- Home

- »

- Consumer F&B

- »

-

U.S. Consumer Packaged Goods Market Size Report, 2033GVR Report cover

![U.S. Consumer Packaged Goods Market Size, Share & Trends Report]()

U.S. Consumer Packaged Goods Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Personal Care, Home Care, Health & Wellness, Food, Beverage), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-763-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. CPG Market Summary

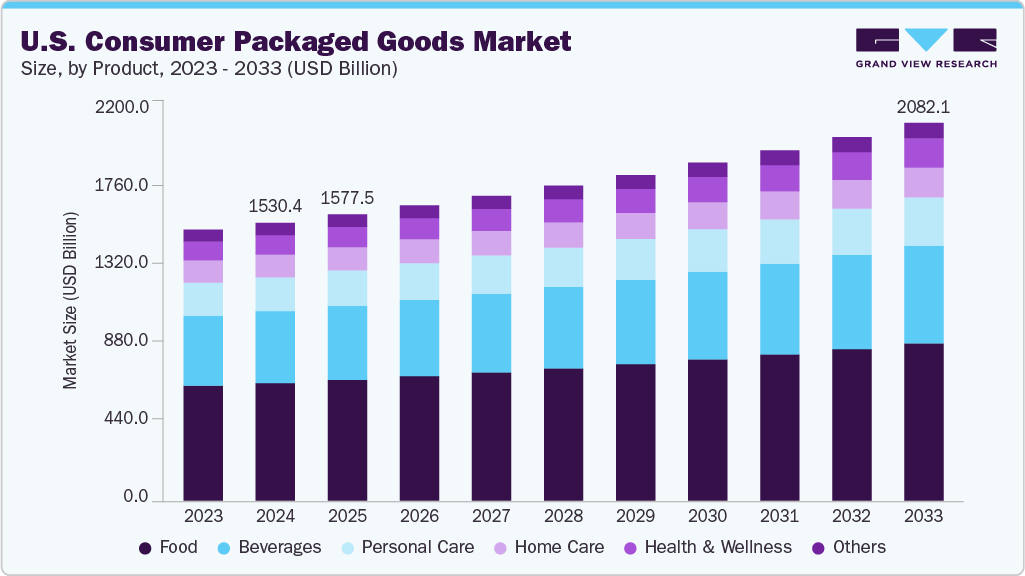

The U.S. consumer packaged goods (CPG) market size was estimated at USD 1,530.43 billion in 2024 and is projected to reach USD 2,082.15 billion by 2033, growing at a CAGR of 3.5% from 2025 to 2033. This steady demand for food, beverages, household, and health products, combined with innovation, e-commerce growth, and strong retail networks, continues to drive consistent expansion in the U.S. market.

Key Market Trends & Insights

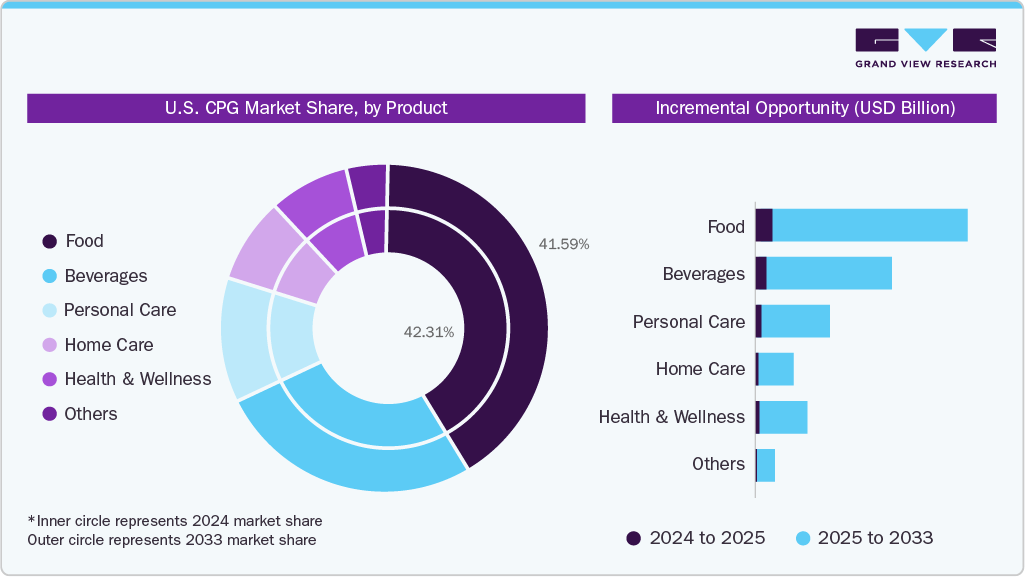

- By product, the food segment led the market with the largest revenue share of 42.49% in 2024.

- By distribution channel, the offline sales accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,530.43 Billion

- 2033 Projected Market Size: USD 2,082.15 Billion

- CAGR (2025-2033): 3.5%

A key trend in the U.S. CPG market is the rapid growth of private-label and value-focused products at big-box and grocery chains like Walmart, Costco, and Kroger. Inflation and cost-of-living pressures push consumers to swap national brands for retailer-owned alternatives, especially in everyday staples such as snacks, beverages, and household goods.

A key factor propelling the U.S. consumer packaged goods (CPG) industry is the shift toward eating at home. With hybrid work routines, many families are stocking up on packaged foods like Kraft Mac & Cheese, Campbell’s soups, or PepsiCo’s Frito-Lay snacks instead of eating out. Sales of ready-to-drink and single-serve frozen meals from brands like Lean Cuisine have also benefited as shoppers look for fast, reliable options during the workday.

Moreover, rising interest in Health and wellness is another prominent growth driver. Consumers are opting for protein-forward products such as Fairlife milk and Premier Protein shakes, or plant-based items like Beyond Meat and Silk almond milk. Even in household care, eco-friendly lines like Seventh Generation and Mrs. Meyer’s are gaining shelf space at Target and Walmart. The demand is not just about “better for you” but also “better for the planet,” which keeps pushing brands to reformulate and innovate.

Retail and delivery convenience play a crucial role in driving the market growth, too. Walmart’s Great Value private label and Costco’s Kirkland products are seeing steady traction thanks to value-for-money positioning. Online, Amazon’s Subscribe & Save has made it easy for households to keep essentials like Colgate toothpaste, Tide detergent, or Quaker oats stocked without repeat trips to stores. Grocery delivery apps like Instacart also push impulse CPG buys through coupons and limited-time discounts, keeping sales strong week after week.

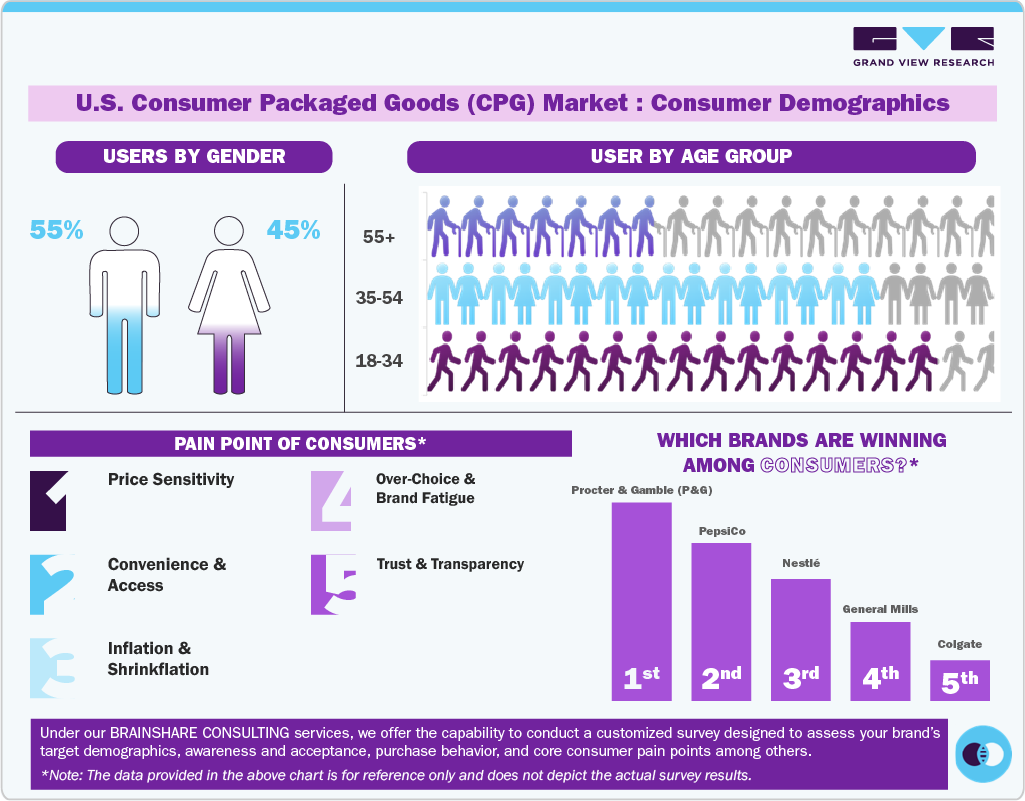

Consumer Insights

In the U.S. consumer packaged goods (CPG) industry, women remain the largest buying group, representing around 55% of buyers, especially in areas like groceries, home care, and personal items. Men make up about 45% of the total and are becoming more active shoppers in categories such as snacks, beverages, grooming, and health products. This changing balance has encouraged brands to tailor their marketing to household decision-makers and individual lifestyle consumers, expanding the reach of everyday goods.

When looking at age groups, younger consumers between 18 and 34 stand out as the most active segment. They experiment more with organic food, plant-based choices, and direct-to-consumer brands, while relying heavily on e-commerce and subscription models. The 35-54 group comes next, and they are the backbone of CPG spending because they prioritize family needs, bulk buying, and convenience shopping at big retailers such as Walmart, Costco, and Target. Older consumers aged 55+ are fewer in number but remain loyal to trusted names in health, food, and home care, making them a dependable source of repeat business.

Shoppers across these groups share some common frustrations. Rising prices and shrinkflation make many feel they’re paying more for less, while busy schedules keep convenience at the top of their priorities. The sheer number of options on shelves can lead to brand fatigue, and with so many “natural” or “clean” claims, people are skeptical about what’s really authentic. As a result, transparency, trust, and clear labeling are increasingly important for companies hoping to hold onto their customers.

Even with shifting consumer expectations, a few big names continue to stand out in the U.S. consumer packaged goods (CPG) industry. Procter & Gamble holds its ground in everyday household essentials with products like Tide and Pampers, while PepsiCo leads the way in snacks and drinks through brands such as Doritos and Gatorade. General Mills remains a staple in family kitchens with Cheerios, Annie’s, and Nature Valley, and Colgate maintains its dominance in oral care through long-established trust. Nestlé also keeps a strong foothold with its broad food and beverage range. These companies show how scale, diverse product lines, and loyal customer bases keep them at the forefront of the U.S. consumer packaged goods (CPG) industry.

Product Insights

The food segment led the market with the largest revenue share of 42.49% in 2024, due to its consistent demand and essential role in daily life. Food makes up the bulk of U.S. CPG sales as it is an everyday necessity that spans from snacks and cereals to frozen dinners. Large players such as General Mills (Cheerios, Nature Valley) and Mondelez (Oreo, Ritz) keep these categories strong with constant product refreshes and convenient packaging. Busy lifestyles and the U.S. culture of frozen and ready-to-eat meals further support the dominance of packaged foods.

The health and wellness segment is anticipated to grow at the fastest CAGR of 4.6% from 2025 to 2033. Health and wellness goods are set to rise steadily as Americans put more emphasis on preventive care. Demand for vitamins, protein powders, and functional foods is expanding, with companies like Nestlé Health Science, Johnson & Johnson, and General Mills moving deeper into the space. Younger consumers, especially millennials and Gen Z, are fueling this growth by choosing organic, plant-based, and “clean label” options over conventional products.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 79.22% in 2024. The majority of CPG sales in the U.S. still happen in physical stores owing to the extreme dominance of Walmart, Target, Costco, and major supermarket chains. Occasionally, and every day, shoppers rely heavily on these outlets for weekly grocery trips, bulk packs, and in-store deals. The convenience of grabbing multiple categories in one trip, plus the instant availability of goods, explains why offline retail still commands such a high share of the market.

The online segment is expected to grow at the fastest CAGR of 5.0% from 2025 to 2033. This can be attributed to the fast expansion of digital channels, as services like Amazon Fresh, Walmart+, and Instacart make grocery and household shopping easier. Subscription models for everyday goods (e.g., Dollar Shave Club or P&G’s Native) add another layer of convenience. Faster delivery times and personalized product suggestions are helping more consumers shift repeat purchases online, which is why e-commerce is set for steady long-term growth in the U.S.

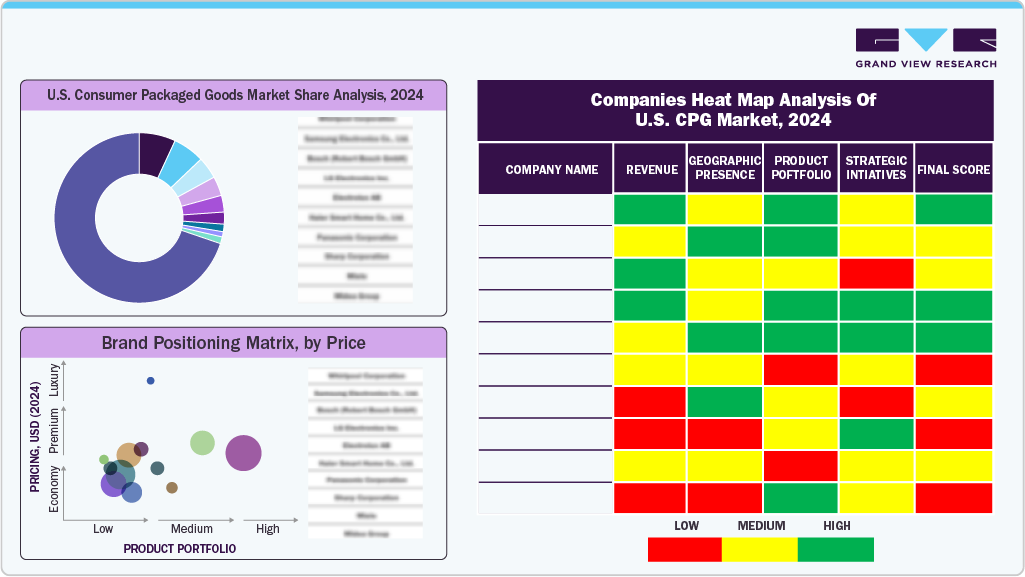

Key U.S. Consumer Packaged Goods Company Insights

The U.S. consumer packaged goods (CPG) sector is anchored by a mix of global and domestic powerhouses, with Procter & Gamble (P&G), PepsiCo, Coca-Cola, Nestlé USA, Mondelez International, and Unilever ranking among the most dominant players with intense competition.

These companies hold strong positions across food, beverages, personal care, household products, and health categories. The scale, broad distribution reach, and long-standing consumer trust give them a clear edge, while steady spending on product development, marketing, and omni-channel retail keeps their brands highly visible and accessible.

Unlike global trends, however, the U.S. market shows greater fragmentation, with regional specialists and private-label goods steadily carving out space in groceries, personal care, and household staples. The rise of e-commerce, direct-to-consumer models, and deep partnerships with mass retailers such as Walmart, Target, Amazon, and Costco has further cemented the presence of big CPG players, while also forcing them to diversify formats, innovate packaging, and stay agile in response to competitive pressure.

Key U.S. Consumer Packaged Goods Companies:

The following are the leading companies in the U.S. consumer packaged goods (CPG) market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble (P&G)

- PepsiCo

- Coca-Cola Company

- Nestlé USA

- Mondelez International

- Unilever

- Colgate-Palmolive

- Kimberly-Clark

- Johnson & Johnson (Consumer Health division)

- General Mills

Recent Developments

-

In July 2025, Procter & Gamble (P&G) launched Gemz at Target, offering water-activated, single-dose hair care “gems” in five shampoos and five conditioners. These compact, travel-friendly, and TSA-approved products provide concentrated ingredients while cutting plastic waste, tapping into the trend for sustainable and convenient personal care CPG products.

-

In April 2025, Dove, a brand under Unilever, teamed up with Crumbl Cookies to launch a limited-edition body care line with cookie-inspired scents at Walmart. Leveraging TikTok and Instagram, the campaign generated 3.2 billion impressions and sold out quickly, showcasing Dove’s innovation and appeal to a younger, social-first audience. This collaboration highlights Dove’s focus on innovation, social media-driven engagement, and its ability to adapt to evolving consumer preferences in the competitive personal care CPG market.

-

In May 2025, Clean Cult launched its refillable cleaning system nationwide at Target, offering 17 sustainable products-including hand soap, dish soap, laundry detergent, and all-purpose cleaner-in paper-based cartons and aluminum bottles. Backed by a USD 5 million Series B extension from existing investors and celebrities like Zac Efron and Kevin Hart, the rollout in 1,800 stores and online aims to expand eco-friendly, low-waste home care solutions.

U.S. Consumer Packaged Goods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,577.50 billion

Revenue forecast in 2033

USD 2.082.15 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Procter & Gamble (P&G); PepsiCo; Coca-Cola Company; Nestlé USA; Mondelez International; Unilever; Colgate-Palmolive; Kimberly-Clark; Johnson & Johnson (Consumer Health); General Mills

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Consumer Packaged Goods Market Report Segmentation

This report forecasts revenue growth at the country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. consumer packaged goods (CPG) market report by product, and distribution channel.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Personal Care

-

Skincare

-

Haircare

-

Cosmetics & Beauty

-

Oral Care and Personal Hygiene

-

-

Home Care

-

Laundry

-

Surface Cleaning

-

Dish Care

-

Air Care

-

-

Health & Wellness

-

OTC Medicines

-

Vitamins & Supplements

-

Functional Nutrition

-

-

Food

-

Staples & Pantry

-

Snacks & Confectionery

-

Bakery & Breakfast

-

Frozen & Convenience Foods

-

Dairy & Alternatives

-

Meat, Poultry & Seafood

-

-

Beverage

-

Bottled Water

-

Soft Drinks & Juices

-

Others

-

-

Others

-

-

Distribution Channel (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Traditional Trade

-

-

Online

-

E-commerce Platforms

-

D2C / Brand-owned Websites

-

Social Commerce

-

-

Frequently Asked Questions About This Report

b. The U.S. consumer packaged goods market size was estimated at USD 1,530.43 billion in 2024 and is expected to reach USD 1,577.50 billion in 2025.

b. The U.S. consumer packaged goods market is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2033 to reach USD 2.082.15 billion by 2033.

b. Consumer packaged food accounted for 42.31% of the market in 2024, due to its consistent demand and essential role in daily life. Staples like snacks, dairy, and packaged meals are purchased frequently, creating high repeat consumption.

b. Some key players in the U.S. consumer packaged goods market include Procter & Gamble (P&G); PepsiCo; Coca-Cola Company; Nestlé USA; Mondelez International; Unilever; Colgate-Palmolive; Kimberly-Clark; Johnson & Johnson (Consumer Health); General Mills

b. The U.S. consumer packaged goods market’s growth is fueled by steady demand for food, beverages, household, and health products, combined with innovation, e-commerce growth, and strong retail networks

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.