- Home

- »

- Pharmaceuticals

- »

-

Drug Discovery Outsourcing Market, Industry Report, 2033GVR Report cover

![Drug Discovery Outsourcing Market Size, Share & Trends Report]()

Drug Discovery Outsourcing Market (2026 - 2033) Size, Share & Trends Analysis Report By Workflow (Target Identification & Screening, Target Validation & Functional Informatics, Preclinical Development), By Drug, By Service, By Therapeutics Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-392-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Discovery Outsourcing Market Summary

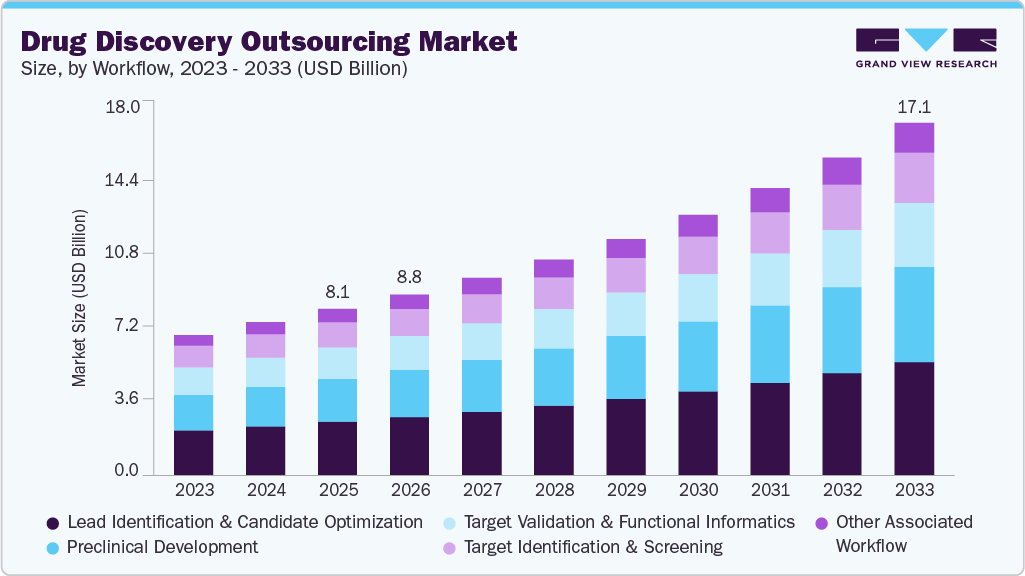

The global drug discovery outsourcing market size was estimated at USD 8.08 billion in 2025 and is projected to reach USD 17.11 billion by 2033, growing at a CAGR of 10.0% from 2026 to 2033. The market growth is driven by increasing drug development activities, the growing complexity of therapeutics, rising R&D costs, and a growing need to accelerate time-to-market.

Key Market Trends & Insights

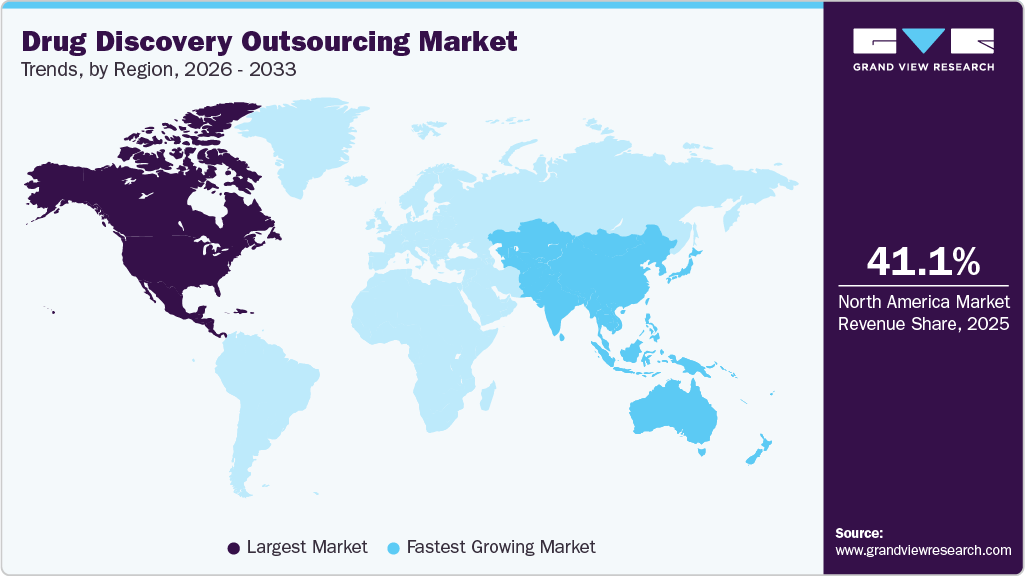

- North America drug discovery outsourcing market held the largest share of 41.11% of the global market in 2025.

- The drug discovery outsourcing in the U.S. is expected to grow significantly over the forecast period.

- By workflow, the lead identification & candidate optimization segment held the largest market share of 32.25% in 2025.

- By drug, the small molecules segment held the highest market share in 2025.

- By service, the chemistry services segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.08 Billion

- 2033 Projected Market Size: USD 17.11 Billion

- CAGR (2026-2033): 10.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Besides, there is an increasing burden of diseases, a rising demand for novel modalities such as biologics and gene therapies, and the adoption of advanced technologies, including AI and high-throughput screening.There are several other factors contributing to the market growth include the increasing outsourcing of discovery activities to access specialized expertise, advanced technologies, and scalable research infrastructure. In addition, growing adoption of AI-based drug discovery, increased demand for biologics, and targeted therapies are contributing to the market growth. Moreover, outsourcing enables risk sharing, operational flexibility, and cost optimization, making it an attractive strategy amid patent expirations and propelling competition in the global pharmaceutical landscape, which is expected to drive market growth.

The pharmaceutical industry has experienced significant transformations, including the expiration of patents, a trend toward biologics, and unprecedented downsizing of internal discovery of big pharmaceuticals, which is expected to drive the market growth. Besides, an increase in R&D funding and investments in novel drug development is a crucial trend in the biotechnology and pharmaceutical industries. For instance, around 75.0% to 80.0% of research and development spending in the biopharmaceutical industry can be outsourced, further propelling new growth opportunities for CROs, which is expected to boost market growth.

Pharmaceutical companies are partnering with manufacturing facilities in developing countries, backed by skilled workforces, low costs, and quality data. Cost-cutting, innovation, gaining access to knowledge and technology, and increasing speed and agility are significant factors encouraging pharma companies to expand the level of outsourcing. Moreover, there has been a considerable increase in interest from both private and public sectors in the development and discovery of innovative therapies. Several major pharmaceutical companies are investing in the development of novel solutions to establish a strong market position. There has also been a considerable increase in venture capital investments, especially in the life sciences sector.

Moreover, technological advancements are a fundamental driver shaping the growth and structural evolution of the global drug discovery outsourcing industry. The rising complexity of therapeutic targets, along with the industry's focus on increasing productivity and reducing attrition rates in early-stage research stages has led to greater adoption of advanced discovery technologies. As pharmaceutical and biotech companies reevaluate their internal capabilities, outsourcing partners with unique technological platforms, strengthening the position of contract research organizations (CROs) as innovation facilitators rather than just service providers.

Furthermore, the market competition is driven by high quality and strict compliance to regulations worldwide, international scientific excellence, especially in the most demanded research areas, speed and unbeatable timelines to delivery, and complex, competitive prices. In addition, companies are increasingly collaborating and leveraging expertise, which is expected to drive the drug discovery outsourcing industry. Organizations are undertaking & extending strategic partnerships with many academic institutions, venture capitalists for funding, and other public or private companies to exploit patented technology, molecules, and more. Rising partnerships among public and private entities accelerate drug discovery processes, increasing the global demand for outsourcing. In addition, emergence of various new startups across the hotspot countries, such as the U.S., India, China, South Korea, Singapore, & other Southeast Asian countries are contributing to the market’s growth. For instance, in March 2025, Syngene International Limited announced the acquisition of its first biologics site in the USA, which includes several manufacturing lines for monoclonal antibodies (mAbs). The site was acquired from Emergent Manufacturing Operations in Baltimore, enhancing Syngene's expanding global presence in the biologics sector and enabling the company to serve clients in both the human and animal health markets.

Opportunity Analysis

The global drug discovery outsourcing market is expected to witness significant growth over the estimated time period, fueled by the increasing complexity of therapeutic targets, rising research and development costs, and a growing pipeline of biotech companies with limited internal resources. With over 70% of new drug candidates arising from small to mid-sized biotech firms, outsourcing has become crucial for expediting timelines and accessing specialized expertise in areas such as medicinal chemistry, biology, AI-driven screening, and innovative modalities such as mRNA and cell and gene therapies. In addition, significant opportunities such as integrated drug discovery collaborations, where CROs provide comprehensive services that span from target validation to IND-enabling studies, are anticipated to support the market. The rising adoption of platform technologies and data-driven approaches in drug design also presents prospects for CROs that specialize in computational chemistry and machine learning. Furthermore, geopolitical changes and tariff issues are prompting a shift away from China, leading to emerging regional opportunities in India, Eastern Europe, and Southeast Asia.

Moreover, CROs that can provide flexible pricing structures, efficient collaboration platforms, and expertise in high-value therapeutic areas such as oncology and rare diseases are expected to witness new growth opportunities during the forecast period. As pharmaceutical companies strive for quicker and less risky innovation, drug discovery outsourcing is expected to serve as a strategic tool for pipeline advancement. Such factors are expected to drive the market growth over the estimated time period.

Technological Advancements

Technological advancements are evolving the drug discovery outsourcing market, with artificial intelligence (AI), machine learning (ML), automation, and integrated platforms enhancing both efficiency and innovation. AI and ML applications in drug discovery are expediting early-stage development through predictive modeling, virtual screening, and the prioritization of targets. Besides, companies that outsource are utilizing these advancements to lower attrition rates and improve success in hit-to-lead transitions. Automation in high-throughput screening (HTS) significantly increases productivity, allowing contract research organizations (CROs) to quickly evaluate thousands of compounds using robotic systems and miniaturized assays, which is essential for phenotypic and functional genomics research. In addition, computational chemistry and in silico modeling facilitate virtual compound design, structure-activity relationship (SAR) assessment, and binding affinity predictions, thereby reducing synthesis cycles and optimizing resource allocation.

Moreover, the integration of omics spanning genomics, proteomics, and transcriptomics enables CROs to delineate disease pathways, discover new targets, and classify patient populations, especially in fields like oncology and rare diseases. Such multi-omics insights support more accurate and personalized approaches to drug discovery. Furthermore, cloud-based collaboration and data management platforms are transforming global outsourcing partnerships by allowing real-time data sharing, workflows, and ensuring compliance traceability, which enhances transparency and speed among distributed teams. Such factors are expected to drive the market growth over the forecast period.

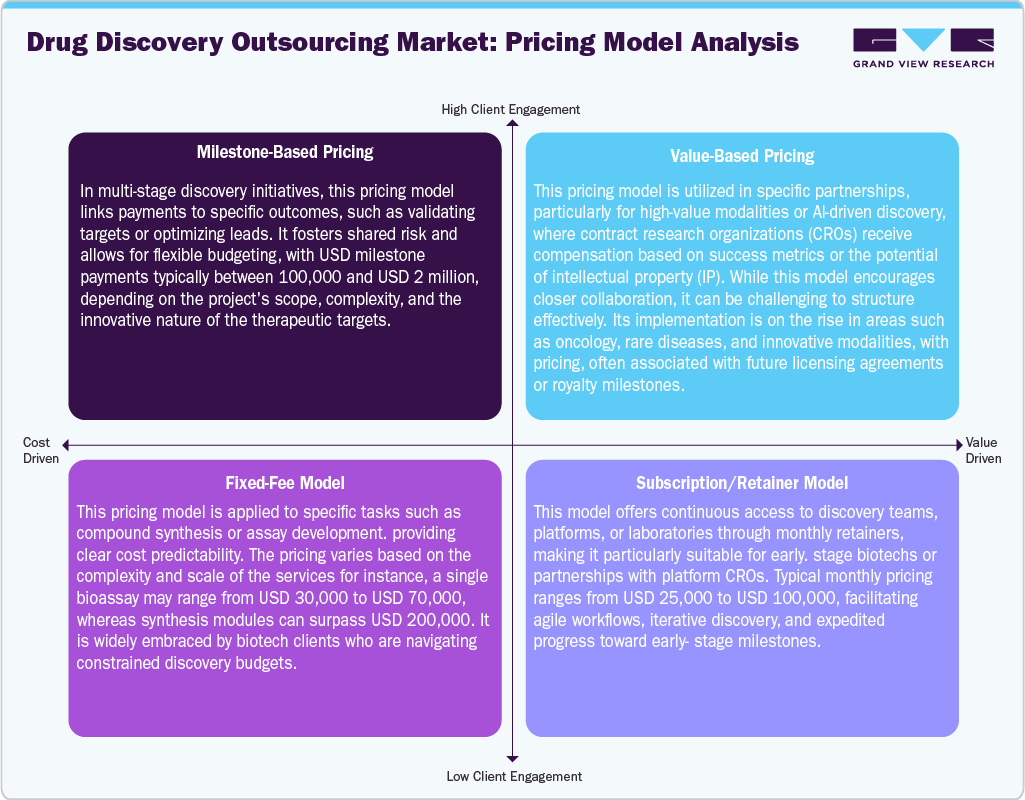

Drug discovery outsourcing market utilizes various pricing models for project complexity, risk-sharing arrangements, and client needs. Among the pricing models, milestone-based pricing is prevalent, particularly in integrated or multi-phase projects, where payments are contingent upon achieving specific deliverables, such as hit identification or lead optimization. This pricing model aligns incentives and mitigates upfront risk for clients with milestone payments typically ranging from USD 100,000 to USD 2 million, depending on the project's scope. Moreover, value-based pricing model is widely used in high-impact therapeutic areas or with AI-enhanced platforms, where compensation is correlated to downstream results or the value of intellectual property (IP). However, its adoption remains limited (around 5–10%) due to valuation challenges.

The fixed-fee model remains a popular option for discrete services such as compound synthesis or assay development, providing budget predictability; pricing for these services can vary between USD 20,000 and USD 300,000 per module. Moreover, subscription or retainer models are used in long-term discovery partnerships or by platform-focused CROs, allowing monthly access to discovery resources and expertise. In addition, this pricing model is priced between USD 25,000 and USD 100,000 per month. Thus, these pricing models demonstrate an increasing flexibility and strategic collaboration within outsourced discovery efforts.

Market Concentration & Characteristics

The drug discovery outsourcing market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The drug discovery outsourcing market is witnessing significant innovation owing to rising use of AI and machine learning for target identification, virtual screening, and predictive modeling. CROs are incorporating automation, cloud technologies, and multi-omics approaches to boost both accuracy and efficiency. In addition, advancements in biologics discovery are prominent, particularly with mRNA, CRISPR technology, and protein degradation platforms. Many CROs are transforming into technology-driven discovery partners, providing flexible and integrated discovery solutions aimed at minimizing costs and accelerating early development timelines.

Regulatory frameworks play a crucial role in shaping outsourcing practices, particularly as expectations for data integrity, Good Laboratory Practice (GLP) compliance, and biosafety in discovery research continue to evolve. Global harmonization initiatives, such as the ICH guidelines, improve the competitiveness of Contract Research Organizations (CROs) across international borders. Besides, increased regulatory scrutiny from the U.S. FDA and EMA regarding biologics and AI-derived candidates elevates compliance standards. In addition, export control measures, data localization regulations, and trade tariffs influence service sourcing choices, encouraging clients to seek regions with clear regulations, robust intellectual property protection, and reliable compliance processes.

M&A in the drug discovery outsourcing sector are moderate but strategically focused, with CROs targeting niche companies to gain access to AI technologies, biologics capabilities, or specific regional markets. Significant transactions often involve larger integrated discovery companies acquiring smaller firms specializing in chemistry or bioinformatics, allowing them to provide comprehensive services and enhance their expertise in specific therapies or modalities.

CROs are broadening their service portfolios to encompass AI-driven hit discovery, high-throughput biology, and comprehensive chemistry-to-IND workflows. Many of these organizations are also venturing into innovative modalities such as PROTACs and RNA therapeutics. In addition, there is a notable increase in investments in translational sciences, biomarker discovery, and early toxicology, enabling CROs to provide enhanced value throughout the entire discovery process.

In the global market, CROs are geographically expanding beyond their traditional hubs. Investments in discovery chemistry and computational platforms are increasing in India and Eastern Europe, while Southeast Asia is becoming a key player for cost-effective biology services. In the U.S. and EU, the focus of expansion is on high-value discovery efforts, ensuring proximity to biotech clusters and regulatory compliance. Although China remains a significant market, it is encountering challenges from tariffs and geopolitical scrutiny, which is prompting CROs to adopt multi-region delivery strategies.

Workflow Insights

The lead identification & candidate optimization segment held the largest market share of 32.25% in 2025. This segment is expanding due to the rising cost, complexity, and speed. The workflow of drug development involves the Quantitative Structure-Activity Relationship (QSAR) and structure-based optimization of the generated lead compound. Besides, these techniques involve many in silico, in vitro & in vivo approaches that have been thoroughly tested & proven reliable.

Furthermore, the rising need for skilled resources combined with knowledge of computer software, along with the high cost associated with the integration of the latest computational technology is enabling a higher outsourcing for lead identification services. Besides, the knowledge of metabolism and analytical chemistry play an important role in generating the need for these services. In addition, the introduction of advanced in silico techniques to improve the lead identification process, i.e., computer-aided drug discovery & structure-based drug designs support the segmental growth. For instance, the most frequently used lead optimization methods include MS & NMR methods. The iterative process of lead identification is a significant stage in early drug discovery. It has historically proven to have improved efficiencies and economies of scale for drug developers. In addition, the success of lead optimization in drug discovery & safety requires knowledgeable & collaborative scientists at a CRO that invests in technology. The presence of tools for predicting drug safety using techniques drives the segment's growth. Thus, increased investment by pharmaceutical companies in drug discovery is expected to drive the market growth.

On the other hand, the other associated services segment is expected to witness the fastest CAGR over the forecast period. The other related services segment includes analytical/bioanalytical methods, cell line development, upstream & downstream processes, formulation & quality assessment, and regulatory assistance, which is expected to grow rapidly in the upcoming years. This is due to increased adoption of outsourcing services and investments in drug discovery research and development activities. Such factors are anticipated to drive the segmental growth.

Drug Insights

The small molecules segment accounted for the largest share in 2025 during the forecast period. In the drug discovery outsourcing, the small molecules remain a core focus for drug innovations as these offer well-understood chemistry, scalable manufacturing, and broad therapeutics. Outsourcing enables pharmaceutical and biotechnology companies to access specialized expertise in target identification, lead optimization, medicinal chemistry, and preclinical evaluation while reducing costs and development timelines. Besides, most of the contract research organizations (CROs) offer advanced technologies, scalable resources, and integrated discovery platforms that support efficient small molecule development further contributing to market growth. In addition, growing prevalence of chronic and complex diseases such as cardiovascular, oncology, autoimmune, and respiratory diseases, coupled with rising R&D expenditures and pressure to accelerate pipelines is expected to drive the market growth.

Furthermore, most of the new drugs in the market are based on this capability of small molecules. Sales of the specialty medicines are increasing owing to small molecule applications. For instance, in 2024, the U.S. FDA Center for Drug Evaluation and Research approved 50 new molecular entities, consisting of 32 chemical entities & 18 biologic entities. of the NCEs, small molecules held the major attention and share, making up 91% (31 drugs), with the remaining drugs comprising peptides and nucleic acids.

In addition, large molecules are anticipated to grow as the fastest-growing segment during the forecast period. Large molecule also known as biopharmaceuticals are protein-based class of drugs that consist of more than 1,300 amino acids optimized by versions of endogenous human proteins. These molecules hold great promise for disease diagnosis and prevention as demonstrated by early phase clinical trials. Moreover, significant investments for drug development entities are anticipated to drive the segment in the coming years.

Service Insights

The chemistry services segment accounted for the largest revenue share in 2025. This growth can be attributed to the expansion of target identification faster than internal chemistry capacity. Advances in proteomics and genomics continue to generate large sets of tractable targets; however, target validation and lead optimization require iterative synthesis, structure-activity refinement, and rapid scale adjustments. In addition, several pharmaceutical and biopharmaceutical companies face increasing complexity at this stage, which in turn increases their reliance on external chemistry teams. Besides, outsourcing partners provide integrated capabilities across medicinal chemistry, custom synthesis, and process chemistry, which shortens cycle times between design and biological testing, which is expected to contribute to market growth.

On the other hand, the biology services segment is expected to witness the fastest CAGR during the forecast period. Biology services play a crucial role in drug discovery outsourcing by supporting early-stage research and target validation. These outsourced services, which include target identification, assay development, in vitro & in vivo studies, and biomarker analysis, enable pharmaceutical & biotechnology companies to speed up discovery timelines and enhance decision-making processes. CROs offers specialized expertise, advanced platforms, and cost-effective solutions supports to alleviate the strain on internal resources. The increasing complexity of R&D, alongside the rising demand for precision medicine and the necessity for rapid proof-of-concept studies are driving the uptake of outsourced biology services. Such factors are expected to drive the market growth.

Therapeutics Area Insights

The respiratory system segment accounted for the largest market share in 2025.High incidence of respiratory disorders, such as bronchitis, Chronic Obstructive Pulmonary Diseases (COPD), tuberculosis, and asthma, coupled with increasing cases of drug resistance, has influenced the growth of segments. For instance, COPD affects 11.7 million adults accounting for majority of emergency department visits and 10 billion in healthcare costs annually. Furthermore, the introduction of novel drug delivery technologies, such as nasal sprays, has been identified to be the key contributor to the segment revenue. Lung diseases are responsible for hospital admissions and over millions of inpatient bed-days in the U.S. per year. In addition, for COPD around 90% of deaths under 70 years occur in low- to middle-income countries. The disease is the eighth leading cause of poor health across the globe. In these regions, tobacco smoking accounts for 30-40% of COPD cases, and air pollution is a major risk factor.

The oncology segment is expected to grow at the fastest CAGR during the forecast period. Increased focus on the identification of novel targets to support cancer treatment contributes to the lucrative growth of the oncology segment. In addition, research focused on the tumor microenvironment, including cancer-associated fibroblasts, immune cells, and extracellular matrix, which is expected to drive the segment growth. Furthermore, emerging new immunotherapies, including bispecific antibodies, CAR-T therapies, and tumor vaccines, are gaining increasing its demand to improve response rates and broaden the scope of immunotherapy to different cancer types. Moreover, private players provide biophysical, biochemical, and cellular assay systems for oncology targets, which include tumor microenvironment, tumor metabolism, cancer immunology, and other assays.

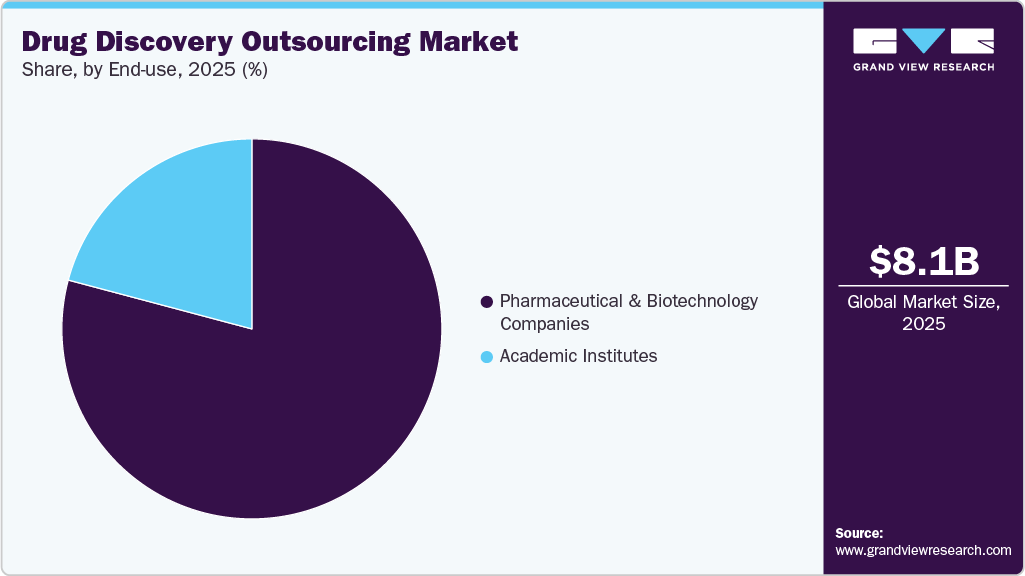

End Use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest market share in 2025. Pharmaceutical and biotechnology companies are increasingly turning to drug discovery outsourcing as a strategy to enhance the efficiency of their research and development efforts while managing the costs of development. By outsourcing, these companies gain access to specialized scientific expertise, advanced technologies, and scalable resources that are crucial for various stages of drug discovery, including target identification, hit-to-lead, lead optimization, and preclinical studies. Besides, collaborating with CROs enables companies to boost their timelines, mitigate operational risks, and focus their internal resources on strategic innovation. The rise in complexity of drug pipelines, along with the expansion of biologics & small molecules, coupled with the need to improve productivity, which is propelling the trend toward outsourcing in the market.

The academic institutes segment is expected to grow at a significant CAGR during the forecast period, due to significant amounts of funding provided for drug discovery research to research institutions, which is one of the key factors driving the segment growth. Furthermore, collaboration agreements with market players and research institutes have further promoted segment growth. For instance, Evotec mentioned a multiyear partnership with the Medical Center Hamburg-Eppendorf for the development of cell therapy treatment for heart failure. Adoption of such strategies by market players in the future is likely to have a positive impact on market growth.

Regional Insights

North America Drug Discovery Outsourcing Market Trends

In 2025, North America held the largest revenue share of 41.11% in the global market. This can be attributed to technological advancements, well-established research infrastructure & market players, higher investments in drug discovery R&D, and the local presence of major players involved in intensive investigations of new drug candidates against various diseases. Moreover, the increase in disease-related morbidity and mortality has led to the discovery of more drug candidates, thereby driving the growth in this region. In addition, the region’s growing R&D investment, rise in the incidence of various diseases, and increasing need for efficiency, quality, and innovation are driving the growth of the drug discovery outsourcing industry in North America. Furthermore, public-private partnerships formed to develop novel drug molecules are expected to impact market growth in this region dramatically. In addition, growing extensive drug development activities, several pharmaceutical & biotech companies, and a surge in regional clinical trials are some factors boosting the market.

U.S. Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in the U.S. held the largest share in 2025. The growing need for innovative drug options, rising disease prevalence, and the surge in public-private partnerships focused on developing new molecules have fueled the collaborations between drug developers and service providers. In addition, these collaborations have contributed to the increased market size. For instance, in November 2025, Insilico Medicine and Eli Lilly signed a research and licensing collaboration to advance AI-driven drug discovery using the former’s Pharma.AI platform and Lilly’s drug development expertise. The agreement is valued at over USD 100 million and includes upfront payments, milestone fees, and tiered royalties tied to future sales of the drug. The partnership aimed to accelerate the identification and optimization of novel drug candidates through the combined use of AI and biopharmaceutical capabilities. Such factors are expected to drive the country’s growth.

The Canada drug discovery outsourcing market is driven by robust research framework, a highly skilled scientific workforce, and favorable government initiatives supporting life sciences innovation. Canadian CROs are increasingly collaborating with global biotech and pharmaceutical companies to provide specialized services such as medicinal chemistry, early-stage biology, and preclinical development. In addition, the ecosystem benefits from strong ties between academia and industry, with notable advancements in fields such as biologics, AI-driven discovery, and rare disease research are contributing to market growth. Besides, the regulations and adherence to data integrity standards further fuels the Canada's outsourcing hub. Moreover, growing demand for innovative-oriented partnerships is expected to drive market growth over the estimated time period.

Europe Drug Discovery Outsourcing Market Trends:

Europe drug discovery outsourcing market is driven by rising demand for biopharmaceutical products and the increasing need for new drugs to treat complex diseases. In addition, the European market has a highly skilled workforce, well-developed infrastructure, and favorable regulatory policies, making it a destination for pharmaceutical companies to outsource their drug discovery activities. Moreover, with the increasing adoption of personalized medicine and the need for precision medicine, Europe's drug discovery outsourcing market is expected to drive the market growth over the estimated time period.

The drug discovery outsourcing market in Germany held the highest share in 2025. Germany drug discovery outsourcing plays a critical role for pharmaceutical manufacturers owing to growing new drug candidates’ development in collaboration with many research institutions & organizations. This factor is expected to bridge a gap between the discovery of new treatment approaches, their preclinical development, and clinical testing, as well as encourage the participation of larger pharmaceutical firms. Moreover, collaborations among enterprises to develop novel drugs are anticipated to drive market growth over the estimated time. For instance, in July 2025, BioSpring launched a major GMP-compliant manufacturing facility in Offenbach, Germany, for DNA- and RNA-based active pharmaceutical ingredients. The 30,000 sqm complex, will support ton-scale production for nucleic acid therapeutics like mRNA vaccines and gene therapies, creating around 1,500 jobs across three production units. This expansion strengthens Germany's biotech hub status, enhancing supply chain reliability for global clients amid surging demand for oligonucleotides in oncology and rare diseases. Such factors are anticipated to drive the market.

The UK Drug Discovery Outsourcing market is expected to grow significantly over the forecast period. The country's growth is driven by growing discovery of high-quality drug molecules, and the presence of top-notch companies such as AstraZeneca, Bayer Pharma, Merck KGaA, Lundbeck, UCB Pharma, Janssen Pharmaceuticals, and Sanofi is anticipated to drive the requirement for the drug discovery outsourcing market.

Asia Pacific Drug Discovery Outsourcing Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to various factors, such as rising healthcare expenditure and growing demand for pharmaceutical products. In addition, the region is emerging as a hub for outsourcing drug discovery activities owing to the lower costs, favorable regulatory environment, and quality data. In addition, a growing number of ongoing studies in the region for drug discovery, private-public collaborations, and government initiatives are some of the key factors likely to propel the growth of the Asia Pacific drug discovery outsourcing industry.

The drug discovery outsourcing market in China is one of the major hubs for drug discovery as it supports minimizing the cost of drug discovery and a skilled workforce; hence, outsourcing services has become one of the most favored strategies adopted globally. In addition, recent trends have shown that the increasing percentage of clinical trials being performed will drive the market. Besides, many outsourcing providers offer excellent drug/therapy development and manufacturing services.

Japan drug discovery outsourcing market is second-largest drug discovery outsourcing market in 2025 at a global level, is expected to provide a robust opportunity for drug discovery outsourcing services, thus driving the market. The country has the fastest aging population in the world and is developing a demographic trend that results in a higher incidence of cancer. This makes Japan a lucrative market for drug discovery outsourcing.

Drug discovery outsourcing market in India isdriven by growing number of low costs of drug discovery services, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. Furthermore, various initiatives undertaken by the government and investments in R&D programs are further boosting market growth in the country. For instance, the operational costs in India are comparatively lower than in other countries, which certainly presents economic benefits for multinational companies. Increased government funding for R&D to accelerate new product development has made India one of the most favored locations for research activities. These factors are anticipated to drive the market in India.

Latin America Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in Latin America is experiencing significant growth driven by an expanding pool of scientific expertise, cost-effective operations, and increases in biomedical research investment. Countries such as Brazil, Argentina, and Mexico are becoming preferred choices for early-stage drug discovery services, especially in areas such as medicinal chemistry, in vitro biology, and compound screening. Besides, CROs forming strategic partnerships with international sponsors to advance projects focused on oncology, infectious diseases, and neglected tropical diseases is expected to support market growth.

Brazil drug discovery outsourcing market is driven by advancements in genomics, proteomics, and computational modeling, positionig the country as a strategic hub for drug discovery services. Collaborations between academic institutions, government agencies, and industry players are fostering innovation, particularly in therapeutic areas such as oncology and infectious diseases. In addition, the pharmaceutical companies seek cost-effective and efficient R&D solutions. Moreover, robust infrastructure and scientific expertise make it an increasingly attractive destination for drug discovery outsourcing. Such factors are expected to drive the market growth over the estimated time period.

Middle East & Africa Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in the MEA region is expected to experience steady growth in the upcoming years. The segment growth is driven by increasing investments in biomedical research, a growing pool of skilled professionals, and the adoption of advanced technologies such as AI and in silico modeling. Besides, growing collaborations between academic institutions, government agencies, and industry players are expected to drive the innovation, particularly in therapeutic areas such as oncology and infectious diseases. Moreover, global pharmaceutical companies seek cost-effective and efficient R&D solutions, robust infrastructure, and scientific expertise which further drives the market growth.

South Africa drug discovery outsourcing market is driven by a rising demand for biologics, the attractiveness of the pharmaceutical industry, and the presence of diverse population. Furthermore, shifting market dynamics and enhanced access to biologic products in underserved areas are expected to further contribute to market growth.

Key Drug Discovery Outsourcing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market.

Key Drug Discovery Outsourcing Companies:

The following are the leading companies in the drug discovery outsourcing market. These companies collectively hold the largest Market share and dictate industry trends.

- Albany Molecular Research Inc. (Curia Global, Inc.)

- EVOTEC

- Laboratory Corporation of America Holdings.

- GenScript

- Thermo Fisher Scientific, Inc.

- Charles River Laboratories International, Inc.

- WuXi AppTec

- Merck & Co., Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

Recent Developments

-

In November 2025, QIAGEN announced the acquisition of Parse Biosciences, expanding scalable single-cell technologies and AI-ready sample workflows, boosting outsourced single-cell analytics, multi-omics research, and computational drug discovery services.

-

In October 2025, Syngene added a GMP bioconjugation suite for ADCs, enabling integrated discovery-to-manufacturing services at a single site, reducing development timelines and increasing reliance on full-service CDMO outsourcing partners.

-

In October 2024, Samsung Biologics mentioned a launch of high-concentration formulation platform to support developing and manufacturing high-dose biopharmaceuticals. S-HiConTM can identify unintended pH changes, reduce viscosity, enhance efficacy, enhance formulation stability, and maximize drug delivery.

-

In August 2025, Skyhawk Therapeutics announced a strategic collaboration with Merck KGaA, Darmstadt, Germany, to discover novel RNA-targeting small molecules for neurological disorders using Skyhawk's proprietary SkySTAR platform. The deal, valued at over USD 2 billion, includes upfront payments, milestones, and tiered royalties, with Skyhawk leading discovery and preclinical work before Merck assumes development and commercialization upon option exercise. This partnership targets high-unmet-need indications where traditional therapies fall short, leveraging RNA splicing modulation to address challenging disease biology.

-

In March 2025, Syngene International Limited mentioned the acquisition of its first biologics site in the USA, which includes several manufacturing lines for monoclonal antibodies (mAbs). The site was purchased from Emergent Manufacturing Operations in Baltimore, enhancing Syngene's expanding global presence in the biologics sector and allowing the company to better cater to clients in both human and animal health market.

Drug Discovery Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.79 billion

Revenue forecast in 2033

USD 17.11 billion

Growth rate

CAGR of 10.0% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Workflow, drug, service, therapeutics area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Albany Molecular Research Inc. (Curia Global, Inc.); EVOTEC; Laboratory Corporation of America Holdings; GenScript; Thermo Fisher Scientific, Inc.; Charles River Laboratories International, Inc.; WuXi AppTec; Merck & Co., Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; QIAGEN; Eurofins SE; Syngene International Limited; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.; Domainex Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global drug discovery outsourcing market report based on workflow, drug, service, therapeutics area, end use, and region.

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Others

-

-

Drug Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecules

-

Large Molecules

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemistry Services

-

Biology Services

-

-

Therapeutics Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Respiratory system

-

Pain and Anesthesia

-

Oncology

-

Ophthalmology

-

Hematology

-

Cardiovascular

-

Endocrine

-

Gastrointestinal

-

Immunomodulation

-

Anti-infective

-

Central Nervous System

-

Dermatology

-

Genitourinary System

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology companies

-

Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global drug discovery outsourcing market size was estimated at USD 8.08 billion in 2025 and is expected to reach USD 8.79 billion in 2026.

b. The global drug discovery outsourcing market is expected to grow at a compound annual growth rate of 9.98% from 2026 to 2033 to reach USD 17.11 billion by 2033.

b. North America dominated the drug discovery outsourcing market with a share of 41.11% in 2025. The market growth is attributed to technological advancements, well-established research infrastructure & market players, higher investments in drug discovery R&D, and the local presence of major players involved in intensive investigations of new drug candidates against various diseases. Moreover, the increase in disease-related morbidity and mortality has led to the discovery of more drug candidates, thereby driving the growth in this region

b. Some key players operating in the drug discovery outsourcing market include Albany Molecular Research Inc. (Curia Global, Inc.), EVOTEC, Laboratory Corporation of America Holdings, GenScript, Thermo Fisher Scientific, Inc., Charles River Laboratories International, Inc., WuXi AppTec, Merck & Co., Inc., Dalton Pharma Services, Oncodesign, Jubilant Biosys, QIAGEN, Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., and Domainex Ltd. among others.

b. Key factors that are driving the drug discovery outsourcing market growth include increasing drug development activities, the growing complexity of therapeutics, rising R&D costs, and a growing need to accelerate time-to-market. Besides, there is an increasing burden of diseases, a rising demand for novel modalities such as biologics and gene therapies, and the adoption of advanced technologies, including AI and high-throughput screening.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.