- Home

- »

- Medical Devices

- »

-

U.S. Diabetic Retinopathy Market Size, Industry Report 2030GVR Report cover

![U.S. Diabetic Retinopathy Market Size, Share & Trends Report]()

U.S. Diabetic Retinopathy Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Proliferative DR, Non-proliferative DR), By Management (Anti-VEGF Therapy, Vitrectomy), And Segment Forecasts

- Report ID: GVR-4-68040-283-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Diabetic Retinopathy Market Trends

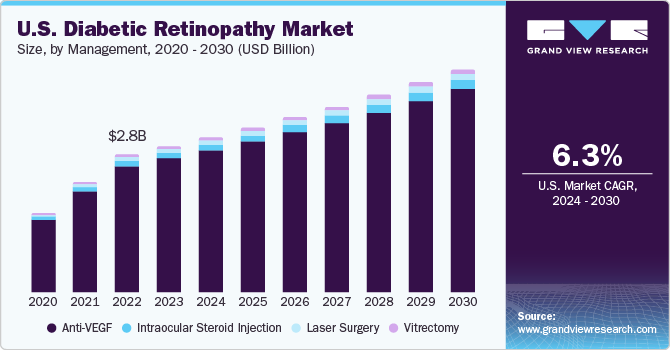

The U.S. diabetic retinopathy market size was estimated at USD 3.02 billion in 2023 and is expected to grow at a CAGR of 6.3% from 2024 to 2030. Rising geriatric population, increasing cases of diabetes owing to lifestyle changes, growing prevalence of obesity, and high cost of treatment are some of the key factors determining the market growth. Furthermore, introduction and adoption of technologically advanced devices such as the use of artificial intelligence & data analytics, and new smart diabetes devices are also driving the market growth.

Diabetic retinopathy is a complication of both type I and type II diabetes that affects the tiny blood vessels in the retina. If left untreated, it can progress to a stage where it compromises eyesight and eventually leads to blindness and other visual impairments. In the United States, the prevalence of diabetic retinopathy is expected to rise rapidly, with one in every 29 citizens affected by the condition. This makes diabetic retinopathy one of the leading causes of blindness in the country. People with diabetes are also at a higher risk of developing diabetes-related eye diseases, such as macular edema, cataracts, and glaucoma.

The United States accounted for 34.0% of the global diabetic retinopathy market in 2023. The country's favorable reimbursement policies provide access to healthcare services to a significant portion of the population, which creates a demand for efficient and cost-effective devices for diabetes management. This, in turn, increases the demand for cost-effective treatment options and the integration of digital health in the care delivery system. As a result, many companies are seeking U.S. FDA approval to launch their diabetes-related products in the U.S. market. For example, in February 2023, Regeneron received FDA approval for Eylea, a powerful drug designed to treat infantile diabetic retinopathy.

Obesity is one of the leading factors that contribute to the development of diabetes. According to the Centers for Disease Control and Prevention's National Diabetes Statistics Reports for 2023, approximately 11.6% of the U.S. population suffers from diabetes, including both diagnosed and undiagnosed cases. The rise in obesity and diabetes is primarily attributed to unhealthy diets, a sedentary lifestyle, and heredity. Additionally, chronic conditions such as diabetes are prevalent in older people aged 65 years and above. The elderly population is currently the fastest-growing group in the U.S., and the rising geriatric population is a significant driver of the diabetes epidemic. Diabetes in older people is directly linked with higher mortality rates and reduced functional status.

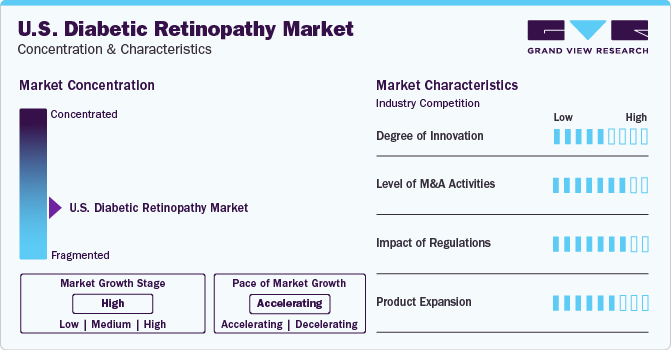

Market Concentration & Characteristics

The diabetic retinopathy market is fragmented, and several leading players drive it. However, the market remains highly competitive, with companies focusing on application innovation and strategic collaborations to maintain their position in the market. Market participants are focusing on early diagnosis of diabetic retinopathy. The increasing awareness about diabetes management & care and new product launches further boost market growth. In addition to product launches and merger and acquisition (M&A) activities, extensive investments in R&D by key players are expected to boost market growth over the forecast period.

New product launches and several R&D investments and activities are driving the industry's growth. In addition, the availability of resources is enabling further technological advancements, which has led to an increase in the number of manufacturing facilities in the country. Hence, several companies are launching innovative products and partnering with manufacturers to offer technologically advanced products.

Prominent industry players are adopting different strategies such as partnerships & collaborations and mergers & acquisitions to stay from their competitive base in the industry. By implementing this approach, companies can enhance their abilities and broaden their range of products. For instance, in December 2022, Harrow Health, Inc. announced its acquisition of exclusive U.S. commercial rights to five ophthalmic medications from Novartis AG for up to USD 175 million.

The market for diabetic retinopathy devices and drugs is subjected to regulatory scrutiny. Governments regulate devices and drugs used for diabetic retinopathy treatment. The regularizations are primarily intended to ensure the safety of these drugs and devices and implement cost-control measures to maintain affordability for the rural patient pool. However, favorable government policies and laws ensure the safety and efficacy of medical devices. In addition, increasing government initiatives to prevent diabetes and diabetic retinopathy is also driving the industry's growth.

Management Insights

The Anti-VEGF segment dominated the market with a share of 91.74% in 2023. These agents are injected into the eye to block the weak blood vessel formation and slow down retinopathy progress. Currently, four major anti-VEGF agents-Eylea, Avastin, Lucentis, and Macugen-are available in the market and are U.S. FDA-approved. Key players in the market plan to launch new anti-VEGF agents over the forecast period to improve treatment outcomes & expedite recovery.

The progress in laser surgical procedures, such as scatter photocoagulation and focal laser surgery, is expected to lead to the highest growth in the segment during the forecast period. Scatter photocoagulation is mostly used to manage Proliferative Diabetic Retinopathy (PDR). Focal laser surgery includes photographic techniques and other examinations to identify areas leaking fluid into the macula.

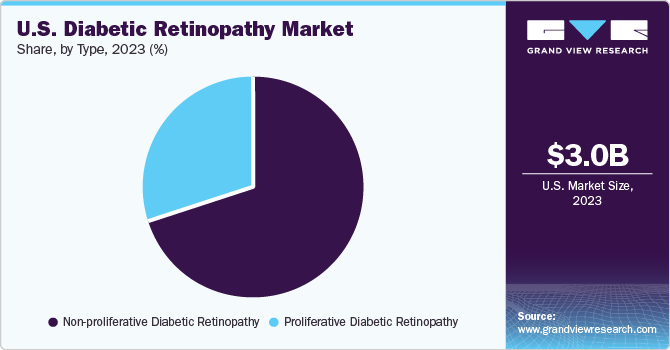

Type Insights

The non-proliferative diabetic retinopathy segment dominated the market with a share of 70.36% in 2023 owing to the large number of patients with a history of diabetes of less than ten years. It is a common diabetic eye condition that progresses from mild to moderate, leading to serious eye conditions. Hence, the rising concern is expected to fuel the segment’s growth.

Proliferative diabetic retinopathy is expected to grow most over the forecast period. It is an advanced stage of diabetic retinopathy and is generally treated with laser surgery, which helps shrink the fragile blood vessels. New drug developments, adoption of new therapies and innovative diagnostic tools, and healthcare infrastructure expansion are projected to surge the segment’s growth.

Key U.S. Diabetic Retinopathy Company Insights

Some prominent U.S. diabetic retinopathy market companies include Bayer AG, ABBVIE INC., Novartis AG, Oxurion NV, Sirnaomics, Alimera Sciences, Ampio Pharmaceuticals Inc., BCNPeptides, Kowa Company, Ltd., and Genentech, Inc. Key market players are focusing on innovative product launches, growth strategies, and technological advancements.

These players have strong distribution networks and their capacity to invest heavily in R&D efforts to launch tailored products is likely to offer a competitive edge. Brand preference in this market is high, considering the presence of these key players.

Key U.S. Diabetic Retinopathy Companies:

- Bayer AG

- ABBVIE INC.

- Novartis AG

- Oxurion NV

- Sirnaomics

- Alimera Sciences

- Ampio Pharmaceuticals Inc.

- BCNPeptides

- Kowa Company Ltd.

- Genentech, Inc.

Recent Developments

-

In May 2023, Alimera Sciences acquired further commercialization rights from EyePoint Pharmaceuticals, Inc. for YUTIQ (fluocinolone acetonide intravitreal insert) 0.18mg aimed for the treatment of chronic non-infectious uveitis that is responsible for affecting the posterior portion of the eye

-

In January 2022, Genentech, Inc. received FDA approval for Vabysmo (faricimab-svoa) for the treatment of wet, or neovascular, age-related macular degeneration and diabetic macular edema

U.S. Diabetic Retinopathy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.02 billion

Revenue forecast in 2030

USD 4.62 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, management

Country scope

U.S.

Key companies profiled

Bayer AG; Abbvie Inc.; Novartis AG; Oxurion NV; Sirnaomics; Alimera Sciences; Ampio Pharmaceuticals Inc.; BCNPeptides; Kowa Company Ltd.; Genentech, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Diabetic Retinopathy Market Report Segmentation

This report forecasts revenue growth at country level as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. diabetic retinopathy market report based on type, and management:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proliferative Diabetic Retinopathy

-

Non-proliferative Diabetic Retinopathy

-

-

Management Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-VEGF

-

Intraocular Steroid Injection

-

Laser Surgery

-

Vitrectomy

-

Frequently Asked Questions About This Report

b. The U.S. diabetic retinopathy market size was estimated at USD 3.02 billion in 2023 and is expected to reach USD 3,214.1 million in 2024.

b. The U.S. diabetic retinopathy market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 4.62 billion by 2030.

b. The non-proliferative diabetic retinopathy (NPDR) segment dominated the market and accounted for the largest revenue share of above 70% in 2023. The growing geriatric population and rising incidences of blindness caused by diabetes are the key factors accounting for its large share.

b. Some key players operating in the U.S. diabetic retinopathy market include Bayer AG; Abbvie Inc.; Novartis AG; Oxurion NV; Sirnaomics; Alimera Sciences; Ampio Pharmaceuticals Inc.; BCNPeptides; Kowa Company Ltd.; Genentech, Inc.

b. The U.S. diabetic retinopathy market is expected to grow over the forecast period owing to the presence of major players, such as Genentech, Inc., AbbVie Inc., Alimera Sciences, and Ampio Pharmaceuticals. The favorable reimbursement scenario provides access to healthcare services to a large portion of the population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.