- Home

- »

- Medical Devices

- »

-

U.S. Drug Discovery Outsourcing Market Size Report, 2033GVR Report cover

![U.S. Drug Discovery Outsourcing Market Size, Share & Trends Report]()

U.S. Drug Discovery Outsourcing Market (2025 - 2033) Size, Share & Trends Analysis Report By Workflow (Target Identification & Screening, Target Validation & Functional Informatics), By Drug, By Service, By Therapeutics Area, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-281-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

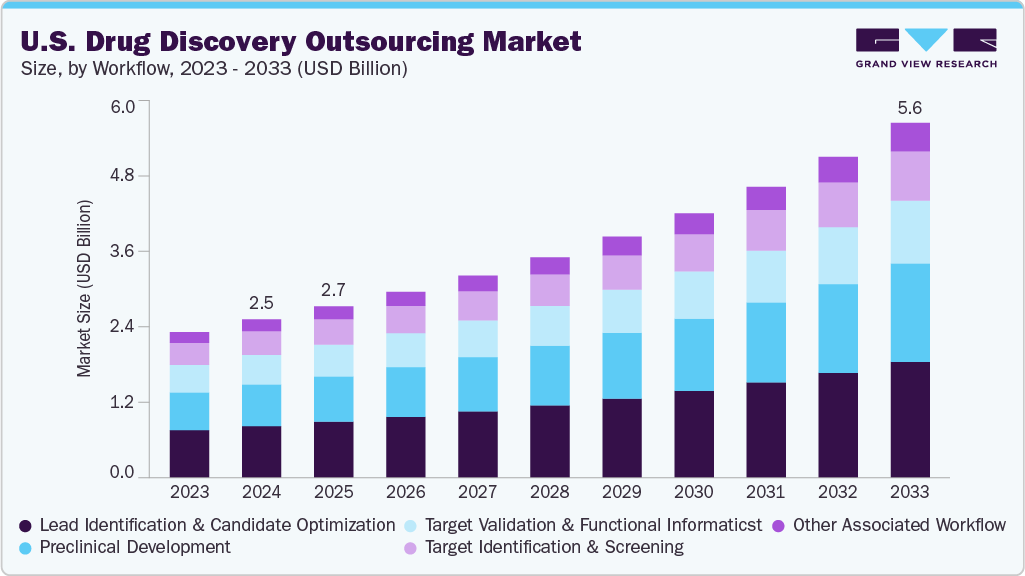

The U.S. drug discovery outsourcing market size was estimated at USD 2.49 billion in 2024 and is projected to grow at a CAGR of 9.52% from 2025 to 2033. The market for drug discovery outsourcing is driven by growing demand for novel drug candidates, rising incidence of chronic diseases, increasing R&D expenditures, emerging new private-public partnerships, a need for specialized knowledge, and a growing array of complex and targeted therapies.

Key Market Trends & Insights

- The U.S. drug discovery outsourcing market is expected to grow at a significant CAGR over the forecast period.

- Based on workflow, the lead identification & candidate optimization segment accounted for the largest market revenue share in 2024.

- Based on workflow, the lead identification & candidate optimization segment accounted for the largest market revenue share in 2024.

- Based on service, the chemistry services segment accounted for the largest market revenue share in 2024.

- By therapeutic area, the respiratory system segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.49 Billion

- 2033 Projected Market Size: USD 5.58 Billion

- CAGR (2025-2033): 9.52%

- U.S.: Largest market in 2024

Besides, most of the biopharmaceutical and pharmaceutical companies are turning to CROs and CDMOs to leverage advanced technologies such as artificial intelligence, bioinformatics, and high-throughput screening. In addition, the rising number of small and virtual biotech companies, which often lack robust internal capabilities, further accelerates the trend toward outsourcing.Moreover, shifting trends towards personalized medicine and adaptable development frameworks enhances the demand for outsourced discovery services. Globalization, the need for quicker time-to-IND submissions, and the emergence of new therapeutic areas are continuously driving outsourcing as a key strategy for growth.

In addition, the emergence of personalized medicine is driving the need for adaptable, small-batch production within the U.S. drug discovery outsourcing sector. As treatments become increasingly targeted, particularly in areas like oncology, rare diseases, and gene therapy, traditional mass production methods are shifting towards customized drug development strategies, which are expected to drive the market growth over the estimated time period.

Contract research organizations (CROs) and contract development and research organizations (CDROs) utilize a modular infrastructure, flexible workflows, and quick assay development are becoming vital partners. Outsourcing provides biopharma companies with the ability to navigate variability in drug design, patient stratification, and biomarker-driven studies, which in turn enhances their agility, cost-effectiveness, and speed in bringing precision therapies to market.

Furthermore, the growing integration of artificial intelligence (AI) and machine learning (ML) in drug discovery is transforming the process of identifying, optimizing, and validating compounds. AI streamlines target identification, assesses drug-likeness, and models molecular interactions, leading to significant reductions in early-stage R&D timelines and expenses. Besides, ML algorithms sift through extensive datasets ranging from omics data to clinical outcomes to reveal innovative insights and minimize risks in candidate selection.

In addition, biopharma companies in the U.S. are increasingly incorporating AI-driven solutions into their workflows or collaborating with AI-focused contract research organizations (CROs) to boost productivity, accelerate the path to Investigational New Drug (IND) applications, and enhance success rates in the development of treatments for complex and rare diseases. For instance, in July 2024, Exscientia plc mentioned Amazon Web Services expansion to use the AI & ML services of cloud providers to power the company’s platform for end-to-end drug discovery and automation. Such factors are expected to drive the estimated time period.

Opportunity Analysis

The U.S. drug discovery outsourcing industry is expected to witness rising growth opportunities due to the increasing demand for cost-effective and expedited research and development processes. The rising expenses associated with drug development and the growing complexity of therapeutic areas in oncology, neurology, and rare diseases are driving the pharmaceutical and biotech companies to collaborate with specialized contract research organizations (CROs). In addition, the expanding use of artificial intelligence (AI) and machine learning (ML) for target identification and screening is expected to drive the need for data-driven discovery platforms.

Moreover, the small and mid-sized biotech firms, which primarily lead early-stage pipelines, often depend on outsourcing to acquire advanced infrastructure, global expertise, and regulatory support. Also, the introduction of innovative modalities, such as cell and gene therapies is creating new opportunities for niche CROs that offer tailored services further supporting the market growth. As the FDA streamlines the approval process through Fast Track and Breakthrough Therapy designations, sponsors that are increasingly turning to outsourcing partners to efficiently manage preclinical and IND-enabling studies. Thus, to navigate this evolving and innovation-driven outsourcing landscape, establishing strategic collaborations, integrated platforms, and IP-secure partnerships are expected to be the critical part of the innovations.

Impact of U.S. Tariffs on the U.S. Drug Discovery Outsourcing Market

The impact of U.S. tariffs on the U.S. drug discovery outsourcing sector is moderate in the U.S. by raising input costs and disrupting global supply chains. CROs and CDMOs involved in drug discovery often affordable reagents, laboratory equipment, and raw materials from countries impacted by these tariffs, including China and India. Thus, these tariffs have led to increased expenses in early-stage research and development, particularly in areas such as medicinal chemistry and high-throughput screening, where laboratory supplies and instruments contribute substantially to costs.

Moreover, the tariffs have prompted companies to rethink their international partnerships, leading to a shift towards nearshoring and onshoring of discovery services in an effort to mitigate geopolitical risks and enhance supply chain resilience. Although CROs based in the U.S. might gain from these reshoring trends, thus these companies face rising operational costs due to the increased prices of imported tools, chemicals, and technological components.

In addition, small biotechnology companies with their constrained budgets are vulnerable as increased costs limit the number of compounds they can screen or advance into preclinical development. Furthermore, impact of U.S. tariffs has created opportunities for trade partners that are exempt from tariffs, such as Mexico, Canada, and EU countries, and has spurred the growth of domestic production capabilities. Thus, in the long run the strategic reevaluation of sourcing strategies and increased automation supports to alleviate the challenges posed by tariffs in the realm of drug discovery outsourcing.

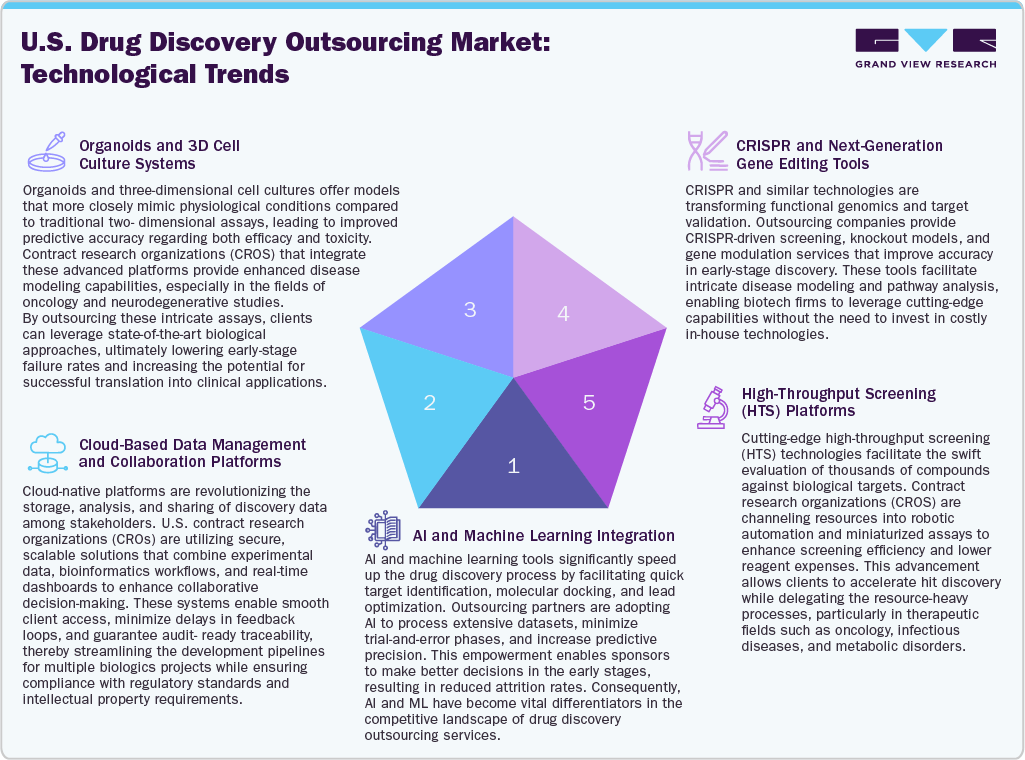

Technological Advancements

Technological innovations are reshaping the landscape of drug discovery outsourcing in the U.S., significantly improving speed, accuracy, and scalability. CROs are increasingly utilizing Artificial Intelligence and Machine Learning (AI/ML) to enhance target identification, assess drug-likeness, and refine lead compounds which contribute to lower early-stage attrition rates and shortened development timelines. Besides, high-throughput screening technologies, combined with automation and miniaturized assays, facilitate the swift evaluation of extensive compound libraries, enabling sponsors to efficiently outsource the identification of promising hits.

In addition, CRISPR and next-generation gene editing technologies have transformed target validation and functional genomics, with outsourcing partners providing tailored gene-editing services for biotech companies that may not have these capabilities in-house. Moreover, cloud-based data management systems are fueling for better collaboration between sponsors and CROs by allowing for real-time data sharing, secure storage, and improved workflow transparency, which is especially crucial for virtual biotech and multi-site trials. Furthermore, the utilization of organoids and 3D cell culture systems is enhancing preclinical modeling by delivering more physiologically relevant insights into drug responses. Thus, by outsourcing these intricate, high-fidelity systems, companies can access state-of-the-art translational tools, positioning U.S. CROs as vital innovation allies in the advancing drug discovery process.

Pricing Model Analysis

In the U.S. drug discovery outsourcing industry, pricing models are designed to meet the varying needs of sponsors and the complexities of different projects. The milestone-based pricing is commonly utilized for multi-phase initiatives, with payments tied to the completion of specific R&D objectives, such as target validation or studies needed for IND submissions. This model offers flexibility, aligns interests, and ensures transparency. Besides, the fixed-fee arrangements are favored for short-term or well-defined assignments, providing predictable costs and straightforward budgeting, though they may lack adaptability if the project's scope changes.

In addition, value-based pricing associates’ compensation with the scientific or commercial value produced, such as the identification of promising leads, making particularly suitable for strategic partnerships. This approach promotes innovation and shared risk but necessitates robust frameworks for measuring outcomes. Moreover, subscription or retainer models enable ongoing access to CRO resources, allowing sponsors especially smaller biotechnology firms to utilize scientific capabilities continuously. This model supports team continuity and agile R&D processes, although it is crucial to have clearly defined deliverables to demonstrate return on investment and ensure operational efficiency.

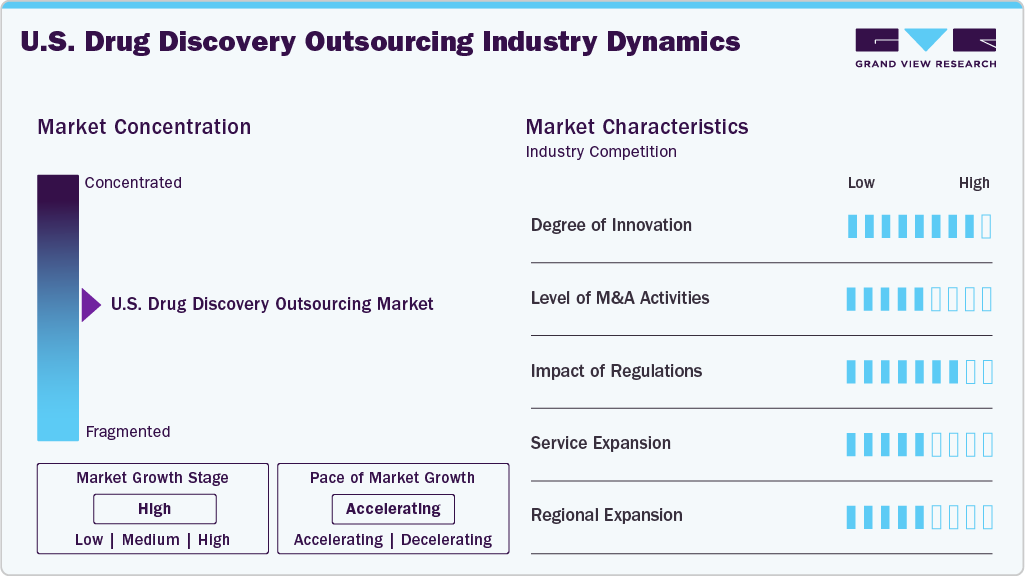

Market Characteristics

The market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation in U.S. drug discovery outsourcing is thriving, fueled by advancements in AI-driven platforms, CRISPR technologies, and sophisticated screening tools. Contract Research Organizations (CROs) are making significant investments in novel modalities, data science, and target validation techniques. This commitment enables them to provide cutting-edge and differentiated services that align with the evolving needs of clients and the therapeutic landscape.

M&A activity in the CRO sector is strong, driven by efforts to consolidate and acquire specialized technologies, therapeutic expertise, and comprehensive capabilities. Recent acquisitions have primarily targeted AI companies, gene-editing specialists, and niche biotech service providers. This strategy not only facilitates integrated service offerings but also enhances strategic scale within a highly competitive outsourcing environment.

Stringent regulations from the FDA, EMA, and ICH concerning preclinical data integrity, IND submissions, and GLP compliance have amplified the demand for regulatory-savvy CROs. Outsourcing partners are now required to ensure traceability, utilize validated methodologies, and maintain thorough documentation to assist sponsors in meeting evolving regulatory expectations efficiently.

U.S.-based CROs are increasingly expanding both upstream and downstream within the discovery value chain by providing integrated solutions such as target validation, ADMET profiling, and IND-enabling packages. Enhanced bioinformatics, biomarker discovery, and translational models are now incorporated into comprehensive platforms designed to address the complex demands of sponsors effectively.

To meet growing global demand and mitigate operational risks, U.S. CROs are expanding their presence in Asia-Pacific, Europe, and LATAM. This expansion facilitates follow-the-sun discovery models, enhances regional trial support, and provides cost efficiencies while addressing the needs of biotech clusters in emerging innovation hubs.

Workflow Insights

The lead identification & candidate optimization segment accounted for the largest market revenue share in 2024. Lead identification and candidate optimization are at the forefront of the U.S. drug discovery outsourcing market, driven by the rising demand for precision-targeted therapies and expedited preclinical development. U.S.-based CROs provide advanced capabilities in high-throughput screening, computational chemistry, and structure-based drug design, which facilitate efficient hit-to-lead conversion and compound refinement. The integration of AI/ML and omics technologies further enhances candidate profiling, lowering attrition rates and speeding up timelines. Consequently, biotech and pharmaceutical companies are increasingly outsourcing these critical stages to tap into specialized expertise, reduce R&D costs, and utilize flexible, scalable infrastructure essential for maintaining a competitive edge in a rapidly evolving innovation landscape.

The preclinical development segment is expected to witness at the fastest CAGR over the forecast period. Preclinical development represents a significant segment of the U.S. drug discovery outsourcing market, bolstered by advanced infrastructure, regulatory expertise, and high demand for innovation. U.S.-based CROs provide comprehensive services in toxicology, pharmacokinetics, and IND-enabling support that expedite the journey to clinical trials. Biopharma companies are increasingly outsourcing preclinical work to leverage integrated platforms and minimize fixed R&D costs. This trend is further driven by the rising number of biologics in development and an increasing emphasis on safety validation and translational science.

Drug Insights

The small molecules segment accounted for the largest market revenue share in 2024. The segment is driven by established development pathways, scalability, and regulatory familiarity. U.S.-based CROs are increasing focusing on medicinal chemistry, high-throughput screening, and lead optimization for small molecule candidates particularly in areas such as oncology, CNS, and infectious diseases. In addition, biotech and pharmaceutical companies prioritize outsourcing to gain access to extensive compound libraries, advanced synthesis capabilities, and cost-effective innovation, ensuring that small molecules continue to be a key emphasis in early-stage drug discovery efforts, which further supports the market growth.

The large molecules segment is anticipated to grow as the fastest CAGR during the forecast period. Large molecule drug discovery is experiencing rapid growth in the U.S., fueled by increasing demand for biologics, monoclonal antibodies, and gene therapies. U.S.-based CROs provide specialized services in protein engineering, bioassays, and cell-based screening to support early-stage biologics development. These outsourcing partners offer essential infrastructure and regulatory expertise, allowing biotech firms to accelerate timelines and reduce costs while effectively managing the complex molecular properties inherent to large therapeutic modalities.

Service Insights

The market is segmented into chemistry services, and biology services. The chemistry services segment led the market with the largest revenue share of 76.37% in 2024. Chemistry services are a fundamental aspect of U.S. drug discovery outsourcing, emphasizing hit generation, lead optimization, and structure-activity relationship (SAR) studies. U.S.-based CROs utilize advanced medicinal and computational chemistry platforms to design and synthesize novel compounds that enhance efficacy and safety. These services play a vital role in facilitating rapid candidate progression and are extensively employed by both startups and large pharmaceutical companies seeking flexible and scalable discovery support.

The biology services segment is expected to grow at the fastest CAGR during the forecast period. Biology services in U.S. drug discovery outsourcing include target validation, assay development, and disease modeling. CROs offer access to specialized screening platforms-cell-based, biochemical, and phenotypic-tailored to specific therapeutic areas. The use of advanced tools such as CRISPR, 3D cell cultures, and biomarker discovery enhances translational relevance. Sponsors increasingly depend on outsourced biology capabilities to mitigate risks in early-stage programs and expedite decision-making across a range of therapeutic pipelines.

Therapeutics Area Insights

The respiratory system segment accounted for the largest market revenue share in 2024.Respiratory drug discovery in the U.S. is gaining momentum, driven by the increasing prevalence of asthma, COPD, and complications related to COVID-19. CROs provide specialized preclinical models, inhalation formulation support, and biomarker analysis for the development of novel respiratory treatments. In addition, biopharma companies are increasingly outsourcing early-stage respiratory R&D to tap into niche expertise and shorten development timelines. Moreover, the demand for targeted, locally delivered therapies is further boosting the innovation and growth in outsourcing within the respiratory therapeutic area.

The oncology segment is expected to grow at the fastest CAGR during the forecast period. Oncology is a dominant force in the U.S. drug discovery outsourcing landscape is fueled by significant unmet medical needs and robust R&D pipelines. Besides, CROs in U.S. offer integrated discovery platforms, which include immuno-oncology models, biomarker identification, and high-content screening. The use of advanced genomic and AI tools further enhances personalized oncology research. By outsourcing, pharmaceutical and biotech companies can boost the development of targeted therapies, manage costs effectively, and gain access to cutting-edge translational capabilities within a competitive oncology market.

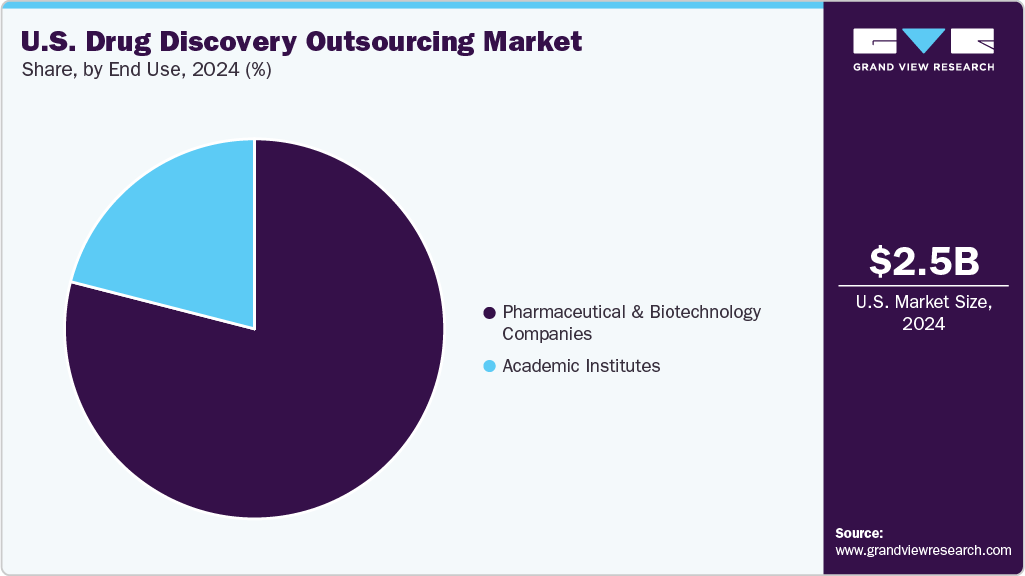

End Use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest market revenue share in 2024. Pharmaceutical and biotechnology companies are the main forces behind drug discovery outsourcing in the U.S. Besides, with the increasingly focusing on R&D costs and intricate pipelines, the companies are shifting towards Contract Research Organizations (CROs) for specialized tools, talent, and infrastructure. In addition, outsourcing supports for innovation in both small and large molecule discovery, accelerates timelines, and minimizes fixed investments. U.S.-based CROs provide customized solutions that enhance scientific productivity while allowing clients to maintain their strategic focus on core competencies.

The academic institute segment is expected to grow at the fastest CAGR during the forecast period.Academic institutions in the U.S. play a crucial role in early-stage drug discovery by engaging in basic research and identifying novel targets. Thus, to boost translational research, the institute mostly focus on collaborating with Contract Research Organizations (CROs) to outsource services such as medicinal chemistry, screening, and validation. These partnerships not only enhance technology transfer but also facilitate the creation of startups. Moreover, growing NIH funding and public-private initiatives are bolstering academia-industry outsourcing models, fostering innovation and bridging the gap between bench research and therapeutic development.

Country Insights

U.S. Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in the U.S.is driven by increasing complexity of research and development, high costs associated with drug development, and the pressing demand for quicker innovation. Contract Research Organizations (CROs) provide comprehensive services that encompass medicinal chemistry, biology, and preclinical development for both small and large molecule drugs. The integration of advanced technologies like AI, CRISPR, and organoid-based platforms is enhancing discovery efficiency and lowering attrition rates in the development process. Thus, pharmaceutical and biotechnology companies are increasingly outsourcing to leverage specialized expertise, access cutting-edge infrastructure, and benefit from regulatory support. This approach not only accelerates early-stage development but also allows for flexible resource allocation and a sharper focus on core innovations. Such factors are expected to support the market growth over the estimated time period.

Key U.S. Drug Discovery Outsourcing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in March 2025, Syngene International Limited mentioned the acquisition of its first biologics site in the USA, which includes several manufacturing lines for monoclonal antibodies (mAbs). The site was purchased from Emergent Manufacturing Operations in Baltimore, enhancing Syngene's expanding global presence in the biologics sector and allowing the company to better cater to clients in both human and animal health market.

Key U.S. Drug Discovery Outsourcing Companies:

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

Recent Developments

-

In October 2024, Accenture announced partnership with 1910 Genetics to assist biopharma companies in revolutionizing drug discovery through artificial intelligence. This collaboration aims to integrate customized solutions with scalable infrastructure, enabling clients in the biopharmaceutical sector to speed up the identification of drug targets, lower expenses, and provide improved, more accessible therapies for patients.

-

In March 2024, Pace Analytical Services announced the acquisition of Lebanon, a New Jersey laboratory facility from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

U.S. Drug Discovery Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.70 billion

Revenue forecast in 2033

USD 5.58 billion

Growth rate

CAGR of 9.52% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Workflow, drug, service, therapeutics area, end use

Country scope

U.S.

Key companies profiled

Albany Molecular Research Inc.; EVOTEC; Laboratory Corporation of America Holdings; GenScript; Pharmaceutical Product Development, LLC; Charles River Laboratories; WuXi AppTec; Thermo Fisher Scientific Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; DiscoverX Corp.; QIAGEN; Eurofins SE; Syngene International Limited; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.; Domainex Ltd. among others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. drug discovery outsourcing market report based on workflow, drug, service, therapeutics area, end use, and country.

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Others

-

-

Drug Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecules

-

Large Molecules

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemistry Services

-

Biology Services

-

-

Therapeutics Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Respiratory system

-

Pain and Anesthesia

-

Oncology

-

Ophthalmology

-

Hematology

-

Cardiovascular

-

Endocrine

-

Gastrointestinal

-

Immunomodulation

-

Anti-infective

-

Central Nervous System

-

Dermatology

-

Genitourinary System

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology companies

-

Academic Institutes

-

Frequently Asked Questions About This Report

b. The U.S. drug discovery outsourcing market size was estimated at USD 2.49 billion in 2024 and is expected to reach USD 2.70 billion in 2025.

b. The U.S. drug discovery outsourcing market is expected to grow at a compound annual growth rate of 9.52% from 2025 to 2033 to reach USD 5.58 billion by 2033.

b. The small molecules segment dominated the market, with a share of 61.11% in 2024. The segment's growth is driven by demand for faster timelines, the growing adoption of AI technology, and established development pathways. In addition, increasing focus on medicinal chemistry, high-throughput screening, and lead optimization for small molecule candidates, particularly in areas such as oncology, CNS, and infectious diseases, is expected to support the market's growth.

b. Some key players operating in the U.S. drug discovery outsourcing market include Albany Molecular Research Inc., EVOTEC, Laboratory Corporation of America Holdings, GenScript, Pharmaceutical Product Development, LLC, Charles River Laboratories, WuXi AppTec, Thermo Fisher Scientific Inc., Dalton Pharma Services, Oncodesign, Jubilant Biosys, DiscoverX Corp., QIAGEN, Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., and Domainex Ltd. among others.

b. Key factors driving market growth include growing demand for novel drug candidates, rising incidence of chronic diseases, increasing R&D expenditures, and a growing array of complex and targeted therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.