- Home

- »

- Healthcare IT

- »

-

U.S. Employee-sponsored Healthcare Market Report, 2030GVR Report cover

![U.S. Employee-sponsored Healthcare Market Size, Share & Trends Report]()

U.S. Employee-sponsored Healthcare Market Size, Share & Trends Analysis Report By Service (Healthcare, Wellness), By Organization Size (Small, Medium, Large), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-050-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

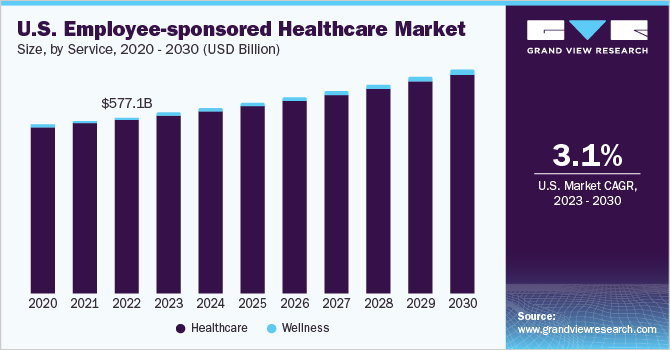

The U.S. employee-sponsored healthcare market size was valued at USD 577.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.07 % from 2023 to 2030. The growth of the market is attributed to the factors such as growing health insurance programs for employees and increasing investment in health and wellness by the people. An increasing number of employers providing subsided wellness services to increase productivity is propelling the market growth. The employer-provided group insurance plans continue to become a more valuable benefit for employees. As healthcare restructuring evolves the lives and finances of individuals, group health coverage through an employer becomes a valuable incentive. It is quite helpful to have a significant portion of medical costs covered by the employee benefits package. A person without health insurance is practically one major injury away from financial ruin.

As per the findings of a poll conducted by Seven Letter Insight for the ‘protecting Americans’ coverage together’ campaign, in 2020, the majority of Americans were satisfied with their corporate health insurance. Organizations with 50 or more employees are mandated to provide some form of health insurance coverage. Employers have a choice to select an individual plan or a group plan. The group plans tend to be the most effective, efficient, and affordable solution.

The adoption of new initiatives and alternatives in healthcare benefits has transformed the rising cost of healthcare services under the regulations of the Affordable Care Act. In the U.S., 91.4% of people have health insurance. This plan helps to balance out and implement these wellness programs to improve employee health and lower long-term healthcare costs.

According to the insurance carriers, the organization must contribute at least half of the employee premium, with the remaining funds paid by the employee. Employee contributions to healthcare insurance range from 20% to 50%. The level of employee contribution is determined by state laws. Employers must seek advice from brokers who can ensure that regulations are followed and who can set the right price of premiums for the organization.

The COVID-19 pandemic had a significant impact on the U.S. employee-sponsored healthcare industry. As the infection spread, it increased employee spending on COVID-19 hospitalizations and treatment. Furthermore, owing to the increased importance of wellness, spending on wellness activities such as meditation, fitness, and others increased. This positively impacted the market growth.

Service Insights

The healthcare segment dominated the market in 2022 due to a large number of employees covered under healthcare insurance. Under the corporate insurance plan, an employee has many options to select health insurance. According to Kaiser Family Foundation, employees paid 17% of self-only insurance plans and 27% of family insurance plans in 2021. The organization provides group health insurance to employees in the event of a medical emergency. Preventive healthcare measures are also included in modern insurance plans, and employees who practice healthy habits are rewarded. This helps organizations to avoid sickness and improve overall employee efficiency.

The wellness segment is projected to witness the fastest growth in the coming years as wellness programs improve health and assist individuals in overcoming specific health-related issues. Employee health and wellness have a direct impact on an organization’s efficiency and productivity. Many corporates recognize this link and are willing to invest in such programs. As a result, the benefits of implementing comprehensive employee wellness programs exceed the program costs.

Organization Size Insights

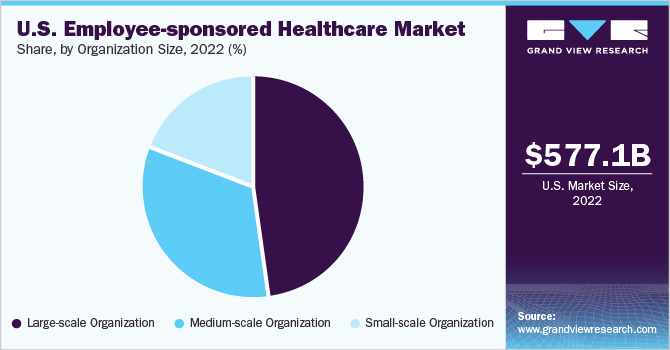

The large-scale organization segment dominated the market with a share of 48.36% in 2022. The segment is estimated to dominate the market throughout the forecast period. Many large organizations have programs to help employees identify health issues and manage chronic conditions, such as biometric screenings, health risk assessments, and health promotion initiatives. Large organizations provide subsidized wellness services such as gym memberships, spa treatments, mental health sessions, and others. High adoption of these services among people working in large corporate firms is propelling segment growth. It is estimated that 64% of covered employees, including 21% of covered employees in small organizations and 82% of covered employees in large organizations, are enrolled in self-funded plans.

The medium-scale organization segment is projected to witness the fastest growth in the coming years. Rising spending on health and wellness programs such as yoga and meditation classes is rendering high growth of the segment. The increasing number of medium-sized organizations and the focus on employee health due to increased absenteeism and attrition are likely to boost the growth of the segment.

Key Companies & Market Share Insights

Market players in the U.S. employee-sponsored healthcare industry are offering various healthcare coverage and wellness services to their customers. These companies are also introducing new schemes & plans for the well-being of their employees. The players are incorporating in-house healthcare coverage and wellness programs for the employees to provide fast service. Furthermore, strategic initiatives such as new service launches, and partnerships are major strategies undertaken by major players to capture a huge market share. Some prominent players in the regional U.S. employee-sponsored healthcare market include:

-

United HealthCare Services, Inc.

-

Kaiser Foundation Health Plan, Inc.

-

Anthem Insurance Companies, Inc.

-

Cigna

-

Blue Cross Blue Shield Association

-

Independence Blue Cross

-

Highmark Inc.

-

Health Net of California, Inc.

-

UPMC HEALTH PLAN, INC.

-

Nationwide Medical Insurance

-

ComPsych

-

EXOS

-

Wellness Corporate Solutions

-

Marino Wellness

-

Virgin Pulse

-

Privia Health

-

Wellsource, Inc.

-

Vitality

-

Central Corporate Wellness

-

SOL Wellness

-

Truworth Wellness

U.S. Employee-sponsored Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 591.5 billion

Revenue forecast in 2030

USD 731.1 billion

Growth rate

CAGR of 3.07% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD Million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Service, organization size

Country Scope

U.S.

Key companies profiled

United HealthCare Services, Inc.; Kaiser Foundation Health Plan, Inc.; Anthem Insurance Companies, Inc.; Cigna; Blue Cross Blue Shield Association; Independence Blue Cross; Highmark Inc.; Health Net of California, Inc.; UPMC HEALTH PLAN, INC.; Nationwide Medical Insurance; ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; SOL Wellness

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Employee-sponsored Healthcare Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the regional U.S. employee-sponsored healthcare market report based on service and organization size:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Self or Single Coverage

-

Family Coverage

-

-

Wellness

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small-scale Organization

-

Medium-scale Organization

-

Large-scale Organization

-

Frequently Asked Questions About This Report

b. The global U.S. employee-sponsored healthcare market size was estimated at USD 577.1 billion in 2022 and is expected to reach USD 591.5 billion in 2023

b. The global U.S. employee-sponsored healthcare market is expected to grow at a compound annual growth rate of 3.07% from 2023 to 2030 to reach USD 731.1 billion by 2030.

b. Large-scale organizations dominated the U.S. employee-sponsored healthcare market with a share of 48.4% in 2022. Many large organizations have programs in order to help employees in identifying health issues and managing chronic conditions, such as biometric screenings, health risk assessments, and health promotion initiatives.

b. Some key players operating in the U.S. employee-sponsored healthcare market include United HealthCare Services, Inc.; Kaiser Foundation Health Plan, Inc.; Anthem Insurance Companies, Inc.; Cigna; Blue Cross Blue Shield Association; Independence Blue Cross; Highmark Inc.; Health Net of California, Inc.; UPMC HEALTH PLAN, INC.; Nationwide Medical Insurance; ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; and SOL Wellness

b. Key factors that are driving the market growth include growing health insurance programs for employees and increasing investment in health and wellness by the people.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."