- Home

- »

- Homecare & Decor

- »

-

Cookware Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Cookware Market Size, Share & Trends Report]()

Cookware Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Standard /Non-Coated, Non-Stick/ Coated), By Product, By Material, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-420-4

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cookware Market Summary

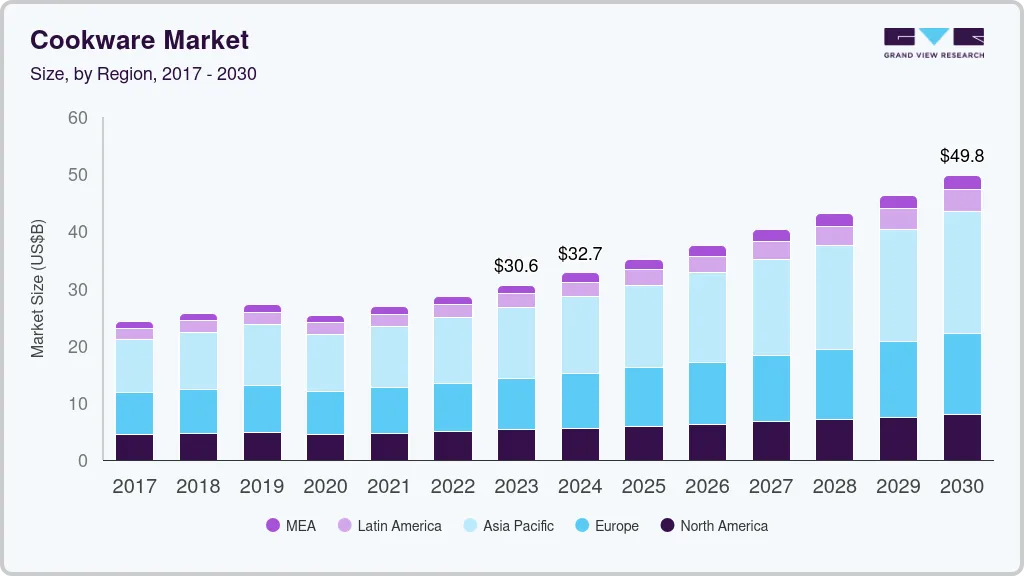

The global cookware market size was valued USD 30.59 billion in 2023 and is projected to reach USD 49.85 billion by 2030, growing at a CAGR of 7.3% from 2024 to 2030. The rising preference for modular kitchens, coupled with the improving standard of living, is driving the demand for cookware products in the commercial as well as residential sectors.

Key Market Trends & Insights

- North America cookware market is expected to witness a CAGR of 5.2% from 2024 to 2030.

- Asia Pacific cookware market accounted for the largest revenue share of 40.53% in 2023.

- By application, the residential segment dominated the global market with a share of over 68% in 2023.

- By type, non-stick/ coated segment accounted for the largest share of 61.80% in 2023.

- By distribution channel, the supermarket/ hypermarket segment dominated the global market with a share of nearly 40% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.59 Billion

- 2030 Projected Market Size: USD 49.85 Billion

- CAGR (2024-2030): 7.3%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

In addition, the growing trend of food-away-from-home has raised awareness regarding different cooking techniques and utensils, thereby driving the adoption of various cookware products. Increased spending on home improvement projects or home remodeling is also boosting product demand. The growing home values have doubled the homeowners’ equity in the last five years since 2019, indicating a surge in the spending capacity toward home improvement

Increased spending on home improvement projects or home remodeling is also boosting product demand. The growing home values have doubled the homeowners’ equity in the last five years since 2019, indicating a surge in the spending capacity toward home improvement. Houzz, an online platform for home remodeling and design, conducted its 12th annual U.S. Houzz & Home Study, surveying over 46,000 respondents in the U.S. The findings revealed that in 2022, almost 58% of surveyed homeowners chose to renovate their homes, while nearly half, or 48%, focused on essential repairs and also on quality cookware. These developments are likely to positively influence the market.

Rapid expansion in commercial constructions, particularly in developing economies such as India, and China is paving the way for eateries, restaurants, and food joints, indicating rising growth prospects for cookware products. The increasing number of meals consumed away from home due to the surge in the working population worldwide will further drive market growth, particularly in the commercial sector. For instance, according to The World Cooking Index Report published by Cookpad Inc. in 2022, the average number of meals consumed at home each week has declined overall, from 9.9 meals in 2020 to 9.8 in 2021.

Consumers with a high level of affordability spend make informed choices to elevate their quality of life, leading to the acquisition of practical and versatile household products like cookware. This trend is expected to contribute to the growth of the market in the foreseeable future. According to a report published by The National Kitchen & Bath Association (NKBA) in 2021, rising homeowner expenditure on kitchen remodeling projects would boost the demand for kitchenware and cookware products. Improved standards of living, backed by rising disposable income levels, drive the demand for high-end and exquisite cookware products across the globe.

Customers are appealing for more sustainable products due to worries about deforestation and climate change. Demand for eco-friendly cookware that is devoid of adhesives, polymers, coatings, or colors is higher than ever. Customers are looking for environmentally friendly products that also look good. For instance, Our Place, a Los Angeles-based firm that produces Teflon and PTFE-free cookware that is created responsibly with responsible materials. Such initiatives are expected to propel the market growth over the forecast period.

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer spending on cookware which having multi functionality. Cookware designed for multiple functions, such as interchangeable lids and modular components, aimed to provide users with versatile options for various cooking techniques and recipes.

In the coming years, globally recognized companies are expected to prioritize strategic acquisitions as a means to bolster their market standing and extend their reach internationally. The focus is likely to be on acquiring small and medium-sized enterprises within the industry, aiming to enhance regional expansion efforts.

Stringent regulations ensure that cookware products meet safety standards, addressing concerns related to harmful substances or materials. Compliance requirements may impact manufacturing processes and material choices, affecting product development and design.

End-user concentration influenced the competitive landscape, with manufacturers vying for relationships with key customers. Companies may need to differentiate their products and services to secure and maintain partnerships with major retailers or distributors.

Type Insights

The non-stick/ coated segment accounted for the largest share of 61.80% in 2023, as non-stick cookware offers several compelling advantages, such as ease of maintenance, minimal need for cooking fats, and excellent food release properties. It is particularly beneficial for professional cooks in commercial settings and is used to prepare breaded or fried dishes as it helps maintain food integrity. Cleaning non-stick cookware is easy, making it a convenient choice, especially when hosting guests or facing time constraints. These factors are propelling the market growth over the forecast period.

Standard /non-coated is projected to be the second fastest-growing segment, growing at a CAGR of 6.2% from 2024 to 2030. Standard /non-coated cookware offers a distinct advantage in achieving attractive browning effects on food, such as the desirable crust on baked bread or appealing sear marks on meats. Its ability to withstand high heat without the risk of damaging nonstick coatings makes it a preferred choice among professional chefs, allowing for efficient and rapid cooking while achieving a delightful golden finish.

Product Insights

The pots & pans segment dominated the global market with a share of nearly 42% in 2023, owing to the rising demand for multi-purpose and colorful pans. People purchase pans and pots based on their requirements; thus, these products should meet the personal needs of a consumer. Consumers prefer variety in terms of features, designs, and colors. Moreover, the rise in the demand for colorful products to match the kitchen interiors and tableware designs, especially in the residential sector, will fuel this segment’s growth over the forecast period.

The pressure cooker segment is estimated to grow at the fastest CAGR of 8.2% from 2024 to 2030. The demand for pressure cookers is on the rise due to increased demand for easy-to-use and faster-to-operate equipment, as well as a rise in the number of cafes, shops, fast-food restaurants, and hotels in the region. These cookers are available in both electric and stovetop versions. Pressure cooker sales are expected to increase in the region as people in most metropolitan areas continue to lead a hectic lifestyle. Consumer awareness of the importance of conserving gas and energy has driven the use of various cooking methods, including pressure cooking, which can save cooking time by up to 70%.

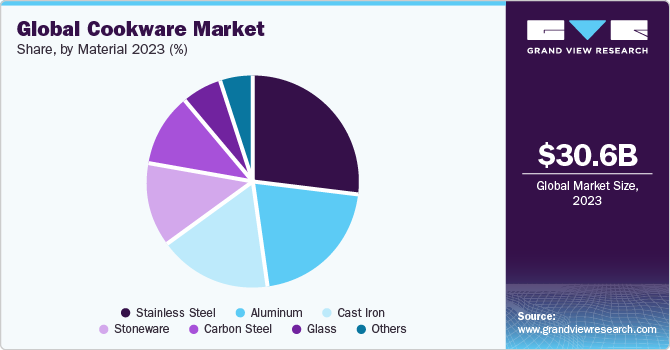

Material Insights

The stainless steel segment dominated the global market with a revenue share of over 27% in 2023. Stainless steel is generally produced by incorporating chromium and nickel into steel, and the ratio of these elements determines the grade of stainless steel. The highest quality stainless steel, known as 18/10 stainless steel, is currently the top choice in the market. The demand for this material is steadily increasing due to its exceptional properties, such as non-reactivity with acidic or alkaline foods, and its compatibility with dishwashers, ovens, and broilers.

The cast iron segment is estimated to grow at the fastest CAGR of 8.9% from 2024 to 2030. Cast iron cookware is ideal for stews, soups, casserole dishes, and baking bread. It offers exceptional cooking performance and versatility, making it suitable for various culinary projects. However, according to a blog by Shoamie, LLC, cast iron is advised not to be used for grilling or cooking over an open fire, as direct exposure to flames can potentially damage the enamel coating.

Application Insights

The residential segment dominated the global market with a share of over 68% in 2023. A growing interest in cooking, especially over the last few years, has significantly driven the demand for cookware in Germany. According to the Food and Agriculture Ministry in May 2020, a large number of consumers in the country were cooking more meals themselves during the COVID-19 crisis. A survey at the time showed that roughly 30% of respondents said they cooked more meals than they did before the pandemic. This increased preference for fresh food during the stay-at-home phase had a significant impact on the demand for cookware for residential applications.

The commercial segment is estimated to grow at the fastest CAGR of 7.8% from 2024 to 2030. Developments in the hospitality sector have resulted in the growth of the hotel industry, leading to the construction of a greater number of hotels across the globe. A thriving travel and tourism industry also offers growth opportunities for different categories owing to consumer preference for luxurious stays in resorts or highly rated hotels. Thus, these trends are likely to shift the spotlight on premium quality cookware in hotel chains and restaurants. In addition, increasing construction of commercial spaces such as clubs, marriage halls, and group centers also offers growth opportunities for buffets and self-service leading to a rise in demand for cookware in commercial kitchens.

Distribution Channel Insights

The supermarket/ hypermarket segment dominated the global market with a share of nearly 40% in 2023.The major factor contributing to the growth of this segment is the increasing consumer preference for purchasing high-end products from supermarkets/ hypermarkets. Supermarkets/ hypermarkets tend to offer customers a rich shopping experience and make it easy for them to assess the size, appearance, weight, and quality of the product.

The online segment is estimated to grow at the fastest CAGR of 9.0% from 2024 to 2030. The rising popularity of e-commerce has contributed to the growth of the online distribution segment. The online distribution segment has enabled manufacturers to gain potential customers, improve their communication, track finances, and cost-effectively boost brand awareness. Digitalization has offered the cookware market several growth avenues and also an active consumer base that prefers shopping online.

Regional Insights

The Asia Pacific cookware market accounted for the largest revenue share of 40.53% in 2023. The continuous expansion of the residential sector, increasing number of home remodeling and renovation projects, and rising disposable income are likely to generate significant demand for cookware products over the forecast period. In the Asia Pacific region, since the last few years, single-person households have been the fastest-growing household type due to both long-term demographic trends and increasing economic independence. The growing popularity of single-person households in the upcoming years will create significant demand for cookware.

India cookware market

The cookware market in India is expected to grow at a CAGR of 9.2% from 2024 to 2030, as a result of factors such as the robust demand for cookware is rooted in the country's rich culinary heritage, where home-cooked meals are a cultural cornerstone. The diverse regional cuisines and cooking methods, combined with a growing middle class, increased urbanization, and a burgeoning interest in culinary experiences, contribute to the high demand for a variety of cookware products in the Indian market.

Germany cookware market

The cookware market in Germany is expected to grow at a CAGR of 5.8% during the forecast period, driven by the country's focus on sustainability and the trend towards home cooking further contribute to the steady demand for innovative and high-quality cookware products in Germany.

The North America cookware market is expected to witness a CAGR of 5.2% from 2024 to 2030. Continuous expansion of the residential sector on account of the increasing number of households, coupled with major home improvement projects undertaken by consumers in the region, is boosting the demand for premium cookware. Consumers in the region are likely to invest in high-end cookware that complements their kitchen décor.

Key Companies & Market Share Insights

The industry is characterized by the presence of global companies and emerging players. The major players of the industry emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

Fissler GmbH, is a family-owned manufacturer of cookware. The company’s products include pots, pans, pressure cookers, roasters, woks, and kitchen accessories and parts. Headquartered in Rhineland-Palatinate, the company manufactures its products locally and distributes them through a network of over 62 subsidiaries and employs over 800 people. The company has a presence in over 80 countries.

Key Cookware Companies:

The following are the leading companies in the cookware market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these cookware companies are analyzed to map the supply network.

- Groupe SEB

- Werhahn Group

- Target

- Meyer Corporation

- Fissler

- Tramontina

- Newell Brands Inc.

- SCANPAN

- TTK Prestige Ltd.

- The Vollrath Co., L.L.C.

- Hawkins Cookers Limited

Recent Developments

-

In October 2023, Le Creuset added the newest color variant—thyme—to its enameled cast iron and stoneware product lines. This fresh color option is now accessible on the company's website, at its signature stores, and at Crate & Barrel.

-

In May 2023, Groupe SEB acquired Pacojet, a Swiss family-owned company that specializes in developing and marketing a unique culinary appliance that has been popular with chefs for three decades. The acquisition is part of Groupe SEB's strategy to expand its presence in the professional market.

-

In January 2023, Groupe SEB had its partnership extended with GXO, a contract logistics provider. The partnership will provide Groupe SEB with additional warehouse space to support sustainable growth, enabling its omnichannel business to deliver a superior customer experience in the UK and Ireland using customized end-to-end supply chain solutions.

-

In November 2022, Target intends to open large-format stores that will cover an area of approximately 150,000 square feet. The new store design will enable the company to expand its online ordering services and in-store merchandise offerings. In addition to enhancing Target's drive-up and in-store pickup capabilities, the new store design will be intended to provide more space for employees to prepare online delivery orders.

Cookware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.75 billion

Revenue forecast in 2030

USD 49.85 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, material, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Indonesia; South Korea; Australia & New Zealand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Groupe SEB; Werhahn Group; Target; Meyer Corporation; Fissler; Tramontina; Newell Brands Inc.; SCANPAN; TTK Prestige Ltd.; The Vollrath Co., L.L.C.; Hawkins Cookers Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cookware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cookware market report on the basis of type, product, material, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard /Non-Coated

-

Non-Stick/ Coated

-

Teflon (PTFE) Coated

-

Ceramic Coated

-

Enamel Coated

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pots & Pans

-

Pressure Cooker

-

Cooking Racks

-

Cooking Tools

-

Bakeware

-

Microware Cookware

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Carbon Steel

-

Cast Iron

-

Aluminum

-

Glass

-

Stoneware

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cookware market was estimated at USD 30.60 billion in 2023 and is expected to reach USD 32.75 billion in 2024.

b. The global cookware market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 49.85 billion by 2030.

b. Asia Pacific dominated the cookware market with a share of 40.5% in 2023. The growth of the regional market is mainly driven by the presence of popular market players in the geography, combined with the continuous expansion of the residential sector, increasing number of home remodeling and renovation projects, and rising disposable income.

b. Some of the key players operating in the cookware market include Groupe SEB; Werhahn Group; Target; Meyer Corporation; Fissler; Tramontina; Newell Brands Inc.; SCANPAN; TTK Prestige Ltd.; The Vollrath Co., L.L.C.; and Hawkins Cookers Limited.

b. Key factors that are driving the cookware market growth include the rising preference for modular kitchens coupled with improving living standards, growing trend of food-away-from-home, increased spending on home improvement projects or home remodeling, and rapid expansion in commercial constructions, particularly in developing economies such as India and China.

b. The Europe cookware market size was estimated at USD 8.98 billion in 2023 and is expected to reach USD 9.56 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.