- Home

- »

- Medical Devices

- »

-

U.S. Dental Laboratories Market Size & Share Report, 2030GVR Report cover

![U.S. Dental Laboratories Market Size, Share & Trends Report]()

U.S. Dental Laboratories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Restorative), Material (Metal-Ceramic), By Equipment (3D Printing Systems), By Prosthetic Type, And Segment Forecasts

- Report ID: GVR-4-68040-203-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dental Laboratories Market Trends

The U.S. dental laboratories market size was estimated at USD 7.06 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.32% from 2024 to 2030. Increasing demand for cosmetic dental procedures and the growing geriatric population are among the factors anticipated to fuel market growth. According to the World Bank, the global population aged 65 years and above population accounted for nearly 8.4% in 2016 and reached 9.3% in 2020. This is anticipated to propel the growth in the near future.

In 2023, the U.S. accounted for over 14.2% of the global dental laboratories market. The National Association of Dental Laboratories (NADL) represents nearly 1,000 commercial laboratories nationwide and upholds and advances the dignity, honor, and efficiency of those engaged as operators of dental laboratories. According to the American Dental Association, nearly 202,304 registered dentists were actively practicing in the U.S. in 2023. The implementation of advanced imaging technologies, such as Computer Aided Design (CAD) and Computer Aided Manufacturing (CAM), has made it easier to plan and perform complex dental procedures, as well as provide 3D imaging of dental implants, crowns, and bridges, resulting in improved patient diagnosis.

The curbing of aesthetic procedures during the COVID-19 pandemic has led to a post-pandemic bloom in the industry. The closure of dental clinics during COVID-19 lockdowns created a significant backlog, thus propelling the overall industry growth for dental treatment. Moreover, in the U.S., periodontal disease and dental caries are highly prevalent, affecting over half of the population. According to the Centers for Disease Control and Prevention, the nation spends over USD124 billion on dental care each year, and poor oral health is associated with other chronic diseases such as diabetes and heart disease. Public health strategies such as community water fluoridation and school sealant programs are safe and effective in preventing oral diseases.

The U.S. dental laboratory market is expected to grow due to increasing demand for cosmetic dentistry procedures and the trend towards group dental practices. The presence of Dental Service Organizations (DSOs) that assist dental practices in providing critical business management and support is also expected to propel the market. Advanced imaging techniques and the incorporation of bone morphogenic proteins and hydroxyapatite coatings in implant materials have transformed oral procedures, leading to reduced chair time, faster healing, and improved patient comfort.

Market Concentration & Characteristics

The market growth is high, and the pace of industry growth is accelerating. Furthermore, it is characterized by a high degree of innovation, primarily responding to rising demands for cosmetic dentistry and shifts towards group dental practices.

Advances in technology, such as CAD/CAM systems and digital imaging techniques, facilitate more accurate and efficient dental procedures. Companies continue to leverage specialized technologies to differentiate themselves in the market. Moreover, the use of all-ceramic restorations and improvements in stent manufacturing machines and laser welding systems are some crucial developments in the field.

To promote the reach of their offerings and increase their product capabilities, major players have resorted to acquisition of companies leading in technology in the market. For instance, in June 2022, Henry Schein, a key company in the U.S., acquired Condor Dental, a dental distribution service organization, to leverage their distribution channels for product promotion.

In recent decades, dental laboratories face increased regulations through occupational health & safety laws, enforced by federal (OSHA) and state authorities, aiming to ensure employee wellbeing and workplace safety. Furthermore, as separate dental practices, dental laboratories in the U.S. must also adhere to Quality System/Good Manufacturing Practice (QS/GMP) guidelines, as specified by the Food and Drug Administration (FDA). Participation in the Dental Appliance Manufacturer Audit System (DAMAS) and the Dental Prosthetics Identification (DPid) system is mandatory. Thus, the impact of regulations in the industry is moderate-to-high, and the complexity of regulations in the market is moderate.

3D printing technology presents a potential substitute in the market, allowing for the direct production of dental prosthetics. As this technology advances, it offers an alternative to traditional milling methods, influencing industry dynamics by providing a more flexible and potentially cost-effective solution for dental product fabrication. For instance, in October 2023, ZimVie Inc. introduced the Azure Multi-Platform Product Solutions, a comprehensive array of restorative components designed to efficiently meet the needs of the dental laboratory market.

Companies are pursuing regional expansion strategies through market entry in new geographic areas, forming partnerships with local distributors, and customizing products to align with specific healthcare needs in each region. As the U.S. dominates the global market, most global companies operate in the country and have expanded their base towards additional local markets. For instance, Dental Care Alliance, a DSO based in Florida, was acquired by the Mubadala Investment Company. Dental Care Alliance operates 390 practices and is active in 22 states, thus aiding major control for the investment firm.

Product Insights

Oral care segment led dental laboratories market and accounted for 27.67% of global revenue in 2023. It is also anticipated to witness lucrative growth over the forecast period owing to an increase in awareness regarding oral hygiene and the growing adoption of dentures. The restorative segment followed the oral care segment in terms of revenue share. Technological advancements in areas such as CAD/CAM implant dentistry, digital radiography, intraoral imaging, and caries diagnosis have enhanced the precision of restorations, contributing to growth. The market is further divided into five product categories: restorative, orthodontics, endodontic, oral care, and implant.

The orthodontic segment is expected to show lucrative growth during the forecast period. This is attributable to the growth in research initiatives and a higher uptake of novel dental treatments due to the growing demand for long-term alternatives to conventional operations are further driving the expansion of the orthodontic consumables market. The coronavirus outbreak massively influenced every business, including the cosmetics industry, because of the stringent limits placed by authority bodies globally as a precaution to control its spread.

Material Insights

Metal ceramics segment dominated the market with a significant revenue share, owing to their longstanding history of reliability, durability, and versatility in restorative dentistry. Metal ceramic restorations are a popular type of dental prosthetics that combine the strength of metal with the aesthetic appeal of porcelain. They are used for a wide range of dental procedures, including crowns, bridges, and implant-supported restorations. The combination of metal and porcelain makes them suitable for a variety of dental prosthetics. The success of metal-ceramic restorations depends on the compatibility of the two materials, the strength of the bond between them, and the thermal expansion coefficients of the ceramic and the metal.

The CAD/CAM materials segment is expected to experience significant growth over the forecast period. This is attributable to the transformative impact they have on the fabrication process of dental prosthetics. These materials are specifically engineered to be used with CAD/CAM systems, allowing for precise digital design and automated milling or 3D printing of restorations. The integration of CAD/CAM technology streamlines the production workflow in laboratories, reducing manual errors, enhancing efficiency, and enabling the creation of highly customized and accurate dental prosthetics, such as crowns, bridges, and veneers. The market has been further categorized into restorative, orthodontics, endodontic, oral care, and implant based on product.

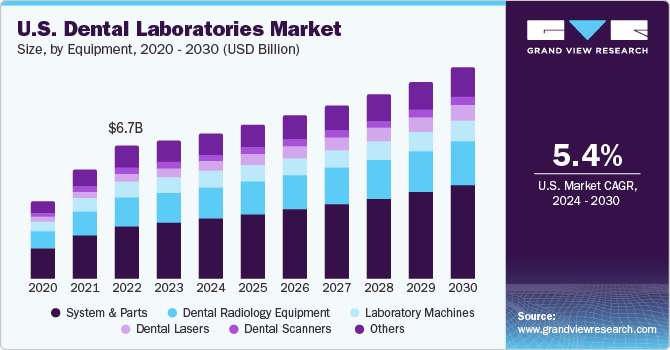

Equipment Insights

System and parts dominated the market with a revenue share of 35.93%. Innovations such as 3D printing and Cone Beam CT Systems empower technicians to create prosthetics tailored to individual patients’ requirements. Moreover, the rapid production capabilities of 3D printing equipment, which can generate unique surgical guides, implants, and splints, have positioned it as a dominant force. Thus, dental laboratories can improve productivity and meet the rising need for personalized, top-quality dental prosthetics.

The dental lasers segment is expected to show lucrative growth during the forecast. Dental lazers are indispensable for dental practices, and have witnessed several developments and variations in the products offered. For instance, in December 2023, Oral Science and Zolar Technologies launched Photon EXE Soft-Tissue Diode Laser for treatment dental issues like soft tissue crown lengthening, implant recovery, gingival troughing, uninterrupted teeth, and others.

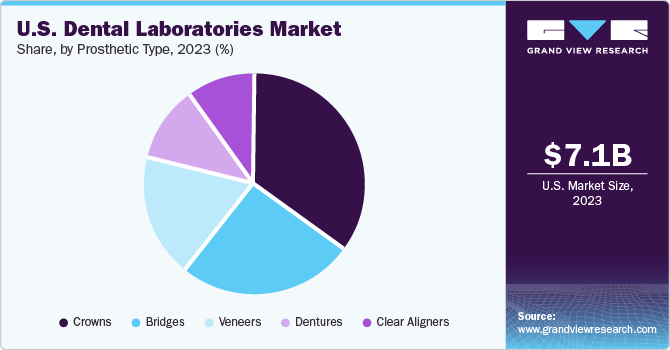

Prosthetic Type Insights

The crowns segment led the U.S. dental laboratories market with a share of around 30% in 2023, owing to their widespread use in the restorative dentistry. Crowns are highly versatile prosthetics and can be crafted from various materials such as metal, porcelain-fused-to-metal (PFM), all-ceramic, or zirconia, catering to different patient needs and preferences. Moreover, they are personalized to cater to the patient’s requirements and fulfill varied dental applications, including damaged or decayed tooth, restoring its shape, size, strength, and appearance. In addition, the increasing demand for cosmetic dentistry and the growing awareness among patients about the benefits of dental prosthetics further propel the dominance of crowns.

The bridges segment is anticipated to witness lucrative growth over the forecast period. The rising prevalence of tooth loss, whether due to decay, trauma, or age-related factors, has fueled the demand for the bridges as a reliable and aesthetically pleasing solution. Thus, dental bridges, which consist of two or more crowns, anchor onto adjacent teeth implants and bridge the gap caused by one or more missing teeth.

Key U.S. Dental Laboratories Company Insights

Key dental laboratories companies are adopting strategic moves such as mergers, acquisitions, and product expansions in order to move towards consolidation. Some of the key players operating in the U.S. dental laboratories market include Envista Holdings Corporation; Dentsply Sirona; and 3M Healthcare. These companies are collaborating with regional players and DSOs to expand their services geographically.

Knight Dental Design and Henry Schein, Inc. are some of the emerging players in the Dental Laboratories industry. These players are continuously focused on niche segments, leveraging specialized technologies to differentiate themselves.

Key U.S. Dental Laboratories Companies:

- Envista Holdings Corporation

- Dentsply Sirona

- A-dec Inc.

- Straumann AG

- Henry Schein, Inc.

- Champlain Dental Laboratory, Inc.

- Knight dental design

- National Dentex Corporation

- 3M Health Care

- Dental Services Group

Recent Developments

-

In May 2023, Zimmer Biomet Holdings, Inc. acquired OSSIS, a medical device producer specializing in personalized 3d-printed implants.

-

In October 2023, Henry Schein, a healthcare solutions leader, acquired a majority stake in Shield Healthcare, a homecare medical product supplier, intending to expand their continuum-of-care delivery model that serves aging populations receiving care at home.

-

In March 2023, Freqty Technology launched the smallest and latest PANDA intra-oral scanner, the PANDA Smart, at IDS 2023. This product launch is anticipated to drive growth.

-

In March 2023, the Straumann Group launched several new digital solutions at the IDS 2023, including digital solutions for implantology and automatic connection of intraoral scans to the "Straumann AXS" platform and various services, aiming to improve the customer experience for both clinicians and patients, increase practice productivity, and enhance treatment outcomes

U.S. Dental Laboratories Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.78 billion

Growth rate

CAGR of 6.36% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, equipment

Country scope

U.S.

Key companies profiled

Envista Holdings Corporation; Dentsply Sirona; A-dec Inc.; Straumann AG; Henry Schein, Inc.; Champlain Dental Laboratory, Inc.; Knight dental design; National Dentex Corporation; 3M Health Care; Dental Services Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Laboratories Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental laboratories market report based on product, material, equipment, and prosthetic type

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Restorative

-

Orthodontic

-

Endodontic

-

Oral care

-

Implant

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Ceramics

-

Traditional All Ceramics

-

CAD/CAM Materials

-

Plastic

-

Metals

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Radiology Equipment

-

Dental Lasers

-

System and Parts

-

3D Printing Systems

-

Integrated CAD/CAM Systems

-

Other Systems and Parts

-

-

Laboratory Machines

-

Casting Machines

-

Milling Equipment

-

Furnaces

-

Articulators

-

Other Laboratory Machines

-

-

Dental Scanners

-

Others

-

-

Prosthetic Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bridges

-

Crowns

-

Veneers

-

Dentures

-

Clear Aligners

-

Frequently Asked Questions About This Report

b. The U.S. dental laboratories market size was estimated at USD 7.06 billion in 2023 and is expected to reach USD 7.4 billion in 2024

b. The U.S. dental laboratories market is expected to grow at a compound annual growth rate of .6.36% from 2024 to 2030 to reach USD 10.78 billion by 2030.

b. Oral care segment led dental laboratories market and accounted for 27.67% of global revenue in 2023. It is also anticipated to witness lucrative growth over the forecast period owing to an increase in awareness regarding oral hygiene and the growing adoption of dentures.

b. Some key companies operating in U.S. dental laboratories market are Envista Holdings Corporation; Dentsply Sirona; A-dec Inc.; Straumann AG; Henry Schein, Inc.; Champlain Dental Laboratory, Inc.; Knight dental design; National Dentex Corporation; 3M Health Care; Dental Services Group

b. Increasing demand for cosmetic dental procedures and growing geriatric population are among factors anticipated to fuel market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.