- Home

- »

- Next Generation Technologies

- »

-

U.S. Electric Boat Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Electric Boat Market Size, Share & Trends Report]()

U.S. Electric Boat Market (2025 - 2030) Size, Share & Trends Analysis Report By Boat Type (Leisure Boats, Fishing Boats), By Propulsion Type (Outboard Electric Propulsion), By Battery Type, By Power Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Boat Market Summary

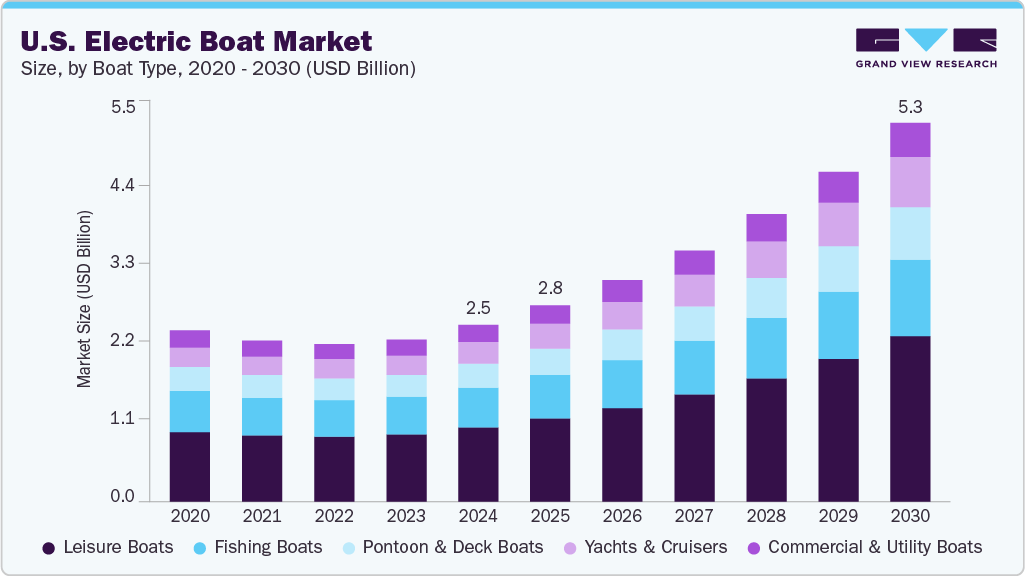

The U.S. electric boat market size was estimated at USD 2.49 billion in 2024 and is projected to grow at a CAGR of 14.0% from 2025 to 2030. The market is driven by a combination of environmental awareness, consumer demand for sustainable recreational options, and supportive policies aimed at reducing emissions in the maritime sector. With the country hosting one of the world’s largest recreational boating industries, there is a growing shift among boat owners, marina operators, and charter businesses toward cleaner alternatives. The increasing emphasis on decarbonizing transportation, along with the availability of government incentives for electric mobility, is encouraging both manufacturers and consumers to transition to electric-powered boats.

Technological advancements are playing a pivotal role in the evolution of the electric boat market in the U.S. Innovations in battery technology, particularly the development of high-capacity, fast-charging lithium-ion batteries, are extending the range and reducing charging times for electric boats. Furthermore, the integration of smart navigation systems, onboard energy management tools, and solar charging capabilities is enhancing the performance and appeal of electric boats. Companies are also exploring the use of lightweight composite materials to improve energy efficiency. These innovations improve user experience and address core challenges such as range anxiety and charging convenience.

Investment activity in the U.S. electric boat market is accelerating as both established marine manufacturers and startups enter the space. Prominent companies such as Brunswick Corporation and Vision Marine Technologies are allocating significant resources to develop new electric boat models and expand their production capabilities. In addition, venture capital and private equity firms are backing startups focusing on battery systems, marine electric drivetrains, and charging infrastructure. Public and private marinas are also investing in dockside charging stations, particularly in high-traffic recreational boating areas such as the Great Lakes, Florida, and the Pacific Northwest.

The regulatory landscape in the U.S. increasingly supports electric boating, although it varies by state and locality. Through the Environmental Protection Agency (EPA) and the Department of Energy (DOE), the federal government promotes cleaner marine transportation via grants and research funding. States such as California and New York are implementing stricter emissions regulations for internal combustion engine (ICE) boats and providing incentives for electric alternatives. In some regions, policies are being introduced to phase out gas-powered motors on certain lakes or waterways, further boosting demand for electric options. These regulations are helping to standardize the market and accelerate adoption.

Despite its growth potential, the U.S. electric boat market faces several restraints. High upfront costs associated with electric boat purchase and infrastructure installation remain a significant barrier for many consumers. Limited charging infrastructure, particularly outside of major boating hubs, also hampers broader adoption. In addition, range limitations and longer charging times compared to refueling traditional gas-powered boats can deter potential buyers. Some consumers also remain hesitant due to a lack of awareness or misconceptions about the performance and durability of electric boats. Overcoming these barriers will require continued technological innovation, greater infrastructure investment, and targeted consumer education.

Boat Type Insights

The leisure boats segment accounted for the largest share of 42.2% in 2024. The expansion of marine infrastructure customized to electric vessels supports the growth of leisure electric boating. Many marinas, particularly in popular boating destinations such as Florida, California, and the Great Lakes, are now offering charging stations for electric boats. Public and private investments are also interested in developing sustainable waterfront facilities that cater specifically to electric recreational boating. This infrastructure build-out makes electric boat ownership more practical and encourages adoption by reducing range anxiety and charging concerns.

The yachts & cruisers segment is expected to grow at the highest CAGR from 2025 to 2030. The growing desire among affluent consumers for sustainable luxury experiences is boosting demand for electric yachts and cruisers. Many high-net-worth individuals are concerned about their environmental impact and are actively seeking eco-friendly alternatives in their leisure activities. Electric yachts provide a zero-emission, quieter, and smoother experience on the water, making them a preferred option for environmentally conscious luxury travelers. This aligns with broader societal shifts toward green luxury, particularly in coastal regions such as California and Florida, where sustainability is becoming a lifestyle priority.

Propulsion Type Insights

The outboard electric propulsion segment accounted for the largest share in 2024. The simplicity and flexibility of installation fuels growth of the segment. Unlike inboard systems that often require complex integration, electric outboard motors are easy to mount and remove, making them an attractive option for boat owners who want to retrofit their existing vessels. This do-it-yourself compatibility significantly lowers the entry barrier for users transitioning from gasoline engines, especially in recreational boating markets.

The hybrid propulsion segment is projected to grow at a significant CAGR in the forecast period. The growing demand for extended range and operational flexibility fuels the growth of hybrid propulsion. While fully electric boats offer zero emissions and quieter operation, many boaters in the U.S., particularly those involved in long-distance cruising or offshore fishing, require the ability to travel long distances without the need for frequent recharging. Hybrid systems allow users to operate on electric power in environmentally sensitive areas or for short trips while still having the reliability and range of a combustion engine when needed. This dual-mode capability makes hybrids especially attractive in a market that includes large lakes, coastal routes, and offshore excursions.

Battery Type Insights

The lithium-ion batteries segment accounted for the largest share in 2024. The high energy density in lithium-ion batteries compared to traditional lead-acid batteries drives the growth of the market. These batteries can store significantly more energy in a smaller, lighter package. This is critical for marine applications where space and weight are at a premium. A lighter battery reduces the overall weight of the boat, which improves speed, range, and efficiency, key concerns for both recreational and commercial users. As boaters seek longer run times and improved performance, lithium-ion batteries are proving to be the most viable option.

The lead-acid batteries segment is expected to register a notable CAGR from 2025 to 2030.In the U.S., a large segment of the electric boat market consists of pontoon boats, small fishing boats, and inland watercraft used on lakes and rivers. These vessels typically operate at low speeds and over short distances, making them ideal for the energy capacity and discharge profiles of lead-acid batteries. In such applications, the lower energy density and heavier weight of lead-acid batteries are less of a limitation, allowing them to provide reliable power without incurring the higher costs of lithium-based alternatives.

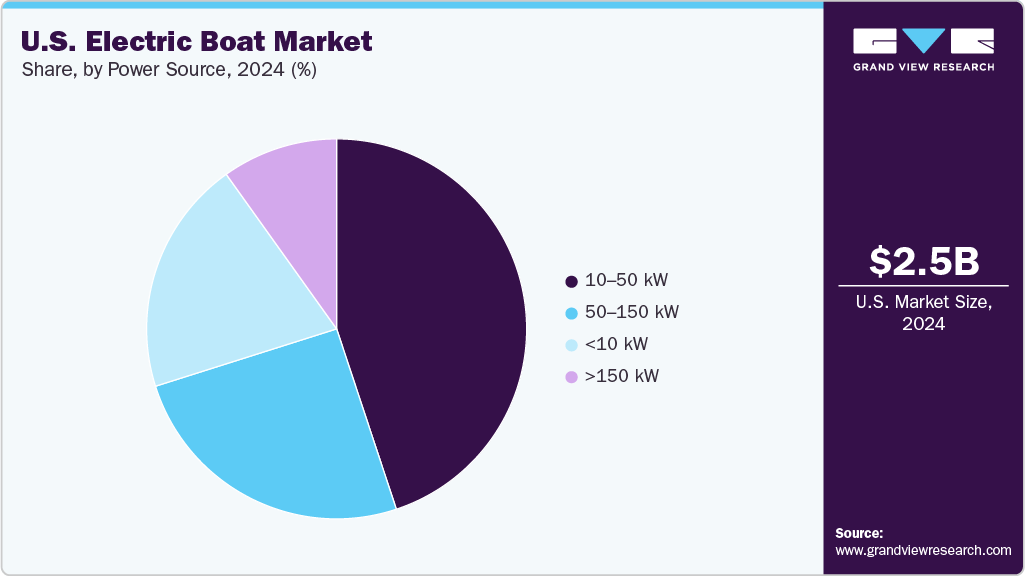

Power Source Insights

The 10-50 kW segment accounted for the largest share in 2024. Electric propulsion systems in the 10-50 kW range provide a strong value proposition for boat owners looking for a balance between cost and performance. Compared to lower-powered systems (<10 kW), they offer better speed and range, which appeals to a broader group of boaters. At the same time, they are significantly more cost-effective and easier to maintain than high-powered electric systems or hybrid solutions. This makes them especially attractive for first-time electric boat adopters and cost-conscious consumers transitioning from internal combustion engines.

The 50-150 kW segment is expected to grow at the fastest CAGR from 2025 to 2030. The 50-150 kW range is well-suited for mid-sized boats, such as day cruisers, cabin cruisers, pontoon boats, and small ferries, vessels that dominate many U.S. waterways. These boats typically require more power than low-speed fishing boats or pontoons but don’t need the high output demanded by large ships. As electric propulsion gains popularity in the recreational boating community, this power segment offers adequate thrust for moderate speeds and longer ranges, enabling boaters to enjoy clean propulsion without compromising on performance.

Key U.S. Electric Boat Market Company Insights

Some of the key players operating in the market include Pure Watercraft, Vision Marine Technologies, Flux Marine, Ingenity Electric, and Navier Boats.

-

Pure Watercraft is a company in the marine industry focused on developing battery-electric propulsion systems for boats as a cleaner, quieter, and more environmentally friendly alternative to traditional gasoline engines. Driven by a commitment to sustainability and innovation, Pure Watercraft quickly gained recognition for its high-performance electric outboards and integrated boat packages, appealing to boaters seeking to reduce emissions and protect waterways.

-

Flux Marine is an innovative company specializing in the design and manufacture of powerful, all-electric outboard motors for the recreational boating industry. The company's flagship product is a 100-horsepower electric outboard motor capable of reaching speeds up to 32 miles per hour with a range of approximately 30 miles on a single charge, which can be fully recharged overnight. The company partners with boat manufacturers such as Scout to integrate its electric motors and battery systems into boats, enhancing performance, sustainability, and user experience while reducing environmental impact by eliminating diesel engines.

Key U.S. Electric Boat Companies:

- Pure Watercraft

- Vision Marine Technologies Inc.

- Ingenity Electric

- Torqeedo GmbH

- Flux Marine

- Navier Boats

- Correct Craft

- X Shore AB

- AB Volvo Penta

- Arc Boats

Recent Developments

-

In May 2025, Arc Boat Company unveiled the Arc Coast, its most affordable electric boat to date, priced at USD 168,000. This 24-foot center console model is designed from the ground up as an electric vessel, offering a 400-horsepower motor and a 226 kWh battery pack, enabling speeds up to 50 mph and 4-5 hours of use on a single charge, with convenient overnight recharging. The Arc Coast features a quiet, emission-free ride and a unique integrated sterndrive motor hidden within the hull, which opens up the entire rear of the boat for swimming and relaxation.

-

In October 2024, Evoy Vita, a provider in marine electrification, announced the launch of its powerful Storm 300+ hp electric outboard motor in the US leisure market, marking a significant milestone in the adoption of high-performance electric boating. This move is highlighted by a partnership with Axopar, the renowned Finnish adventure boat manufacturer, to introduce the AX/E line of electric boats, starting with the AXE 25 model equipped with the Storm 300+ hp outboard. The AX/E series aims to bring the benefits of electric boating, such as silent operation, zero emissions, and increased torque, to recreational users, making the experience both enjoyable and eco-friendly.

U.S. Electric Boat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.76 billion

Revenue Forecast in 2030

USD 5.32 billion

Growth rate

CAGR of 14.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Boat type, propulsion type, battery type, power source, and region

Key companies profiled

Pure Watercraft; Vision Marine Technologies Inc.; Ingenity Electric; Torqeedo GmbH; Flux Marine; Navier Boats; Correct Craft; X Shore AB; AB Volvo Penta;Arc Boats

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Boat Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electric boat market report based on boat type, propulsion type, battery type, and power source.

-

Boat Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Leisure Boats

-

Fishing Boats

-

Pontoon & Deck Boats

-

Yachts & Cruisers

-

Commercial & Utility Boats

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Outboard Electric Propulsion

-

Inboard Electric Propulsion

-

Hybrid Propulsion

-

Solar-Integrated Systems

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion Batteries

-

Lead-acid Batteries

-

Other Advanced Chemistries

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

<10 kW

-

10-50 kW

-

50-150 kW

-

>150 kW

-

Frequently Asked Questions About This Report

b. The U.S. electric boat market size was estimated at USD 2.49 billion in 2024 and is expected to reach USD 2.76 billion in 2025.

b. The U.S. electric boat market is expected to grow at a compound annual growth rate of 14.0% from 2025 to 2030 to reach USD 5.32 billion by 2030.

b. Leisure boats dominated the U.S. electric boat market with a share of 42.2% in 2024. The growth of leisure electric boating is supported by the expansion of marine infrastructure customized to electric vessels.

b. Some key players operating in the U.S. electric boat market include Pure Watercraft; Vision Marine Technologies Inc.; Ingenity Electric; Torqeedo GmbH; Flux Marine; Navier Boats; Correct Craft; X Shore AB; AB Volvo Penta; Arc Boats

b. The market is driven by a combination of environmental awareness, consumer demand for sustainable recreational options, and supportive policies aimed at reducing emissions in the maritime sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.