- Home

- »

- Advanced Interior Materials

- »

-

U.S. Copper Scrap Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Copper Scrap Market Size, Share & Trends Report]()

U.S. Copper Scrap Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Wire Rod Mills, Bar Mills, Ingot Makers, Foundries), Consumer Behavior, Key Companies, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-920-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Copper Scrap Market Summary

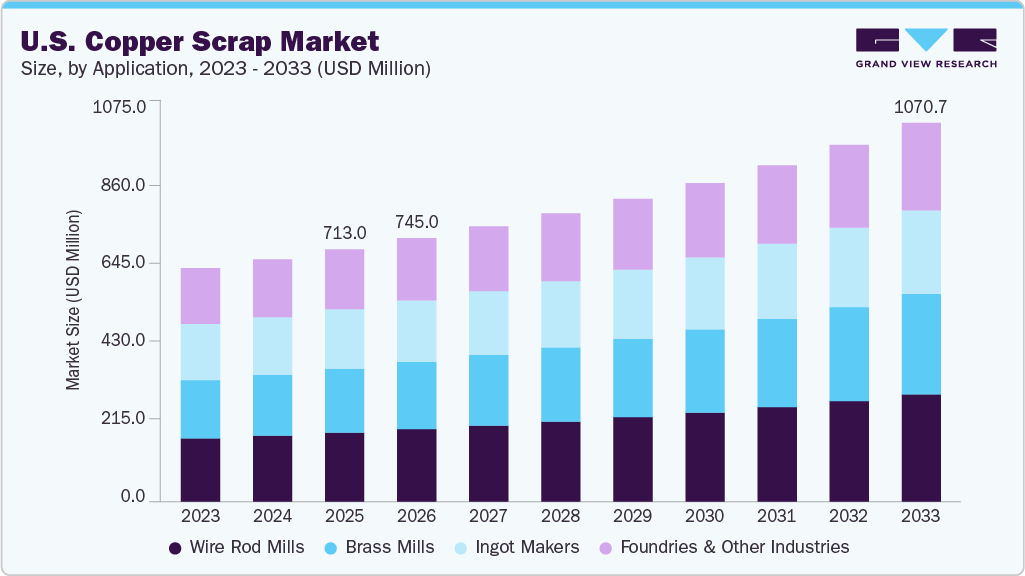

The U.S. copper scrap market size was estimated at USD 713.0 million in 2025 and is projected to reach USD 1,070.7 million by 2033, growing at a CAGR of 5.3% from 2026 to 2033. The market is driven by increasing demand for cost-efficient recycled copper in the electrical and construction sectors, supported by sustainability targets, higher recycling rates, and rising consumption from EV and renewable energy supply chains.

Key Market Trends & Insights

- The copper scrap market in the U.S. is expected to grow at a substantial CAGR of 5.3% from 2026 to 2033.

- By application, wire rod mills segment dominated the market with a revenue share of over 27.0% in 2025.

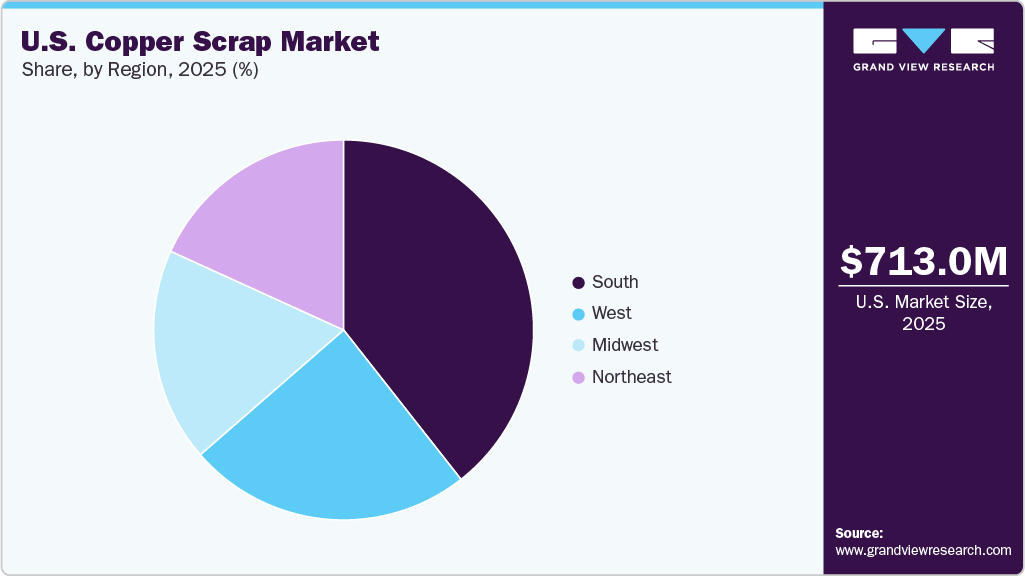

- The south region in the U.S. held the largest share of over 39.0% of copper scrap revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 713.0 Million

- 2033 Projected Market Size: USD 1,070.7 Million

- CAGR (2026-2033): 5.3%

Sustainability is becoming a core catalyst for the U.S. copper scrap market, as manufacturers and regulators intensify efforts to reduce carbon emissions and promote circular economy practices. Recycled copper requires significantly less energy than primary production, making it a preferred material for industries aiming to lower their environmental footprint. Federal and state-level initiatives promoting higher recycling efficiencies, landfill diversion, and resource conservation are further encouraging the collection and reuse of scrap materials. As a result, end use sectors such as electrical equipment, construction, and automotive increasingly rely on secondary copper to meet both cost and sustainability targets.

Technological advancements in scrap sorting, automated material recovery, and furnace efficiency are significantly improving the quality and yield of recycled copper in the U.S. market. Innovations such as sensor-based sorting, AI-enabled scrap identification, and advanced smelting technologies are enabling processors to extract higher purity metal with lower operational costs. In addition, improvements in closed-loop recycling systems and real-time monitoring tools are helping manufacturers maintain consistent material quality for high-end applications, including EV components and renewable energy infrastructure. These innovations collectively enhance productivity, reduce waste, and strengthen the long-term competitiveness of the U.S. copper scrap industry.

Drivers, Opportunities & Restraints

A key driver for the U.S. copper scrap market is the accelerating demand resulting from electrification, renewable energy expansion, and data center construction. In 2025, U.S. utilities and grid developers increased procurement of recycled copper for transmission upgrades and EV-charging infrastructure, reflecting a strong preference for lower-carbon feedstock. Major OEMs in the automotive and electrical sectors also intensified secondary copper sourcing due to rising refined copper shortages and volatile primary copper prices. Federal and state-level circular economy programs are further propelling growth. In 2024-2025, multiple U.S. recycling grants and critical minerals funding rounds were awarded to expand domestic scrap collection and processing capacity, improving supply consistency and lowering input costs for manufacturers.

Significant opportunities are emerging from new investments in domestic recycling and secondary refining infrastructure. In 2025, several global recycling companies announced U.S. capacity expansions for high-grade scrap processing and copper refining, aimed at supporting EV battery suppliers and renewable-energy component manufacturers. These projects reduce import dependence and create long-term contract opportunities for scrap suppliers. Rapid advancements in scrap-sorting technologies also create market headroom. The adoption of AI-assisted optical sorting systems and upgraded smelting lines in 2024-2025 has enabled recyclers to achieve higher purity levels, thereby unlocking access to premium markets, including high-efficiency motors, power electronics, and grid conductors.

A major restraint is the limited availability of domestic smelting and refining capacity. Although recycling volumes are rising, the U.S. still relies heavily on overseas refiners, creating bottlenecks when export channels slow or when high-grade conversion capacity is insufficient. Delays in permitting and long construction timelines for refining assets reinforce this supply-chain constraint. Policy uncertainty also poses challenges. Ongoing discussions around scrap export controls, environmental compliance requirements, and tariff adjustments create operational and pricing volatility for processors and brokers. These regulatory shifts can temporarily suppress trade flows, reduce margins, and affect long-term investment decisions in the copper scrap ecosystem.

Application Insights & Trends

By application, wire rod mills dominated the market with a revenue share of over 27.0% in 2025. Wire rod mills lead the U.S. copper scrap market as they serve core demand centers, including power transmission, electrical wiring, renewable energy systems, and EV-related components. Their operations require high-purity copper inputs, and scrap provides a cost-effective, low-carbon alternative to refined copper, especially during periods of price volatility. With the U.S. grid undergoing large-scale modernization and utilities expanding high-voltage line installations, wire rod mills consistently procure substantial volumes of secondary copper to meet the rising demand for conductors and cables.

Brass mills primarily consume copper scrap in the production of brass sheets, strips, rods, and specialty alloys used in plumbing, automotive components, electronics, and industrial hardware. The segment benefits from steady demand in construction and manufacturing, with scraps offering flexibility in alloy formulation and cost optimization. Growing emphasis on recycled content and sustainability credentials has further encouraged brass mills to increase the share of secondary copper in their feedstock mix.

Ingot Makers play a crucial role by converting copper scrap into standardized ingots that serve as feedstock for downstream fabricators and foundries. Their operations focus on blending, refining, and homogenizing scrap to meet specific chemical and physical specifications. Demand from this segment is supported by smaller manufacturers seeking consistent, ready-to-use copper inputs without direct access to large-scale scrap processing infrastructure.

Foundries and other industrial users consume copper scrap for casting components used in machinery, transportation, electrical equipment, and industrial tooling. This segment typically utilizes a broader range of scrap grades, benefiting from lower material costs and flexible sourcing. While demand is more cyclical compared with wire rod and brass mills, ongoing industrial activity, maintenance requirements, and niche casting applications continue to support steady scrap consumption across this segment.

Region Insights

The south region in the U.S. held the largest share of over 39.0% of copper scrap revenue in 2025. South region dominates the U.S. copper scrap market due to its extensive industrial presence, particularly in the electrical manufacturing, automotive production, and metal processing sectors. States such as Texas, Georgia, Alabama, and Tennessee host major wire & cable mills, rod manufacturers, and recycling hubs that consume large volumes of secondary copper. Growing investments in renewable energy, particularly in solar and onshore wind projects, have accelerated demand for copper-intensive components, thereby driving scrap consumption in the region.

The northeast U.S. copper scrap market is supported by a mature industrial base, dense urban population, and strong scrap generation from construction, demolition, and electrical upgrades. The region hosts numerous scrap processors and brokers that supply copper to wire, brass, and specialty alloy producers, benefiting from proximity to end users and export terminals. Ongoing investments in grid modernization, data centers, and infrastructure rehabilitation continue to sustain steady demand for recycled copper across the region.

The Midwest serves as a significant hub for copper scrap consumption, largely due to its concentration of manufacturing, automotive production, and heavy industry. States such as Ohio, Michigan, and Illinois generate substantial volumes of industrial copper scrap from auto plants, machinery manufacturing, and appliance production. The strong presence of foundries, ingot makers, and wire mills, combined with efficient rail and trucking networks, supports high scrap throughput, making the Midwest a critical link in the U.S. copper recycling value chain.

The west U.S. copper scrap market is driven by demand from renewable energy projects, technology manufacturing, and construction activity across states such as California, Arizona, and Washington. High levels of electronic waste generation and sustainability-focused regulations encourage recycling and recovery of copper from diverse sources. While processing capacity is more geographically dispersed, the region benefits from strong export connectivity through Pacific ports and increasing demand from solar, wind, and data-center developments.

Key U.S. Copper Scrap Company Insights

Key players operating in the U.S. market include Commercial Metals Company, Sims Metal Management, SA Recycling, and others.

-

Commercial Metals Company (CMC) is a U.S.-based diversified metals recycler and manufacturer, operating a nationwide network of scrap processing facilities, steel minimills, and downstream fabrication units. Founded in 1915 and headquartered in Irving, Texas, CMC collects, processes, and sells ferrous and non‑ferrous scrap, including copper, to support domestic steel and metal markets. With a strong focus on sustainability, operational efficiency, and vertical integration, the company utilizes advanced shredding, sorting, and melting technologies to supply high-quality recycled metal to the construction, manufacturing, and industrial sectors.

-

Sims Metal Management USA is the U.S. arm of the global recycling company Sims Limited and one of the largest non‑ferrous and ferrous scrap processors in North America. With a network of facilities across major metropolitan and industrial regions, Sims handles a wide range of recyclable materials, including copper scrap from electronic, industrial, and construction sources. The company emphasizes environmental stewardship, advanced material recovery technologies, and safe operations to deliver recycled commodities to domestic and international markets while reducing carbon intensity and waste.

-

SA Recycling is a leading North American scrap metal recycling company, operating an extensive network of collection and processing centers throughout the United States. As part of the Platinum Equity portfolio, SA Recycling processes a diverse mix of ferrous and non-ferrous metals, including copper, aluminum, and brass, serving mills, foundries, and smelters with high-quality recycled feedstock. The company prioritizes safety, customer service, and sustainable recycling practices, employing modern shredding, sorting, and material handling systems to optimize recovery rates and support circular economy objectives.

Key U.S. Copper Scrap Companies:

- AIM Recycling

- Commercial Metals Company (CMC)

- Metalico, Inc.

- Nucor Corporation

- OmniSource, LLC

- Radius Recycling

- SA Recycling

- Sims Metal Management

- Upstate Shredding - Weitsman Recycling

- USM Companies

Recent Developments

-

In September 2025, Aurubis AG commenced production at its new USD 800 million copper recycling plant in Richmond, Georgia, marking one of the largest secondary copper investments in the United States. The facility can process up to 180,000 metric tons of complex copper scrap annually, including cables and printed circuit boards, to produce approximately 70,000 tons of high-grade blister copper, thereby reducing reliance on imported refined copper and strengthening domestic recycling infrastructure.

-

In April 2025, Aurubis announced the ramp‑up of its U.S. copper recycling smelter operations after a four‑year build‑out, with capacity to handle up to 180,000 metric tons of copper scrap and produce 70,000 tons of refined copper annually. The investment reflects expanding demand for circular metal recovery within North America and underscores a strategic shift toward boosting domestic scrap processing capabilities.

-

In Q3 2025, the U.S. copper scrap market experienced structural shifts in pricing and trade flows following new trade policy actions, including the implementation of a 50 percent tariff on certain copper imports, which accelerated adjustments in how scrap pricing benchmarks are referenced and influenced supply‑chain decisions by scrap processors and end manufacturers.

U.S. Copper Scrap Report Scope

Report Attribute

Details

Market size value in 2026

USD 745.0 million

Revenue forecast in 2033

USD 1,070.7 million

Growth rate

CAGR of 5.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2021 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

U.S.

Key companies profiled

AIM Recycling; Commercial Metals Company (CMC); Metalico, Inc.; Nucor Corporation; OmniSource, LLC; Radius Recycling; SA Recycling; Sims Metal Management; Upstate Shredding - Weitsman Recycling; USM Companies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Copper Scrap Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. copper flat-rolled products market report by application and region.

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Wire Rod Mills

-

Brass Mills

-

Ingot Makers

-

Foundries and Other Industries

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Northeast

-

Midwest

-

West

-

South

-

Frequently Asked Questions About This Report

b. The U.S. copper scrap market size was estimated at USD 713.0 million in 2025 and is expected to reach USD 745.0 million in 2026.

b. The U.S. copper scrap market is expected to grow at a compound annual growth rate of 5.3% from 2026 to 2033 to reach USD 1,070.7 million by 2033.

b. By application, wire rod mills dominated the market with a revenue share of over 27.0% in 2025

b. Some of the key players operating in the U.S. copper scrap market are AIM Recycling, Commercial Metals Company (CMC), Metalico, Inc., Nucor Corporation, OmniSource, LLC, Radius Recycling, SA Recycling, Sims Metal Management, Upstate Shredding – Weitsman Recycling, USM Companies, and others.

b. The U.S. copper scrap market is driven by rising demand for low-carbon secondary copper, growth in EV and renewable energy sectors, adoption of circular economy practices, and technological advances in scrap processing and sorting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.