U.S. Ductile Iron Pipes Market Summary

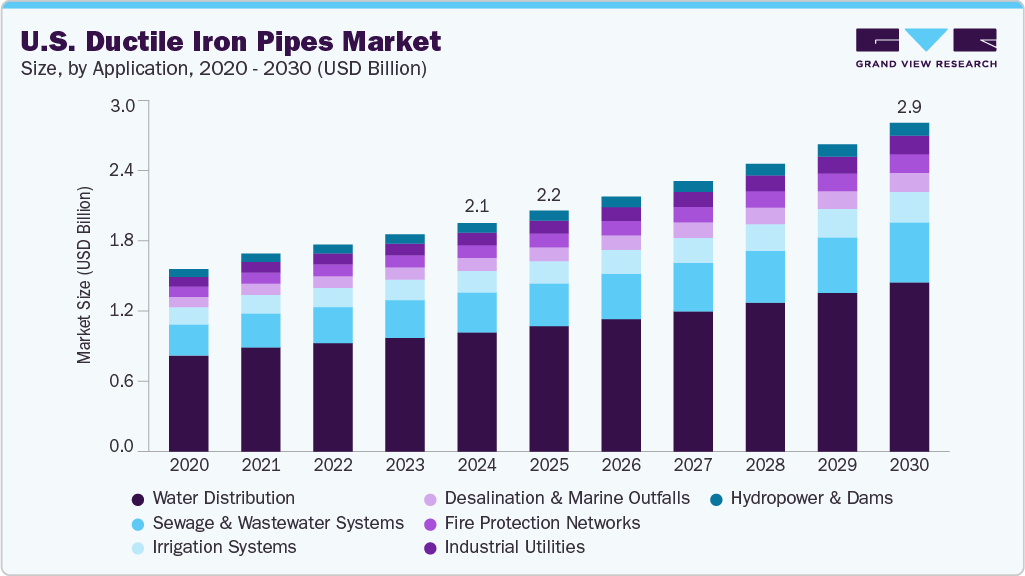

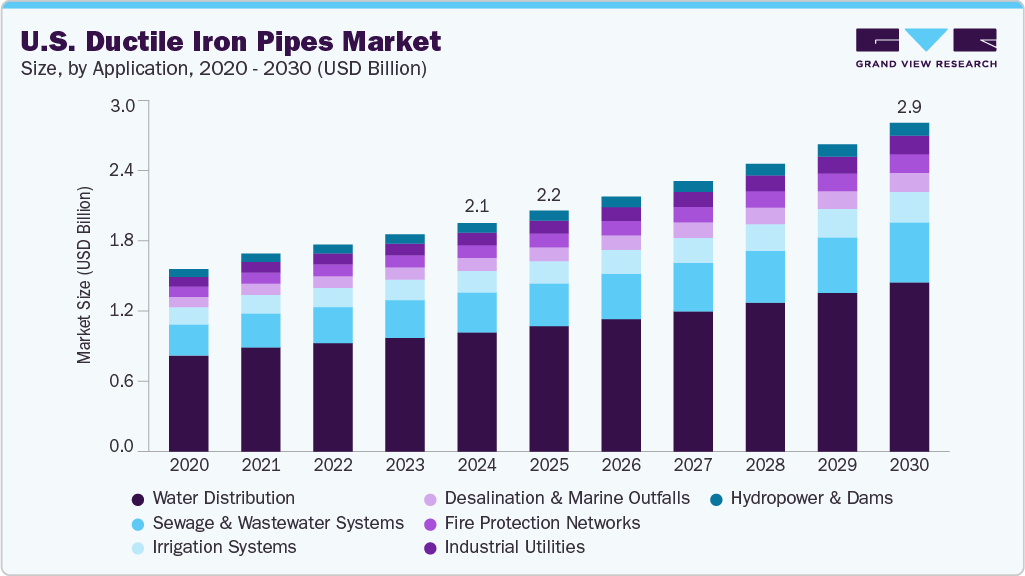

The U.S. ductile iron pipes market size was estimated at USD 2.06 billion in 2024 and is projected to reach USD 2.96 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The growth is driven by the need to replace water and wastewater infrastructure across major cities like New York, Los Angeles, and Houston.

Key Market Trends & Insights

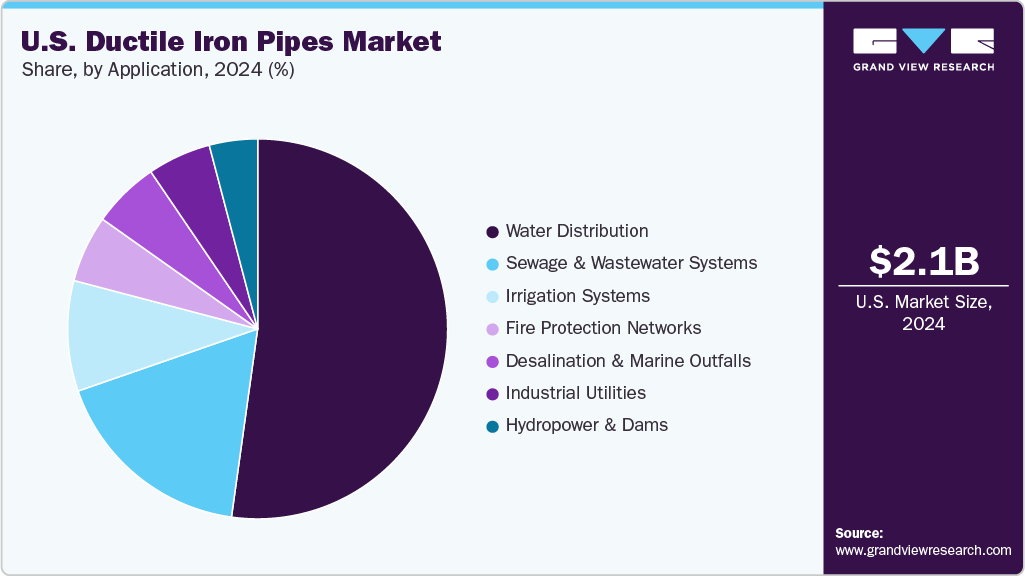

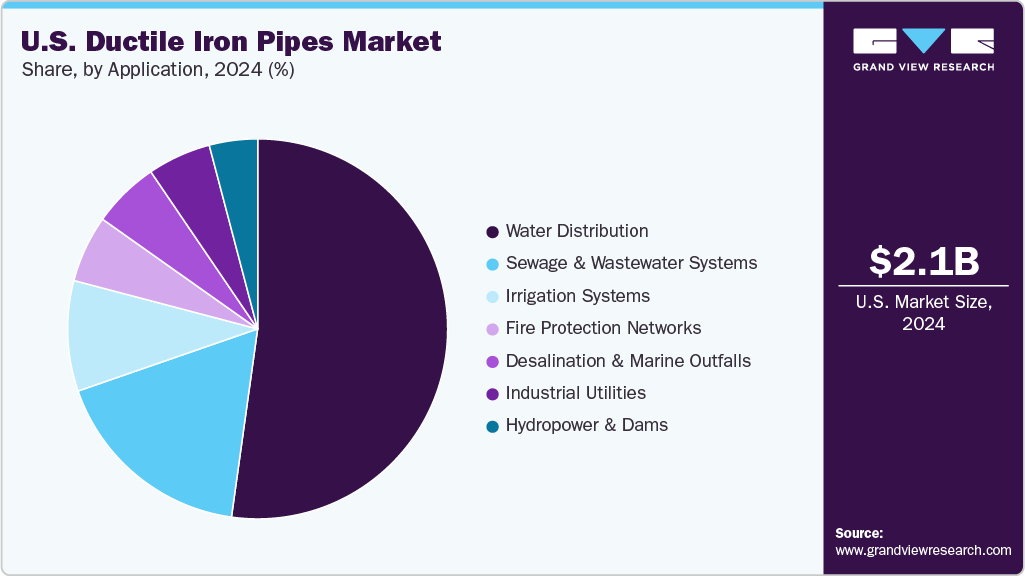

- By application, the water distribution segment held the highest market share of 52.2% in 2024.

- The sewage & wastewater systems segment is expected to grow at the fastest CAGR of 7.1% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.06 Billion

- 2030 Projected Market Size: USD 2.96 Billion

- CAGR (2025-2030): 6.4%

In the U.S., much of the underground pipeline network is decades old and increasingly prone to leakage and failure. DI pipes are being deployed as a reliable solution in replacement projects due to their longer service life and lower lifetime cost than other materials. Their ability to withstand ground movement and pressure surges has made them a preferred material in country’s vulnerable to seismic activity or soil instability. For instance, the U.S. Environmental Protection Agency (EPA) has funded several state-level Drinking Water State Revolving Fund (DWSRF) programs. Under these programs use ductile iron pipes to upgrade outdated municipal water systems.

Application Insights

The water distribution segment dominated the market and accounted for the largest revenue share of 52.2% in 2024. High resistance to corrosion, strength, and durability are key advantages of DI pipes, making them suitable options for water distribution. Additionally, as many pipes reached the end of their design life, the rising need for newer pipes in the water supply segment drives the segment's growth. According to the ASCE's 2025 Infrastructure Report Card, the U.S. drinking water infrastructure features over 2 million miles of underground distribution & transmission lines. While some of these pipes date back to the 19th century. With an average lifespan of 75 to 100 years, these pipes reach or exceed their intended operational life. These factors are expected to drive the growth of the water distribution segment.

The sewage & wastewater systems segment is expected to grow at the fastest CAGR of 7.1% over the forecast period. The rising government focus on developing wastewater infrastructure nationwide is the major driving factor for the segment's growth. In October 2024, the U.S. Environmental Protection Agency announced funding of USD 3.6 billion under the Biden-Harris Administration's Bipartisan Infrastructure Law. This funding aims to upgrade the country's secure wastewater management, safeguard local freshwater resources, and provide safe drinking water to residences, educational institutions, and commercial establishments.

Key U.S. Ductile Iron Pipes Company Insights

Some key U.S. ductile iron pipe industry companies include AMERICAN (American Cast Iron Pipe Company), McWane Ductile, and Electrosteel USA.

- AMERICAN (American Cast Iron Pipe Company) produces valves, ductile iron pipe, fire hydrants, and spiral-welded steel pipe. The company's business segments include steel pipelines, ductile iron pipes, flow control (valves and hydrants), castings, and spiral-wide pipes.

Key U.S. Ductile Iron Pipes Companies:

- AMERICAN (American Cast Iron Pipe Company)

- McWane Ductile

- Electrosteel USA

- U.S Pipe

Recent Developments

- In January 2025, AMERICAN Cast Iron Pipe Company completed the acquisition of C&B Piping Inc. Based in Leeds, Alabama, C&B Piping is a company specializing in the manufacturing and supply of ductile iron and steel piping systems.

U.S. Ductile Iron Pipes Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 2.16 billion

|

|

Revenue forecast in 2030

|

USD 2.96 billion

|

|

Growth Rate

|

CAGR of 6.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Key companies profiled

|

AMERICAN (American Cast Iron Pipe Company), McWane Ductile, Electrosteel USA, U.S Pipe

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Ductile Iron Pipes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ductile iron pipes market report based on application.