- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Creatine Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Creatine Market Size, Share & Trends Report]()

U.S. Creatine Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Creatine Monohydrate, Creatine Ethyl Ester, Creatine Hydrochloride), By Application (Dietary Supplements, Functional Food, Online), And Segment Forecasts

- Report ID: GVR-4-68040-582-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Creatine Market Size & Trends

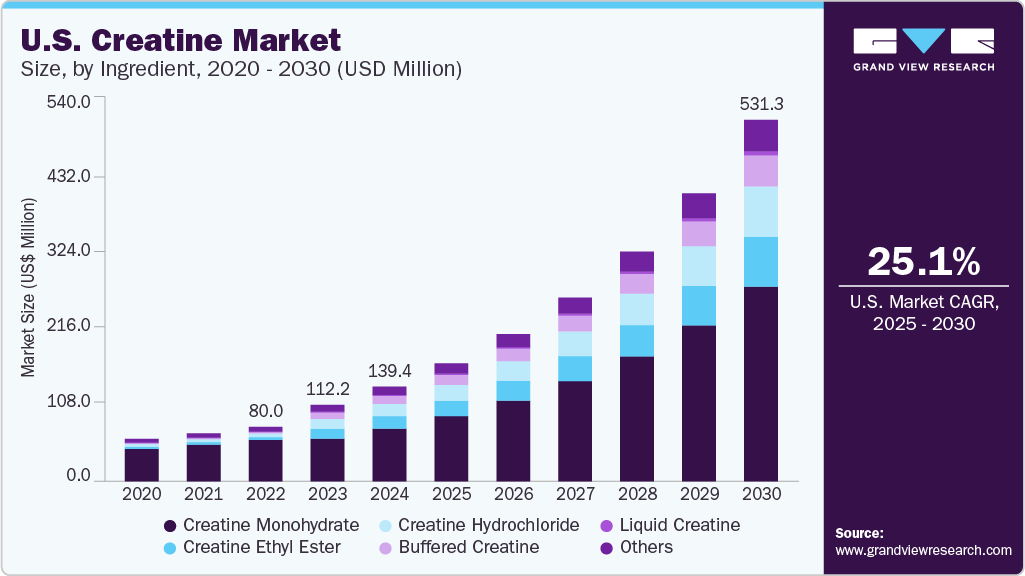

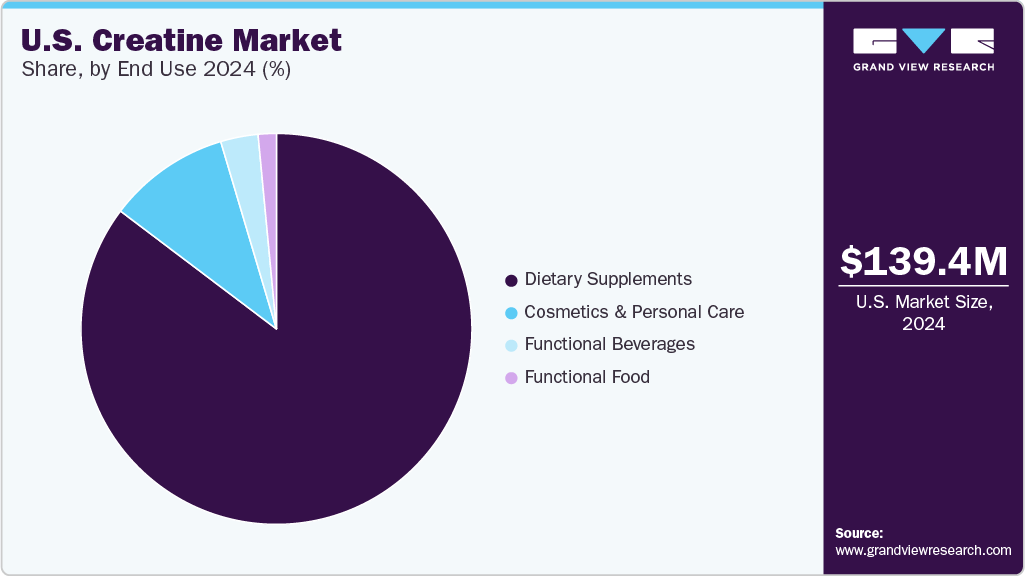

The U.S. creatine market size was estimated at USD 139.4 million in 2024 and is expected to grow at a CAGR of 25.1% from 2025 to 2030. This growth is attributable to the country’s thriving fitness culture, which includes a large population of athletes, bodybuilders, and gym-goers, strongly driving demand for performance-enhancing supplements such as creatine. For instance, Americans consume over 4 million kilograms of creatine annually, reflecting widespread adoption across various age groups and fitness levels. This growth is supported by increasing health awareness and a shift toward self-care and preventive wellness, motivating consumers to incorporate scientifically validated supplements into their routines.

Furthermore, advancements in creatine formulations, such as micronized creatine that offers better absorption and fewer side effects, have broadened the product appeal beyond traditional users. The rise of personalized nutrition and plant-based creatine options also attracts diverse consumer segments, including vegans and older adults seeking muscle maintenance and cognitive health benefits. In addition, the expanding e-commerce sector in the U.S. facilitates convenient access to a wide range of creatine products, enabling direct-to-consumer sales and enhancing market penetration.

Moreover, strong endorsements by fitness influencers and professional athletes on social media platforms have significantly increased creatine’s visibility and acceptance. This marketing influence, combined with growing scientific evidence supporting creatine’s efficacy and safety, has helped normalize its use among recreational fitness enthusiasts and non-athletic populations. For instance, targeted campaigns promoting creatine’s role in muscle recovery and cognitive function have expanded its appeal beyond bodybuilding circles, fueling sustained market growth amid competitive pressures from alternative supplements.

Consumer Insights for Creatine Products in the U.S.

An increasing trend toward healthier lifestyles and self-care has propelled the popularity of sports nutrition supplements, including creatine, across different age groups. For instance, according to the data published in December 2022, Americans consume over 4 million kilograms of creatine per year. In addition, a large number of fitness influencers and athletes promoting creatine on social media and in advertisements have contributed to its widespread acceptance and use.

Moreover, according to the data published in November 2022 by UCLA Health, creatine is effective in enhancing anaerobic performance, including weightlifting and resistance training. As people strive to push their physical limits, they seek products such as creatine that help improve their muscle endurance, recovery times, and overall performance.

According to the 2023 Council for Responsible Nutrition (CRN) consumer survey, 74% of Americans take dietary or nutritional supplements, and 55% are regular users. This shows that supplements are mainstream and play an important role in the lives of many Americans.

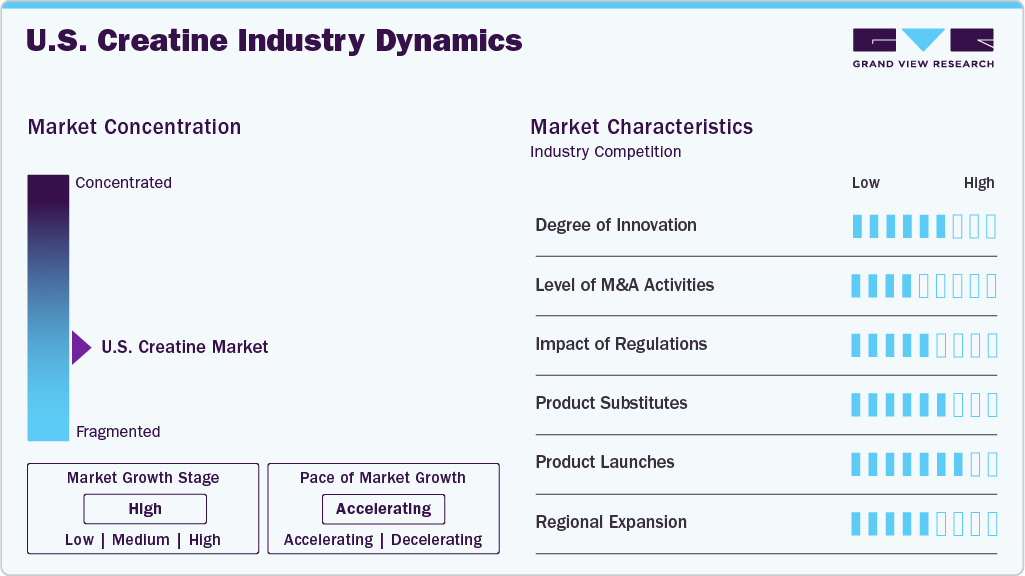

Market Concentration & Characteristics

The U.S. creatine market is evolving rapidly, driven by technological advancements, shifting consumer preferences, and stringent regulatory oversight. Product innovation is a key focus area, with manufacturers developing advanced creatine formulations such as micronized creatine, creatine hydrochloride, and buffered creatine to improve solubility, absorption, and reduce side effects. Consumers increasingly demand clean-label products with transparent ingredient sourcing and manufacturing processes. In response, companies are adopting Good Manufacturing Practices (GMP) and securing certifications such as FSSC 22000 to ensure high safety and quality standards. For instance, Vitaquest International LLC operates a GMP-certified, state-of-the-art facility that complies with global food safety standards, reflecting industry efforts to build consumer trust through transparency and rigorous quality control.

Regulatory frameworks play a crucial role in shaping the market. The U.S. Food and Drug Administration (FDA) regulates creatine supplements under the Dietary Supplement Health and Education Act (DSHEA) of 1994, which mandates accurate labeling and restricts unsubstantiated health claims, particularly regarding cognitive benefits. This ensures that product claims are evidence-based, protecting consumers and maintaining market credibility. In addition, the rise of e-commerce and direct-to-consumer sales channels has expanded market reach, making creatine supplements more accessible to a broad demographic, including athletes, fitness enthusiasts, and older adults focused on muscle maintenance and cognitive health.

Market dynamics are further influenced by growing fitness awareness, preventive healthcare trends, and the increasing popularity of personalized nutrition. Consumers seek multifunctional supplements that support muscle strength, recovery, and overall wellness, driving demand for innovative creatine products. Companies are leveraging digital marketing and collaborations with fitness influencers to enhance brand visibility and consumer engagement. Moreover, sustainability considerations are gradually entering the market, with some manufacturers exploring eco-friendly packaging and responsible sourcing to align with consumer values. Together, these factors contribute to a competitive and dynamic U.S. creatine market that continuously adapts to evolving consumer needs and regulatory requirements.

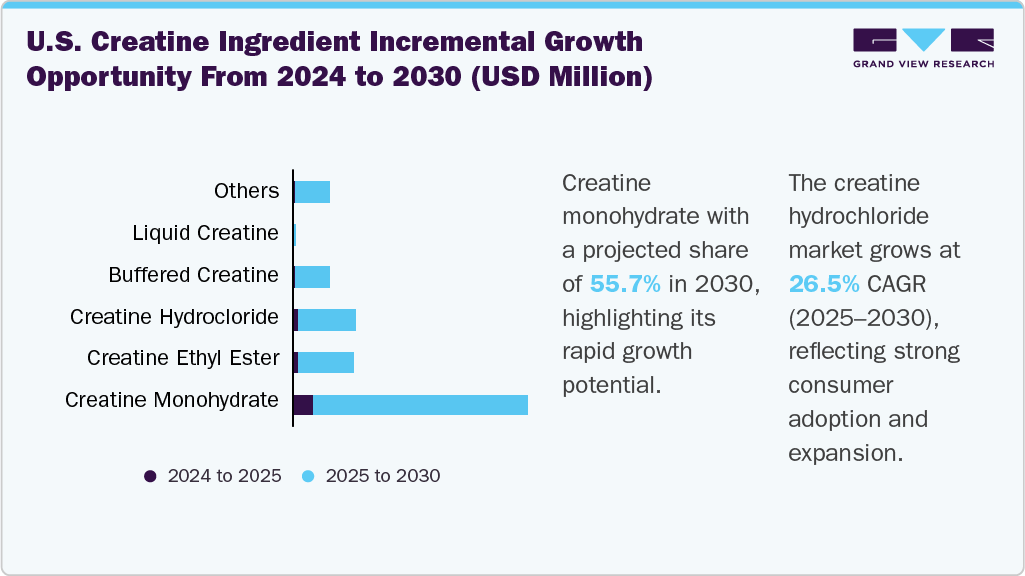

Ingredient Insights

The creatine monohydrate ingredient accounted for a revenue share of 55.7% of the U.S. revenue in 2024, primarily due to its extensively researched and scientifically validated form of creatine, offering proven benefits in enhancing muscle strength, endurance, and recovery. Its high stability, solubility, and cost-effectiveness make it the preferred choice among athletes, bodybuilders, and fitness enthusiasts. For instance, numerous clinical studies have demonstrated that creatine monohydrate can increase strength gains by 5-10% during weight training, which reinforces consumer confidence in its efficacy. In addition, its widespread availability in various formulations, especially powders that are easy to mix and customize, supports its dominant market share. The strong safety profile and consistent performance outcomes, coupled with rising fitness culture and increased adoption of sports nutrition products in the U.S., further drive the preference for creatine monohydrate over other forms in the market.

The creatine hydrochloride ingredient is projected to grow at a CAGR of 26.5% from 2025 to 2030. The hydrochloride group enhances water solubility, allowing creatine HCl to dissolve more completely in liquids, which reduces sediment and improves bioavailability, leading to faster and more efficient muscle uptake. This results in lower required doses and fewer side effects such as bloating and gastrointestinal discomfort, making it highly appealing to consumers sensitive to creatine monohydrate. For instance, fitness enthusiasts who experienced digestive issues with monohydrate often switch to creatine HCl for better tolerance and convenience. In addition, growing demand for convenient, mixable, and quick-absorbing supplements, supported by targeted marketing and influencer endorsements, drives its adoption. Advances in formulation technology and increasing awareness of creatine’s benefits beyond muscle building, such as cognitive health, further contribute to the robust growth prospects of creatine HCl in the global market.

Application Insights

The dietary supplements in U.S. accounted for a share of 85.3% of the revenue in 2024, primarily due to growing health awareness and a strong focus on preventive healthcare among American consumers. Rising concerns about lifestyle-related diseases such as diabetes and hypertension have increased demand for supplements that support overall wellness and fitness, including creatine-based products that enhance muscle strength and recovery. For instance, the surge in personalized nutrition and sports supplements tailored to individual health needs has expanded creatine’s appeal beyond athletes to a broader population seeking self-directed care. In addition, the widespread availability of dietary supplements through both offline retail and rapidly growing e-commerce platforms has made these products more accessible nationwide. Innovations in convenient supplement formats like powders, capsules, and ready-to-drink options further boost consumer adoption.

Functional beverages in the U.S. are projected to grow at a CAGR of 27.1% from 2025 to 2030, due to rising consumer interest in health and wellness, which drives demand for convenient drinks with added nutritional benefits. These beverages, including energy drinks, enhanced waters, and probiotic-infused options, cater to consumers seeking improved immunity, better digestion, and enhanced energy. The increasing prevalence of diabetes and related health concerns has also led to a preference for beverages with natural sweeteners. This, combined with innovations in plant-based formulations and a shift towards personalized nutrition, supports the robust growth outlook for functional beverages in the U.S. market.

Key U.S. Creatine Company Insights

Key companies in the U.S. creatine market employ diverse strategies to maintain a competitive edge, including launching innovative formulations such as micronized and plant-based creatine to meet evolving consumer preferences. They focus on expanding product accessibility through omnichannel distribution, combining traditional retail, e-commerce, and subscription models. In addition, companies prioritize sustainability by adopting eco-friendly sourcing and packaging to align with growing consumer demand for clean and responsible products.

Key U.S. Creatine Companies:

- Allmax Nutrition

- Nutrex Research, Inc.

- MuscleTech

- WEIDER GLOBAL NUTRITION

- Glanbia PLC

- Ajinomoto Co., Inc.

- GNC Holdings, LLC

- The Hut Group (Myprotein)

- Tiens Group Co. Ltd.

- Alzchem Group AG

Recent Developments

-

In February 2025, The Vitamin Shoppe and biotech company Specnova launched BodyTech Elite Creatine Beadlets, introducing a significant innovation in creatine supplementation. This product features Specnova’s NovaQSpheres delivery technology, which encapsulates creatine in four polymer-wrapped layers to reduce creatine waste during digestion, enhance muscle saturation, and support prolonged muscle uptake.

U.S. Creatine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 173.5 million

Revenue forecast in 2030

USD 531.3 million

Growth rate

CAGR of 25.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, application

Key companies profiled

Allmax Nutrition; Nutrex Research, Inc.; MuscleTech; WEIDER GLOBAL NUTRITION; Glanbia PLC; Ajinomoto Co., Inc.; GNC Holdings, LLC; The Hut Group (Myprotein); Tiens Group Co. Ltd.; Alzchem Group AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Creatine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. creatine market report based on ingredient, and application:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Creatine Monohydrate

-

Creatine Ethyl Ester

-

Creatine Hydrochloride

-

Buffered Creatine

-

Liquid Creatine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Functional Food

-

Functional Beverages

-

Cosmetics & Personal Care

-

Frequently Asked Questions About This Report

b. The U.S. Creatine market size was estimated at USD 139.4 million in 2024 and is expected to reach USD 173.5 million in 2025.

b. The U.S. Creatine market is expected to grow at a compounded growth rate of 25.1% from 2025 to 2030 to reach USD 531.3 million by 2030.

b. The creatine monohydrate ingredient accounted for a revenue share of 55.7% of the U.S. revenue in 2024, primarily due to its extensively researched and scientifically validated form of creatine, offering proven benefits in enhancing muscle strength, endurance, and recovery

b. Some key players operating in the U.S. Creatine market include Allmax Nutrition; Nutrex Research, Inc.; MuscleTech; WEIDER GLOBAL NUTRITION; Glanbia PLC; Ajinomoto Co., Inc.; GNC Holdings, LLC; The Hut Group (Myprotein); Tiens Group Co. Ltd.; Alzchem Group AG and others

b. Key factors that are driving the market growth include the rising country’s thriving fitness culture, which includes a large population of athletes, bodybuilders, and gym-goers, strongly driving demand for performance-enhancing supplements like creatine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.