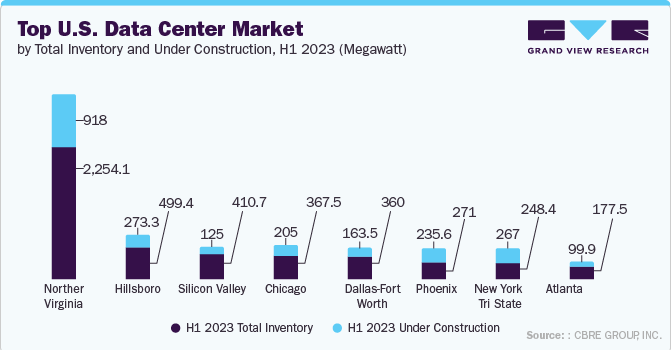

Market Size & Trends

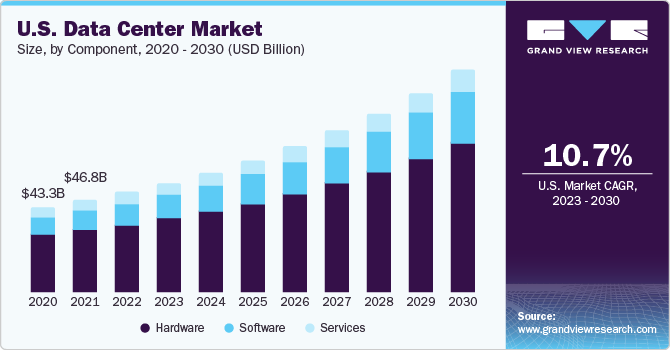

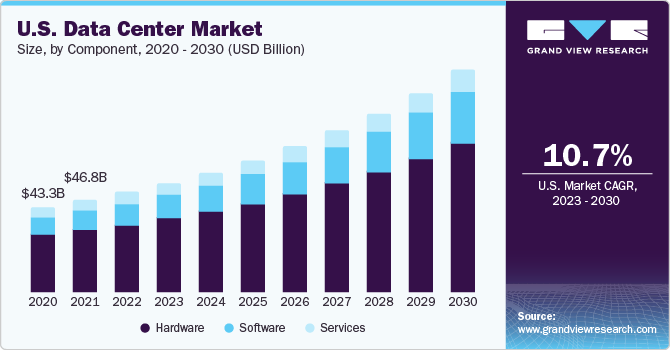

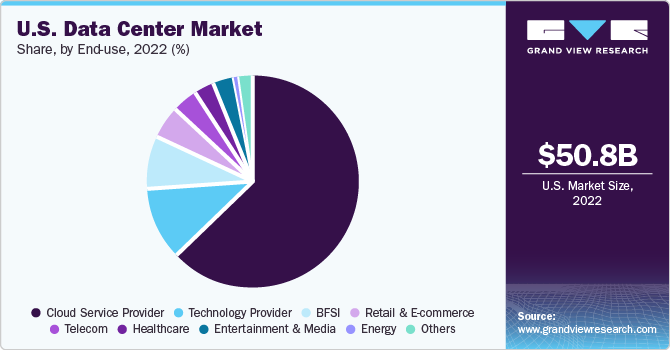

The U.S. data center market size was valued at USD 50.76 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030. The demand for data centers has witnessed significant growth owing to the increasing adoption of cloud technology across organizations in the country, which is inducing the need for large-scale data centers for companies to store and access data across networks. The implementation of Artificial Intelligence (AI) and Machine Learning (ML), which require substantial computing resources and power, is another factor driving the demand for a data center in the country. Additionally, the accelerating adoption of edge computing through generative AI, such as Chat GPT, is further augmenting the edge computing requirement as organizations are leveraging edge technologies to enhance their operational scale and deliver AI-based applications for efficient and better response. The adoption of such technologies across the U.S. is expected to increase the demand for data center infrastructure, with the growing requirement for services to store data.

The outbreak of COVID-19 has had a positive impact on the demand for data centers across the U.S. As Americans resorted to staying indoors in order to restrict the spread of the virus, the country witnessed a surge in internet usage owing to the implementation of practices such as working from home, online education, increasing use of social media platforms, and online shopping. The country further experienced a rise in subscriptions on stream platforms. The subsequent increase in internet usage led to an increase in demand for high-speed internet and streaming services, thereby increasing the demand for data centers to manage the rising internet traffic.

Further, with the increasing focus on enhancing sustainability, many businesses are adopting energy-efficient solutions, leading to the demand for green data centers across countries. The rising pressure from government and regulatory bodies towards forming stringent laws and rules to protect the climate and achieve environmental sustainability has emerged the need for green data centers, thereby boosting the demand for the overall data center market during the forecast period. Green data centers mainly use renewable energy sources like solar, wind, and hydroelectric electricity to lessen their dependency on non-renewable fossil fuels. Energy-efficient solutions lead to significant cost savings for data center operators.

Component Insights

Based on the components, the U.S. data center market is segmented into hardware, software, and services. The hardware segment held the largest market share in 2022. The substantial growth of social media, digital transactions, and the Internet of Things (IoT) in the U.S. requires data centers to expand their storage and processing capabilities. The upgradation of hardware technologies such as CPU, servers, storage devices, GPU, and memory drives to store the burgeoning data requires data centers to update their hardware installations, thereby driving the hardware segment of the data center market. Further optimized hardware solutions are required to accelerate complex tasks and model training.

Type Insights

Based on the type, the U.S. data center market is segmented into on-premise, hyperscale, HPC, colocation, and edge. The on-premise segment held the largest market share in 2022. On-premise data centers provide enterprises with complete control over the security and data stored, following the stringent compliance requirements based on industry standards or sensitive data handling necessities. Also, managing and building on-premise data centers enables for the customization of infrastructure to fulfill the required needs of the business, performance demands, and application needs. On-premise data centers further form an ideal type for applications requiring high performance and low latency, as they help in faster data transmission and optimized user experience. These factors are collectively supporting the growth of the on-premise segment.

Server Rack Density Insights

Based on the server rack density, the U.S. data center market is segmented into <10kW, 10-19kW, 20-29kW, 30-39kW, 40-49kW, and >50kW. The 10-19kW segment held the largest market share in 2022. The 10-19kW server rack density is known for its medium to high power consumption. Data centers with 10-19kW power densities mainly apply across industries, effectively supporting high-performance computing tasks. Engineering simulations, scientific research, and financial modeling need substantial computing power. This growing demand is expected to boost segmental growth, thereby fueling the growth of the U.S. data center market across regions.

Redundancy Insights

Based on the redundancy, the U.S. data center market is segmented into N+1, 2N, N+2, and N. The N+1 segment held the largest market share in 2022.N+1 redundancy provides high processing and minimized downtime to data centers. Downtime in business processes leads to significant financial losses and damage to an enterprise’s position. N+1 redundancy offers a backup system, allowing operations to continue even after any failure in the component. Many businesses are adopting cloud-based services and online transactions, where uninterrupted availability is important. The N+1 redundancy segment offers this service, thereby propelling the U.S. data center market growth.

PUE Insights

Based on the PUE, the U.S. data center market is segmented into Less than 1.2, 1.2 - 1.5, 1.5 - 2.0, and, greater than 2.0. Data centers with 1.2 to 1.5 power usage efficiency (PUE) are considered highly efficient in terms of energy consumption. The growing demand for environmentally friendly and sustainable operations is accelerating the adoption of advanced technology solutions such as 1.2-1.5 PUE, thereby propelling the demand for the U.S. data center market. Furthermore, the need for long-term financial savings through lower operational costs and reduced energy consumption is anticipated to generate huge demand for the segment.

Design Insight

Based on the design, the U.S. data center market is segmented into traditional, containerized, and modular. The traditional segment held the largest market share in 2022. The traditional data center market is expected to grow in the coming years due to the rising need for data storage and processing, safety issues, regulatory limitations, specific hardware specifications, and enhanced connectivity. To accommodate the growing data requirements, these data centers could be developed by adding more servers, networking equipment, and storage. The increasing demand for greater security is projected to drive the U.S. data center market forward.

Tier Level Insight

Based on the tier level, the U.S. data center market is segmented into tier 1, tier 2, tier 3, and tier 4. The tier 3 segment held the largest market share in 2022. The demand for efficient and reliable data processing and storage solutions is expected to grow for the segment. The continuous digital transformation across sectors needs more processing power, connectivity, and data storage, which tier 3 level data centers mainly provide. Further, the government has been adopting stringent data protection and security regulations, where tier 3 level data centers are highly adopted by organizations to meet the standards.

Enterprise Size Insight

Based on the enterprise size, the U.S. data center market is segmented into large enterprises and SMEs. The large enterprise segment held the largest market share in 2022. Large enterprises create and handle massive data from multiple sources, such as customer transactions, interactions, and operations. Further, there has been a rise in the adoption of cloud computing to boost operations, enhance scalability, and minimize costs. The data center offers capabilities to support advanced technologies and applications. It is vital in housing cloud infrastructure, promising reliable access to cloud services. The growing global operations and advanced technologies are driving the growth of the market across large enterprises.

End-use Insight

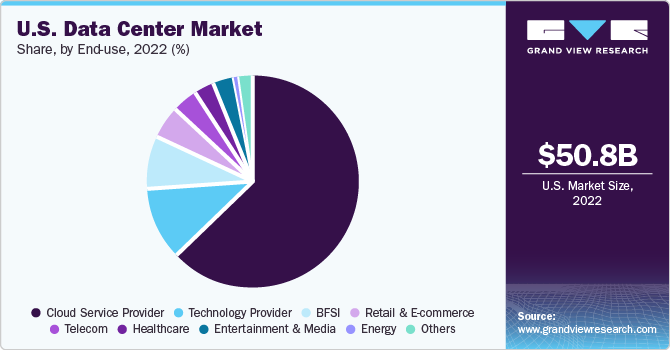

Based on the end-use, the U.S. data center market is segmented into cloud service providers, technology providers, telecom, healthcare, BFSI, retail & e-commerce, entertainment & media, energy, and others. The adoption of cloud computing services by organizations, businesses, and people is likely to increase demand for data centers, which will fuel market expansion. Data accessibility and company continuity are ensured by the disaster recovery and backup capabilities offered by cloud services. Additionally, edge computing services that permit data closer to its sources and hence reduce latency are advantageous to cloud service provider end users. These elements are promoting the expansion of the U.S. data center industry.

Competitive Insights

Key players operating in the market are Alibaba Cloud, Amazon Web Services, Inc., AT&T Intellectual Property, Lumen Technologies (CenturyLink), China Telecom Americas, Inc., CoreSite, CyrusOne, Digital Realty, Equinix, Inc., Google Cloud, IBM, Microsoft, NTT Communications Corporation, Oracle and Tencent Cloud. The market players typically resort to strategic initiatives such as launching new technologies and research and development activities. The following are some instances of such initiatives.

-

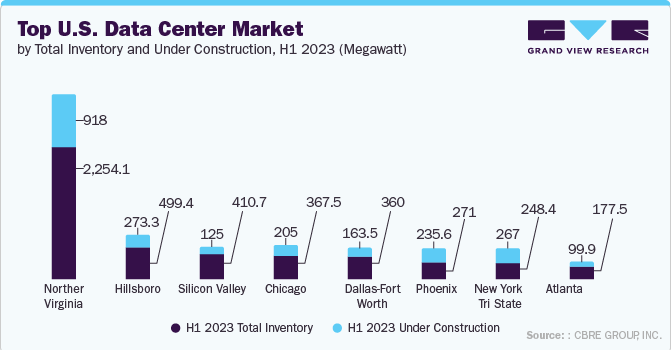

In September 2023, Google LLC announced plans to invest USD 600 million in developing the second data center campus in the Dallas and Fort Worth areas of Texas. The centers built by Google LLC will provide infrastructure for AI innovation and digital services worldwide.

-

In May 2023, Meta Platforms, Inc. announced plans to develop the solar project in Salt Lake City, Idaho, which is expected to aid data operations in Boise. The solar project developer organization rPlus Engeries, entered a long-term power-based purchase agreement to install the 200 MW Pleasant Valley sol.