- Home

- »

- Medical Devices

- »

-

U.S. Disposable Trocars Market Size, Industry Report, 2033GVR Report cover

![U.S. Disposable Trocars Market Size, Share & Trends Report]()

U.S. Disposable Trocars Market (2025 - 2033) Size, Share & Trends Analysis Report By Tip (Bladeless Trocars, Optical Trocars, Blunt Trocars, Bladed Trocars), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Pediatric Surgery), And Segment Forecasts

- Report ID: GVR-4-68040-694-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Disposable Trocars Market Trends

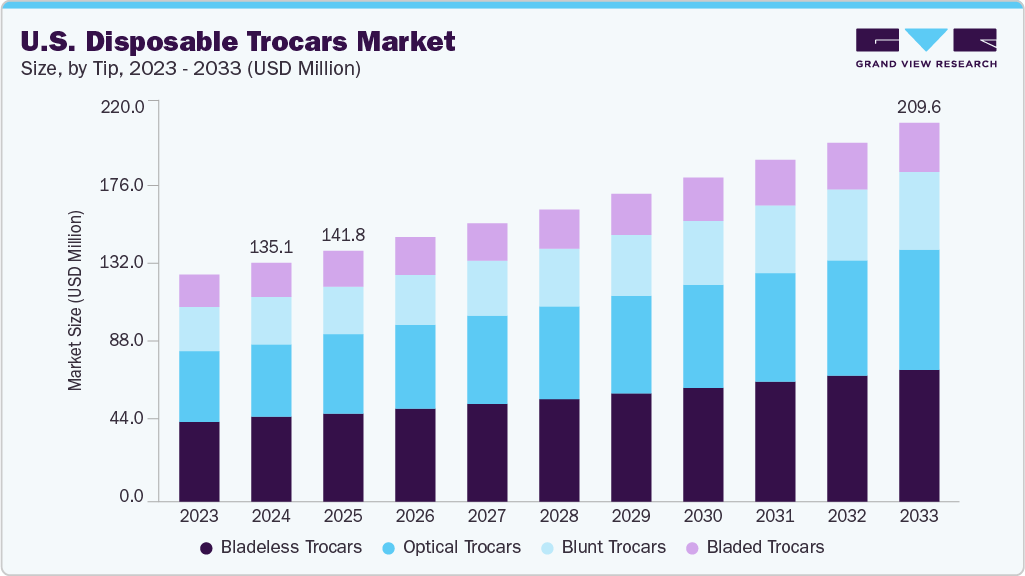

The U.S. disposable trocars market size was estimated at USD 135.11 million in 2024 and is projected to reach USD 209.62 million by 2033, growing at a CAGR of 5.00% from 2025 to 2033. The market growth is attributed to the country’s high volume of minimally invasive surgical procedures, including laparoscopic, bariatric, gynecological, and urological surgeries requiring reliable and sterile access devices. The rapid expansion of ambulatory surgical centers (ASCs), where infection control, efficiency, and turnaround time are top priorities, further accelerates the demand for single-use trocars. In addition, the growing integration of robotic-assisted surgical systems in hospitals, such as the da Vinci platform, has fueled the need for advanced optical and bladeless trocars that ensure precision and compatibility. Strict FDA infection control regulations and post-COVID emphasis on sterility have made disposable options more attractive than reusable ones, while ongoing technological innovations, such as universal seals and low-profile cannulas, enhance surgeon preference and drive market growth.

The growing adoption of robotic-assisted systems such as Intuitive Surgical’s da Vinci platform in U.S. hospitals drives demand for precision-compatible surgical tools. These procedures rely on accurate trocar placement and benefit significantly from optical and specialized disposable trocars that integrate seamlessly with robotic instruments. As advanced visualization and navigation technologies become more common in surgery, there is a rising need for high-performance trocars that offer enhanced control, stability, and compatibility, making disposable options increasingly preferred in robotic-assisted procedures.

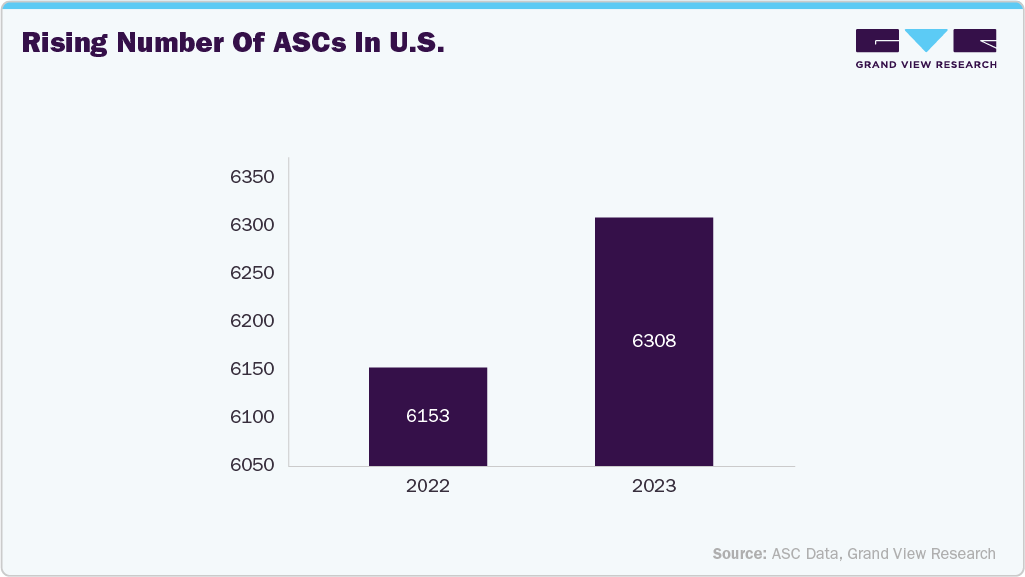

The rapid growth of Ambulatory Surgical Centers (ASCs) in the U.S. fuels demand for disposable surgical devices, particularly trocars. Focused on maximizing efficiency, maintaining sterility, and reducing costs, ASCs find single-use trocars to be a practical solution that aligns with their workflow. These centers handle a high volume of outpatient procedures, such as hernia repairs and gynecological surgeries, where disposable trocars help reduce turnaround times and eliminate the need for complex sterilization processes, ultimately enhancing operational throughput and patient safety.

The rising prevalence of cancer in the U.S. is a significant driver of the disposable trocars market, as many oncologic procedures, such as laparoscopic colectomies, hysterectomies, and prostatectomies, require minimally invasive surgical access. With cancer cases increasing annually, particularly among the aging population, the demand for safe, sterile, and efficient surgical tools is growing. Disposable trocars are widely used in these procedures because they reduce the risk of infection, support complex surgical navigation, and align with hospital protocols for oncology care. Their compatibility with robotic-assisted systems and advanced imaging makes them ideal for cancer surgeries requiring high precision and control.

U.S. Estimated New Cancer Cases 2025

Rank

Common Types of Cancer

Estimated New Cases 2025

Estimated Deaths 2025

1

Breast Cancer (Female)

316,950

42,170

2

Prostate Cancer

313,780

35,770

3

Lung and Bronchus Cancer

226,650

124,730

4

Colorectal Cancer

154,270

52,900

5

Melanoma of the Skin

104,960

8,430

6

Bladder Cancer

84,870

17,420

7

Kidney and Renal Pelvis Cancer

80,980

14,510

8

Non-Hodgkin Lymphoma

80,350

19,390

9

Uterine Cancer

69,120

13,860

10

Pancreatic Cancer

67,440

51,980

-

Cancer of Any Site

2,041,910

618,120

Source IARC, Grand View Research

Innovation in trocar technology, such as bladeless tips, optical entry systems, radially expandable cannulas, and universal sealing valves, has significantly improved safety, precision, and surgeon ergonomics. These advancements contribute to better procedural outcomes and are increasingly adopted by leading hospitals across the U.S. For instance, a major medical device company's widely used bladeless trocar design has gained popularity for its ability to minimize insertion force and reduce tissue trauma, making it a preferred option in both laparoscopic and robotic-assisted surgeries.

KOLs

Company Name

Verticals

KOLs

Xpan Inc.

In December 2023, Xpan Inc., a medical device company specializing in minimally invasive surgical technologies, has received 510(k) clearance from the U.S. Food and Drug Administration for its Xpan Universal Trocar System. It has successfully completed its initial clinical procedures in the U.S. This milestone marks a significant step forward in advancing access solutions for laparoscopic and robotic-assisted surgeries.

“Our goal is to provide patients and the healthcare system with a product that can reduce complications and provide superior post-operative outcomes,” said Zaid Atto, CEO of Xpan. “This technology was developed in collaboration with forward thinking surgeons who recognize an opportunity and need for innovation in laparoscopic surgical access”.

Source: Xpan Inc, Grand View Research

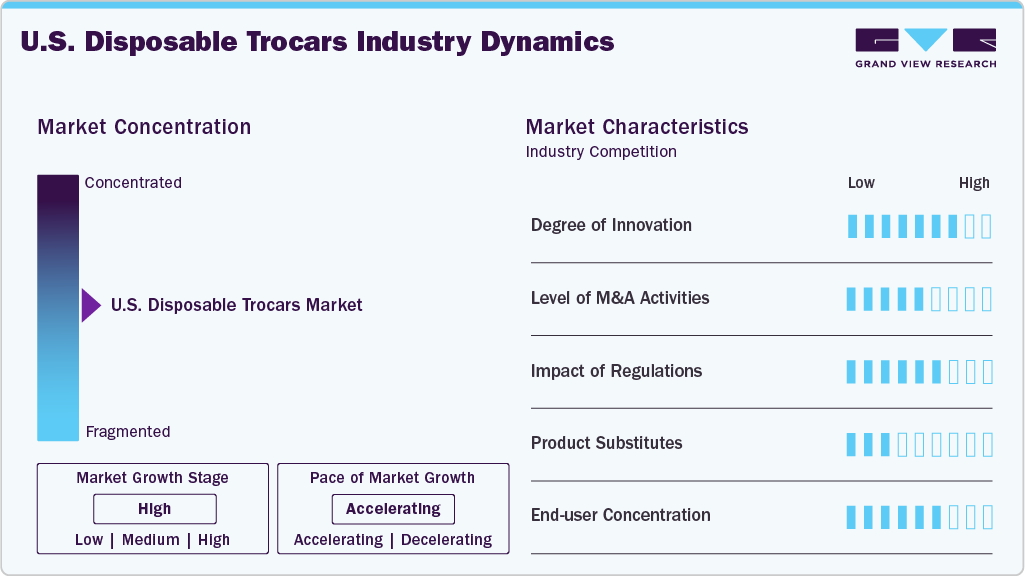

Market Concentration & Characteristics

The degree of innovation in the U.S. disposable trocars market is notably high, driven by continuous advancements in surgical technology and the increasing complexity of minimally invasive procedures. Manufacturers are introducing trocars with bladeless and optical entry systems, universal sealing valves, ergonomic handles, and radially expandable cannulas to enhance precision, reduce tissue trauma, and improve surgical efficiency. Integration with robotic-assisted platforms and compatibility with advanced imaging systems have further elevated the design requirements, encouraging the development of more specialized and high-performance products. Moreover, FDA-cleared innovations, such as expandable universal trocars and procedure-specific kits, reflect a strong commitment to clinical safety, workflow optimization, and surgeon preference, positioning the U.S. as a global leader in trocar technology innovation.

Regulations play a critical role in shaping the U.S. disposable trocars market, particularly through the stringent oversight of the U.S. Food and Drug Administration (FDA). All disposable trocars must obtain 510(k) clearance, ensuring they meet high safety, performance, and sterility standards. These regulatory requirements drive manufacturers to invest heavily in quality control, design validation, and biocompatibility testing, fostering innovation while maintaining patient safety. In addition, regulations related to infection control and device traceability, reinforced in the post-COVID-19 healthcare environment, have accelerated the shift toward single-use, sterile solutions. While these standards increase development costs and time-to-market, they also enhance product credibility and market acceptance, making regulatory compliance a key competitive differentiator in the U.S. market.

The level of M&A activity in the U.S. disposable trocars market has been moderate to active in recent years, reflecting strategic efforts by medtech companies to expand their minimally invasive surgical portfolios and strengthen market positioning. Larger players are acquiring smaller, innovation-focused firms to gain access to advanced trocar technologies, such as optical systems, universal sealing, and robotic-compatible designs. These acquisitions also allow companies to enhance their distribution networks, accelerate regulatory clearances, and tap into high-growth outpatient and ambulatory surgery segments. While not as frequent as in other device categories, mergers and acquisitions involving trocar technologies are often part of broader deals focused on laparoscopic instruments, robotic platforms, or access solutions, signaling a growing interest in consolidating capabilities in this evolving surgical access space.

In the U.S. disposable trocars market, the primary product substitutes include reusable trocars, single-incision laparoscopic surgery (SILS) ports, and advanced robotic-assisted access systems that reduce reliance on traditional trocar-based entry. While reusable trocars are more cost-effective in high-volume hospitals, they require stringent reprocessing protocols, which can pose infection risks and increase operational burdens. SILS and robotic platforms, which offer multi-instrument access through a single or integrated port, are gaining traction in select procedures, particularly in high-tech surgical centers. However, disposable trocars remain preferred for their sterility, ease of use, and alignment with infection control protocols, especially in ambulatory surgical centers (ASCs) and outpatient settings, where turnaround time and safety are critical.

U.S. disposable trocars market shows a high level of end user concentration, primarily dominated by hospitals, ambulatory surgical centers (ASCs), and specialized surgical clinics. Large hospitals and academic medical centers account for a significant portion of the demand due to their high surgical volumes and adoption of advanced procedures such as laparoscopic and robotic-assisted surgeries. However, ASCs are rapidly emerging as key contributors, driven by their focus on outpatient minimally invasive procedures, fast turnover, and strict sterility protocols. This concentration around high-volume, efficiency-driven facilities creates a strong, steady demand for disposable trocars, while also shaping product design requirements, emphasizing ease of use, safety, and regulatory compliance.

Tip Insights

On the basis of tip, bladeless trocars segment held the largest share in 2024. This growth can be attributed to their superior safety profile and ease of use in minimally invasive procedures. Bladeless trocars reduce the risk of vascular and organ injury by separating, rather than cutting, tissue during insertion. This makes them a preferred choice among surgeons for laparoscopic and robotic-assisted surgeries. Their design also contributes to lower post-operative complications and faster patient recovery. Widespread adoption in high-volume procedures such as cholecystectomies, hernia repairs, and bariatric surgeries, especially within hospitals and ASCs, further solidified their market dominance. In addition, their compatibility with advanced sealing technologies and robotic systems continues to enhance their clinical appeal and drive usage across diverse surgical specialties.

Optical trocars segment is expected to witness the fastest growth over the forecast period, owing to the increasing need for precision and safety in minimally invasive surgeries. These trocars allow direct visualization of tissue layers during insertion via an endoscope, significantly reducing the risk of inadvertent injury to organs or vessels. Their use is especially critical in high-risk procedures such as laparoscopic bariatric surgery or robotic-assisted hysterectomies, where safe trocar placement is essential. For example, leading U.S. hospitals performing robotic procedures using platforms such as da Vinci frequently utilize optical trocars to enhance control and accuracy during entry. As robotic and image-guided surgeries continue to expand, optical trocars are becoming the preferred choice for surgeons seeking enhanced visibility and patient safety, fueling rapid adoption and segment growth.

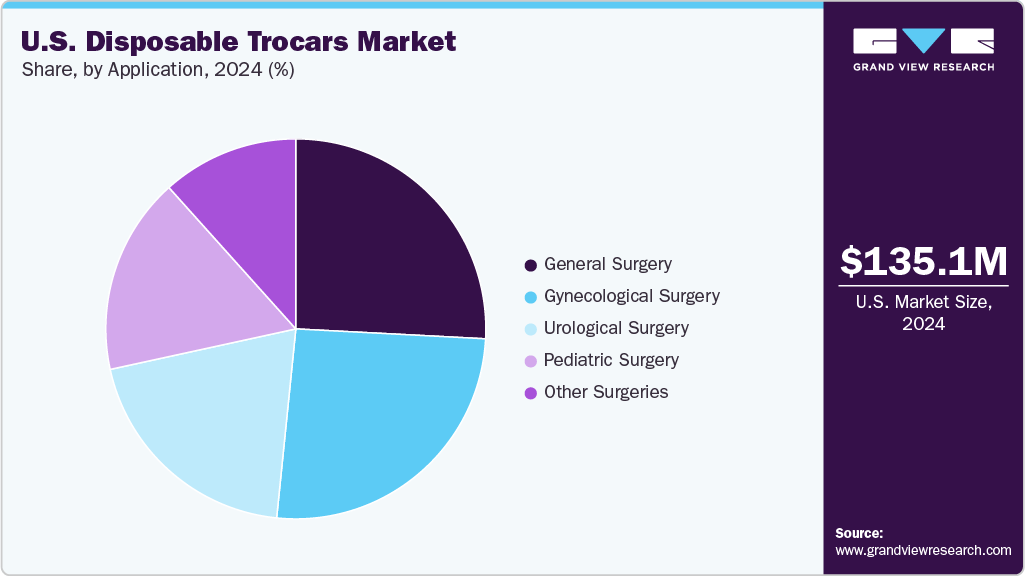

Application Insights

On the basis of application, general surgery segment held the largest share in 2024. This growth can be attributed due the high volume of routine laparoscopic procedures such as cholecystectomies, appendectomies, and hernia repairs. These surgeries are among the most frequently performed across hospitals and ambulatory surgical centers, creating consistent demand for reliable, sterile access tools such as disposable trocars. General surgery procedures typically require multiple trocar placements for instrumentation, further increasing unit consumption per case. In addition, the focus on reducing infection risk and surgical turnaround times in high-throughput settings has reinforced the preference for single-use trocars in general surgery, solidifying this segment's leading market position.

Gynecological surgery segment is expected to witness the significant CAGR over the forecast period. This can be attributed to the increasing prevalence of conditions such as uterine fibroids, endometriosis, ovarian cysts, and infertility, which often require minimally invasive surgical intervention. Laparoscopic hysterectomies, oophorectomies, and tubal ligations are commonly performed using disposable trocars to ensure sterility and reduce the risk of post-operative infections. The rise in outpatient gynecologic procedures in ambulatory surgical centers (ASCs), coupled with growing patient preference for faster recovery and reduced scarring, is accelerating the adoption of disposable, bladeless, and optical trocars.

Key U.S. Disposable Trocars Market Company Insights

Some of the key companies include Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc., among others. They provide a broad range of breast conserving surgery solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launch, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies to expand their businesses and market presence.

Key U.S. Disposable Trocars Market Companies:

- Medtronic

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Applied Medical Resources Corporation

- CooperSurgical, Inc.

- Teleflex Incorporated

- CONMED Corporation

- Xpan Inc.

- Stryker

Recent Developments

-

In March 2025, Nexus CMF introduced a new addition to its 2023 product lineup: the 1.9mm Disposable Trocar, designed with a cleaner and sharper needle point edge for enhanced precision and performance.

-

In December 2023, Xpan Inc., a medical device company specializing in minimally invasive surgical technologies, has received 510(k) clearance from the U.S. Food and Drug Administration for its Xpan Universal Trocar System. It has successfully completed its initial clinical procedures in the U.S. This milestone marks a significant step forward in advancing access solutions for laparoscopic and robotic-assisted surgeries.

U.S. Disposable Trocars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 141.83 million

Revenue forecast in 2033

USD 209.62 million

Growth rate

CAGR of 5.00% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application tip

Country scope

U.S.

Key companies profiled

Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc.; Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S Disposable Trocars Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. disposable trocars market report on the basis of application, and tip:

-

Tip Outlook (Revenue, USD Million, 2021 - 2033)

-

Bladeless Trocars

-

Optical Trocars

-

Blunt Trocars

-

Bladed Trocars

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Pediatric Surgery

-

Other Surgeries

-

Frequently Asked Questions About This Report

b. The U.S. disposable trocars market size was estimated at USD 135.11 million in 2024 and is expected to reach USD 141.83 million in 2025.

b. The U.S. disposable trocars market is expected to grow at a compound annual growth rate of 5.00% from 2025 to 2033 to reach USD 209.62 million by 2030.

b. General surgery dominated the disposable trocars market with a share of 25.83% in 2024. This is attributable to the high volume of routine laparoscopic procedures such as cholecystectomies, appendectomies, and hernia repairs. These surgeries are among the most frequently performed across hospitals and ambulatory surgical centers, creating consistent demand for reliable, sterile access tools like disposable trocars.

b. Some key players operating in the U.S. disposable trocars market include Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc.; Stryker.

b. Key factors that are driving the market growth include the country’s high volume of minimally invasive surgical procedures, growing integration of robotic-assisted surgical systems in hospitals, and Strict FDA infection control regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.