- Home

- »

- Beauty & Personal Care

- »

-

U.S. Cosmetics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Cosmetics Market Size, Share & Trends Report]()

U.S. Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Makeup, Fragrance), By End-user (Men, Women), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-211-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cosmetics Market Size & Trends

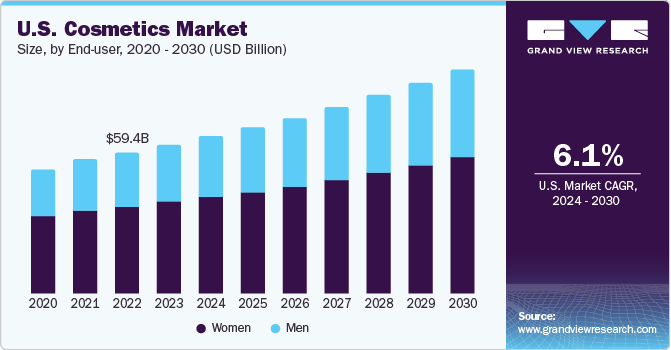

The U.S. cosmetics market size was estimated at USD 62.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. The U.S. is considered as one of the top growing markets for cosmetics with its increased focus on personal hygiene and self-care products. In recent past, consumers from the U.S. have started using beauty and cosmetics products such as skin care, colour cosmetics, and hair care products increasingly. Consumers in United States are keen towards spending a lot on personal appearance, which in turn, results into development of lucrative growth opportunities for the U.S. cosmetics market. Adoption of makeup and accessories in regular routines has been assisting this market growth.

The U.S. cosmetics market accounted for 21.28% revenue share of global cosmetics market. The increasing number of people using e-commerce websites to buy variety of consumer products is also resulting in rising demand. Growing penetration of offline retail channels, upsurge in demand of personal care products owing to peer-group pressure, increased availability of variety of modern-day cosmetics in different kinds of stores including hypermarkets, convenience stores, and grocery corners among others, impact of aggressive market strategies adopted by the top brands operating in cosmetic industry are some of the key contributing factors for the potential growth of the U.S. cosmetics market from 2024 to 2030.

Those who belong to consumer groups of millennials and Gen Z, mainly set of young customers, have been driving the growth patterns for this industry since a while. Use of cosmetics such as skin care products, Face mask, Bath / shower products, skin lightening products, Chemical exfoliation products, External intimate care products, Lip care products, Products with antiperspirant activity, Foundation, Mascara, Lip stick, Hydro alcoholic perfumes, Scalp and hair roots care products, Nail care, Breath spray, and make-up accessories among others has been generating rapid adoption across the US since few years now.

Market Concentration & Characteristics

The U.S. cosmetics market is growing at an accelerating pace and the growth stage is identified as high. This industry is principally characterised by the enormously competitive market, which has existence of several key market participating operating in the industry since many years. These players have attained extremely good market penetration through online as well as offline channels of distribution.

However, some of the companies founded only a few years ago have also been successful in developing a good revenue share in the market. This is often done through adoption of strategies like innovation, collaborations, brand building and more.

Degree of innovation is high in the cosmetics market of the U.S. This is largely because of continuously growing range of requirements and demand for customised yet generic solutions. For instance, key market participants have been launching face care solutions for specific skin kinds such as dry, oily, normal, and sensitive skin.

Evolving science related to skin care and chemistry of elements used in cosmetics have been unfolding several facts about human skin. Increasing availability of such information and growing accessibility to consumer behavioural data has been helping companies to develop new products, which are expected to help the market grow in upcoming years.

Mergers and acquisitions in the U.S. cosmetics market are mostly done with motive of extending the product portfolio or deepen the market presence through umbrella of brands. In addition, these actions result in key technology interchange, united efforts regarding innovation, segmental growths and more.

Threat of substitute is at low level, as individual sanitation and personal care rituals cannot be substituted. However, the lone threat posed by counterfeit goods, which are distributed widely through offline channel is a challenge for industry growth. The industry for cosmetics in the U.S. is greatly influenced by regulations. Use of components, testing prior to launch, timely recalls if necessary and unblemished labelling are key aspects which marketers and manufactures need to look after in terms of regulations. Observance with compliance standards is also significant in this business as it has consequence on health and safety of user directly.

End-user Insights

Based on end-users, the U.S. cosmetics market is principally influenced by women users. The women end- user segment accounted for 61.40% in 2023. This segment considerably controls the market, as women have been one of the key consumers for almost every invention offered by cosmetics industry. Solid movement among women concerning usage of skin-care products, cosmetics for make-up, nail care offerings and other self-care routine offerings has been shaping extraordinary growth for the cosmetics market in United States.

However, the industry has also been undergoing the fluctuating developments concerning adoption of cosmetics among men consumers. The increasing number of men spending on purchase of cosmetic products such as hair care, face creams, beard oils and hair gels is backing the growth for cosmetics industry in the country. Based on end-users, the men cosmetics market in the U.S. is expected to grow at CAGR of 6.6% from 2024 to 2030.

Distribution Channel Insights

The sales derived from offline channel in U.S. cosmetic market accounted for 71.17% in the year 2023. Existence of popular brands developed through offline distribution channels is generating great demand for cosmetics across the country. Hypermarkets, and supermarkets, medicinal supplies shops, shopping malls, specialty stores, brand stores, convenience stores, and general grocery shops are places where market participants dump their products in larger quantities to occupy the shelf space. The brand visibility these places offer plays vital role in generating impulse for purchasing cosmetic products of various kinds. Presence of these points of sale develops an opportunity for brands to directly reach their customers and let them examine their products.

However, the online channel of distribution has also been developing lucrative opportunities for the cosmetics industry and is expected to grow at CAGR 7.1% from 2024 to 2030. The millennials and Gen Z consumers have their lives revolving around technology, which is integral part of their routine. This characteristic replicates in their spending habits, shopping preferences, and behaviours as consumers. The online experience of purchasing cosmetics is considered as absolutely private and is preferred more by growing number of customers. The companies assist such consumers through offering their products through their own websites and offering their products through e-commerce websites.

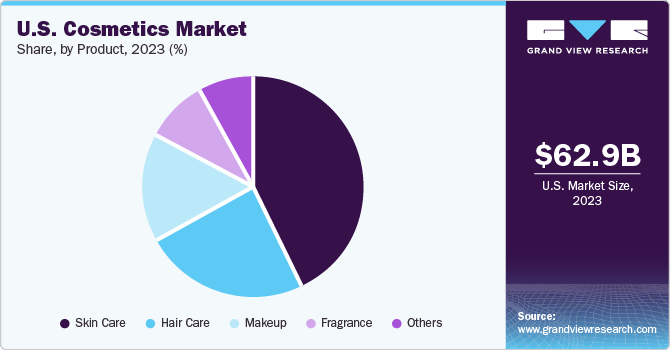

Products Insights

Based on product, the skin-care products held highest market share of the U.S. cosmetic markets. In 2023, it accounted for 42.80 % and is expected to maintain its dominance over 2024 to 2030. The skin-care product range contains range of offerings such as serums, face creams, cleansers, gels, oils, scrubs, masks, peels, powders, and more. One of the fundamental factors that assists this section mature in terms of growth is reputation of brands and perceived value associated with use of the skin care products offered by it.

Improved accessibility of branded skin-care products, inventions such as involvement of active-ingredients and nurturing elements in product development, influence of popular personalities as ambassadors of brand, instructional use according to advice of medical practitioners and experts are some of the additional causes that have been contributing to upsurge in demand for skin-care products. The hair care market segment is fastest growing in the U.S. cosmetics market and it is expected to grow at a CAGR of 7.1% from 2024 to 2030.

Increasing sense of acknowledgement about adoption of healthy personal care practices, growing trend of using cosmetics in everyday life, use of makeup products, eyeliners, lipsticks on regular basis, perceived significance of fragrance as statement about personalities, and growing importance of colour cosmetics are some of major contributors for the upsurge in demand of cosmetics in the U.S. cosmetics market.

Key U.S. Cosmetics Company Insights

The cosmetics industry continues to evolve with changing trends, and a desire to adapt among manufacturers. To gain a competitive edge in the market, players tend to launch new strategies regularly. Key players are focused on increasing investments in advertisements through social sites to increase awareness regarding cosmetics in the market.

-

Coty Inc, one of the leading companies in cosmetic markets, is widely popular in the U.S., which offer diverse product portfolio entailing uniquely developed brands across skin care, body care, color cosmetics and fragrances. The company established in 1904 is home to nearly 40 brands as of 2024.

-

Avon Products, Inc., popularly known as Avon is an American British multinational cosmetic company which offers products such as skin care, personal care, fragrances and more. The company was founded in 1886 in New York, United States.

Key U.S. Cosmetics Companies:

- Coty Inc.

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Revlon, Inc.

- Avon Products Inc.

- Unilever PLC

- Procter & Gamble

- Beiersdorf AG

- Shiseido Company, Limited

- Godrej

Recent Developments

-

In February 2024, the Coty Inc., announced that they have entered in new licencing agreement with Italian luxury fashion house Etro, to develop, manufacture and distribute beauty care products. This partnership is aimed at expanding the beauty portfolio of the brand through adoption of strategies such as shared innovations and exchange of expertise. The timeline announced for this is beyond 2040.

-

In January 2024, Shiseido, one of the leading companies in cosmetics market, announced that they have developed digital application beauty AR navigation. The innovation is aimed at supporting appropriate beauty treatment regimens. Company proposes uses of smartphones and tablet terminals to execute their strategy. This was announced at CES2024*2, one of largest digital technology trade shows of the world, organised in Las Vegas, US from 9th to 12th January 2024.

U.S. Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 66.47 billion

Revenue Forecast in 2030

USD 95.05 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actual data

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, end-user, distribution channel

Key companies profiled

Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Revlon, Inc.; Avon Products Inc.; Unilever PLC; Procter & Gamble; Beiersdorf AG; Shiseido Company, Limited; Godrej

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cosmetics Market Report Segmentation

This report forecasts revenue growth at the regional level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cosmetics market report based on product, end-user and distribution channel:

-

Product Outlook (Revenue; USD Billion; 2018 - 2030)

-

Skin Care

-

Hair care

-

Makeup

-

Fragrance

-

Others

-

-

End-user Outlook (Revenue; USD Billion; 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue; USD Billion; 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. cosmetics market was estimated at USD 62.97 billion in 2023 and is expected to reach USD 66.47 billion in 2024.

b. The U.S. cosmetics market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 95.05 billion by 2030.

b. Skin care cosmetics dominated the U.S. cosmetics market with a share of around 42.9% in 2023. The skin-care product range contains a range of offerings such as serums, face creams, cleansers, gels, oils, scrubs, masks, peels, powders, and more. One of the fundamental factors that assist this section's maturity in terms of growth is the reputation of brands and the perceived value associated with the use of the skin care products offered by it.

b. Some of the key players operating in the U.S. cosmetics market include Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Revlon, Inc.; Avon Products Inc.; Unilever PLC; Procter & Gamble; Beiersdorf AG; Shiseido Company, Limited; Godrej

b. The U.S. is considered as one of the top growing markets for cosmetics with its increased focus on personal hygiene and self-care products. In the recent past, consumers from the U.S. have started using beauty and cosmetics products such as skin care, color cosmetics, and hair care products increasingly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.