- Home

- »

- Biotechnology

- »

-

U.S. CRISPR And Cas Genes Market, Industry Report, 2030GVR Report cover

![U.S. CRISPR And Cas Genes Market Size, Share & Trends Report]()

U.S. CRISPR And Cas Genes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service, By Application (Biomedical, Agricultural), By End-use (Biotechnology & Pharmaceutical Companies), And Segment Forecasts

- Report ID: GVR-4-68040-243-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. CRISPR & Cas Genes Market Trends

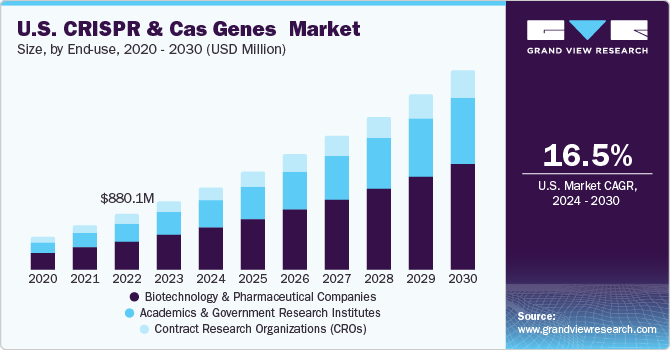

The U.S. CRISPR and Cas genes market size was valued at USD 1.07 billion in 2023 and is anticipated to grow at a CAGR of 16.5% from 2024 to 2030. Therapeutic applications of CRISPR and Cas genes, rising significance for gene editing, and the introduction of anti-CRISPR proteins are boosting market growth. Moreover, CRISPR and Cas genes provide growth prospects for developing novel cancer therapies that boost market expansion.

U.S. CRISPR and Cas genes market accounted for a 63.0% share in the global CRISPR and Cas genes market in 2023. CRISPR technology is preferred for treating various diseases, including cancer and inflammatory and infectious diseases, making it favorable for future biomedical therapeutics. It revolutionizes cancer treatment by enhancing Chimeric Antigen Receptor T-cell (CAR-T) immunotherapy. Unlike traditional methods, the next generation of CAR-T therapies utilizes CRISPR to improve the precision and efficiency of therapeutic and manufacturing processes. This advancement allows for accurate delivery of CAR genes into T-cell DNA, a significant improvement over viral vectors that randomly insert genes. These features of CRISPR-Cas increase its demand in the market.

Furthermore, the increasing investment from government bodies, funding agencies, and biotechnology companies in genomic research is poised to impact the CRISPR market significantly. International funding organizations such as the NIH and Wellcome Trust play a crucial role by providing financial support for genetic studies. This substantial funding is expected to drive the utilization of genetic editing tools in the country, shaping the landscape of the CRISPR market. Furthermore, a report published in June 2022 stated that the U.S. government granted USD 639.0 million to Human Genome Research Institute for R&D in 2022. The institute further requested USD 629.0 million as funding for 2023.

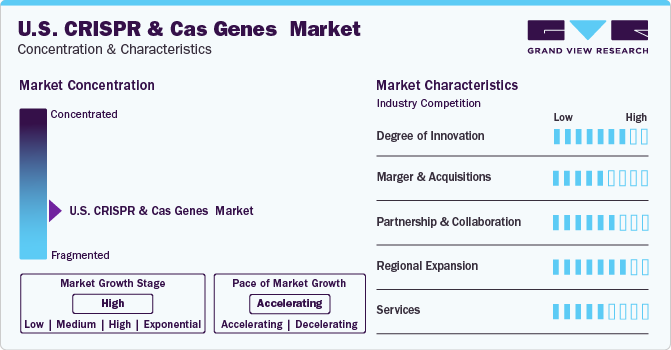

Market Concentration & Characteristics

The presence of several companies in the U.S. CRISPR And CAS Genes market contributed to its fragmented landscape. Moreover, companies are leveraging CRISPR editing in the human genome, offering growth opportunities in academic and pharmaceutical research.

By introducing innovative CRISPR-based therapies, companies have the potential to attract customers, drive revenue growth, and enhance patient outcomes significantly. Utilizing CRISPR technology in the development of advanced therapies can assist companies in differentiating themselves in the market, meet patients' evolving requirements, and contribute to personalized medicine. This offers a promising path for using cutting-edge therapies and advancement in personalized medicine.

Companies like CRISPR Therapeutics, Vertex Pharmaceuticals, Intellia Therapeutics, and Regeneron Pharmaceuticals have engaged in strategic partnerships to drive innovation in precision medicine. These collaborations involve sharing resources, expertise, and technologies to develop novel treatments that target genetic disorders at their root cause.

Numerous biotechnological and pharmaceutical companies focus on M&A activities that showcase crucial aspects of strategic management that enable companies to facilitate growth, restructuring, and enhancing competitive positions within the industry

Various biotechnology and CRISPR-based therapeutics companies focus on providing services such as cell line engineering and design tools that help in research activities undertaken by institutions and other companies. This approach increases their customer base and enables them to sustain their position in the industry.

Increasing focus on regional expansion by key manufacturers serves a wide range of customers and capitalizes on geographical industry growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local market needs, and enhance their market share by targeting diverse customer segments.

Product & Service Insights

In 2023, the product segment held the largest market share of 79.0%. This growth was fueled by the efforts of institutions and key companies to increase research and development activities. This comprises kits& enzymes such as CAS9, CRISPR libraries, antibodies, design tools, and more. Moreover, Vector-based CAS9 products facilitate research experiments, signifying the use of CRISPR/Cas for gene editing. Such applications shift the focus of manufacturers to develop these products, further expanding market growth. Epic Bio unveiled the GEMS (Gene Expression Modulation System) platform in 2022, which offers precise gene expression modification. The GEMS platform contains a vast library of newly discovered modulators combined with advanced functional and computational genomics capabilities. It enables the rapid design of guide RNAs highly targeted to specific genes.

From 2024 to 2030, the services segment is expected to experience the most rapid compound annual growth rate. This growth is fueled by the rising number of licensing agreements with biotech firms, which offer services ranging from cell line engineering and beyond. Moreover, CRISPR-based gene editing companies focus on offering advanced services to fulfill the unmet demand for this market. For instance, in August 2022, Creative Biogene introduced one-stop microbial genome editing services for knock-in, knockout, and foreign gene insertion using a variety of bacteria. These microbial genome editing services maximize customers’ microbial gene sequence efficiency and minimize off-target effects using the advanced CRISPR/Cas 9 platform.

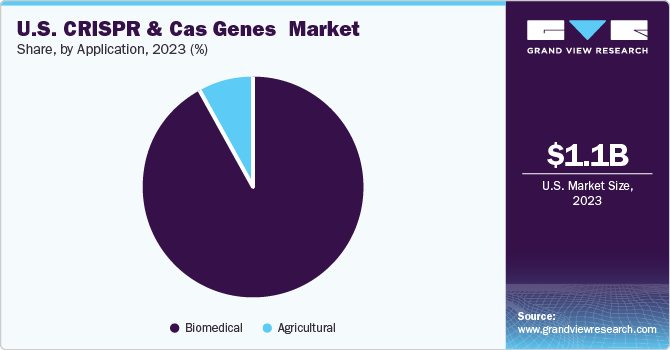

Application Insights

The biomedical application segment held the largest share of 92% in 2023, owing to the increasing popularity of CRISPR/Cas9 genome editing technology in several areas of biomedical sciences. The market is experiencing profitable growth opportunities thanks to the emergence of different CRISPR-based therapies to treat chronic conditions such as cancer, diabetes, blood disorders, and infectious diseases. Moreover, regulatory approval of these therapies is driving the segment’s growth. For instance, in December 2023, the US FDA approved Casgevy therapy for sickle cell anemia. Casgevy is the first FDA-approved therapy utilizing CRISPR/Cas9, a genome editing technology.

The agriculture segment will exhibit the quickest compound annual growth rate (CAGR) between 2024 and 2030. The rise in awareness of CRISPR-based gene editing in the agriculture sector has led to increasing adoption improvement in crop production. There is an increase in research studies on agriculture products using CRISPR technology. This trend will expand the growth trajectory of this segment.

End-use Insights

The biotechnology and pharmaceutical companies segment dominated the market with a share of 50.0% in 2023, owing to the increasing development of CRISPR-based products by major biotechnology and pharmaceutical companies for drug and therapy development. The growing adoption of CRISPR technology in these sectors significantly influences the market landscape and drives revenue growth. Additionally, the rise in the number of companies offering gene and gene-editing products and services in recent years is further fueling the revenue growth within this segment.

The academic and government research institutes are anticipated to grow at a CAGR of 16% over the forecast period. The increased research and numerous genomics and gene editing studies in academic and government institutes have increased the demand for CRISPR-Cas9. This surge in research activities focusing on gene engineering and its applications is anticipated to drive rapid growth in the forecast period.

Key U.S. CRISPR And Cas Genes Company Insights

The key companies operating in the market include Genscript, Thermofisher Scientific, Inc., Benitec Biopharma, Inc., and Mammoth Biosciences, Inc. among others.

These companies are involved in the CRISPR-based therapy development, with strategic acquisitions, collaborations, and innovative product lines to maintain their market dominance and advance the field of gene editing therapies.

Key U.S. CRISPR And CAS Genes Companies:

- Genscript

- Mammoth Biosciences, Inc

- Editas Medicine, Inc.

- Calyxt, Inc.

- Caribou Biosciences, Inc

- Addgene

- Thermofisher Scientific, Inc

- Integrated DNA Technologies, Inc

- Egenesis

- Danaher Corporation

- Synthego

- Recombinetics, Inc

- Origene Technologies, Inc.

- Inscripta, Inc.

- Intellia Therapeutics, Inc.

Recent Developments

-

In June 2023, researchers from the University of California announced the development of diseases-resistant rice plants using the CRISPR-Cas editing tool. This genetically modified crop would offer anti-fungal resistance and high yield.

-

In January 2023, Ensoma announced the acquisition of Twelve Bio with $85 million in financing.This would help in the development of its in vivo engineered cell therapy platform and accelerate its pipeline of genomic medicines for immuno-oncology and other therapeutic applications.

U.S. CRISPR And Cas Genes Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 9.22 billion

Growth rate

CAGR of 16.5% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end-use

Country scope

U.S.

Key companies profiled

Genscript ; Mammoth Biosciences, Inc; Editas Medicine, Inc.; Calyxt, Inc.; Caribou Biosciences, Inc; Addgene

Thermofisher Scientific, Inc; Integrated DNA Technologies, Inc; Egenesis; Danaher Corporation; Synthego; Recombinetics, Inc; Origene Technologies, Inc.;Inscripta, Inc.; Intellia Therapeutics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. CRISPR And Cas Genes Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. CRISPR and Cas Genes market report based on product & service, application, and end-use:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

By Product

-

Kits & Enzymes

-

Vector-based Cas

-

DNA-free Cas

-

-

Libraries

-

Design Tool

-

Antibodies

-

Others

-

-

By Service

-

Cell Line Engineering

-

gRNA Design

-

Microbial Gene Editing

-

DNA synthesis

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical

-

Genome Engineering

-

Disease Model Studies

-

Functional Genomics

-

Epigenetics

-

Others

-

-

Agricultural

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academics & Government Research Institutes

-

Contract Research Organizations (CROs)

-

Frequently Asked Questions About This Report

b. The U.S. CRISPR and cas genes market size was estimated at USD 1.07 billion in 2023

b. The U.S. CRISPR and cas genes market is expected to grow at a compound annual growth rate of 16.5% from 2024 to 2030 to reach USD 9.22 billion by 2030.

b. Based on application, biomedical application segment held the largest share of 92% in 2023 owing to the increasing popularity of CRISPR/Cas9 genome editing technology in several areas of biomedical sciences.

b. Some of the key players in the market are Genscript ; Mammoth Biosciences, Inc; Editas Medicine, Inc.; Calyxt, Inc.; Caribou Biosciences, Inc; Addgene Thermofisher Scientific, Inc; Integrated DNA Technologies, Inc; Egenesis; Danaher Corporation; Synthego; Recombinetics, Inc; Origene Technologies, Inc.;Inscripta, Inc.; and Intellia Therapeutics, Inc.

b. Some of the key factors driving the market include technological advancements in CRISPR & Cas gene system and increased investments in gene editing-based R&D. Moreover, innovative technologies such as karyotyping, neonatal screening, viral screening and others have boosted the demand for gene editing techniques like CRISPR & Cas gene technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.