- Home

- »

- Distribution & Utilities

- »

-

U.S. E-House Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. E-House Market Size, Share & Trends Report]()

U.S. E-House Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Mobile, Semi-Mobile, Fixed), By Voltage (Low, Medium), Consumer Behavior, Key Companies, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-673-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. E-House Market Size & Trends

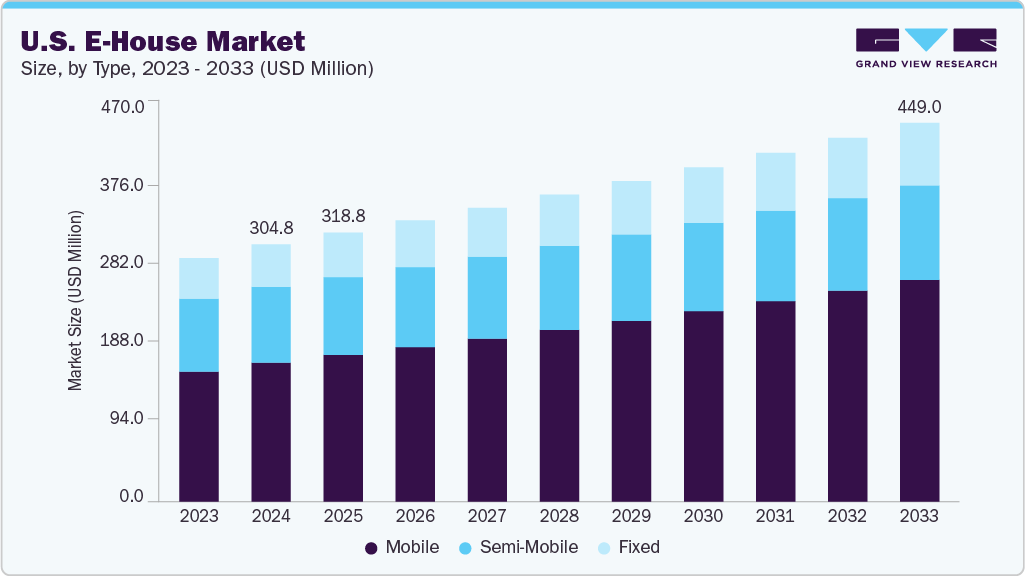

The U.S. E-House market size was estimated at USD 304.8 million in 2024 and is projected to reach USD 449.0 million by 2033, growing at a CAGR of 4.37% from 2025 to 2033. The market expansion is driven by increasing demand for modular power solutions, rapid industrialization, and the need for reliable, scalable electrical infrastructure across various sectors, including oil & gas, mining, and utilities. As industries prioritize efficiency, mobility, and cost-effective power distribution, adopting E-Houses is expected to accelerate over the forecast period.

E-Houses are primarily used in applications where rapid deployment, modularity, and space optimization are critical. While traditional substations require extensive on-site construction, E-Houses offer a prefabricated alternative that integrates essential electrical components into a single, transportable unit. These solutions are ideal for industries such as oil & gas, mining, utilities, and renewable energy, where operational continuity and scalability are vital. Their plug-and-play design and reduced installation time make them especially suitable for remote or challenging environments. The increasing demand for reliable, decentralized power infrastructure in the country alongside government initiatives supporting grid modernization and industrial automation, is a key driver accelerating the growth of the market.

Drivers, Opportunities & Restraints

The market is gaining momentum due to the increasing need for fast, flexible, and cost-efficient power distribution solutions across energy, transportation, mining, and utilities. As companies seek to modernize their electrical infrastructure and reduce deployment timelines, E-Houses offer a practical alternative with their plug-and-play capabilities and minimal on-site construction requirements. The growing push for grid reliability, rising infrastructure investments, and the shift toward automation continue to drive demand for modular electrical systems.

Opportunities in the U.S. market are expanding with the integrating of E-Houses into renewable energy installations, offshore platforms, and microgrid networks. Innovations in smart monitoring systems and digital controls are enhancing E-House performance, making them more appealing for high-tech and remote applications. However, certain challenges could temper market expansion. High initial costs, especially for customized and large-scale units, can hinder entry for smaller operators. Transporting and installing oversized units in urban or restricted-access sites also adds complexity. Despite these hurdles, the long-term outlook remains positive, supported by the technology’s adaptability and performance benefits.

Type Insights

Based on Type, the Mobile E-House segment holds the largest share in the U.S. E-House market, accounting for a revenue share of 54.00% in 2024. This leadership is driven by the growing demand for compact, quickly deployable, and easily transportable power solutions across critical industries such as oil & gas, mining, utilities, and renewable energy. Mobile E-Houses have become the preferred choice for U.S.-based operations that require flexible and temporary power infrastructure, especially in remote or hard-to-access locations. As industries prioritize speed, mobility, and operational efficiency, adopting mobile E-House systems is expected to remain strong across the U.S. market.

Their flexibility and cost-effectiveness also reinforce the preference for mobile units. Their modular design and ease of transportation enable operators to relocate units as project needs evolve, supporting both temporary and semi-permanent installations. Moreover, shorter deployment timelines help reduce project delays and associated costs, which is particularly valuable in sectors facing tight schedules or regulatory constraints. With increasing investment in energy infrastructure, renewable projects, and grid resilience across the U.S., mobile E-Houses are expected to dominate the market.

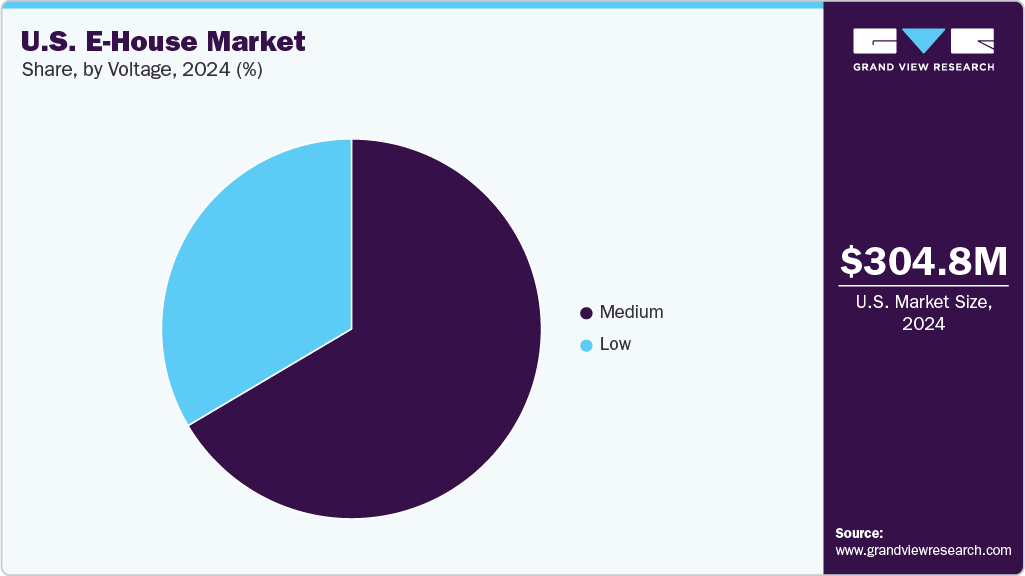

Voltage Insights

The Medium Voltage segment accounted for the U.S. E-House market's largest revenue share of approximately 65.50% in 2024. The widespread use of medium voltage E-Houses in industrial, utility, and infrastructure projects is a major factor driving this segment's dominance. These E-Houses typically support voltage ranges from 1 kV to 36 kV and are essential in mining operations, oil & gas fields, renewable energy plants, and grid extension projects. Their ability to balance compact design with sufficient power capacity makes them ideal for permanent and temporary installations across diverse industries.

The Medium Voltage segment accounted for the largest revenue share of 66.50% in the U.S. E-House market in 2024. This dominance is primarily driven by the segment’s suitability for a wide range of industrial and utility-scale applications that require safe, reliable, and efficient power distribution. Medium voltage E-Houses are commonly used in sectors such as oil & gas, mining, transportation, and renewable energy, where power needs typically range from 1kV to 35kV. Their ability to support critical infrastructure while ensuring operational safety and reducing power losses makes them preferred for permanent and temporary installations. As the push for efficient, scalable, and mobile power solutions continues across the U.S., the medium voltage segment is expected to maintain its lead, supported by ongoing technological advancements and strong industry adoption.

Key U.S. E-House Company Insights

Some key players operating in the U.S. E-House market include ABB Ltd., Schneider Electric, Siemens AG, Eaton Corporation, General Electric (GE), Powell Industries, Inc., Emerson Electric, Rittal, Vertiv, and AZZ Inc. They are investing in advanced engineering, digital monitoring technologies, and energy-efficient designs to meet the growing demand for flexible, quickly deployable, and space-optimized E-Houses. Strategic focus on R&D, product customization, and fast-track deployment capabilities is helping these market leaders address evolving infrastructure needs across the U.S.

Key U.S. E-House Companies:

- ABB Ltd.

- Schneider Electric

- Siemens AG

- Eaton Corporation

- General Electric (GE)

- Powell Industries, Inc.

- Emerson Electric

- Rittal

- Vertiv

- AZZ Inc.

Recent Developments

- In January 2025, Schneider Electric partnered with The Mobility House in the U.S. to deliver integrated smart charging solutions, enhancing electric fleet infrastructure through energy automation and optimized load management systems.

U.S. E-House Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 318.8 million

Revenue forecast in 2033

USD 449.0 million

Growth rate

CAGR of 4.37% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, voltage

Key companies profiled

ABB Ltd.; Schneider Electric; Siemens AG; Eaton Corporation; General Electric (GE); Powell Industries, Inc.; Emerson Electric; Rittal; Vertiv; AZZ Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. E-House Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. E-House market report on the basis of type, and voltage:

-

Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Mobile

-

Semi-Mobile

-

Fixed

-

-

Voltage Outlook (Revenue, USD Million; 2021 - 2033)

-

Low

-

Medium

-

Frequently Asked Questions About This Report

b. The U.S. E-House market size was estimated at USD 304.8 million in 2024 and is expected to reach USD 318.8 million in 2025.

b. The U.S. E-House market is expected to grow at a compound annual growth rate of 4.37% from 2025 to 2033 to reach USD 449.0 million by 2033.

b. Based on the type segment, Mobile held the largest revenue share of more than 54% in 2024 owing to their superior power conversion efficiency, low manufacturing cost, and flexibility, making them highly suitable for next-generation solar technologies and portable energy solutions.

b. Some of the key players in the U.S. E-House market include Oxford PV, First Solar, Hanergy, Ascent Solar Technologies, and Heliatek, among others.

b. The key factors driving the E-House market include the rising demand for lightweight, flexible, and high-efficiency solar technologies. These cells support a wide range of applications, from portable electronics to building-integrated photovoltaics, making them ideal for accelerating the global shift toward sustainable and decentralized energy solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.