- Home

- »

- Homecare & Decor

- »

-

U.S. Educational Toys Market Size, Industry Report, 2030GVR Report cover

![U.S. Educational Toys Market Size, Share & Trends Report]()

U.S. Educational Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Building & Construction Sets, Role Play Toys), By Age (Toddlers, Preschoolers), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-238-9

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Educational Toys Market Size & Trends

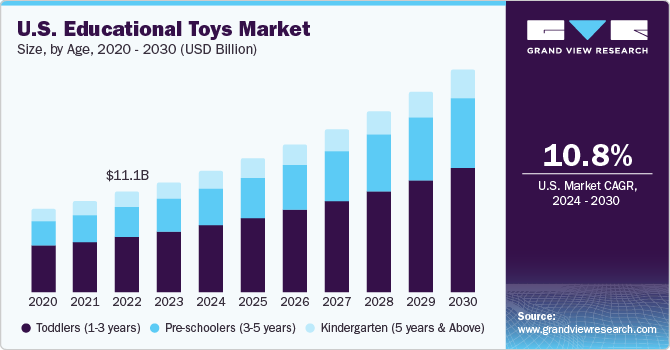

The U.S. educational toys market size was estimated at USD 12.19 billion in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. The projected growth can be attributed to factors such as increasing consciousness among parents and educators regarding significance of cognitive development accomplished through educational toys, growing awareness regarding importance of early childhood education and engaging learning experiences offered by the products. Educational toys are gaining lot of popularity among children and their parents in the United States. In April 2021, the National Association for the Education of Young Children (NAEYC) reported that approximately 90% of preschool-aged children in the U.S. engage with toys.

The U.S. market accounted for a share of 22.6% of the global educational toys market in 2023. The educational toys market in the U.S. has been witnessing rapid growth owing to variety of market drivers. In recent past, science has strongly proved the fact that early childhood educational plays significant role in children’s growth. In times where screen and voice is taking over most of the free time of parents and their children as well, educational toys are providing unparalleled solutions to families while reducing their screen time. These toys are designed and developed in such a way that they will help children to learn new things while they engage in the playful experiences.

Such tools play important role in early childhood education, as concentration is a difficult for children; however, engaging activities which involves games and toys is something they will always admire. This adds aspect of willingness and interest in the activity and improves possibility of attaining the desired results. Parents working in factories and offices and government job in the United States spend most of their time in work and have to provide children with interesting toys and games in order to nurture them even in their absence. These factors are assisting this market to grow at expected rate.

Screens have occupied modern lives and children are no exception to it. However, the growing conscious efforts to reduce their screen time has resulted in upsurge in demand of educational toys. Simultaneously, like every other consumer good this industry is experiencing demand for sustainably developed products. Often, educational toys manufactured by companies, which prioritize adoption of environment friendly practices, are developed through eco-consciousness while utilizing sustainably sourced materials and cruelty free production methods.

According to a survey conducted by the Toy Association among U.S. parents in 2023, 45% of those under the age of 40 take into account the environmental impact of toys when making purchasing choices. In 2024, toymakers are likely to focus on sustainability not only by adopting eco-friendly materials but also by embracing a comprehensive approach that aligns with the shifting values of consumers.

Market Concentration & Characteristics

The U.S. educational toys industry is growing at accelerating pace and growth stage is identified as high. This market is characterised with presence of companies, which operate of global and larger scale. In addition, many companies have entered this market in recent decades while prioritizing consumer demands in designing their products. The combination of fun and learning accomplished with diligently designed products is generating demand for the market.

Degree of innovation is moderate in the industry. Companies often adopt innovation as strategy in order to deliver improved products, technology led solutions and enhanced experiences. New product development, customer retention, competitive advantage are the results companies aim for through innovation. Through use of innovation, key market participants launch products, which can stimulate children’s creativity, problem-solving abilities, and cognitive development. In October 2023, Toycra launched the Open Ended product range, which marks a milestone in the educational toys market, highlighting a commitment to providing high levels of engagement and catering to children's individual skills.

The level of M&A (mergers & acquisitions) is moderate in the industry. Often companies in this market also adopt partnerships and collaborations as prime strategy to advance their well-thought plans about growth and expansion. For instance, in March 2023, the company collaborated with PlayMonster to expand PlayMonster's portfolio to include more of the Playskool brand in 2024. Playskool, a subsidiary of Hasbro, is renowned for its educational toys designed for young children.

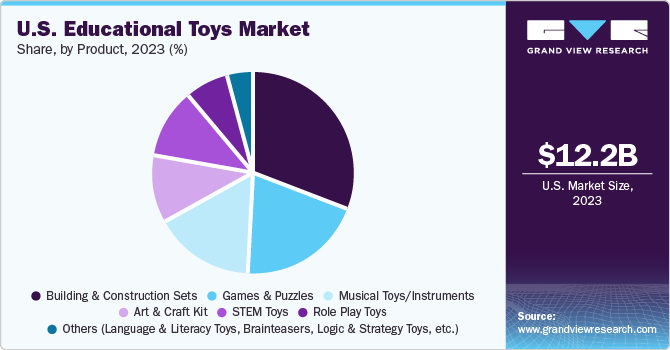

Product Insights

Building & construction sets accounted for a share of 30.9% in 2023. The other products types include role play toys, art & craft kit, STEM toys, games & puzzles, music toys, instruments, language and literacy toys, brain teasers and more. Versatility and resourcefulness of constructions sets attract more consumers. These toys attract more attention from children owing to same factors. Through activities such as experiment, design, and construct, children engage in cognitive improvements unknowingly. These sets encourage them to use their imaginations as well as make them aware about basic fundamentals of the spatial awareness and physical world.

The demand for STEM toys is expected to grow at a CAGR of 15.0% from 2024 to 2030. STEM is abbreviation commonly used for Science, Technology, Engineering, and Math. Children in age group of 5 years and above generally like these games and toys as they involve relatively complex mechanisms and processes in it. By engagement with the STEM toys, children can develop fundamentals for abilities such as problem-solving, critical thinking, and fine motor skills.

Distribution Channel Insights

The sale of educational toys through offline distribution channels accounted for a share of 66.6% in 2023. Offline distribution channels include places such as supermarkets & hypermarkets, convenience stores, departmental stores, and specialty stores. In addition, such toys are available at different shopping malls and in local marketplaces as well. These places are easily accessible for consumers while they go through their routine days. Furthermore, factors such as immediate possession and availability of opportunity to examine the products at the time of purchase adds to the offline shopping experience.

The online sales of educational toys are expected to grow at a CAGR of 12.8% from 2024 to 2030. The online shopping experience offers absolute privacy while assisting customers with information regarding large range of products, refund and return policies, delivery time required variety of payment alternatives, product descriptions, material descriptions, and the reviews of previous buyers. These aspects are expected to fuel online presence of the industry in upcoming years.

Age Insights

The educational toys market for toddlers accounted for a share of 54.7% in 2023. The industry is largely driven by toys designed for this age group (1-3 years). Parents and caregivers exceedingly prefer educational toys for toddlers that highlight hands-on engagement and skill improvement. Things like motor skills, spatial awareness and problem-solving abilities are enhanced through use of toys such as building blocks, shape sorters, and stacking toys. Instinctive curiosity and keenness to learn more about things presented in front of their eyes adds to the overall influence of the toys.

The demand for educational toys designed for pre-schoolers (3 - 5 years) is expected to grow at a CAGR of 11.9% from 2024 to 2030. A little complicated than the toys for toddlers, these products include Memory games, alphabet games, floor puzzles, building blocks, counting games, math games, and art books as well. After initial phase of developing spatial awareness and basic motor skills, parents prefer buying these products for their pre-schoolers in order to introduce them to things such as logic, math, reading fundamentals, sensory and focus skills.

Key U.S. Educational Toys Company Insights

The market is characterized by the presence of globally recognized brands, which have been commonly occupying households in the United States from last few decades. In addition, new companies are also positioning themselves to be exclusive educational toy makers. The market is competitive in nature as all the prime market participants adopt various strategies such as partnerships with international brands, innovation, and online distribution to enhance their market share.

Key U.S. Educational Toys Companies:

- Melissa & Doug

- Mattel, Inc.

- VTech Holdings Limited

- Hasbro

- Osmo

- Sphero, Inc.

- MindWare, Inc.

- Fat Brain Toys

- KinderLab Robotics

- VEX Robotics

Recent Developments

-

In November 2023, LeapFrog Enterprises, Inc., a brand owned by VTech, unveiled new additions to its infant and preschool product lines.

-

In September 2023, Melissa & Doug revealed the opening of its inaugural physical store at The Westchester, an upscale shopping mall in White Plains, New York. The 1,600 square feet space highlights a curated selection of the brand's best-selling toys across various categories, including learning toys, puzzles, baby and toddler products, pretend play sets, and arts & crafts.

U.S. Educational Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.44 billion

Revenue Forecast in 2030

USD 24.86 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Actual data

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, distribution channel, age

Key companies profiled

Melissa & Doug; Mattel, Inc.; VTech Holdings Limited; Hasbro; Osmo; Sphero, Inc.; MindWare, Inc.; Fat Brain Toys; KinderLab Robotics; VEX Robotics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Educational Toys Market Report Segmentation

This report forecasts growth at country level and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. educational toys market report based on product, distribution channel, and age:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building & Construction Sets

-

Role Play Toys

-

Art & Craft Kit

-

STEM Toys

-

Games & Puzzles

-

Musical Toys/Instruments

-

Others (Language & Literacy Toys, Brainteasers, Logic & Strategy Toys, etc.)

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toddlers (1-3 years)

-

Pre-schoolers (3-5 years)

-

Kindergarten (5 years & Above)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Others (Departmental Stores, Specialty Stores)

-

-

Frequently Asked Questions About This Report

b. The U.S. educational toys market size was estimated at USD 12.19 billion in 2023 and is expected to reach USD 13.44 billion in 2024.

b. The U.S. educational toys market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 24.86 billion by 2030.

b. Building & construction sets dominated the U.S. educational toys market with a share of 30.8% in 2023. This is attributable to the growing demand for building and construction toys, which act as a highly suitable tool to educate children about spatial awareness and the physical world.

b. Some key players operating in the U.S. educational toys market include Melissa & Doug; Mattel, Inc.; VTech Holdings Limited; Hasbro; Osmo; Sphero, Inc.; MindWare, Inc.; Fat Brain Toys; KinderLab Robotics; and VEX Robotics.

b. Key factors that are driving the market growth include increasing consciousness among parents and educators regarding the significance of cognitive development accomplished through educational toys, coupled with the growing awareness regarding the importance of early childhood education and engaging learning experiences offered by the products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.