- Home

- »

- Electronic & Electrical

- »

-

U.S. Electric Shavers Market Size, Industry Report, 2033GVR Report cover

![U.S. Electric Shavers Market Size, Share & Trends Report]()

U.S. Electric Shavers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hybrid, Rotary Shavers, Foil Shavers), By Type (Cord, Cordless), By End-user (Men, Women), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-2-68038-531-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Shavers Market Summary

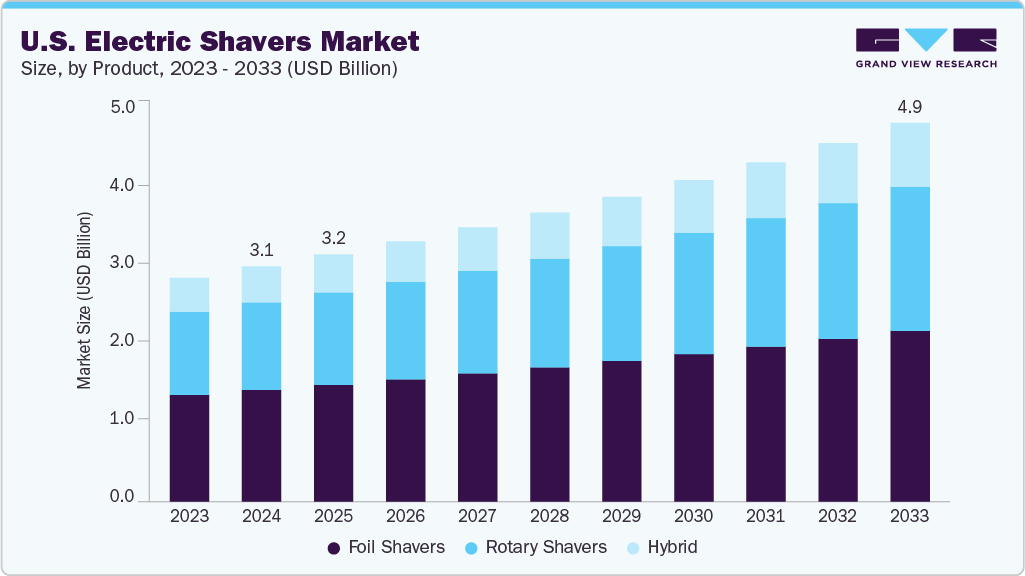

The U.S. electric shavers market size was estimated at USD 3.07 billion in 2024 and is projected to reach USD 4.94 billion in 2033, growing at a CAGR of 5.5% from 2025 to 2033. The increasing demand for electric shavers owing to convenient grooming, rising adoption among women, and a shift in adoption of cordless and hybrid shavers for travel and home use is a major driving factor for market growth during the forecast period.

Key Market Trends & Insights

- The U.S. electric shavers market is growing at a 5.5% CAGR over the forecast period.

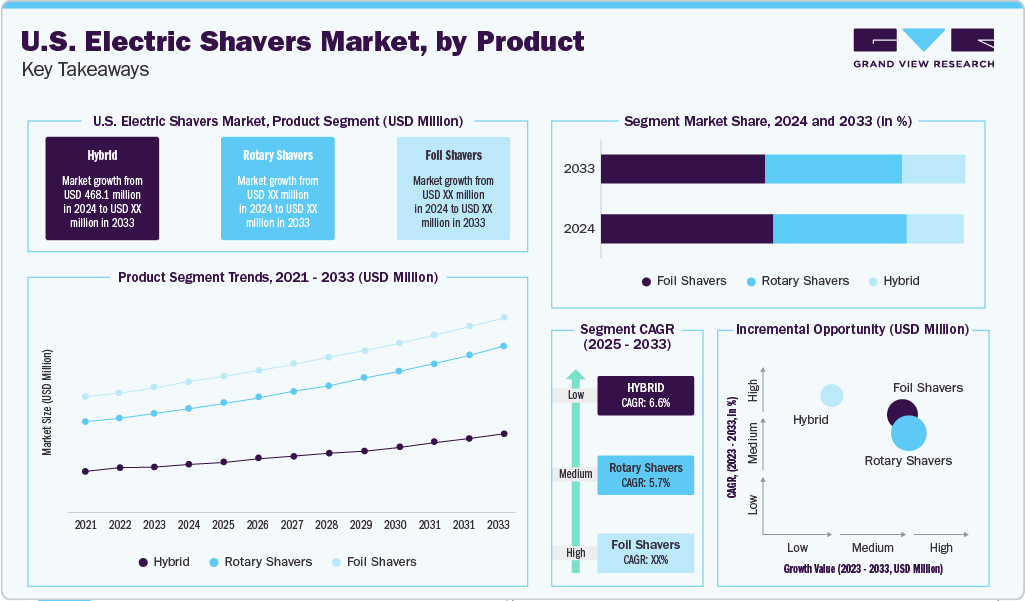

- Based on product, the foil shavers segment in the U.S. electric shavers market accounted for a share of 47.52% in 2024.

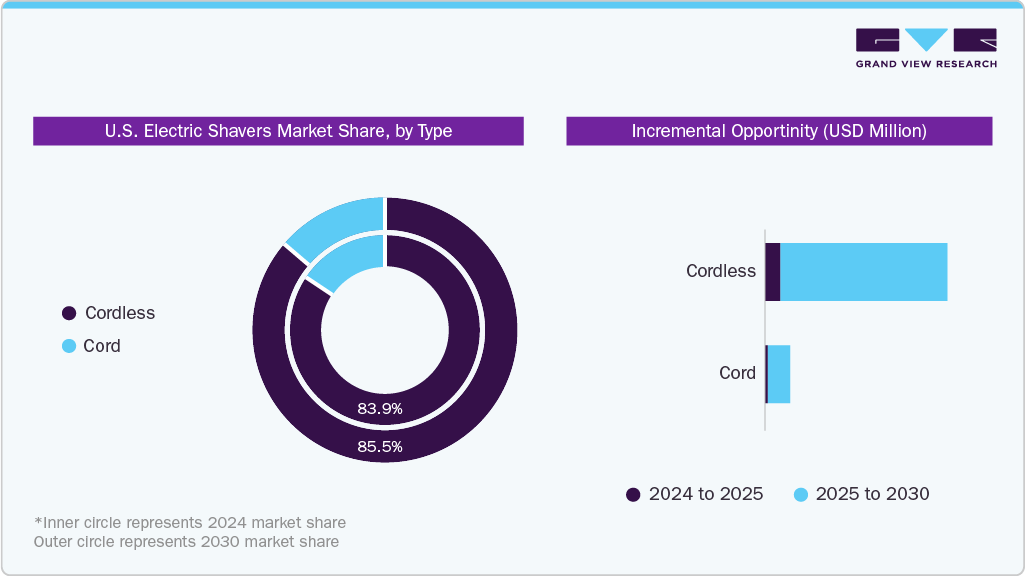

- By type, the cordless segment dominated the U.S. electric shavers market, accounting for a share of 83.95% in 2024.

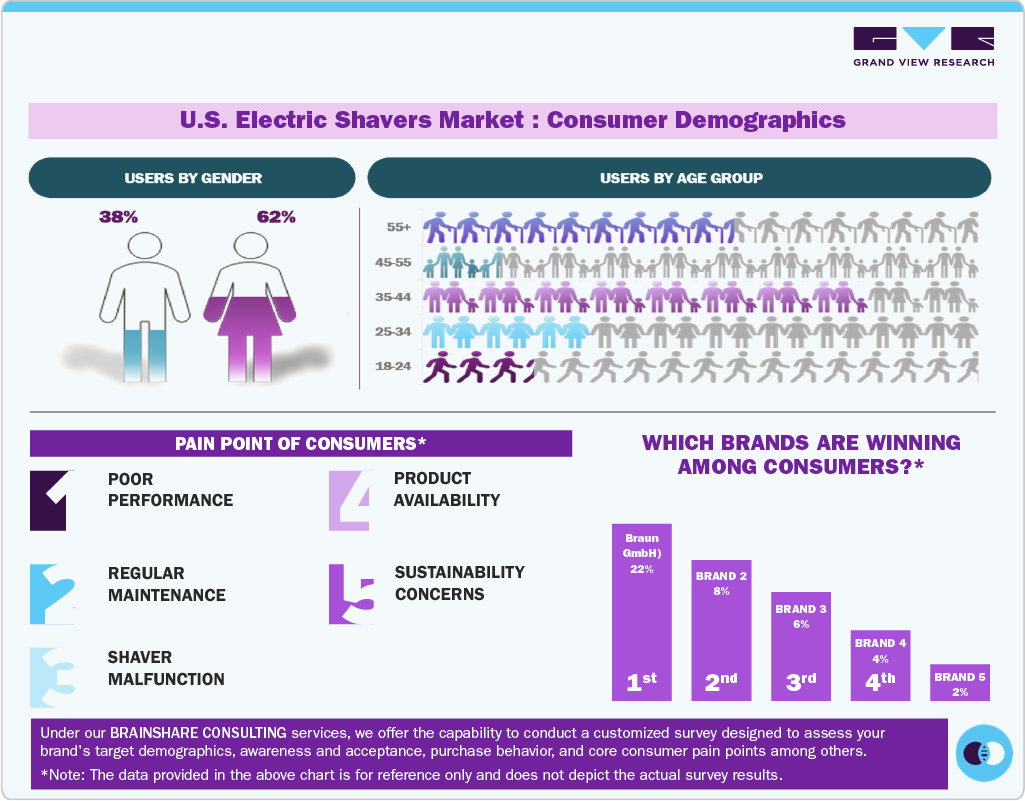

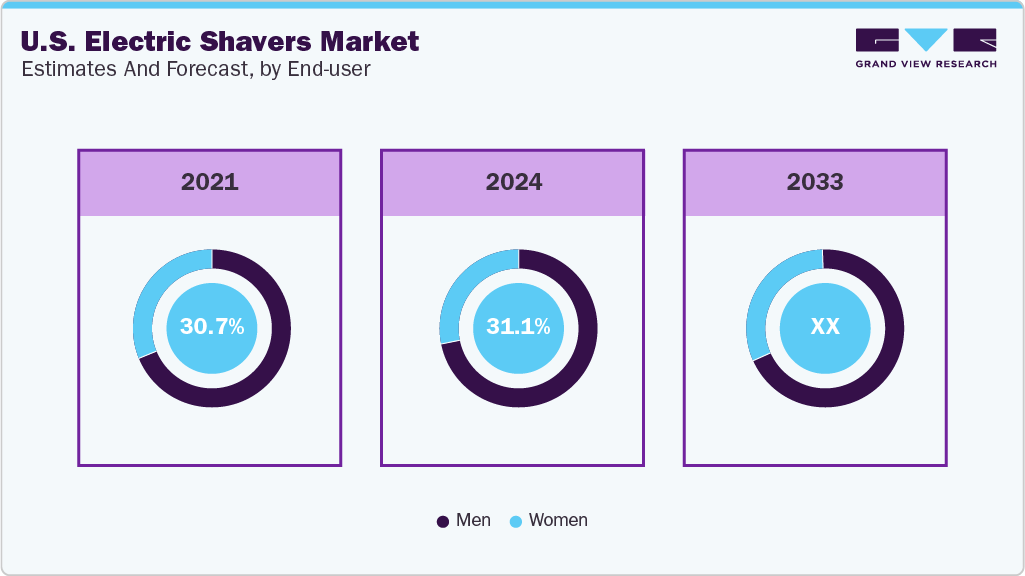

- By end-user, the men segment dominated the U.S. electric shavers market, accounting for a share of 68.94% in 2024.

- Based on the distribution channel, the online segment is growing at a significant CAGR of 6.4% from 2025 to 2033.

Key Market Trends & Insights

- 2024 Market Size: USD 3.07 Billion

- 2033 Projected Market Size: USD 4.94 Billion

- CAGR (2025-2033): 5.5%

- Braun, Philips Norelco, and Panasonic are top brands operating in the U.S electric shavers market.

Furthermore, the demand for electric shavers from online sales channels such as Amazon, eBay, and Walmart bolsters market growth. Increasing awareness of personal hygiene, coupled with the influence of social media and grooming trends in the U.S., is also increasing demand for electric shavers. Manufacturers in the U.S. are introducing technological advancements such as waterproof designs, multi-functional blades, and skin-sensitive features to increase the product's appeal. Integration of rechargeable lithium-ion batteries and smart displays further adds to the appeal of modern electric shavers. For instance, in July 2024, Spectrum Brands, Inc. (Remington) launched the Blader Pro shaver with innovative features including five dual track heads offering efficient and fast shave, power Flex 360° neck for adjusting to the contours, giving a smooth and comfortable finish. Thus, the growing introduction of innovative product advancements to increase the product base is a major driving factor for market growth.Consumers in the U.S. have increased their inclination toward consumer consciousness about personal grooming and hygiene. Lifestyle changes and evolving social norms drive the shift in adoption of electric shavers, which is coupled with growing awareness about skin health and overall appearance, encouraging women to invest more in electric shavers.

Furthermore, advertising campaigns and social media influencers have played a crucial role in educating consumers about the benefits of electric shavers, such as convenience, skin comfort, and efficiency. For instance, manufacturers use YouTube as a major advertising medium to market their products online. It depicts all the important information related to the product and provides consumers with detailed insights. Thus, the growing advertising campaign by manufacturers is a major driving factor for market growth during the forecast period.

Consumer Insights

Consumers in the U.S focus on convenience, personal grooming, and technology integration; these factors have increased the demand for electric shavers due to time-saving benefits and reduced skin irritation compared to traditional razors. The battery-operated, cordless models with quick-charge features have become highly desirable, especially for users with busy lifestyles. The demand for wet/dry shavers also reflects a preference for flexibility and compatibility with existing grooming routines, such as in-shower or pairing with shaving gels. The beauty and grooming tutorials continue to be a key way consumers learn about products, with 67% of Americans aged 18 to 40 engaging with grooming and beauty brands on social media platforms.

Personalization and performance are becoming more important as consumers seek products that cater to individual skin types, beard textures, and grooming habits. Shavers that offer adjustable speed settings, contour-adaptive heads, and specialized attachments such as trimming beards, body hair, or sensitive areas are gaining popularity. The trend also includes a growing demand for multi-functional grooming devices, appealing especially to younger demographics who value versatility and minimal clutter. Companies such as Koninklijke Philips N.V. offer the i9000 Prestige Wet&Dry Electric Shaver under its brand Norelco, integrated with SenseIQ technology that can adapt for intelligent skin comfort. The electric shaver also has a 360°Precision Flexing Head with rotating dual steel precision blades for efficient shaving.

Product Insights

The sale of foil electric shavers accounted for the largest share of 47.52% in 2024. This growth is attributed to their close and precise shaves, especially for daily grooming routines. In addition, these shavers use oscillating blades beneath a thin foil screen, which lifts and cuts hair close to the skin. The growing need of consumers with sensitive skin, coupled with the rising popularity of foil shavers among working professionals and older adults, is a major driving factor for market growth during the forecast period.

The growing Innovation in foil shavers has transformed them into premium grooming tools with advanced features, a major factor aiding market growth. Prominent features such as precision trimmers, LED battery indicators, and hypoallergenic foils further drive consumer satisfaction. For instance, in September 2024, Manscaped, Inc. launched The Chairman Pro electric foil shaver and Premium Face Shaving Kit in the U.S., featuring a dual-head design, SkinSafe tech, a waterproof build, an LED light, a quick five‑minute charge, up to 75 minutes of runtime, and bundled grooming essentials. Leading brands like Braun and Panasonic dominate the foil shaver segment by offering cutting-edge, ergonomically designed products that promise salon-quality grooming results at home.

The hybrid electric shavers segment is expected to expand at the highest CAGR of 6.6% from 2025 to 2033. The increasing demand for hybrid shavers is attributed to features such as dual functionality, which offers both trimming and shaving capabilities in a single device. Furthermore, brands are increasingly focusing on developing trimmers with travel-friendly designs and rechargeable, waterproof features, bolstering market growth during the forecast period. Moreover, the demand for hybrid electric shavers is particularly high among younger consumers seeking cost-effective grooming tools. They are opting for flexible and easy-to-use devices. The growing technological innovation in hybrid electric vehicles is also driving market growth.

Type Insights

The sale of cordless electric shavers in the U.S. accounted for the largest share of 83.95% in 2024. The increasing demand for cordless electric shavers is attributed to their ability to offer unmatched convenience, portability, and ease of use. The young consumer in the U.S. highly prefers cordless shavers, owing to their rechargeability from a USB cable, which leads to increased demand. Innovation by different brands to improve battery life, as they can offer up to 90 minutes of runtime on a single charge. Fast-charging of cordless shavers features that enhance user satisfaction, making cordless devices the preferred choice of consumers in entry-level and premium segments.

The cord electric shavers segment is expected to grow at a CAGR of 4.3% from 2025 to 2033. There is an increasing demand for corded electric shavers among consumers who prioritize continuous power and performance over mobility. Corded electric shavers can offer long shaving sessions or professional use, as they eliminate the worry of battery life, a major driving factor for the increasing demand for corded electric shavers. Corded shavers are often more affordable and offer consistent torque and blade speed. Salons, barbershops, and traditional users still favor this type due to its reliability. In addition, corded models generally require less battery charging and storage maintenance, which appeals to older demographics. Thus, the growing popularity of corded models of electric shavers, owing to their ability to require less maintenance and long battery life, is a major driving factor for market growth.

End-user Insights

The men’s electric saver market had a revenue share of 68.94% in 2024. Since men require routine facial grooming, the increasing demand for electric shavers is a major driving factor for market growth during the forecast period. The growing adoption of electric shavers by men is also attributed to their powerful motors, multi-directional heads, and specialized blades for thick or coarse facial hair.

The growing emphasis on self-care and personal grooming in the U.S. is increasing investment in premium grooming devices, which is also driving market growth. Brands targeting male users focus on performance, precision, and comfort. Rotary and foil shavers with ergonomic grips, fast charging, and waterproof capabilities are key attractions in this segment. High-end brands such as Philips Norelco and Braun offer personalized shaving experiences with app integration, skin sensitivity sensors, and advanced blade systems. All these technological innovations attract new consumers and increase the demand for electric shavers among men.

The women’s electric shaver market is projected to grow at a CAGR of 5.8% from 2025 to 2033. Increasing demand for electric shavers from women owing to their features, such as hypoallergenic blades, soft-touch designs, and vibrant color palettes, is a major driving factor for market growth during the forecast period. Electric shavers designed for women focus on comfort, gentleness, and skin sensitivity, especially for use on hands and legs. Women are also increasing the demand for shavers as they offer convenience, pain-free hair removal, and easy usability, making electric shavers a preferred alternative to razors.

Distribution Channel Insights

The sale of electric shavers through the offline channel accounted for a share of 59.57% in 2024. Consumers in the U.S. prefer in-store evaluation, which in turn is increasing demand for electric shavers through offline sales channels. Moreover, hypermarkets and supermarkets offer wide product visibility and immediate availability, which attracts price-conscious consumers. Thus, the ability of offline stores to provide real-time, hands-on interactions and immediate feedback on electric shavers to customers is a major driving factor for the segment's growth during the forecast period.

For instance, in 2024, Black Wolf Nation sold skin and body care items and grooming products to a customer base of over 500,000 through salons, barbershops, and major retail chains such as CVS, Best Buy, Macy’s, and Urban Outfitters. The founders introduced just three products in their first year and earned USD 85,000. In 2024, the brand boasts a portfolio of over 20 products and generated annual revenues exceeding USD 35 million.

The sale of electric shavers through online distribution channels is expected to grow at a CAGR of 6.4% from 2025 to 2033. The rise in demand for electric shavers from online sales channels is attributable to factors such as their convenience, competitive pricing, and expansive product variety. In addition, product variety on e-commerce platforms, such as Amazon, Walmart.com, and BestBuy.com, attracts many young consumers, propelling the demand for electric shavers from the online distribution channel.

The growing popularity of online shopping among younger consumers and urban professionals who value time efficiency and doorstep delivery is increasing demand for electric shavers through online mediums. Flash sales, digital advertising, and influencer market fuel demand for electric shavers through these platforms, making online sales a critical growth engine for established and emerging brands. For instance, in June 2025, Amazon Inc. launched a flash sale with a discount of up to 31% on different razors and electric shavers from brands such as Braun.

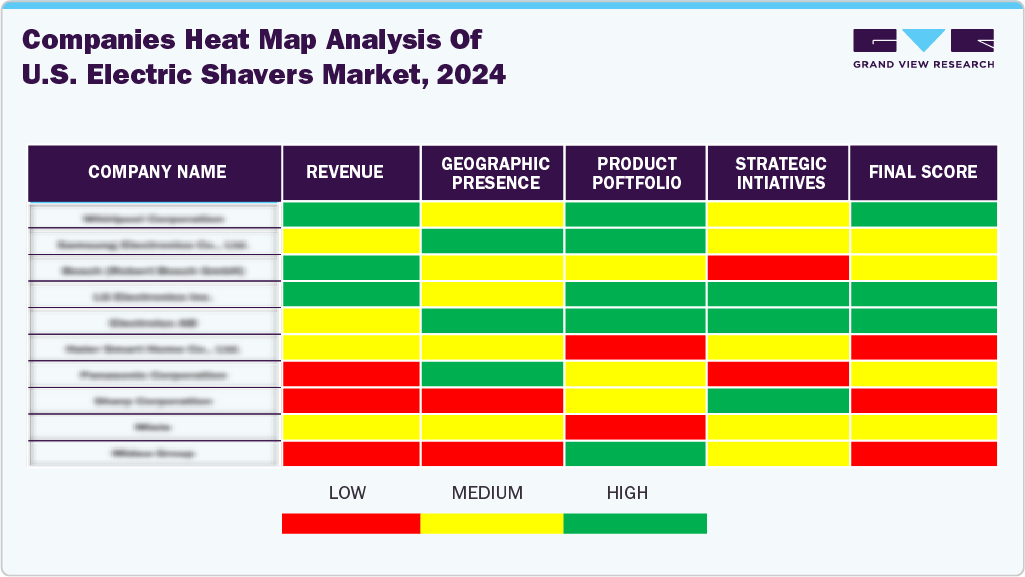

Key U.S. Electric Shavers Company Insights

The U.S. market is characterized by global and local brands, which has resulted in a high intensity of competitive rivalry. Leading brands are expanding through big-box retailers, e-commerce platforms, and direct-to-consumer channels, leveraging influencer marketing and product bundling to strengthen visibility and capture greater market share.

Key U.S. Electric Shavers Companies:

- Andis Company

- Conair Corporation

- Koninklijke Philips N.V.

- Manscaped, Inc.

- Panasonic Corporation

- Procter & Gamble (Braun GmbH)

- Spectrum Brands, Inc. (Remington)

- Vega

- Wahl Clipper Corporation

- Walker & Company Brands (Bevel)

Recent Developments

-

In May 2025, Wahl Clipper Corporation Professional unveiled the next chapter of its “Make It With Wahl Clipper Corporation” campaign in the U.S., evolving its global future makers platform into a storytelling initiative spotlighting authentic barber and groomer journeys and values.

-

In April 2025, Philips launched its most advanced shaver yet, the i9000 Shaver Series, in the U.S., redefining premium personalized male grooming with intelligent features designed to enhance precision, comfort, and user-specific performance through cutting-edge technology.

-

In October 2024, Andis Company introduced Explorer Series Trimmers, designed to enhance personal grooming with a focus on comfort and user confidence. These trimmers feature an ergonomic design that allows easy handling and precision, making them suitable for various grooming tasks. The Explorer Series aims to meet the needs of both professional stylists and individuals at home, combining advanced technology with user-friendly features to deliver a superior grooming experience. This launch reflects the company’s commitment to innovation in personal care products.

U.S. Electric Shavers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.23 billion

Revenue forecast in 2033

USD 4.94 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-user, distribution channel

Key companies profiled

Andis Company; Conair Corporation; Koninklijke Philips N.V.; Manscaped, Inc.; Panasonic Corporation; Procter & Gamble (Braun GmbH); Spectrum Brands, Inc. (Remington); Vega; Wahl Clipper Corporation; Walker & Company Brands (Bevel)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Shavers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. electric shavers market report based on product, type, end-user, and distribution channel:

-

Product Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Hybrid

-

Rotary Shavers

-

Foil Shavers

-

-

Type Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Cord

-

Cordless

-

-

End-user Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Others (pharmacies, department stores, etc.)

-

-

Online

-

E-commerce Website

-

Company-owned Website

-

-

Frequently Asked Questions About This Report

b. The U.S. electric shavers market size was valued at USD 3.07 billion in 2024 and is expected to reach USD 3.22 billion in 2025.

b. The U.S. electric shavers market is projected to reach USD 4.94 billion in 2033, growing at a CAGR of 5.5% from 2025 to 2033.

b. The sale of foil electric shavers accounted for the largest share, 47.52%, in 2024. The rising demand for foil shavers is attributed to their close and precise shaves, especially for daily grooming routines.

b. Some key players operating in the U.S. electric shavers market include Koninklijke Philips N.V., Wahl Clipper Corporation, Spectrum Brands, Inc. (Remington), Procter & Gamble (Braun GmbH), Panasonic Corporation, Conair Corporation, Andis Company, Vega, Manscaped, Inc., and Walker & Company Brands (Bevel)

b. The increasing demand for electric shavers owing to factors such as convenient grooming, growing adoption among women, and a shift in adoption of cordless and hybrid shavers for travel and home use is a major driving factor for the growth of the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.