- Home

- »

- Next Generation Technologies

- »

-

U.S. Digital Signage Market Size & Share Report, 2030GVR Report cover

![U.S. Digital Signage Market Size, Share & Trends Report]()

U.S. Digital Signage Market Size, Share & Trends Analysis Report By Type, By Component, By Technology, By Resolution, By Application, By Location, By Content Category, By Signage Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-463-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Digital Signage Market Size & Trends

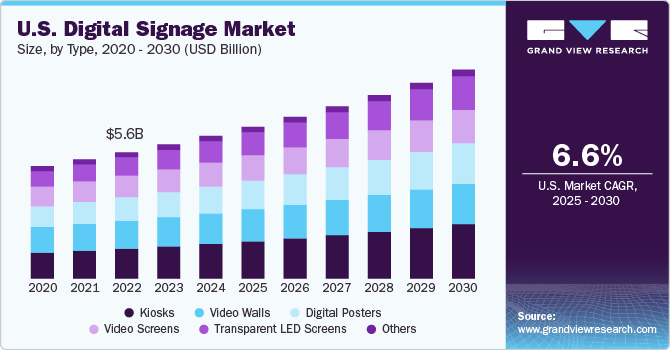

The U.S. digital signage market size was valued at USD 5,987.3 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Digital signage is used for displaying promotional and informative content in the form of images, graphics, design collaterals, videos, and creative advertising on digitized displays. Creative advertising content can attract customers and viewers, engage viewers through impactful content management, and influence consumers’ purchasing decisions. This is leading to increased adoption of digitized displaying technologies in various end-user verticals. Major end-user sectors include retail, hospitality, healthcare, education, transportation, corporate, and banking.

In addition, surging demand for providing concise and comprehensive information about products to consumers is boosting the implementation of digitized signs. Moreover, increasing adoption of advanced technologies such as single or multi-touch display technologies and gesture-based displays is likely to drive the market. These devices require guidance and digitized information management, which can be accessed from a remote location with signage. This is one of the significant drivers which is projected to boost the market over the coming seven years.

The advent of innovative displays, such as liquid crystal display (LCD), LED, OLED, and Super AMOLED display, is allowing advertisers to improve the clarity and quality of the content being presented. This is prompting digitized poster providers to provide content that is compatible with all types of displays. Besides, information is provided with the help of digitized display technologies, which include pictures and motion in a digitized format to gain the attention of customers. High investments are being made by marketers for the creation of new content to attract customers.

The U.S. is a prominent destination for market players as marketing and promotional techniques continue to evolve and advertisers prefer digitized promotion over conventional marketing. Other benefits associated with digitized signs, such as better audience engagement, reduced paper consumption, increased sales owing to improved influence on customers, and cost-effective advertising, are encouraging their adoption in the country. The increasing use of 3D digital signage for effective branding and promotion of the product is anticipated to provide a lucrative platform for market growth over the forecast period. In the U.S., the West American region held the largest share in 2023 owing to the presence of a well-developed and highly penetrated advertising segment that uses innovative digitized signs to attract an audience.

However, high initial investments associated with digitized signs have been poised for the adoption of digital signage. Adoption of digitized signs by small- and mid-sized enterprises is particularly limited owing to the initial investment involved in obtaining supportive software, hardware, and technology. In addition, the lack of research and awareness about the benefits of digitized signs is also another factor that is restraining the smooth growth of the market.

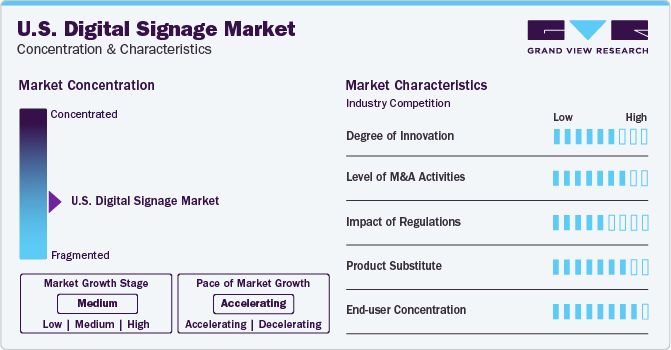

Market Concentration & Characteristics

The U.S. digital signage market has experienced a significant degree of innovation in recent years. Technological innovations that have propelled the industry's expansion include interactive touchscreens, high-resolution displays, and content customization. Digital signage can now deliver dynamic and tailored content to businesses because of the combination of data analytics and artificial intelligence. Businesses constantly seek novel ways to set themselves apart from the competition and satisfy the changing needs of various end-user industries. This creates a competitive, dynamic environment.

The U.S. digital signage market has witnessed a notable level of merger and acquisition (M&A) activities.By acquiring creative startups or merging with complementary service providers, larger firms have attempted to fortify their position in the market. These calculated actions are meant to improve distribution channels, diversify product offerings, and foster synergies. M&A transactions have been essential to the market's consolidation, cooperation, and technology transfer, all of which have aided in the industry's general expansion and advancement.

Regulations have played a significant role in shaping the U.S. digital signage market. It has become imperative for market participants to comply with content standards, privacy legislation, and accessibility requirements. In order to guarantee the proper and ethical use of digital signage technologies, businesses must manage compliance concerns as the regulatory landscape changes. Data privacy, energy efficiency, and content accessibility regulations directly affect product development and market strategies, which in turn affects how companies function and evolve in the ever-changing digital signage industry.

Product substitutes have become a prominent component impacting market dynamics in the U.S. digital signage market. While still widely used, dynamic digital alternatives are posing a challenge to traditional static signage. Furthermore, some digital signage applications may be replaced by developments in augmented reality (AR) and virtual reality (VR). To appropriately position their products against possible competitors and preserve a competitive edge, businesses in the market must be aware of changing consumer tastes and technological advancements.

The end-user concentration in the U.S. digital signage industry is diversified, spanning multiple industries. A number of industries, including retail, hospitality, healthcare, transportation, and education, are using digital signage for advertising and communication. The market's adaptability is enhanced by its capacity to meet a diverse array of end-user requirements. To ensure that their solutions are customized to satisfy the particular needs of each end-user sector, businesses in this space must, nevertheless, adjust to the particular requirements and difficulties of other industries. In this fragmented market, long-term success depends on strategic customization and industry-focused approaches.

Component Insights

In terms of revenue, the hardware segment accounted for largest market share of around 60.7% in 2023. It is anticipated to maintain its position through 2030 as hardware plays a major role in displaying content and is hence of paramount importance. On the other hand, software components are estimated to exhibit CAGR of over 7.8% during the forecast period 2024 to 2030. The demand for software components owing to the technological advancement, which has led to the innovative approaches by the manufacturers such as audience analytics and audience engagement tools, is projected to grow notably over the estimated duration.

The services segment is also expected to grow, albeit at a rate lower than that of the hardware segment and the software segment, like offering services associated with digitized signs hardly generate any significant revenues. Besides, there are a number of service providers ready to offer customized services at lower prices. Nevertheless, the demand for services is expected to grow considerably over the forecast period, as the installed signs would require regular servicing and maintenance.

Type Insights

On the basis of display type, video walls held a share of more than 21% of the displays market in 2023. The increasing adoption of video walls owing to their ability to offer uniform brightness and high-quality pixel density for every picture is expected to drive the segment. They are poised to maintain their position until 2030. Kiosks emerged as one of the largest segments in 2023, the digital posters segment also generated notable revenue during the year. Kiosks are used to display information as well as advertisement in retail stores, malls, shopping complexes, multiplex and theaters, auditoriums, bus and metro stations, airports, and institutes.

The transparent LED screens segment is anticipated to exhibit the highest CAGR during the forecast period 2024 to 2030 owing to the attractive design and the spatial constraints associated with the installation of digital signage screens. Furthermore, the transparent LED screens are one of the most advanced technologies of digital displays which are impacting the adoption of digital signage over the estimated duration. Transparent LED screens offer a transparency level of over 80.0% along with an enhanced and high resolution. Moreover, their energy-efficient operations can reduce energy consumption and help advertisers in cutting operational costs.

Application Insights

The retail sector spearheaded the market in 2023 and constituted a market share of 21.6% as incumbents of the retail industry emerged as one of the leading adopters of digital signage to promote products and services amidst intensifying competition within the industry. Competition in the retail industry is on an upswing as retailers are adopting various marketing strategies to promote their products. The industry holds immense growth potential to drive the market, as retailers are getting increasingly aware of the advantages of digital signage offer while attracting the audience and promoting products and offers.

The healthcare segment is estimated to witness substantial growth over the forecast period 2024 to 2030. In the healthcare industry, digital signs are used for managing inventory and staff and notifying staff and visitors of hospitals. It is also used in displaying patient-related information and flashing indulging information for patients and visitors in order to calm down their anxiety, particularly during rush hours. Furthermore, the increasing adoption of digitized signs in the transportation industry in line with rising urbanization is expected to generate considerable revenue over the next seven years. Digital signage is being installed at bus stands, railway stations, metro stations, and airports to host digitized posters, promotional content, and informative content. It is also being installed within cabs, buses, railways, and metros to advertise various products and services.

Location Insights

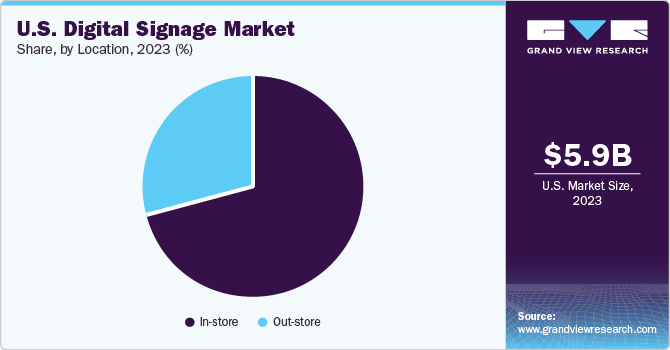

In terms of revenue, the in-store segment dominated the market in 2023 contributing a market share of 60%. The in-store segment covers the installation of digitized signs in retail shops, shopping malls and complexes, offices, banks, hotels, educational institutes, and healthcare centers. It is estimated to remain dominant throughout the forecast period, as retail stores are increasingly installing digital signage in their premises.

The out-store segment is projected to register a higher CAGR during the forecast period 2024 to 2030. The demand for out-store locations is expected to grow over the coming years owing to rapid adoption across the transportation sector, healthcare, and BFSI and increasing development of stadiums and playgrounds in developing countries. Spiraling demand for promotional products on a large scale and new trends such as increasing number of shows and live concerts, election campaigns, offers on products and services are likely to enhance the adoption of digital posters in open spaces, eventually boosting the implementation of out-store located displays.

Technology Insights

Based on display technology, LED segment dominated the market in 2023 and accounted for the share of more than 40%. It is widely adopted in the marketing and advertising industries. The factors responsible for the extensive adoption of the LCD technology in digitized posters are lower manufacturing costs and ease of production of LCDs. LCD is expected to be seen with much higher displays, and the transformation is likely to occur from sRGB to BT.2020, which consists of 4K and 8K resolution embedded displays.

The LED segment is projected to exhibit the highest CAGR of 7.1% during the forecast period 2024 to 2030. Brighter, flat-paneled, larger, and slimmer display technologies are attracting end-users and viewers. The adoption rate of LED displays is estimated to rise over the forecast period as the technology continues to evolve and the demand for innovative OLED displays is high. However, high production costs, complicated manufacturing processes, and shorter lifespans associated with LED displays act as restraining factors for the growth of the segment.

Resolution Insights

The resolution segment is further segmented into 8K, 4K, full high definition (FHD), high definition (HD), and lower than HD. The use of 8K displays in digital signage provides realistic and immersive graphics, making them suitable for applications such as video walls, shop displays, and digital signage. The high resolution of 8K displays enables more detail and clarity, which can be impactful for advertising and promotional content.

Full High Definition (FHD) resolution is a widely used display resolution in the digital signage market. FHD resolution has become the standard for most displays available in the market today. It provides superior image display quality compared to lower-resolution options, such as HD. FHD displays offer more than twice the detail of standard HD, resulting in a sharper and more defined picture. FHD displays are widely adopted due to their affordability, accessibility, and superior image quality.

Signage Size Insights

The signage size segment is further bifurcated into below 32 inches, 32 to 52 inches, and above 52 inches. Displays below 32 inches are employed in confined spaces, where size constraints or limited available space necessitate smaller signage solutions. These environments often include retail counters and small offices, where the compact nature of these displays proves advantageous. In retail settings, below 32 inches, digital signage is commonly utilized for specific applications such as menu boards, providing a concise and easily readable format for presenting available products and pricing. Additionally, in small offices, these displays may serve as promotional tools, conveying important information or advertisements in a space-efficient manner.

Displays larger than 52 inches are strategically positioned in areas with substantial foot traffic due to their size, with the objective of attracting the attention of a wider audience. These displays are typically situated in locations such as shopping malls, airports, and large corporate offices. Their selection is based on the capacity to convey messages and content in a manner that is easily visible from a distance.

Content Category Insights

Broadcast content category is expected to emerge as the fastest-growing segment expanding at a significant CAGR from 2024 to 2030. The broadcast content category is further segregated into the news, weather, sports, and others. The sports segment dominated the market in 2023 and accounted for a market share of over 36%. The increasing adoption of digital signage for displaying sports-related content across the stadium and sports ground during the tournaments is driving segment growth.

The news category is likely to account for a considerable share as well, followed by the sports content category. These segments are anticipated to witness significant growth in the forthcoming years owing to the rapidly increasing demand from the corporate sectors where digital signage is used extensively for communication purposes. In addition, the weather forecast is displayed majorly on external premises, such as roads and transport facilities along with offices. The market for weather content is projected to maintain its share and generate stable revenue over the coming years.

Regional Insights

From a geographical front, in 2023, the western U.S. region held prominent share of 32.7% in the overall country’s market owing to the presence of a large number of manufacturers of electronic display products, systems, hardware components, and software developers based in the West region. The growth in different states of the U.S. is attributable to increasing government investments in infrastructure development and the development of new manufacturing facilities for display products and hardware. The West region dominated the market in terms of revenue in 2023.

The Midwest region is projected to witness the highest CAGR of 8.4% during the forecast period 2024 to 2030. Digital signage sales are rising in Illinois, Ohio, Nebraska, and Minnesota. The increasing adoption of digital signage from the transportation, hospitality, healthcare, and retail industry is positively impacting market growth in the region. Therefore, the region is likely to grow in the coming years.

Key U.S. Digital Signage Company Insights

Some of the key companies operating in the market include NEC Display Solutions and BrightSign, LLC among others.

-

NEC Display Solutions is a Japanese company that creates, produces, and sells visual display goods. Its name was NEC Viewtechnology, Ltd. until June 2007, when company underwent a name change. The business is a division of NEC Corporation (Japan). The public business NEC Corporation trades as stock code 6701 on the Tokyo Stock Exchange. PC monitors, LCD monitors, plasma displays, colour management monitors, DLP rear projectors, theatrical movie projectors, and on-campus bulletin boards are just a few of the many products offered by NEC Display Solutions. Additionally, it provides software options for managing image quality. The company's devices have numerous professional purposes, including conference, presentation, signage, education, CAD/CAM, and other functions. Additionally, the business offers airport information displays, advertising displays for malls and retailers, and project mapping for events.

-

BrightSign, LLC sells Digital signage media players and various accessories are made, designed, and sold by The business also offers networking and software for digital signage. It runs as a Roku, Inc. subsidiary and is a privately held business. Retail, hospitality, healthcare, education, museums, transportation, recreation, restaurants, entertainment, and the corporate sector are just a few of the industries that BrightSign, LLC serves. Operating both online and through a worldwide network of resellers, BrightSign, LLC is based in the United States. Through a network of distributors and value-added resellers, it markets its products. The business has offices in both Europe and Asia.

Christie Digital Systems USA, Inc. and Meridian Kiosks are some of the emerging market participants in the target market.

-

Christie Digital Systems USA, Inc., a California-based company, is one of the leading suppliers of audio, visual and collaborative solutions. It offers diverse solutions for entertainment, business, and industrial sector. The company operates through the business segments namely, 3D/visualization solutions, business projectors, digital cinema, digital signage, and video wall display solutions. Christie Digital Systems USA, Inc. offers a wide range of audio solutions, integrated projections, and display solutions to a variety of industries and applications which includes cinema, enterprise, simulation, worship places, education & training facilities, media, control rooms, 3D & virtual reality, and government. Under the digital signage display solutions, the company provides digital menu boards, digital walls, interactive digital signage, large-format displays, LCD panels, and LCD tiles.

-

Meridian Kiosks is a U.S.-based company specializing in designing, production, integration, and deployment of self-service technologies. It offers end-to-end solutions for the deployment of self-service solutions.The company operates seven integration facilities across the globe and delivers a wide range of customized indoor and outdoor self-service solutions for clients in multiple industries & sectors such as automotive, real estate, retail, hospitality, transportation, healthcare, and government. Over the years, Meridian Kiosks has formed strategic partnerships with companies such as Intel Corporation, Hewlett-Packard Enterprise Development LP, Microsoft Corporation, Avaya, Inc., ZIH Corp., and Storm Technologies.

Key U.S. Digital Signage Companies:

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics (LG Corporation)

- Microsoft

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- SAMSUNG

- Scala Digital Signage

- Winmate Inc.

- Christie Digital Systems USA, Inc

- Meridian Kiosks

Recent Developments

-

In July 2022, Planar System Inc. and Leyard Optoelectronic Co., Ltd (China) introduced a new range of LED displays. The newly launched LED range is available in a variety of sizes such as 108"/135"/162"/196"/216"/245" etc. With the newly launched LED range Leyard is concentrating on offering comprehensive intelligent solutions for all types of conference rooms, including huddle rooms, war rooms, large conference rooms, and expert immersive conference rooms.

-

In May 2022, Christie Digital Systems USA, Inc. announced the acquisition of Brass Roots Technologies LLC. Brass Roots Technologies LLC designs advanced optics and electronics and provides consulting. Brass Roots Technologies' staff has transferred to Christie, and the business will operate under Christie Digital Systems USA, Inc. The purchase will help Christie diversify and advance their engineering capabilities.

-

In March 2022, Intel had recently established Intel Foundry Services to meet the expanding demand for semiconductor production capacity. Tower's technology and production footprint complement Intel's IFS capabilities in cutting-edge processes, allowing the combined firm to offer clients a more excellent range of products at scale.

-

In January 2022, Microsoft Corporation announced the acquisition of Activision Blizzard with plans to launch Activision Blizzard games into Game Pass. The acquisition further strengthens Microsoft's Game Pass portfolio. With this acquisition, Game Pass will promote gaming's excitement and camaraderie to a broader audience.

-

In November 2021, BrightSign, LLC announced the release of the updated software BSN.cloud a cloud-based digital signage network management software. Users can examine and monitor player health in real-time from any place with BSN.cloud's real-time player control, which includes diagnostics and management.

-

In September 2021, Keywest Technology, Inc. announced BRZ 400, their newest digital signage solution, has been released. This SaaS solution is adaptable and customer-focused, making it suited for a wide range of enterprises.

-

In July 2021, Cisco completed the acquisition of Socio Labs, Inc. The acquisition will broaden Webex's capabilities beyond meetings, webinars, and webcasts to encompass conferences and power the future of hybrid events. In the networking industry, the corporation seeks to accomplish desired benefits, business and economic conditions, and growth trends.

-

In April 2021, Scala introduced Scala Enterprise version 12.50, its latest digital signage platform. The version offers improved workgroup management, enhanced Linux player engine, with player snapshot capabilities, support for Q players and Scala Media Player DX, user-friendly menu panel with recognizable icons, and considerable performance improvements.

-

In March 2020, NEC Corporation entered into an agreement with Sharp Corporation to establish a joint venture between NEC Display Solutions, Ltd. and Sharp. The collaboration is aimed at strengthening their presence in visualization market by achieving economies of scale, widening each company’s portfolio in new business categories, and expanding geographic presence.

U.S. Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6,364.1 million

Revenue forecast in 2030

USD 9,322.0 million

Growth Rate

CAGR of 6.6% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, resolution, location, component, screen size, content category, region

Regional scope

Northeast U.S.; Southeast U.S.; West U.S.; Midwest U.S.; Southwest U.S.

States scope

New York; Maryland; Pennsylvania; Florida; North Carolina; California; Idaho; Nevada; Illinois; Ohio; Nebraska; Minnesota; Texas

Key companies profiled

BrightSign, LLC, Cisco Systems, Inc., Intel Corporation, KeyWest Technology, Inc., LG Electronics (LG Corporation), Microsoft, NEC Display Solutions, Omnivex Corporation, Panasonic Corporation, SAMSUNG, Scala Digital Signage, Winmate Inc.Christie Digital Systems USA, Inc, Meridian Kiosks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Signage Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. digital signage market report based on component, type, technology, resolution, application, location, content category, signage size and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Displays

-

Media Players

-

Projectors

-

Others

-

-

Software

-

Services

-

Installation Services

-

Maintenance & Support Services

-

Consulting Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Resolution Outlook (Revenue, USD Million, 2017 - 2030)

-

8K

-

4K

-

Full High Definition (FHD)

-

High Definition (HD)

-

Lower than HD

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transport

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

In-store

-

Out-store

-

-

Content Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Signage Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Northeast

-

New York

-

Maryland

-

Pennsylvania

-

-

Southeast

-

Florida

-

North Carolina

-

-

West

-

California

-

Idaho

-

Nevada

-

-

Midwest

-

Illinois

-

Ohio

-

Nebraska

-

Minnesota

-

-

Southwest

-

Texas

-

-

Frequently Asked Questions About This Report

b. The U.S.digital signage market size was estimated at USD 5,638.9 million in 2022 and is expected to reach USD 5.99 billion in 2023.

b. The U.S. digital signage market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 9,332.0 million by 2030.

b. The hardware segment dominated the U.S. digital signage market with a share more than 61% in 2022. This is attributable to hardware plays a major role in displaying content.

b. Key factors that are driving the U.S. digital signage market growth include surging consumer demand for concise and comprehensive information and growing use of digital signage.

b. Some key players operating in the U.S.digital signage market include NEC Display Solutions of America, Inc.; BrightSign LLC; Planar System Inc.; Cisco Systems, Inc.; Intel Corporation; Microsoft Corporation; Keywest Technology, Inc

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."