- Home

- »

- Consumer F&B

- »

-

U.S. Egg Market Size, Share & Growth, Industry Report 2033GVR Report cover

![U.S. Egg Market Size, Share & Trends Report]()

U.S. Egg Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Brown Eggs, White Eggs), By Production Category (Cage-Free, Organic, Pasture-Raised), By End Use Application (B2B, B2C), And Segment Forecasts

- Report ID: GVR-4-68040-847-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Egg Market Summary

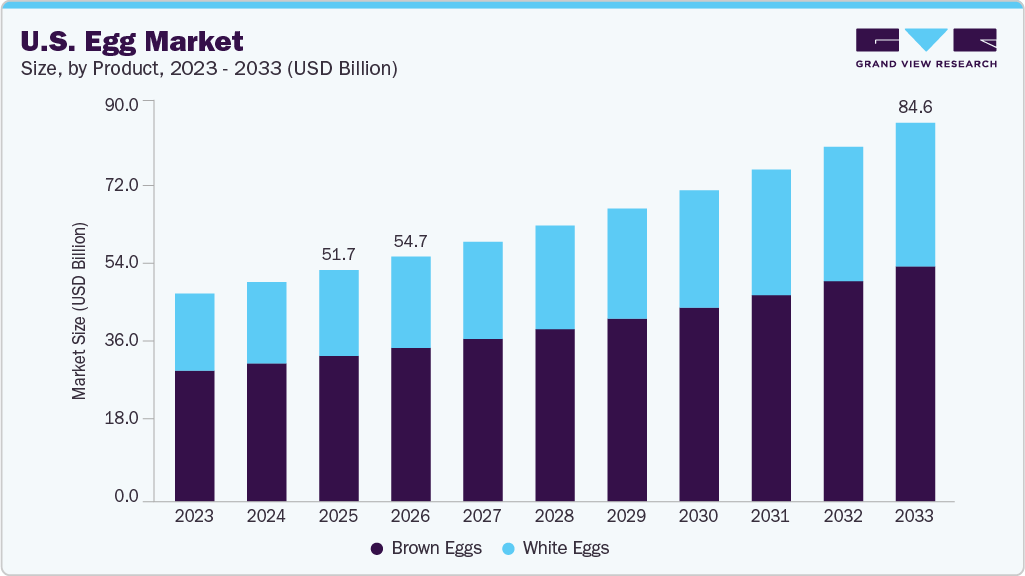

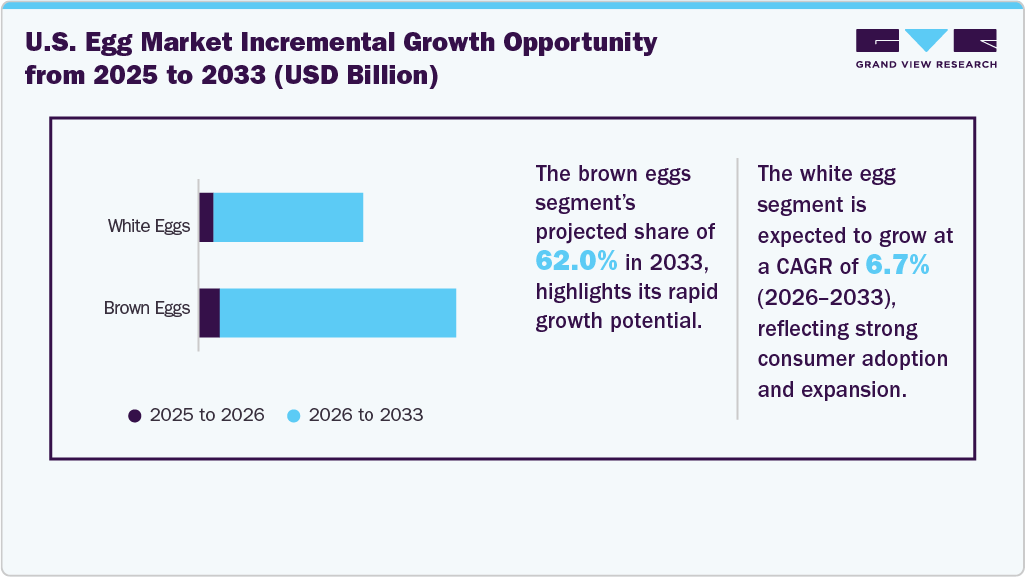

The U.S. egg market size was estimated at USD 51.70 billion in 2025 and is projected to reach USD 84.60 billion by 2033, growing at a CAGR of 6.4% from 2026 to 2033. The demand for eggs and egg products in the U.S. is increasing as consumers prefer affordable, nutrient-dense protein sources that align with modern, busy lifestyles.

Key Market Trends & Insights

- By product, the brown eggs segment dominated the market with the largest revenue share of 62.8% in 2025.

- By production category, the pasture-raised segment dominated the market with the largest revenue share in 2025.

- By end use application, the B2B segment dominated the market with the largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 51.70 Billion

- 2033 Projected Market Size: USD 84.60 Billion

- CAGR (2026-2033): 6.4%

Eggs and egg products offer high protein, convenience, and versatility, driving demand in protein-rich and clean-label foods.The U.S. eggs industry continues to grow, supported by strong production capacity and steady productivity gains. According to the USDA National Agricultural Statistics Service (NASS), total egg production in the U.S. reached 109 billion eggs in 2024. The table-egg layer flock averaged around 311 million hens, maintaining high productivity levels at nearly 79 eggs per 100 layers per day. The value of egg production increased to USD 21.0 billion in 2024, up from USD 17.9 billion in 2023, reflecting volume stability and favorable pricing. These consistent productivity levels, coupled with advancements in layer management and automation, continue to strengthen supply resilience and ensure stable availability of shell, liquid, and dried egg products across food processing and retail segments nationwide.

Moreover, technological advancements and modernization across egg processing facilities are driving industry efficiency and product diversification. Investments in automation, cold chain logistics, and advanced grading systems have enhanced product quality and traceability, supporting compliance with USDA and FDA food safety standards. In addition, the shift toward cage-free and animal welfare certified production, encouraged by both consumer preferences and evolving state regulations, is reshaping supply chains and attracting premium pricing opportunities. These advancements strengthen the capacity of the market, supporting sustained growth and expanding market reach.

Product Insights

The brown eggs segment led the U.S. eggs market, accounting for the largest revenue share of 62.8% in 2025. This growth is driven by increasing consumer preference for premium, organic, and cage-free products. Consumers often perceive brown eggs as higher in quality, more natural, and ethically produced, despite their nutritional composition being comparable to that of white eggs. The growing focus on sustainability, animal welfare, and transparency in the egg market, supported by major retailers and foodservice chains, such as Walmart, Kroger, and McDonald’s, has accelerated the industry’s shift toward cage-free and specialty egg production. This trend reflects a broader shift toward responsible consumption and a growing consumer preference for higher-quality food products. Although brown eggs are typically priced at a premium, their strong association with health, ethical sourcing, and product integrity is expected to drive their demand over the forecast period.

The white eggs segment is projected to grow at the fastest CAGR of 6.7% over the forecast period. The widespread use of white eggs in household consumption, commercial baking, and foodservice operations is contributing to this dominance. The affordability, longer shelf life, and high production efficiency of layer hens also favor the product demand. The large-scale commercial production of white eggs allows producers to achieve strong economies of scale, keeping retail prices competitive and supply consistent across all regions. In addition, white eggs remain the preferred choice in mass-market grocery retail and industrial food manufacturing due to their standardized sizing and grading. The consistent availability and cost-effectiveness ensure that white eggs continue to dominate the U.S. industry.

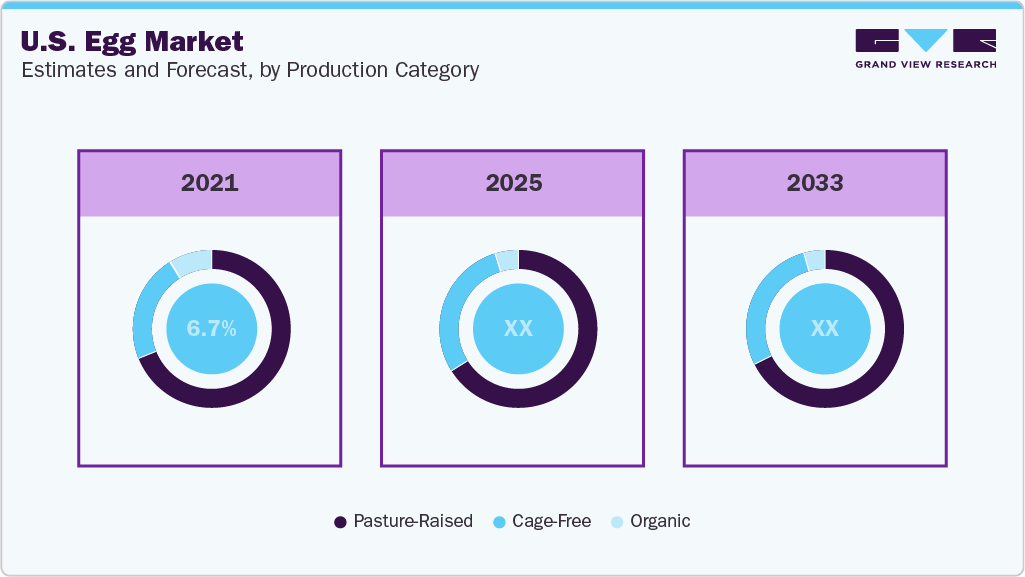

Production Category Insights

The pasture-raised production category segment held the largest revenue share of the U.S. eggs industry in 2025. More consumers now care about animal welfare, food transparency, and natural production, boosting demand for pasture-raised eggs. People consider these eggs healthier because the hens have access to the outdoors, more space, and a natural diet. This aligns with current trends in clean labels and wellness. As incomes grow and the willingness of consumers to pay more increases, sales of pasture-raised eggs are expected to increase, even though they cost more than regular or cage-free eggs. For example, Vital Farms, a producer of pasture-raised eggs, reported strong results in the second quarter of 2025, with earnings ending June 29, 2025. Net revenue increased by 25% year over year to USD 184.8 million from USD 147.4 million, while earnings rose by nearly USD 30 million, driven by continued demand for pasture-raised eggs. Clear marketing, easy-to-read labels, and third-party certifications have helped build trust and differentiate brands.

The organic segment is projected to grow at the fastest CAGR from 2026 to 2033. This growth is driven by rising consumer awareness of health, sustainability, and ethical sourcing. Organic eggs are produced under certified standards that prohibit the use of synthetic pesticides, antibiotics, and genetically modified feed, ensuring a cleaner and more transparent supply chain. Consumers increasingly associate organic labeling with superior nutritional quality and environmental responsibility, leading to higher demand across retail and foodservice channels. Major producers are investing in organic-certified facilities to capture this value-added opportunity, supported by the growing availability of organic feed and improved certification infrastructure. Although production costs are higher, the segment benefits from strong price premiums and brand differentiation, making it a key contributor to the growth of the U.S. industry.Top of FormBottom of Form

End Use Application Insights

The B2B application segment dominated the egg industry, accounting for the largest revenue share in 2025. This can be attributed to the widespread use of eggs across bakery, confectionery, ready-to-eat meals, and processed food formulations. In 2024, according to the United Egg Producers (UEP), of the 258 million cases of eggs produced in the U.S., well over half were distributed as shell eggs through retail outlets, approximately 29% were processed into egg products, and nearly 12.0% were sold through foodservice channels. Eggs and egg products, including liquid, frozen, and dried forms, are used as essential functional ingredients due to their emulsifying, binding, foaming, and coloring properties. The growing demand for high-protein, clean-label, and minimally processed foods is driving the usage of eggs in packaged food. Manufacturers are incorporating egg ingredients to enhance texture, flavor, and nutritional content in baked goods, sauces, dressings, and snacks. In addition, the expansion of quick-service restaurants (QSRs) and ready-to-cook meal kits has strengthened demand consistency within this segment. Continuous innovation in pasteurized and shelf-stable egg products has also led to improved safety and convenience for industrial applications.

The B2C segment is projected to grow at the fastest CAGR from 2026 to 2033. This growth is driven by rising consumer focus on nutrition, affordability, and convenience in home meal preparation. According to the United Egg Producers (UEP), per capita egg consumption in the U.S. reached 273 eggs in 2024, marking a 15% increase over the past two decades. This rise reflects consumer preference for eggs as an economical, high-quality protein source that fits modern dietary and wellness trends. The growing popularity of at-home cooking, protein-rich breakfasts, and versatile meal options further accelerated this trend. In addition, innovations such as pre-cooked, liquid, and pasteurized egg products have enhanced convenience and safety, supporting higher household penetration.

The rapid expansion of e-commerce platforms, growing consumer preference for doorstep delivery, and the increasing availability of fresh and specialty egg products through digital grocery channels are also contributing to the growth of this segment. Retailers such as Walmart, Amazon Fresh, Instacart, and Kroger Online are expanding their cold-chain logistics and online assortments to include organic, cage-free, and value-added egg products. The convenience of subscription models and contactless delivery has further strengthened online penetration, particularly among younger, urban consumers seeking freshness, transparency, and time efficiency in their food purchases.

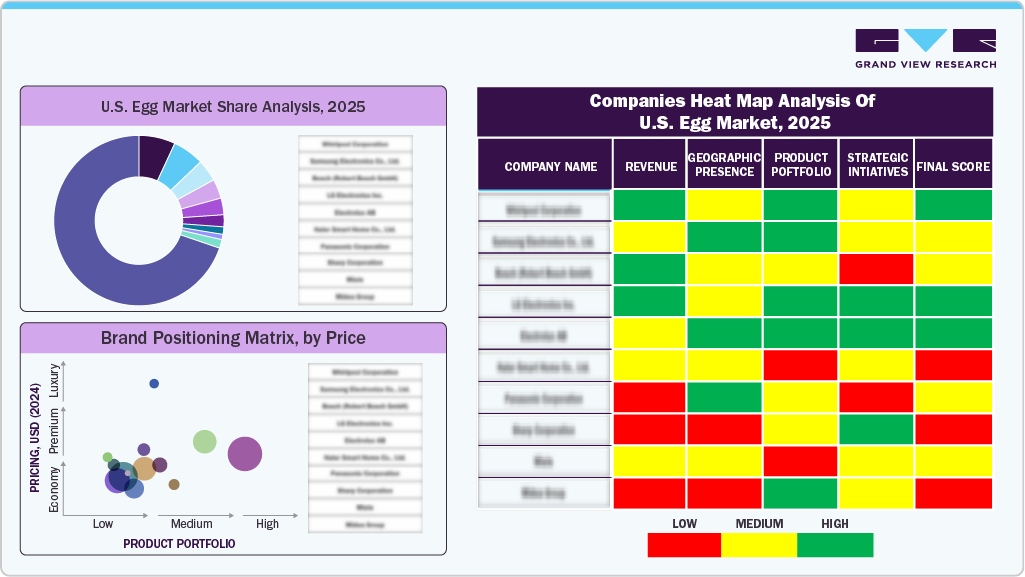

Key U.S. Egg Company Insights

Some of the key players in the U.S. eggs industry include Cal-Maine Foods, Inc.; Michael Foods, Inc.; Rose Acre Farms, Inc; and Hillandale Farms.

-

Michael Foods, Inc., based in the U.S., is a food processor specializing in value-added egg products, dairy, and refrigerated potatoes. Its egg portfolio includes liquid eggs, egg whites, and hard-cooked products for foodservice and retail. The company also processes ultra-pasteurized dairy and refrigerated potato products, primarily serving the central U.S. market.

-

Cal-Maine Foods, Inc. is a producer and distributor of shell eggs in the U.S., engaged in operating a network of farms and processing facilities across multiple states. Its offerings include conventional, cage-free, brown, organic, pasture-raised, and nutritionally enhanced eggs, serving retail, food-service, and industrial customers. Cal-Maine focuses on high-volume production, efficiency, and scale.

Key U.S. Egg Companies:

- Cal-Maine Foods, Inc.

- Michael Foods, Inc.

- Rose Acre Farms, Inc

- Hillandale Farms

- Daybreak Foods Inc.

Recent Developments

-

In May 2023, Daybreak Foods, Inc. acquired Hen Haven, LLC and Schipper Eggs, LLC. These acquisitions enabled the former to grow its business model by expanding its egg product portfolio and widening the customer base. This acquisition was also expected to add locations in Clearfield, Iowa and Holland, Michigan, bringing the total to 16 locations, with over 1,000 employees, and more than 19 million hens across the Midwest.

U.S. Egg Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 54.70 billion

Revenue forecast in 2033

USD 84.60 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, production category, end use application

Country scope

U.S.

Key companies profiled

Cal-Maine Foods, Inc.; Michael Foods, Inc.; Rose Acre Farms, Inc.; Hillandale Farms; Daybreak Foods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

U.S. Egg Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. egg market report based on product, production category, and end use application:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Brown Eggs

-

White Eggs

-

-

Production Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cage-Free

-

Organic

-

Pasture-Raised

-

-

End Use Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2B

-

Processing Industry

-

Bakery & Confectionery

-

Processed and Convenience Foods

-

Dairy and Dairy Products

-

Nutritional & Functional Food

-

-

Foodservice Industry

-

-

B2C

-

Hypermarket/Supermarket

-

Grocery Stores

-

Online

-

Company-Owned Websites

-

E-Commerce

-

-

Others (Wholesalers, etc.)

-

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.