- Home

- »

- Advanced Interior Materials

- »

-

U.S. Earth Anchors Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Earth Anchors Market Size, Share & Trends Report]()

U.S. Earth Anchors Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Arrowhead Anchors, Bullet Anchors, Duckbill Anchors, Screw Pile Anchors, Auger Anchors), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-480-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Earth Anchors Market Summary

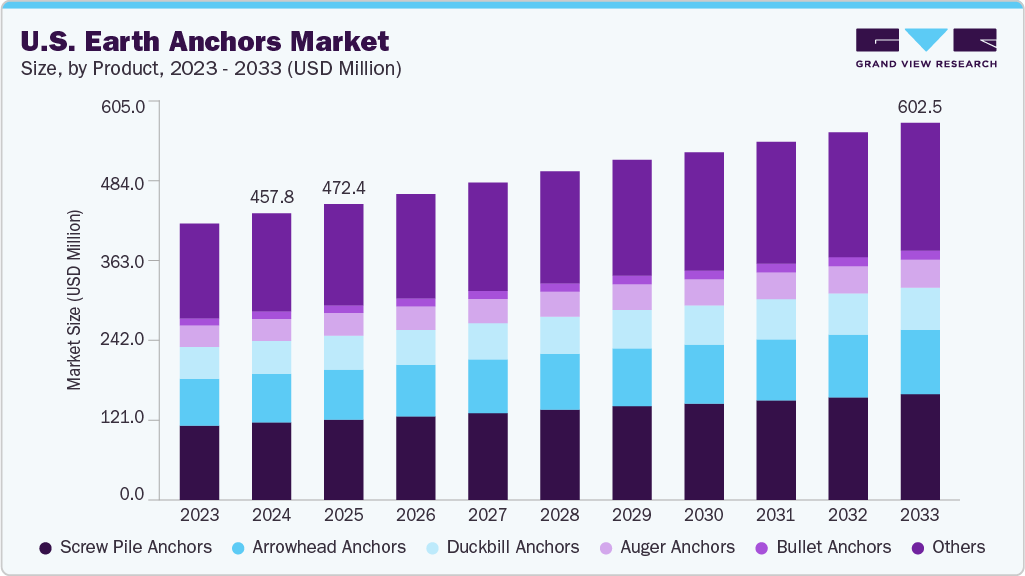

The U.S. earth anchors market size was estimated at USD 457.8 million in 2024 and is projected to reach USD 602.5 million by 2033, growing at a CAGR of 3.1% from 2025 to 2033. The demand for earth anchors in the U.S. is increasing due to a surge in infrastructure development projects, including roads, bridges, and utility upgrades.

Key Market Trends & Insights

- By product, the screw pile anchor segment held the highest revenue share of 27.0% in 2024.

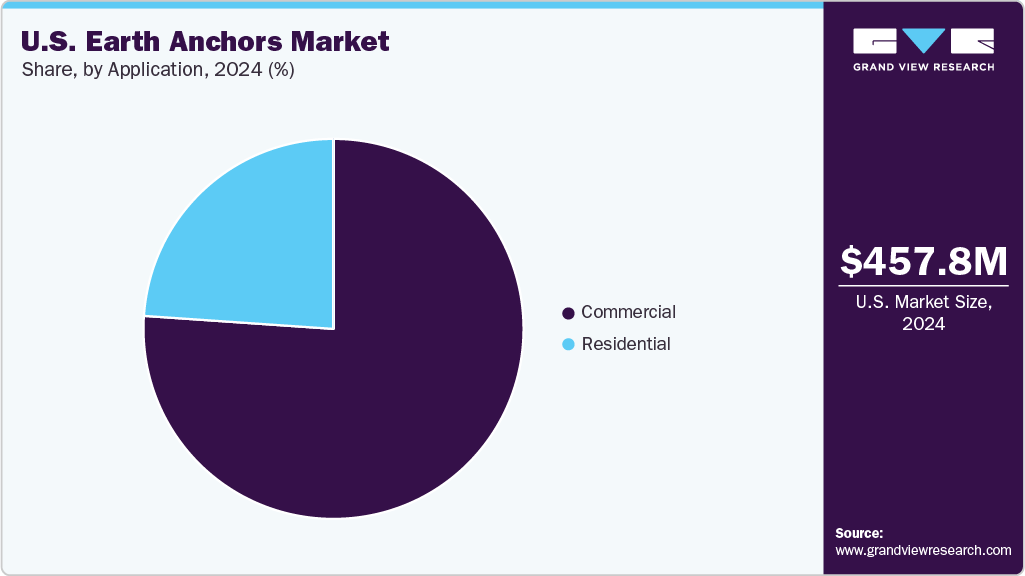

- By application, the commercial segment dominated the U.S. earth anchors market with the highest revenue share of 76.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 457.8 Million

- 2033 Projected Market Size: USD 602.5 Million

- CAGR (2025-2033): 3.1%

Climate change-induced events such as hurricanes, floods, and soil erosion are further pushing the need for ground reinforcement solutions. The rise in renewable energy projects, especially solar farms and wind turbines, also requires strong anchoring systems. In addition, increasing urbanization has led to the construction of high-rise buildings and retaining structures that rely on earth anchors for foundation stability. The need for geotechnical stability in landslide-prone regions is boosting demand. Moreover, environmental rehabilitation projects across the U.S. use earth anchors in slope stabilization and soil retention. All these factors are fostering the long-term growth of the U.S. earth anchors industry.U.S. federal and state government initiatives supporting infrastructure upgrades under the Bipartisan Infrastructure Law (BIL), which includes $1.2 trillion in funding, are directly benefiting the earth anchors market. The Department of Transportation (DOT) and FEMA are investing heavily in disaster-resilient construction, including slope stabilization and flood mitigation. In areas vulnerable to wildfires and floods, projects funded by the U.S. Army Corps of Engineers are mandating geotechnical reinforcement methods, including earth anchors. Clean energy policies by the Department of Energy (DOE) are also boosting anchor use in solar and wind projects. Moreover, grants for sustainable development and soil conservation programs under USDA initiatives are indirectly supporting the use of ground anchoring solutions.

A key trend is the shift toward lightweight, corrosion-resistant earth anchors made from galvanized steel and composite materials. Integration of smart load-monitoring systems with earth anchors is gaining traction, particularly in critical infrastructure projects. Another innovation is the growing use of screw piles and helical anchors for fast deployment in remote or difficult terrains, reducing the need for heavy excavation. Anchors with improved soil penetration and load-distribution mechanisms are being adopted to address complex geotechnical environments. Robotic and automated installation technologies are also emerging, improving safety and efficiency. Eco-friendly anchor designs that reduce soil disruption are trending in environmentally sensitive zones and green projects.

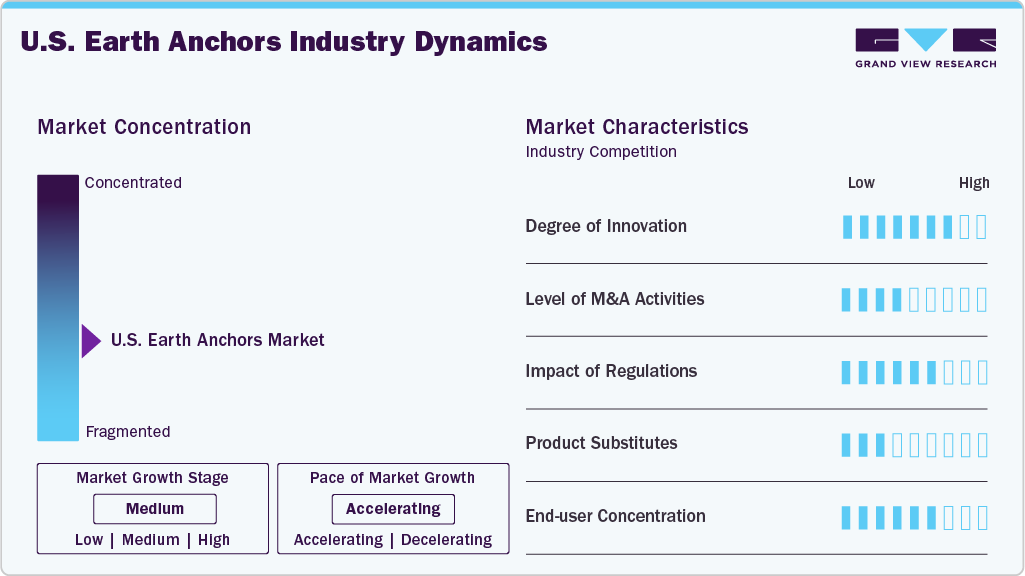

Market Concentration & Characteristics

The U.S. earth anchors market is moderately consolidated, with a mix of large established players and regional specialists. Key players hold a notable share due to their comprehensive product portfolios and national distribution networks. However, local companies compete through customized solutions and rapid delivery. Technological innovation and price competitiveness drive differentiation. Construction contractors often prefer long-standing partnerships with anchor providers, creating entry barriers for new entrants. Product performance, technical support, and compliance with ASTM standards significantly influence market share.

The threat of substitutes in the U.S. earth anchors industry is relatively low. While alternatives like concrete footings or traditional foundations exist, they are more labor-intensive, costly, and unsuitable for quick or temporary installations. In geotechnically unstable areas, conventional substitutes often fail to deliver the same anchoring strength. However, new materials like soil nails and geogrid reinforcement systems present a mild substitution risk in certain applications. Technological advancements in anchoring systems make earth anchors increasingly irreplaceable in dynamic soil and emergency settings.

Product Insights

Screw pile anchors dominated the U.S. earth anchors industry with the highest revenue share of 27.0% in 2024, due to their superior load-bearing capacity, ease of installation, and minimal site disturbance. These anchors are widely used in foundation repair, utility pole installation, and renewable energy applications, especially in solar farms and communication towers. Their ability to be installed in a wide range of soil conditions and the advantage of immediate load-bearing capability make them a preferred choice for both permanent and temporary structures. In high-demand regions such as the Midwest and Southeast, where rapid deployment and structural stability are critical, screw pile anchors have become the industry standard. Contractors favor them for their reduced labor costs and faster project turnaround.

The arrowhead anchors are expected to grow at a significant CAGR of 3.2% over the forecast period, driven by their increasing adoption in landscaping, erosion control, and light-duty construction applications. These anchors are lightweight, cost-effective, and offer high holding power in loose or sandy soils, making them ideal for securing geotextiles, fences, and tree supports. Their growth is supported by the rising number of environmental restoration and slope stabilization projects funded by the government and conservation agencies. Arrowhead anchors are also gaining traction in temporary event infrastructure and agricultural settings where quick and reversible anchoring solutions are essential. Their versatility, combined with easier manual installation methods, is propelling their rapid market expansion.

Application Insights

The commercial segment dominated the U.S. earth anchors market with the highest revenue share of 76.1% in 2024, primarily due to large-scale infrastructure, utility, and industrial construction projects. Applications such as highway retaining walls, bridge foundations, solar and wind energy farms, and communication towers require high-capacity anchoring systems for structural stability. Earth anchors are also extensively used in commercial landscaping, retaining structures, and utility pole stabilization. Government investments under programs like the Bipartisan Infrastructure Law have further accelerated demand from the commercial sector. The need for long-lasting, high-performance anchoring solutions has positioned commercial use as the leading application category, especially in geotechnically challenging regions.

The residential segment is expected to grow significantly at a CAGR of 2.6% over the forecast period, as homeowners increasingly invest in foundation repair, retaining walls, and property-level erosion control. Urban sprawl, especially in the Sun Belt states, is driving new home construction that requires cost-effective, easy-to-install anchoring systems for deck supports, fencing, and outbuildings. In addition, aging homes in areas prone to soil shifting or floods are being retrofitted using earth anchors, particularly screw piles and small-scale arrowhead systems. Rising awareness of structural safety, combined with greater accessibility to DIY-friendly anchoring products, is fueling rapid adoption in the residential sector. Sustainability-conscious homeowners are also opting for earth anchors in green landscaping and solar panel installations.

Key U.S. Earth Anchors Company Insights

Some of the key players operating in the U.S. market include American Earth Anchors and MacLean Civil Products.

-

American Earth Anchors, based in Massachusetts, manufactures high-performance, portable earth anchoring systems. Their products, such as Penetrator®, Arrowhead, and Bullet anchors, are widely used for tents, signs, erosion control, utilities, and marine applications. The company focuses on ease of installation, corrosion resistance, and versatility across industries.

-

MacLean Civil Products, a division of the MacLean-Fogg Company, is a leading U.S. manufacturer of helical and driven anchoring systems. It serves sectors such as power utilities, civil construction, and telecom infrastructure. Known for its durable, engineered anchoring solutions, the company emphasizes quality and field performance.

Platipus Anchors USA and Foundation Technologies, Inc. are some of the emerging participants in the U.S. earth anchors market.

-

Platipus Anchors USA represents the American operations of the UK-based Platipus Anchors Ltd. It specializes in percussion-driven earth anchoring systems for landscaping, geotechnical, and construction applications. The company is known for innovative, environmentally friendly anchoring solutions that require no excavation or concrete.

-

Foundation Technologies, Inc. is a U.S.-based provider of geotechnical and structural foundation products. It offers helical piers, earth anchors, and soil retention systems for infrastructure, commercial construction, and repair projects. The company partners with engineers and contractors to deliver custom anchoring solutions for complex ground conditions.

Key U.S. Earth Anchors Companies:

- American Earth Anchors

- MacLean Civil Products

- Milspec Anchors

- Earth Contact Products (ECP)

- Platipus Anchors USA

- Nucor Skyline

- Foundation Technologies, Inc.

- Allied Bolt Products LLC

- Williams Form Engineering Corp.

- Anchor Manufacturing, Inc.

Recent Developments

-

In March 2025, Platipus Anchors Ltd was acquired by Minova, significantly expanding Minova’s global infrastructure-ground support portfolio through the addition of Platipus’s mechanical anchoring expertise.

U.S. Earth Anchors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 472.4 million

Revenue forecast in 2033

USD 602.5 million

Growth rate

CAGR of 3.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S

Key companies profiled

American Earth Anchors; MacLean Civil Products; Milspec Anchors; Earth Contact Products (ECP); Platipus Anchors USA; Nucor Skyline; Foundation Technologies, Inc.; Allied Bolt Products LLC; Williams Form Engineering Corp.; Anchor Manufacturing, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Earth Anchors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. earth anchors market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Arrowhead Anchors

-

Bullet Anchors

-

Duckbill Anchors

-

Screw Pile Anchors

-

Auger Anchors

-

Other Product Types

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.