- Home

- »

- Homecare & Decor

- »

-

U.S. Cookware Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Cookware Market Size, Share & Trends Report]()

U.S. Cookware Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Standard /Non-Coated, Non-Stick/ Coated), By Product, By Material (Stainless Steel, Carbon Steel), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-204-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cookware Market Size & Trends

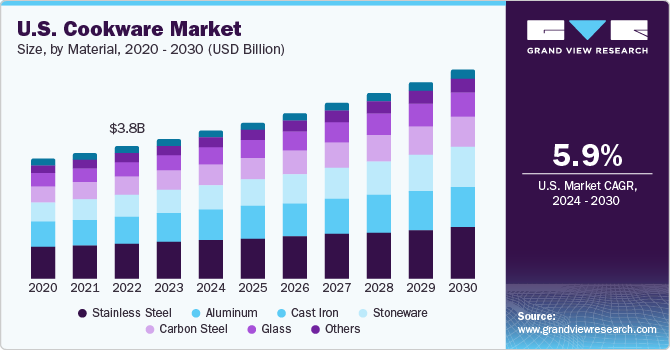

The U.S. cookware market size was estimated at USD 4.02 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. The growing preference for modular kitchens coupled with a high standard of living in the U.S. is driving the demand for cookware products in the commercial as well as residential sectors. Furthermore, the rise the instance of people who enjoy cooking at home is driving the market demand for cookware. The living standards of consumers have evolved and improved over time owing to a rise in disposable incomes and the migration of millennials to cosmopolitan cities.

The U.S. cookware market is expected to witness lucrative growth opportunities owing to a rising trend of food-away-from-home and the increasing number of restaurants and cafes presenting the need for cookware in commercial kitchens for the speedy service and processing of food to customers. Customer desire for high-quality food & service, convenience, socialization, and are mainly driving the growth of the restaurant industry. This, in turn, is influencing restaurant owners to invest in modern and quality cookware products. For instance, according to the National Restaurant Association, there were over 1 million restaurant locations in the U.S. in 2020. Furthermore, the rapid growth of quick service restaurants (QSR) is leading to the convenience of meal options at fast delivery times, which is also generating a high demand for cookware such as instant pots.

Increased spending on home remodeling or home improvement projects is expected to boost the market growth. Since 2019, home values have doubled the homeowners’ equity which indicates a surge in the spending capacity toward home improvement. According to theHouzz & Home Study, the online home remodeling platform, project leads for home professionals reported a 58% surge as of June 2020, as compared to the same period in 2019. These developments are expected to boost the cookware market growth over the forecast period.

Rapid development in the commercial sector, largely in developing economies such as China, and India is paving the way for food joints, restaurants, and eateries indicating growing growth prospects for cookware products. The growing number of meals consumed away from home due to growing working population globally is projected to propel market growth. For instance, according to the World Cooking Index Report in 2022, published by Cookpad Inc., the average number of meals consumed by at home has declined each week from 9.9 meals in 2020 to 9.8 in 2021.

Rise in disposable income coupled with high demand for improved standard of living leading to the acquisition of practical and versatile household products like cookware. Furthermore, rise in kitchen remodeling projects and growing number of homeowner expenditure is expected to boost the demand for kitchenware and cookware products.

The global expansion in the hospitality sector such as resorts, hotels, and spas, are boosting the demand for cookware. Growing demand for eco-friendly cookware that is lacking of polymers, adhesives, coatings, or colors is higher than ever. Customers are also looking for attractive and environmental friendly products, which is likely to positively influence the market.

Market Concentration & Characteristics

The growth of this market can be attributed to rising consumer spending on cookware for its multi-functionablity. Cookware aimed to provide users with versatile option for several cooking recipes and techniques.

Strategic acquisitions is primary prioritize by several market players to expand their portfolio. The focus to include small and medium sized enterprises to enhance regional expansion efforts.

Cookware products ensure stringent regulation in order to meet safety standards, identifying concerns related to harmful materials or substances. Compliance requirements may hampermaterial choices and manufacturing processes, impacting product development and design.

End-user concentration influenced the competitive landscape, with manufacturers vying for relationships with key customers. Companies are expected to differentiate their services and products to maintain and secure partnership with major distributors or retailers.

Type Insights

The non-stick/ coated segment accounted for a revenue share of 62.62% in 2023. The non-stick cookware offers a wide range of advantages, such as minimal need for cooking fats,ease of maintenance, and excellent food release properties. It is beneficial for both commercial and residential applications. It is typically used to prepare fried dishes or bread as it helps maintain food integrity. The cleaning process of this cookware is quite easy and convenient, especially when shortage of time or hosting guests. These factors are anticipated to fuel market growth in the coming years.

The ceramic-coated cookware is expected to grow at a CAGR of 7.4% over the forecast period. Ceramic cookware is used as a surface material to manufacture non-stick cookware. It is the safest and most environment-friendly material, owing to which ceramic cookware is gaining traction. To decrease the carbon footprint, consumers are spending more on sustainable cookware than plastic or Teflon cookware.

Product Insights

The pots & pans cookware dominated the market with a revenue share of 43.06% in 2023 owing to growing demand for colorful and multi-purpose pans. The increasing demand for pots and pans made of natural materials such as wood, steel, and ceramic. This growth trend is mainly driven by millennials. A growing consumer awareness regarding sustainability is driving the demand for sustainable pots and pans.

Demand for pressure cookers is projected to grow at a CAGR of 6.9% from 2024 to 2030. The cooker is easy to use and available in both electric and stovetop versions, which creates a great opportunity for market growth. The rise in the number of fast-food restaurants, cafes, shops, and hotels, coupled with consumer awareness of the importance of conserving gas and energy, is increasing the adoption of pressure cookers.

Material Insights

The stainless-steel cookware market dominated with a revenue share of 26.82% in 2023. The segment is growing steadily owing to the characteristics of the material; for instance, it does not react with alkaline or acidic food, it does not impart metallic flavor to food, and it is dishwasher, oven, and broiler safe. This kind of cookware is considered as one of the most practical and versatile cookware available in the market, which further supports the growth of the segment.

The cast iron cookware market is estimated to grow at a CAGR of 7.5% over the forecast period. This kind of cookware is ideal for soup, strews,casserole dishes, and baking bread. It offers versatility and exceptional cooking performance, making it suitable for various culinary projects.

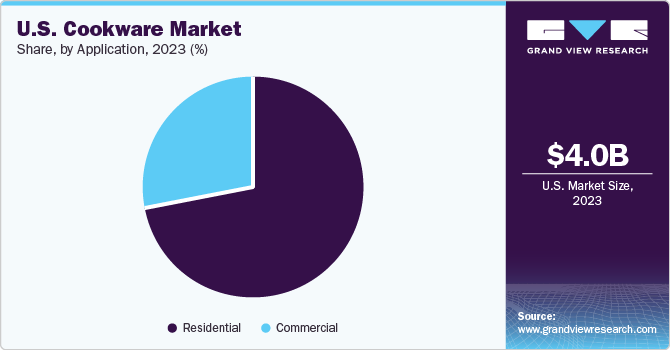

Application Insights

Demand for cookware from the residential sector dominated the market, with a revenue share of 72.29% in 2023. Rapid urbanization, a growing number of residential constructions, and a growing number of nuclear families are acting as major drivers for market growth. Increasing kitchen remodeling activities coupled with convenient and portable small cookware, which are suited for small kitchens, are expected to drive segment growth over the forecast period. According to the Joint Center for Housing Studies of Harvard University, the home improvement industry was valued at USD 425 billion in 2017.

Demand for cookware from the commercial sector is estimated to grow at a CAGR of 6.5% over the forecast period. The increasing trend of food away from home is creating a lucrative growth opportunity for restaurants and eating joints. Rapid development in the hospitality sector and increasing construction of commercial spaces such as marriage halls, group centers, and clubs, also offers growth opportunities for self-service and buffets leading to a rise in demand for cookware in commercial kitchens.

Distribution Channel Insights

Sales of cookware through supermarkets/hypermarkets dominated the market with a revenue share of 39.92% in 2023. Growing consumer preferences for purchasing high-end products from supermarkets/hypermarkets for their rich shopping experience, easy-to-access, and high quality is anticipated to grow the segment’s growth over the forecast period.

Sales through online channels is projected to grow at a CAGR of 7.7% from 2024 to 2030. Rapid digitalization and consumers prefer to purchase cookware through online portals in order to enjoy discounts, cash on delivery, aftersales service, and return policy. Other benefits associated with online segment enables manufacturer to improve their communication, gain potential customers,track finances, and cost-effectively boost brand awareness. These factors are expected to grow segment’s growth.

Key U.S. Cookware Company Insights

Some of the key players operating in the market includeAll-Clad, Made In, Heritage Steel Cookware, Babish, Gunter Wilhelm, and Ninja, Smithey.

-

All-Clad Metalcrafters, LLC is an American cookware manufacturer. Founded by metallurgist John Ulam, in 1967. The company is originally designed to meet the demands of professional chefs.

-

Heritage Steel Cookware is a family-owned specialty manufacturer of cookware. For over 40 years of experience in manufacturing fully clad stainless steel cookware.

Key U.S. Cookware Companies:

- All-Clad

- Made In

- Heritage Steel Cookware

- Babish

- Gunter Wilhelm

- Ninja, Smithey

- Target

- Meyer Corporation

- Newell Brands Inc.

Recent Developments

-

In April 2022, Newell Brands Inc. opened its first multi-purpose brick-and-mortar kitchen facility, the Newell Creative Kitchen, in Hoboken, New Jersey. The facility serves as a hub for content creation and cooking inspiration and hosts both virtual and in-person events. It represents a variety of home and kitchen brands, including Rubbermaid, Ball, Calphalon, FoodSaver, Sistema, CrockPot, and Mr. Coffee.

-

In November 2022, Target intends to open large-format stores that will cover an area of approximately 150,000 square feet. The new store design will enable the company to expand its online ordering services and in-store merchandise offerings. In addition to enhancing Target's drive-up and in-store pickup capabilities, the new store design will be intended to provide more space for employees to prepare online delivery orders.

U.S. Cookware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,249 million

Revenue forecast in 2030

USD 5,994.87 million

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, material, application, and distribution channel

Country scope

U.S.

Key companies profiled

All-Clad; Made In; Heritage Steel Cookware; Babish; Gunter Wilhelm; Ninja, Smithey; Target; Meyer Corporation; Newell Brands Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cookware Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cookware market report based on product, material, application, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard /Non-Coated

-

Non-Stick/ Coated

-

Teflon (PTFE) Coated

-

Ceramic Coated

-

Enamel Coated

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pots & Pans

-

Pressure Cooker

-

Cooking Racks

-

Cooking Tools

-

Bakeware

-

Microware Cookware

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Carbon Steel

-

Cast Iron

-

Aluminum

-

Glass

-

Stoneware

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Specialty Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The growing preference for modular kitchens, coupled with a high standard of living in the U.S., is driving the demand for cookware products in the commercial as well as residential sectors.

b. The U.S. cookware market size was estimated at USD 4,018 million in 2023 and is expected to reach USD 4,249 million in 2024.

b. The U.S. cookware market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 5,994.87 million by 2030.

b. Sales through supermarkets/hypermarkets dominated the U.S. cookware market in 2023, with a revenue share of 39.92%. Growing consumer preferences for purchasing high-end products from supermarkets/hypermarkets for their rich shopping experience, easy-to-access, and high quality is anticipated to grow the segment’s growth over the forecast period.

b. Some of the key players operating in the U.S. cookware market include All-Clad, Made In, Heritage Steel Cookware, Babish, Gunter Wilhelm, Ninja, and Smithey.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.