-based segment held the largest revenue share of 40.8% in 2024, owing to their superior performance characteristics, including high water reduction, extended slump retention, and compatibility with a wide range of cement products. PCE-based superplasticizers are increasingly favored in high-performance and ready-mix concrete applications due to their ability to deliver excellent flowability without compromising strength or durability. The rising focus on sustainable and energy-efficient construction has further accelerated the adoption of PCE formulations, as they require lower dosages and contribute to reduced carbon emissions. Leading manufacturers are prioritizing the development of next-generation PCE technologies tailored to specific climatic and construction conditions, positioning this segment for continued dominance.

In contrast, SNF and SMF based superplasticizers, while still in use, are gradually losing market share due to limitations in slump retention and evolving environmental regulations concerning formaldehyde content. These Products remain relevant in precast and general-purpose concrete applications, where cost-effectiveness and early strength gain are prioritized. MLS represents an older generation of admixtures primarily used in low-performance concrete; however, their market presence is shrinking due to limited efficiency and growing competition from more advanced alternatives. The “other products” category, which includes acrylic polymers and proprietary blends, is gaining attention in niche applications requiring customized performance attributes. Overall, the shift toward high-efficiency, environmentally friendly Products continues to reshape the competitive landscape in favor of PCE-based solutions.

Form Insights

Liquid form segment dominated the market in 2024 with 75.9% of revenue share, driven by its ease of application, uniform dispersion in concrete mixes, and widespread compatibility with automated dosing systems used in modern construction practices. Liquid superplasticizers are particularly favored in ready-mix and high-performance concrete applications, where precision in dosage and real-time performance adjustments are critical. Their ability to be easily mixed on-site or at batching plants makes them ideal for large-scale infrastructure and commercial projects. Additionally, liquid formulations allow for better quality control, reduced labor costs, and improved consistency in concrete properties, contributing to their strong market share and continued preference among contractors and concrete producers.

On the other hand, powdered superplasticizers serve a more specialized market segment, primarily in remote or small-scale construction projects, as well as in dry-mix applications such as bagged or pre-blended concrete products. The key advantages of powder form include longer shelf life, easier transportation and storage, and suitability for regions with limited access to liquid batching infrastructure. While their adoption is relatively limited compared to liquid variants, powder superplasticizers are gaining traction in the precast industry and export-oriented markets where logistics and storage efficiencies are prioritized. The growing trend of modular and prefabricated construction is expected to support steady demand for powdered formulations, though their overall market share remains secondary to liquid alternatives.

Application Insights

The ready-mix concrete segment accounted for the largest revenue share of 40.0% in 2024, fueled by the surge in commercial, residential, and infrastructure development projects that demand consistent quality, workability, and on-site efficiency. Superplasticizers, particularly PCE-based, are widely used in ready-mix applications to enhance slump retention, improve fluidity, and reduce water-cement ratios without sacrificing strength. This application segment benefits from the rising adoption of mechanized construction practices and the increasing use of automated batching and dosing systems, which ensure precise admixture integration. As urbanization and government-backed infrastructure investments accelerate, the demand for high-performance ready-mix concrete incorporating advanced admixtures is expected to remain robust.

Precast concrete and high-performance concrete (HPC) are also key application areas, where superplasticizers play a vital role in achieving early strength, high durability, and reduced curing time. In precast applications, the controlled manufacturing environment allows for the use of customized admixture blends that optimize formwork reuse and production cycles. HPC applications, including high-rise buildings, bridges, and industrial structures, demand exceptional flowability, strength, and durability, performance traits significantly enhanced by PCE-based superplasticizers. Meanwhile, the inclusion of ethylene vinyl acetate (EVA) in this segmentation likely refers to specialized or niche concrete applications such as repair mortars, self-leveling compounds, or flexible concrete formulations. Although currently a smaller segment, the EVA-based concrete market may witness moderate growth driven by demand for specialty products in renovation, waterproofing, and architectural concrete applications.

Key U.S. Concrete Superplasticizer Company Insights

Key players, such as Arkema, MBCC Group, Fosroc Inc, Kao Corporation, Magpei SpA, are dominating the market.

-

Arkema is a leading French specialty chemicals and materials company headquartered in La Défense, Paris. The company operates across three major divisions, adhesives, advanced materials, and coatings, backed by 144 production sites globally (43 in North America) and 13 R\&D centers, including key facilities in North Carolina and Pennsylvania. Arkema offers a range of PCE-based superplasticizers within the construction chemicals space under its Ethacryl portfolio, alongside solutions for mortar, gypsum, precast, and ready-mix applications. The company differentiates through strategic investments in R&D, sustainability-led product development, and expansion of industrial capabilities, evidenced by recent participation in industry events like JEC World 2025 and acquiring complementary technologies to bolster its performance materials lineup.

Key U.S. Concrete Superplasticizer Companies:

- Arkema

- MBCC Group

- Fosroc Inc

- Kao Corporation

- Magpei SpA

- Shandong Wanshan Chemical Co. Ltd.

- Sika AG

- The Euclid Chemical Company

- W. R. Grace & Co.-Conn.

- Zhe jiang LanYa Concrete Admixture Inc.

U.S. Concrete Superplasticizer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,178.3 million

Revenue forecast in 2033

USD 3,714.7 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application

Key companies profiled

Arkema; MBCC Group; Fosroc Inc; Kao Corporation; Magpei SpA; Shandong Wanshan Chemical Co. Ltd.; Sika AG; The Euclid Chemical Company; W. R. Grace & Co.-Conn.; Zhe jiang LanYa Concrete Admixture Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Concrete Superplasticizer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global U.S. concrete superplasticizer market report based on product, form, and application:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Polycarboxylate Ether (PCE)-based

-

Sulfonated Naphthalene Formaldehyde (SNF)-based

-

Sulfonated Melamine Formaldehyde (SMF)-based

-

Modified Lignosulfonates (MLS)

-

Other Products

-

-

Form Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Liquid

-

Powder

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Ready Mix-Concrete

-

Precast Concrete

-

High Performance Concrete

-

Ethylene Vinyl Acetate (EVA)

-

Frequently Asked Questions About This Report

b. The U.S. concrete superplasticizer market size was estimated at USD 2,059.6 million in 2024 and is expected to reach USD 2,178.3 million in 2025.

b. The U.S. concrete superplasticizer market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 3,714.7 million by 2033.

b. The polycarboxylate ether (PCE)‑based segment captured the largest revenue share in 2024 due to its unmatched combination of high water-reduction efficiency, extended slump retention, compatibility across diverse cement products and climates, and strong alignment with the demand for durable, high-performance, and sustainable concrete mixes.

b. Some of the key players operating in the U.S. Concrete Superplasticizer Market include Arkema, MBCC Group, Fosroc Inc, Kao Corporation, Magpei SpA, Shandong Wanshan Chemical Co. Ltd., Sika AG, The Euclid Chemical Company, W. R. Grace & Co.-Conn., Zhe jiang LanYa Concrete Admixture Inc.

b. The U.S. concrete superplasticizer market growth is primarily fueled by massive government infrastructure investments, such as under the Infrastructure Investment and Jobs Act, alongside accelerating urbanization, which drives demand for high-performance, durable concrete in roads, bridges, tunnels, and high-rise construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.