Industry Insights

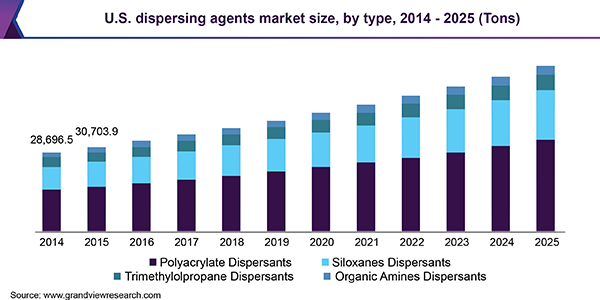

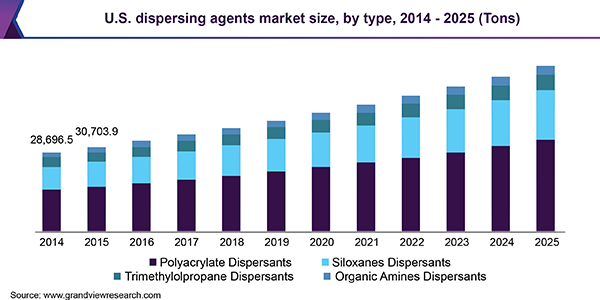

The U.S. dispersing agents market size demand was estimated to be 35, 164.5 tons in 2017. It is projected to register a CAGR of 7.1% over the forecast period. Dispersants reduce the viscosity of coating formulation and prevent agglomeration of particles, thereby ensuring an even and uniform coating on the paper and paperboard material. Rapid changes in the food packaging trends are expected to drive the demand for these products over the forecast period.

The food packaging market in the U.S. was largely dominated by plastic as a packaging material. However, the rise in the consumption of ready-to-eat food has led to the demand for paper and paperboard material in food contact substances thereby driving the demand for dispersants.

As per the United Nations Food and Agriculture Organization (UN FAO), in 2012; consumption of carton board for various applications was estimated at 6, 271, 000 tons in the U.S. and reached 11, 346, 000 tons by 2014. Dispersions and colorants are used as additives for carton and corrugated boards and the steady increase in the consumption of carton and corrugated boards is anticipated to propel the market over the forecast period.

The U.S. dispersing agents market is at a nascent stage and is characterized by specialty chemical manufacturing companies. On account of increasing demand for coated paper and paperboard materials in food contact substance packaging, leading pigment, and specialty chemical manufacturers such as BASF Corporation, Arkema Group, and The Dow Chemical Company are penetrating to tap the underlying growth potential.

Various raw materials, such as isopropyl alcohol, sodium hydroxide, sodium carbonate, and polyacrylic acid, are used in the processing of a wide variety of dispersion agents. The fluctuating raw material prices become a challenge for the dispersant manufacturers for large-scale production and to prepare tailor-made solutions to suit the requirements of customers.

Type Insights

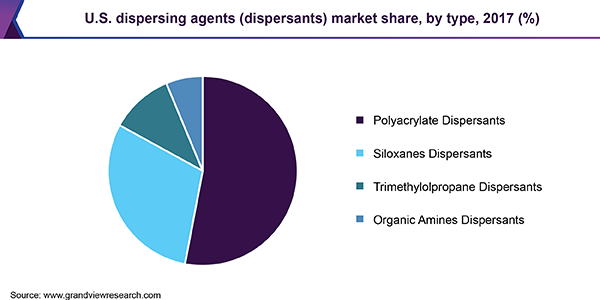

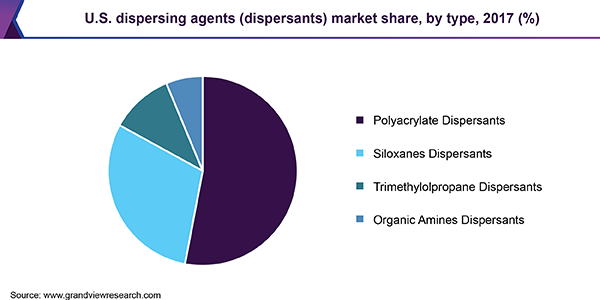

Polyacrylate dispersants were the largest segment in the U.S. dispersing agents market in 2016 and are likely to remain dominant over the forecast period. Among the polyacrylate dispersants, sodium polyacrylate has low molecular weight and is used to overcome frequently encountered problems in the coating, such as flocculation and stability of pigment particles. Sodium polyacrylate is highly soluble in water and because of its hydrophilic nature and thermal stability, it retains dispersant activity for a longer period.

The demand for Methyl Isopropanolamine (MIPA), an organic amine dispersant, is anticipated to register significant growth on account of its use as a surfactant, emulsifier, dispersant, chemical formulations, and other building blocks. It is also being used in personal care products, pharmaceuticals, metalworking fluids, coatings, paper, plastics, and others. Another organic amine, dimethylamino hydroxypropane, is used as a co-dispersant with polyacrylates and polyphosphates in gloss emulsion coatings. For instance, in titanium dioxide pigment dispersions, dimethylamino hydroxypropane, is used as a co-dispersant with polyacrylate dispersants, to enhance the pigment dispersion in pigments and filler slurries. It is economical and offers an attractive performance.

Application Insights

Paper and paperboard are environment-friendly and increasingly preferred by food packaging manufacturers. Carton boards and corrugated boards are the major paperboard materials used for food packaging. Colored paperboards are preferred for food packaging as they are aesthetically appealing. Pigments and fillers are used to impart color and enhance the brightness of paper and paperboard.

Demand for kaolin in the U.S. has declined and the material is likely to be substituted by Precipitated Calcium Carbonate (PCC) as a filler in the uncoated paper and paperboard grade. Polyacrylates dispersants are expected to register steady growth over the forecast period due to the increasing consumption of PCC as a filler to the pigment coating.

U.S. Dispersing Agents Market Share Insights

Market players such as BASF Corporation, Arkema Group, and The DOW Chemical Company have expanded their market presence and are competing in terms of product differentiation parameters such as high dispersing ability in food contact applications. Moreover, the formulation of dispersants specific to the application in paper and paperboard coating requires the possession of superior technical expertise, which is expected to keep the threat of new entrants to a minimum.

Report Scope

|

Attributes

|

Details

|

|

The base year for estimation

|

2017

|

|

Actual estimates/Historical data

|

2014 - 2016

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Volume in tons and CAGR from 2017 to 2025

|

|

Country scope

|

The U.S.

|

|

Report coverage

|

Volume forecast, competitive landscape, growth factors, and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the U.S. dispersing agents market report based on type and application:

-

Type Outlook (Volume, Tons, 2014 - 2025)

-

Application Outlook (Volume, Tons, 2014 - 2025)