- Home

- »

- Next Generation Technologies

- »

-

U.S. Dark Fiber Network Market Size Report, 2030GVR Report cover

![U.S. Dark Fiber Network Market Size, Share & Trends Report]()

U.S. Dark Fiber Network Market (2022 - 2030) Size, Share & Trends Analysis Report By Network Type (Metro, Long-haul), By Fiber Type (Single Mode, Multi-mode), By Application (Telecom, Medical, BFSI), And Segment Forecasts

- Report ID: GVR-4-68039-923-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

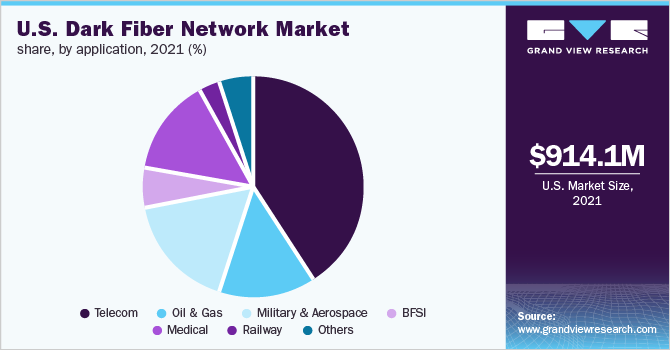

The U.S. dark fiber network market size accounted for USD 914.1 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2022 to 2030. The technology has emerged as a sustainable solution for various organizations that are focusing on enhanced communication and network management. Continuously increasing penetration of internet services, over the period, has paved the way for the high demand for internet bandwidth. This demand is expected to remain rampant over the forecast period. This is the most significant factor responsible for market growth across the region.

The market is strongly supported by companies with a high reliance on internet connectivity. These networks are highly beneficial for organizations with a high volume of data flow in their operation. These benefits include reduced network latency, scalability, reliability, and enhanced security. In fiber-optic communications, optic cables that are not yet put in service by a provider or carrier, are termed Dark Fiber (DF) or unlit fiber. These cables are not connected to any optical device and are installed to be used in the future.

It is also called a new fiber construction project to be owned by a customer or service provider. In the current market scenario, network service providers are leasing these unused fiber optic cables. During the late 90s, the telecommunication industry was booming, and huge capital was poured into building these fiber-optic networks. That period saw the aggressive laying down of fiber networks along with highways and rail lines (i.e., long-haul network type). Similarly, a thousand miles of local or regional networks (i.e., metro network type) were laid across large cities and population centers.

At the turn of the century, the telecom sector witnessed a meltdown, and these billion-dollar unused fiber network (dark fiber) infrastructures were sold at a meager price by telecom providers to avoid bankruptcy. The dark fiber prices in the metro area are considerably higher than in the long-haul area on a per-mile basis. More urban areas’ routes have considerably higher pricing in the metro area than the suburban and exurban areas’ routes. This is due to the rising demand for a fiber network in urban areas. Occasionally, owing to the glut of fiber, the prices of dark fiber networks push down in the urban areas. Moreover, it has been observed that the dark fiber prices in the long-haul areas are more consistent than in the metro-area routes.

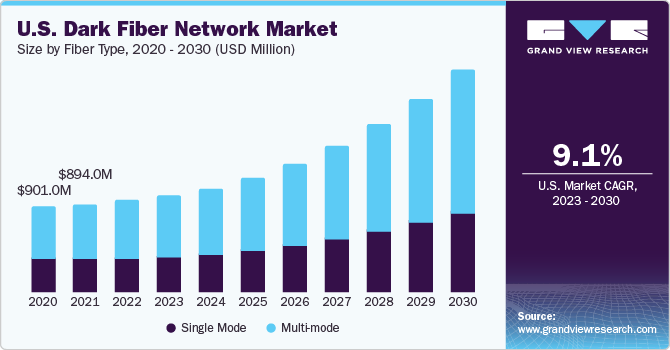

Fiber Type Insights

In 2021, the multimode fiber type segment led the market and accounted for over 66.80% of the total market share. It is expected to continue leading the market over the forecast period. This type is best suited for short transmission distances. It is mainly used in video surveillance and Local-area Network (LAN) systems. Single-mode fiber, on the other hand, is best suited for longer transmission distances. It is mainly used in multi-channel television broadcast systems and long-distance telephony. The single-mode segment is anticipated to witness considerable growth over the projected period. This product type is used for long-distance installations ranging from 2 meters to 10,000 meters.

It offers lower power loss in comparison to multimode. However, it is costlier than multimode fibers. Increasing penetration of internet services in the region has paved the way for an increased internet bandwidth requirement. Furthermore, growing cloud-based applications and rising demand for audio-video streaming & Video-on-Demand (VoD) services are further driving this requirement. Regulated demand for mobile data and the expected launch of 5G services are compelling telecom service providers to purchase the available dark fiber and focus on building their own fiber network. As such, the demand for dark fibers is expected to increase significantly in the coming years.

Network Type Insights

The long-haul fiber network type segment remained the mainstay of the market in 2021 and accounted for the maximum share of more than 66.00% of the overall revenue. The segment continues to gather pace due to the capacity of these fibers to connect over large distances at low signal intensity. Such long-haul terrestrial networks are widely applied in undersea cabling across long oceanic distances. A long-haul network is driven by continuously growing investments, the development of smart cities, and strong competitive dynamics in the market. However, the broadening availability of metro network fibers at a relatively low cost is gradually swinging the momentum towards the segment.

For instance, in October 2021, Zayo Group Holdings Inc. completed three new long-haul dark fiber routes from Denver to Salt Lake City, Atlanta to Dallas, and Eugene to Reedsport. The report includes lease pricing analysis for the log-haul and metro routes. The pricing for dark fiber in the U.S. is based on the routes & locations and is sometimes plainly arbitrary. Also, it relies on several other parameters, such as market competition & demand and construction costs in a particular location. Generally, the U.S. dark fiber network pricing has been bifurcated into two major parts, including metro-area and long-haul area fiber. As developing fiber infrastructure requires a huge capital investment, many companies are inclined toward leasing dark fibers to reduce costs.

Application Insights

In terms of revenue, the telecommunication segment dominated the market with a share of more than 41.00% in 2021 and is anticipated to retain its dominance during the forecast period. Telecommunication is anticipated to present promising growth prospects due to the growing adoption of the 5G technology in communication and data transmission services. Dark fiber enables high-speed data transfer services in both small- and long-range communications. Furthermore, increasing cloud-based applications, audio-video services, and Video-on-Demand (VoD) services stimulate demand. The growing civil engineering sector is a crucial driver of the market.

A rise in commercial and industrial construction activities is expected to increase the demand for fiber connectivity and hence drive the market. The growing expenditure on the defense and military sector in the U.S. has increased dark fiber usage across various applications, such as surveillance border security. The overall penetration of LTE (4G) and the growing adoption of 5G have fueled the demand for bandwidth for backhaul at U.S. cell sites in the last few years. The intense price war among mobile operators and ever-increasing consumer bandwidth consumption have forced mobile operators to opt for dark fiber networks.

Key Companies & Market Share Insights

The market participants adopt various strategies, such as mergers & acquisitions, product developments, collaborations, partnerships, and expansions, to cater to customer demands. For instance, in November 2021, AT&T Inc. partnered with Vanderburgh County, Indiana for building a fiber network to deliver high-speed internet. The contract is valued at USD 39.6 million and is a public-private partnership. The partnership will improve the network coverage and capacity in the region. Some of the prominent players operating in the U.S. dark fiber network market are:

-

AT&T Intellectual Property

-

Comcast

-

Consolidated Communications

-

Verizon Communications, Inc.

-

Lumen Technologies, Inc.

-

Crown Castle International Corp.

-

Frontier Communications Parent, Inc.

-

Zayo Group, LLC

U.S. Dark Fiber Network Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 937.5 million

Revenue forecast in 2030

USD 1.58 billion

Growth rate

CAGR of 6.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, network type, application

Country scope

U.S.

Key companies profiled

AT&T Intellectual Property; Comcast; Consolidated Communications; Verizon Communications, Inc.; Lumen Technologies, Inc.; Crown Castle International Corp.; Frontier Communications Parent, Inc.; Zayo Group, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. dark fiber network market report based on fiber type, network type, and application:

-

Fiber Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Mode

-

Multi-mode

-

-

Network Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Metro

-

Long-haul

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dark fiber network market size was estimated at USD 914.1 million in 2021 and is expected to reach USD 937.5 million in 2022.

b. The U.S. dark fiber network market is expected to grow at a compound annual growth rate of 6.8% from 2022 to 2030 to reach USD 1.58 billion by 2030.

b. The multi-mode segment dominated the U.S. dark fiber network market with a share of 66.87% in 2021. This type is best suited for short transmission distances. It is mainly used in video surveillance and Local-area Network (LAN) systems.

b. Some key players operating in the U.S. dark fiber network market include AT&T Intellectual Property; Comcast; Consolidated Communications; Verizon Communications, Inc.; Lumen Technologies, Inc.; Crown Castle International Corp.

b. Key factors that are driving the U.S. dark fiber network market growth include growing internet traffic worldwide, the need for enhanced network management & communication, and increasing bandwidth demand worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.