- Home

- »

- Communication Services

- »

-

U.S. Customer Experience Management Market, Industry Report, 2030GVR Report cover

![U.S. Customer Experience Management Market Size, Share & Trends Report]()

U.S. Customer Experience Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering, By Analytical Tools, By Touch Point Type, By Deployment, By Organization Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-251-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

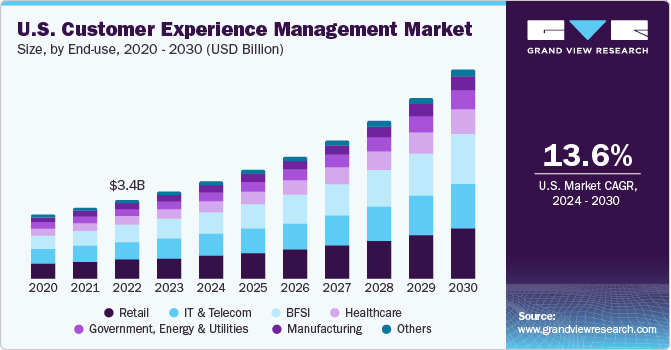

The U.S. customer experience management market size was valued at USD 3.80 billion in 2023 and is projected to grow at a CAGR of 13.6% from 2024 to 2030. The U.S. accounted for 31.6% of the global customer experience management market. The growing importance of understanding customer behavior and their preferences is enabling various brands and organizations to adopt customer experience strategies to deliver the best service performance in real-time. As a result, the U.S. market is witnessing the growth of customer experience management (CEM) solutions.

Moreover, the growing use of digital channels by customers to communicate with brands and organizations is estimated to boost the U.S. CEM market growth over the coming years. Additionally, increasing investments and allocating budgets for digital channels and marketing among U.S. enterprises contribute to market growth and make the industry more competitive.

In addition, many U.S. businesses invest in customer experience management platforms and technologies, often requiring specialized services for implementation and integration. Service providers that offer expertise in deploying and integrating CEM solutions. These factors are expected to drive growth in the U.S. customer experience management market over the forecast period.

Furthermore, the growth of the speech analytics segment in the customer experience management (CEM) market is often attributed to the increasing importance of understanding customer interactions and sentiments. Speech analytics technology allows businesses to analyze and extract valuable insights from customer interactions, including phone calls, chat conversations, and more. As a result, speech analytics may drive the growth of the U.S. customer experience management market.

However, U.S. enterprises are seeking secure and real-time information to offer enhanced customer experience. Therefore, companies collect numerous amounts of data of individual customers through many touchpoints and analyze it virtually. The information gathered has a large amount of personal information such as an address, contact details, etc. Hence, information privacy and data security can be challenging for the growth of U.S. CEM market.

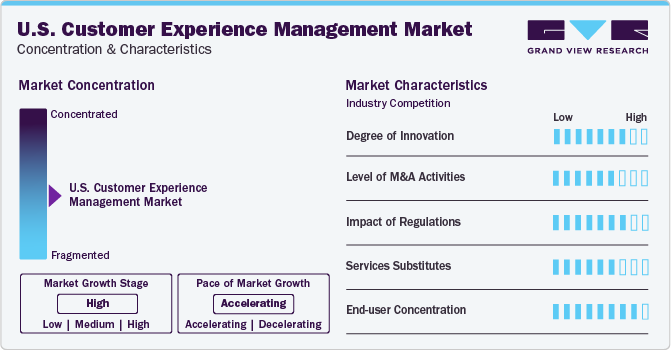

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. customer experience management market is fairly concentrated. As customer service becomes more complex due to the variety of communication channels used by customers, organizations are turning to CEM software to gain a comprehensive understanding of customer needs and integrate data from various sources. As a result, it is likely to generate demand in the U.S. customer experience management market.

The U.S. market for customer experience management (CEM) is highly innovative as CEM software solutions which offer significant benefits to end-users. For example, CEM helps businesses to understand the importance of positive word-of-mouth marketing, building customer loyalty, and ultimately laying the groundwork for long-lasting and profitable customer relationships.

The market is witnessing strategic partnerships, mergers & acquisitions, and joint ventures. For instance, key players in the market such as Adobe Inc., Oracle Corporation, and International Business Machines Corporation, and among others. These companies are aggressively pursuing various initiatives, such as new product launches, collaboration and hosting seminars, as part of their efforts to attract & engage new customers.

Moreover, U.S. CEM market cater to various end-users, for instance, when government agencies seeking to enhance citizen engagement for better delivery of various services. In addition, businesses across multiple industries like BFSI, retail, manufacturing, healthcare, and IT & Telecom. Driven by the rising focus on customer satisfaction and the increasing adoption of predictive analytics, the market is expected to experience significant growth.

Offering Insights

Solution segment dominates the market and accounted for the highest revenue of 2281.5 million in 2023. Increasing adoption of digitalization, technological advancements in cloud and artificial intelligence solutions, rapid integration of multichannel touchpoints into a single platform, and the increasing need to analyze customer data to draw business insights to increase revenue are some of the primary factors boosting the customer service market in the U.S.

Services segment is anticipated to witness significant CAGR of 14.5% from 2024 to 2030 in the U.S. customer experience management market. Understanding customer behavior and preferences is becoming increasingly important for brands and organizations. It allows them to deliver high-quality services and gain access to real-time data. This helps companies stay ahead of their competitors and offer services that are at the forefront of their industry.

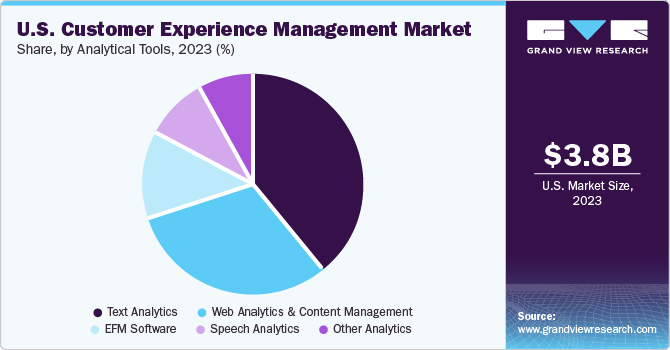

Analytical Tools Insights

Text analytics segment led the market and accounted highest revenue share of 38.7% in 2023. Text analytics technology has become one of the essential tools for businesses focusing on analyzing client sentiment. The technology is effective when dealing with massive amounts of unstructured feedback. It uses machine learning (ML) and natural language processing (NLP) to extract necessary information from unstructured data. Therefore, text analytics has a significant market share in the U.S. customer experience management market.

Speech analytics segment is anticipated to witness CAGR of 16.1% from 2024 to 2030 in the U.S. customer experience management market. Speech analytics is emerging as a popular technology as more people use voice-enabled searches and contact centers. Speech analytics solutions provide conversational analytics by organizing and identifying words and phrases spoken during phone calls and converting them into themes. They also help organizations identify trends, opportunities, and issues. As a result, speech analytics sub-segment is showcasing stable growth during the forecast period.

Touch Point Type Insights

Call Centers segment led the market and accounted highest revenue share of 31.3% in 2023. Businesses are increasingly embracing for human expertise to stay relevant wit consumer needs, call centers within the CEM landscape are undergoing a remarkable transformation. It includes incorporating AI-powered solutions for automation and sentiment analysis, fostering omnichannel support for seamless interaction across various channels, and investing in agent training to build empathy and cultivate expertise. As a result, call centers segment has a significant market share in the U.S. customer experience management market.

Web Services segment is anticipated to witness CAGR of 15.2% from 2024 to 2030 in the U.S. customer experience management market. Web CEM enables enterprises to deliver strong, responsive, mission-critical customer experiences via Omni channel touchpoints that support multiple enterprise information platforms, social media, languages, and devices. Online CEM can also integrate existing enterprise systems with advanced technologies. Thus, web services is showcasing stable growth during the forecast period.

Deployment Insights

On premise segment led the market and accounted highest revenue of 1908.4 million in 2023. Large number of businesses are transitioning from on premise to cloud. Still numerous enterprise groups preferred on-premises implementation over cloud-based deployment due to on premise customer experience management solutions provide better data privacy.

Cloud segment is anticipated to witness CAGR of 16.0% from 2024 to 2030 in the U.S. customer experience management market. Cloud deployments offer remote location and security to the servers without a heavy investment companies can opt for this solutions to deployment of their CEM software solutions. In addition, industries such as healthcare and IT sectors are integrating this type of deployment more. As a result, cloud sub-segment is showcasing stable growth during the forecast period.

Organization Size Insights

Large enterprises segment led the market and accounted for the highest global revenue share of 63.9% in 2023. . Large enterprises, with their complex customer interactions and vast data sets, are significantly adopting advanced CEM solutions to gain a competitive edge in the market. In addition, they are progressively utilizing Artificial Intelligence (AI) and Machine Learning (ML)-enabled CEM systems to personalize customer experiences, automate tasks, and gain deeper insights from customer data. Thus, growing number of large firms in U.S. drive the customer experience management market during the forecast period.

Small and medium sized enterprises (SMEs) segment is anticipated to witness significant CAGR of 14.7% from 2024 to 2030 in the U.S. customer experience management market. SMEs are prioritizing mobile-first CEM solutions. These solutions include elements such as mobile applications for client self-service, which enable users to conveniently access information, manage accounts, and submit requests. As a result, SMEs will drive the market growth in forecast period.

End-use Insights

Retail segment accounted for the largest market revenue of 906.0 million in 2023. Retailers use structured analytics CEM systems to save precise customer information, including their preferences and social media activities. They can understand client preferences by collecting and analyzing data from various touchpoints, such as websites, smartphone applications, social media platforms, and physical stores/branches. As a result, retail sub-segment is driving the growth of the U.S. customer experience management market.

BFSI segment is expected to register the fastest CAGR of 14.8% during the forecast period. The BFSI sector is witnessing increased demand for CEM solutions, specifically in contact centers. Contact centers rely on voice interaction support and incur high operational costs owing to the increasing number of calls. This has encouraged BFSI enterprises to invest and adopt analytical tools that include multi-channel customer experience management features to effectively address customer demands. Which denotes that BFSI sub-segment as a key driver in the U.S. customer experience management market.

Key U.S. Customer Experience Management Company Insights

Adobe, IBM Corporation, Oracle Corporation, and among others are some of the prominent participants operating in the U.S. customer experience management market.

-

Adobe operates its business through three reportable segments, namely digital media, digital experience, and publishing & advertising. The digital media segment offers tools and solutions allowing individuals and small- and medium-sized enterprises to create, publish, and promote digital content. The digital experience segment offers a broader and integrated suite of products, solutions, and services for creating, managing, executing, assessing, and improving customer experience.

-

IBM Corporation manufactures computer hardware, develops middleware and other software, and offers infrastructure hosting and consulting services. The company also provides support services from nanotechnology to mainframe computers. The company is more focused on providing software-defined networking solutions to its customers.

Some of the emerging companies operating in the market include Medallia Inc., Zendesk, Clarabridge, and others.

-

Medallia Inc. provides service platforms that help capture customer feedback from various channels, including mobile telephone, in-store, and online. The company specializes in offering solutions for Customer Experience Management (CEM), business intelligence, enterprise feedback management, social media management, and text analytics.

-

Zendesk is a provider of customer service software. The company’s software solutions help solve customer engagement and customer relationship problems. The company’s areas of expertise include customer community, help desks, customer support, software-as-a-service (SaaS), and customer service.

Key U.S. Customer Experience Management Companies:

- Adobe Inc.

- Avaya Inc.

- Clarabridge

- Freshworks Inc.

- Genesys

- IBM Corporation

- Medallia Inc.

- Open Text Corporation

- Oracle Corporation

- Qualtrics

- SAS Institute Inc.

- Service Management Group (SMG)

- Verint

- Zendesk

Recent Developments

-

In January 2024, Zendesk announced it had signed a definitive agreement to acquire Klaus, the industry-leading AI-powered quality management platform. This will allow the company to integrate AI, resulting in a rapid increase in customer interactions and transforming customer service.

-

In September 2023, Oracle Inc., a customer experience management solutions provider, announced the launch of new capabilities powered by generative AI to enhance the development of connected customer information between its Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems for improved customer experience.

-

In June 2023, Adobe unveiled new advancements in the Adobe Experience Cloud. The company announced the accessibility of Adobe Product Analytics for enterprise customers. It also announced significant enhancements such as personalized customer experience and enhanced operational efficiency to Adobe Experience Manager, Adobe Mix Modeler, Adobe Journey Optimizer, and Adobe Real-Time Customer Data Platform.

-

In May 2023, Genesys, an American software company that offers customer experience and call center technology, announced Genesys Cloud EX solution to engage, motivate, and empower employees. This new employee experience solution empowers businesses to enhance engagement, performance, and trust within the digital workforce. It incorporates capabilities such as AI-powered workforce gamification and performance management, forecasting and scheduling, coaching, and employee development.

U.S. Customer Experience Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.24 billion

Revenue forecast in 2030

USD 9.09 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Actual data

2018 – 2023

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offerings, analytical tools, touch point type, deployment, organization size, end-use

Country scope

U.S.

Key companies profiled

Adobe Inc.; Avaya Inc.; Clarabridge; Freshworks Inc.; Genesys; IBM Corporation; Medallia Inc.; Open Text Corporation; Oracle Corporation; Qualtrics; SAS Institute Inc.; Service Management Group (SMG); Verint; Zendesk

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Customer Experience Management Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Customer Experience Management Market report based on offering, analytical tools, touch point type, deployment, organization size, and end-use.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Analytical Tools Outlook (Revenue, USD Million, 2018 - 2030)

-

EFM software

-

Speech analytics

-

Text analytics

-

Web analytics & content management

-

Other analytics

-

-

Touch Point Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stores/ branches

-

Call Centers

-

Social Media Platform

-

Email

-

Mobile

-

Web Services

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium-Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Government, Energy & Utilities

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. customer experience management market size was estimated at USD 3.80 billion 2023 and is expected to reach USD 4.24 billion in 2024

b. The U.S. customer experience management market is expected to grow at a compound annual growth rate of 13.6% from 2024 to 2030 to reach USD 9.09 billion in 2030.

b. Large enterprises segment led the market and accounted for the highest global revenue share of 63.9% in 2023. . Large enterprises, with their complex customer interactions and vast data sets, are significantly adopting advanced CEM solutions to gain a competitive edge in the market.

b. Some key players operating in the U.S. customer experience management market are Adobe, IBM Corporation, Oracle Corporation, and among others.

b. The growing importance of understanding customer behavior and their preferences is enabling various brands and organizations to adopt customer experience strategies to deliver the best service performance in real-time. As a result, the U.S. market is witnessing the growth of Customer Experience Management (CEM) solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.