- Home

- »

- Next Generation Technologies

- »

-

U.S. Enterprise Agentic AI Market Size, Industry Report, 2030GVR Report cover

![U.S. Enterprise Agentic AI Market Size, Share & Trends Report]()

U.S. Enterprise Agentic AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Machine Learning, Deep Learning), By Agent System (Single Agent Systems), By Type, By Application (Customer Service & Virtual Assistants), And Segment Forecasts

- Report ID: GVR-4-68040-589-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Enterprise Agentic AI Market Trends

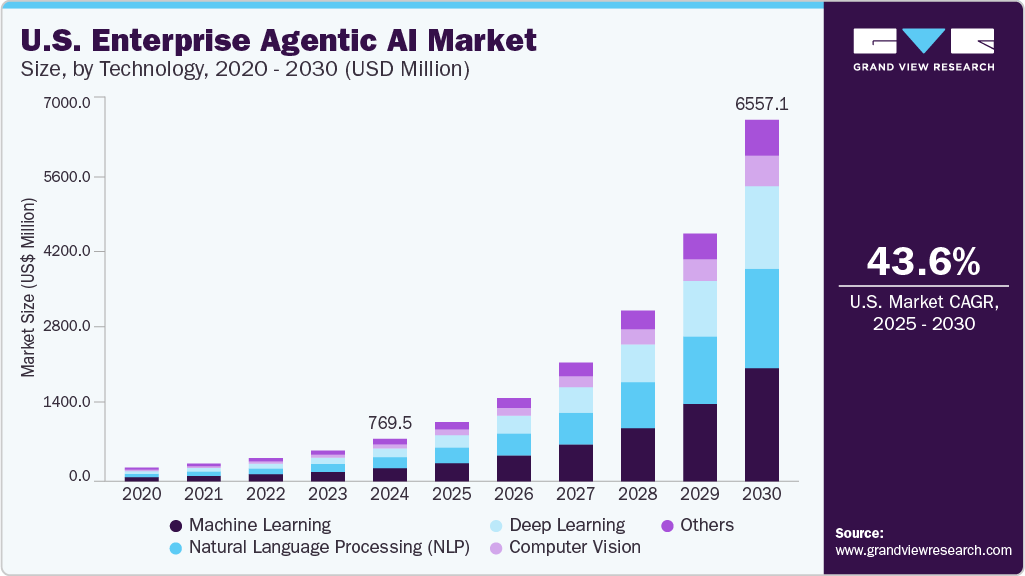

The U.S. enterprise agentic AI market size was estimated at USD 769.5 million in 2024 and is expected to grow at a CAGR of 43.6% from 2025 to 2030. The market is driven by factors, including the increasing complexity of business environments and the essential need for rapid decision-making. Businesses are recognizing the potential of agentic AI to streamline operations and reduce reliance on human intervention. This has led to increased investments in agentic AI technologies as enterprises seek to gain a competitive edge, swiftly adapt to market changes, and improve overall productivity.

The demand for automation and efficiency is a primary driver for adopting enterprise agentic AI. These systems are capable of automating complex tasks that previously demanded significant human effort, which accelerates operations and improves accuracy, helping enterprises reduce costs in the U.S. market. In addition, the exponential growth of big data also fuels the adoption of agentic AI in the U.S., which uses advanced algorithms to analyze large datasets and provide insights for faster, more informed decision-making, giving businesses a competitive advantage. The rise of AI as a service is further democratizing access to agentic AI technologies, enabling U.S. companies of all sizes to implement AI solutions without high initial infrastructure investments.

Furthermore, AI's ability to enhance productivity and efficiency across various sectors is significant. In finance, agentic AI can handle rapid trading and fraud detection by analyzing massive amounts of data in real-time to facilitate quick decisions. Similarly, in healthcare, AI can assist doctors and specialists in diagnosing and recommending treatments for complex cases. Moreover, the integration of multiple automation systems to create end-to-end workflows powered by intelligent AI agents is expected to drive market growth.

Technology Insights

The machine learning segment accounted for the highest revenue share of 30.7% in 2024. ML algorithms are important for predictive analytics, pattern recognition, and decision-making processes, which are essential components of enterprise AI applications. The widespread deployment of ML across various industries has established its dominance, with enterprises leveraging ML for automating tasks and enhancing operational efficiency. Furthermore, the relative maturity and availability of ML tools and resources have facilitated its extensive adoption, contributing to its leading position in the enterprise agentic AI market.

For instance, in March 2025, NVIDIA introduced the open Llama Nemotron AI model family, offering up to 20% higher accuracy and 5x faster inference than earlier models. Delivered as NVIDIA NIM microservices, they support flexible deployment and enable advanced AI agents for decision-making and collaboration. Major companies like Microsoft, SAP, and Accenture are already using these models to drive agentic AI adoption across industries.The deep learning segment registered a CAGR of 46.2% from 2025 to 2030. The ability to learn to process unstructured data, including images, speech, and text, makes it essential for advanced applications. Enterprises are increasingly leveraging deep learning for complex tasks such as natural language understanding, computer vision, and predictive modeling. These capabilities are essential for developing AI agents that can handle complicated and context-rich data.

The increasing availability of large datasets and powerful computing resources further enables the development and deployment of deep learning models, driving their growth. For instance, in March 2025, EY launched the EY.ai Agentic Platform in partnership with NVIDIA to transform sectors like tax, risk, and finance. Leveraging NVIDIA’s full AI stack, the platform combines domain-specific AI models with human expertise to boost productivity and efficiency. Initially, it will support over 80,000 EY tax professionals, with future expansion planned across industries such as life sciences, manufacturing, and financial services.

Agent System Insights

The single agent systems accounted for the largest market revenue share in 2024. The market in the country is driven due to their simplicity and cost-effectiveness in automating specific, well-defined tasks. Single agent systems are easier to deploy and manage, making them a feasible option for enterprises seeking to automate routine processes without extensive integration efforts. For instance, in March 2025, Oracle introduced AI Agent Studio within its Fusion Cloud Applications, allowing users to build, deploy, and manage AI agents to automate complex business processes. Provided at no extra cost, the platform features provide tools for enhancing productivity and seamlessly integrate with Oracle Fusion Applications.

The multi-agent systems are projected to grow significantly over the forecast period. The market is driven as enterprises increasingly require AI solutions that can handle complex, collaborative tasks. Multi-agent systems enable coordination and communication between multiple AI agents, allowing for problem-solving and decision-making capabilities. For instance, in January 2025, Capgemini introduced a new era in industrial operations, driven by multi-agent AI systems and compact generative AI models. These technologies enable autonomous AI agents to work together in real-time, boosting efficiency, minimizing downtime, and advancing hyper-automation to transform productivity across industries.

Type Insights

The ready-to-deploy agents accounted for the largest market revenue share in 2024. Ready-to-deploy agents address common business needs such as customer service, sales automation, and data analysis, providing a straightforward path to AI adoption. For instance, in April 2025, Dataiku introduced enterprise-ready AI agents tailored for the growing agentic AI market, allowing businesses to build, manage, and scale AI agents with centralized oversight and smooth integration into existing workflows. These agents offer a no-code visual interface for business users and full-code flexibility for developers, ensuring secure, agile deployment and ongoing optimization from the start.

The build-your-own agents are projected to grow significantly over the forecast period. Building custom AI agents allows organizations to address specific challenges and optimize processes that are not adequately served by off-the-shelf solutions. For instance, in March 2025, OpenAI’s Agents SDK allows enterprises to easily create custom multi-agent AI systems, facilitating smooth coordination, task assignment, and integrated safety measures for dependable, production-grade agentic applications. Designed with a Python-first approach, the framework streamlines development and speeds up the deployment of intelligent workflows customized to unique business requirements in the expanding agentic AI landscape.

Application Insights

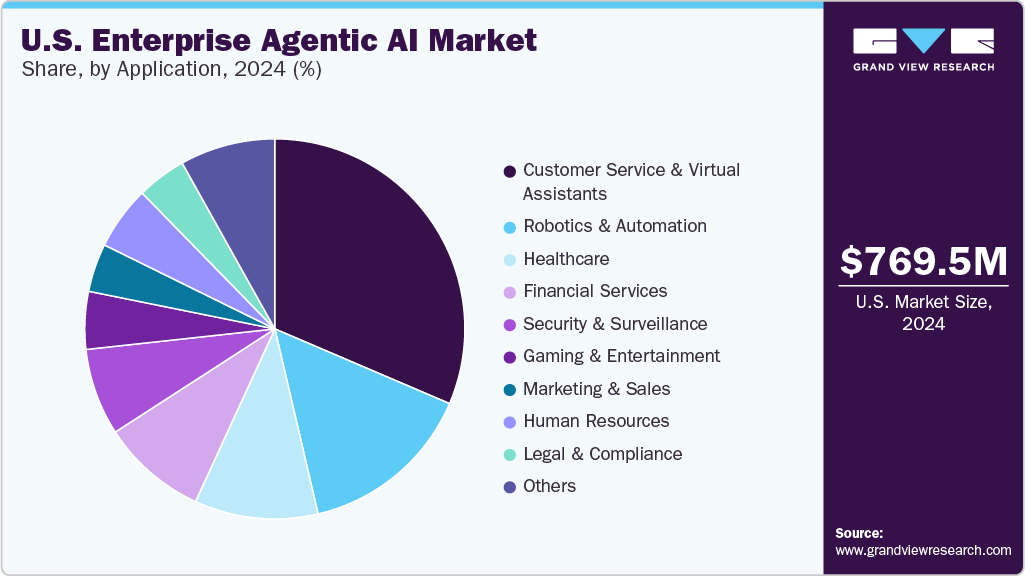

The customer service and virtual assistants segment accounted for the largest revenue share in 2024. The market is driven due to the widespread adoption of AI-powered chatbots and virtual assistants for enhancing customer engagement and streamlining support operations. These AI agents provide 24/7 customer support, handle routine inquiries, and personalize customer interactions, improving overall customer satisfaction. For instance, in October 2024, Celonis AgentC enhances enterprise AI assistants by focusing on process intelligence, enabling smarter ticket prioritization, automated responses, and strategic recommendations. This boosts customer service efficiency and experience. Companies like Cosentino have used Celonis AI to manage up to five times more daily orders without increasing risk, demonstrating its powerful impact.

The healthcare segment is projected to grow significantly over the forecast period. The market is driven by analyzing medical images, predicting patient outcomes, and personalizing treatment plans, improving the accuracy and efficiency of healthcare delivery. AI-powered virtual assistants can also support patient monitoring, medication management, and remote consultations, enhancing access to healthcare services. For instance, in January 2025, NVIDIA teamed up with top healthcare players like IQVIA, Illumina, and Mayo Clinic to transform the enterprise agentic AI space in healthcare. These partnerships use generative and agentic AI to speed up drug discovery, optimize clinical trials, and enhance digital pathology, driving greater efficiency and better patient outcomes in the $10 trillion healthcare industry.

Key U.S. Enterprise Agentic AI Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

NVIDIA Corporation is primarily recognized for its hardware and software solutions that enable the development and deployment of AI applications. Their contributions span providing the AI infrastructure, including GPUs and AI Enterprise software, necessary for building sophisticated AI agents capable of reasoning, planning, and acting autonomously. Collaborations, such as the EY.ai Agentic Platform built with NVIDIA AI, showcase their crucial role in enhancing operational excellence across various industries, helping businesses navigate complexity with unprecedented intelligence.

-

Accenture is a leading global professional services firm dedicated to driving positive changes by blending technology with human creativity to help clients rapidly innovate and grow. Workforce of employees supporting more than 9,000 clients in over 120 countries, Accenture offers cutting-edge solutions in strategy, consulting, technology, and operations to build long-term value and resilience for businesses around the world.

Key U.S. Enterprise Agentic AI Companies:

- Accenture

- qBotica

- NVIDIA Corporation

- SAP SE or an SAP affiliate company

- Oracle

- OpenAI

- Capgemini

- Celonis

- Dataiku

- Shield AI

Recent Developments

-

In March 2025, Oracle and NVIDIA partnered to integrate NVIDIA’s accelerated computing and AI software with Oracle Cloud Infrastructure (OCI), making it easier for enterprises to build and deploy agentic AI applications. The collaboration offers over 160 AI tools and 100+ NVIDIA NIM microservices directly through the OCI Console, with no-code deployment and advanced AI search in Oracle Database 23ai. This alliance delivers scalable, secure AI solutions across cloud, edge, and on-premises environments to boost innovation and business impact.

-

In March 2025, Accenture enhanced its AI Refinery platform with a no-code AI agent builder, allowing business users to quickly create and tailor AI agents. It is also developing over 50 industry-specific solutions using NVIDIA’s reasoning models, with a goal of reaching 100 by year-end. These tools aim to boost efficiency in sectors like telecom, finance, and insurance, supporting clients such as ESPN, HPE, and the UN in driving process transformation and business value.

U.S. Enterprise Agentic AI Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.07 billion

Revenue forecast in 2030

USD 6.55 billion

Growth rate

CAGR of 43.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, agent system, type, application

Key companies profiled

Accenture; qBotica; NVIDIA Corporation; SAP SE or an SAP affiliate company; Oracle; OpenAI ; Capgemini; Celonis; Dataiku; Shield AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enterprise Agentic AI Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. enterprise agentic AI market report based on technology, agent system, type, and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Deep Learning

-

Computer Vision

-

Others

-

-

Agent System Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Agent Systems

-

Multi Agent Systems

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ready-to-Deploy Agents

-

Build-Your-Own Agents

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Customer Service and Virtual Assistants

-

Robotics and Automation

-

Healthcare

-

Financial Services

-

Security and Surveillance

-

Gaming and Entertainment

-

Marketing and sales

-

Human Resources

-

Legal and compliance

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. enterprise agentic AI market size was estimated at USD 769.5 million in 2024 and is expected to reach USD 1.07 billion in 2025.

b. The U.S. enterprise agentic AI market is expected to grow at a compound annual growth rate of 43.6% from 2025 to 2030 to reach USD 6.55 billion by 2030.

b. The Machine Learning segment dominated the U.S. enterprise agentic AI market with a share of 30.7% in 2024. This is attributable to its widespread adoption across industries for automating complex tasks, enhancing decision-making, and driving operational efficiency.

b. Some key players operating in the U.S. enterprise agentic AI market include Machine Learning segment dominated the U.S. Enterprise Agentic AI Market with a share of 30.7% in 2024. This is attributable to

b. Key factors driving the growth of the U.S. enterprise agentic AI market include increasing demand for intelligent automation, robust technological infrastructure, and strong government support. Additionally, the rise of ready-to-deploy and customizable AI agents is accelerating enterprise adoption across diverse sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.