- Home

- »

- Animal Health

- »

-

U.S. Equine Artificial Insemination Market Size Report, 2033GVR Report cover

![U.S. Equine Artificial Insemination Market Size, Share & Trends Report]()

U.S. Equine Artificial Insemination Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Equipment & Consumables, Semen, Services), By Equine (Sports/Racing, Recreation), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-728-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

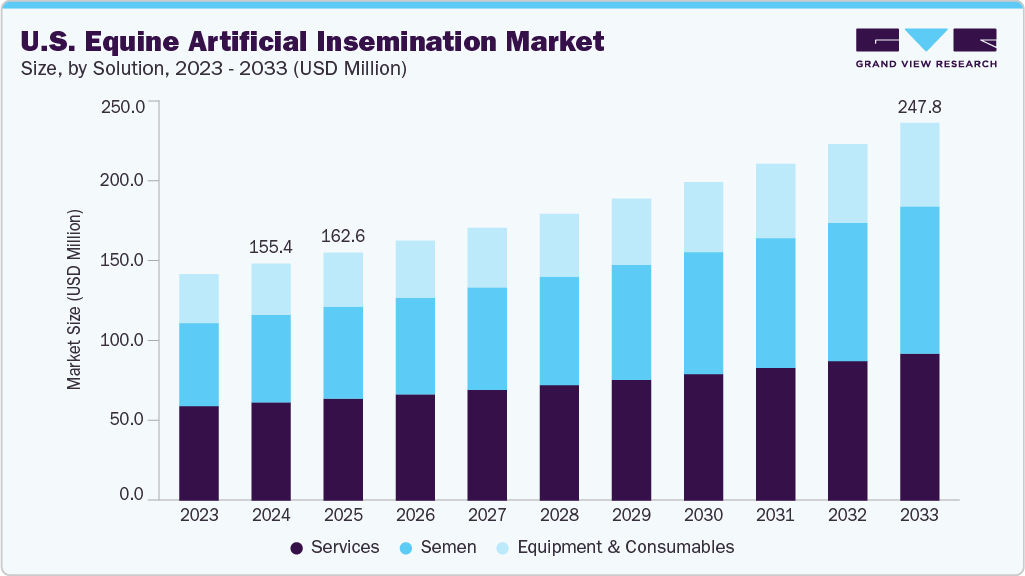

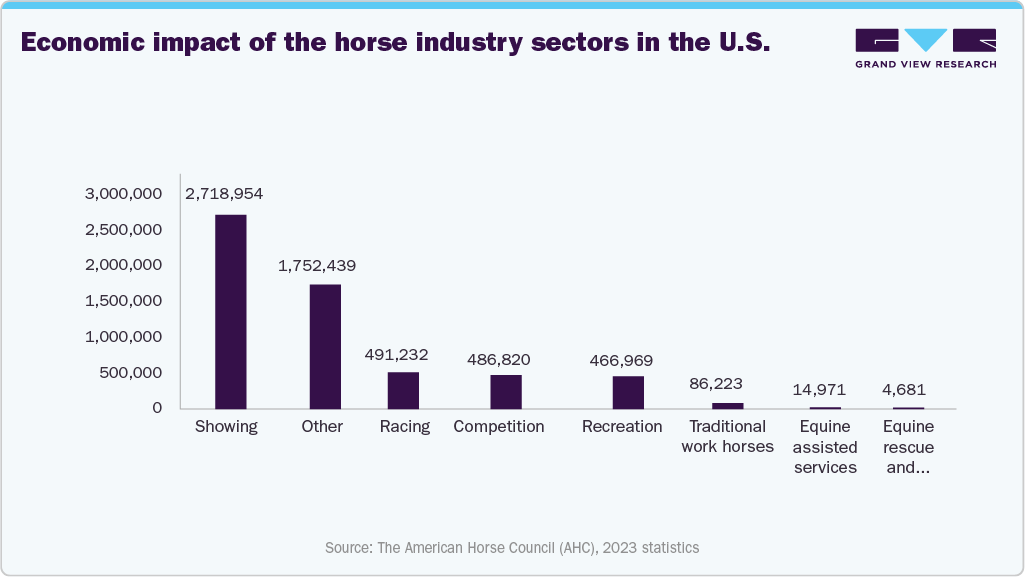

The U.S. equine artificial insemination market size was estimated at USD 155.44 million in 2024 and is projected to reach USD 247.83 million by 2033, growing at a CAGR of 5.41% from 2025 to 2033. The market is continuously growing, driven by the rising popularity of performance and recreational horses, expanding equine veterinary infrastructure, and a supportive regulatory and breeding industry ecosystem. The professional racing and competition, the growing popularity of recreational riding, show jumping, and Western performance events, are driving demand for high-quality horses in the U.S. The U.S. is home to around 9.2 million horses, playing a vital role in recreation, competition, and the broader equine industry. Among this population, nearly 3.9 million are engaged in recreational activities, while about 2.7 million participate in horse shows, reflecting the strong cultural and economic importance of equestrian pursuits nationwide.

Owners are increasingly investing in artificial insemination (AI) to secure foals with superior genetics for endurance, agility, and temperament. This demand spans disciplines such as rodeo, barrel racing, hunter/jumper circuits, and dressage. By enabling wider access to proven stallions, AI supports the breeding of horses suited to diverse performance needs. The expanding recreational equine sector, particularly in states like Texas, Kentucky, and California, continues to boost AI adoption.

The chart below highlights the economic impact of horse industry sectors in the U.S. for 2023:

The U.S. has a well-established network of veterinary clinics, universities, and specialized equine hospitals that offer reproductive services, supporting the artificial insemination market. Institutions such as Texas A&M, Colorado State University, and Kentucky equine clinics provide advanced AI, embryo transfer, and semen preservation services, often setting global benchmarks. Private breeding farms and mobile veterinary practices are also increasing their AI offerings, making reproductive care more accessible to horse owners. With rising investments in equine-focused veterinary education and state-of-the-art breeding facilities, the infrastructure available to support AI is expanding, directly fuelling market growth across regions.

The U.S. equine breeding industry benefits from supportive regulatory frameworks and organized breeding associations, which indirectly encourage AI adoption. Associations such as the American Quarter Horse Association (AQHA) and the United States Trotting Association (USTA) regulate breeding practices and increasingly recognize AI in their registries. This acceptance provides legitimacy and confidence for breeders considering AI. Furthermore, USDA guidelines on animal health and biosecurity reinforce safe reproductive practices. Combined with market-friendly policies and growing breeder awareness, this ecosystem provides a favorable foundation for the expansion of AI services nationwide.

Market Concentration & Characteristics

The U.S. equine AI market is moderately concentrated, led by major firms like Zoetis, Neogen, Nasco, and IMV Technologies, which dominate services and equipment channels. A competitive mid-tier of local specialists complements them, while smaller veterinary and breeding centers cater to regional needs.

The U.S. equine artificial insemination industry’s growth is propelled by significant innovation, particularly in advanced techniques such as frozen/chilled semen, ICSI (intracytoplasmic sperm injection), and embryo transfer. These technologies improve breeding success and access to elite genetics nationwide, boosting adoption among high-performance and sport horse breeders. For instance, in November 2024, UC Davis researchers achieved the first successful equine IVF using frozen-thawed sperm, producing embryos comparable to ICSI, expanding reproductive options for distant, limited, or deceased stallions, while advancing genetic preservation and equine fertility research.

M&A activity in the U.S. equine AI sector remains moderate. While larger players occasionally acquire specialized providers to broaden service offerings or geographic reach, the market largely remains composed of niche firms and regional specialists. In May 2024, WSU’s Veterinary Teaching Hospital expanded equine reproductive services with a new facility, offering advanced techniques like AI, semen cryopreservation, and ovum pick-up with ICSI, enhancing care, infertility investigation, and long-term boarding for regional horse owners.

Regulation significantly shapes the equine AI landscape. For instance, The Jockey Club prohibits AI for Thoroughbred registration, while Standardbred horses permit AI under specific conditions. These rules affect method availability and influence breeding strategy and technology adoption.

Natural mating continues to serve as a viable substitute, especially for smaller operations and Thoroughbred breeders where AI is restricted. Despite AI’s benefits in genetics and biosecurity, these traditional methods persist where regulation and cost present barriers.

Equine AI services are concentrated among large-scale breeding farms, stud centers, and veterinary hospitals specializing in reproduction. These users drive demand for AI, equipped with advanced facilities and technical expertise, whereas smaller farms and individual owners represent a less concentrated market segment.

Solution Insights

Services emerged as the largest segment in the U.S. equine artificial insemination (AI) market with a revenue share of 41.43% in 2024, driven by rising demand for specialized reproductive care, advanced diagnostic tools, and skilled veterinary expertise. Horse owners increasingly rely on professional AI services for improved conception rates, genetic preservation, and enhanced breeding efficiency. Growth is further supported by the adoption of techniques like semen cryopreservation, ovum pick-up, and intracytoplasmic sperm injection (ICSI). Expanding veterinary infrastructure, coupled with increasing awareness among breeders and equine enthusiasts, positions services as a critical growth engine within the market.

Semen represents the fastest-growing segment in the U.S. equine artificial insemination (AI) industry, which includes normal and sexed semen, fueled by advancements in semen collection, preservation, and cryopreservation technologies. Increasing reliance on frozen and shipped semen enables broader genetic exchange, allowing breeders access to superior stallion bloodlines across regions and even internationally. Rising adoption of semen analysis tools ensures higher fertility success rates, while demand for rare or high-performance genetics further accelerates growth. The ability to store and transport semen efficiently also supports year-round breeding, making this segment vital to industry expansion.

Equine Insights

The sports/racing segment has emerged as both the largest and fastest growing area within the U.S. equine artificial insemination market with a revenue share of 58.90% in 2024, driven by the demand for elite bloodlines and genetic improvement. The U.S. horse racing and competitive sports industry is highly lucrative, with owners and breeders continuously seeking to produce horses with superior speed, endurance, and performance capabilities. AI has become an essential tool, enabling breeders to access semen from champion stallions across geographic boundaries, preserving valuable genetics while reducing the risks and costs associated with live cover.

The segment’s growth is also supported by technological advancements such as semen cryopreservation, advanced reproductive diagnostics, and embryo transfer, which provide flexibility and increase the chances of successful conception. Owners and breeders benefit from AI by maximizing reproductive efficiency while ensuring foals carry desirable traits for sports and racing competitiveness. Rising investments in equestrian sports, alongside increasing prize money and recognition of U.S. racing bloodlines, further accelerate adoption.

Distribution Channel Insights

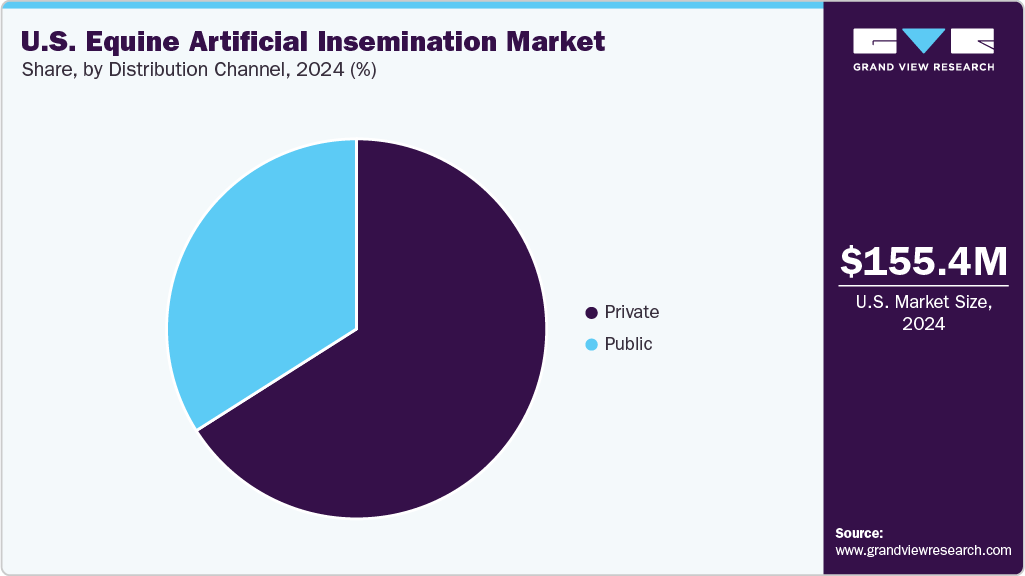

The private segment has emerged as the largest and fastest growing category in the U.S. equine artificial insemination industry with a revenue share of about 66.0% in 2024, fueled by the rising preference of individual horse owners and breeders for personalized reproductive solutions. Private services allow breeders to exercise full control over stallion selection, breeding timelines, and reproductive management, ensuring that foals are produced with specific genetic traits to enhance performance, temperament, or lineage preservation. Unlike communal or partitioned arrangements, private AI services prioritize exclusivity, guaranteeing that semen is used only for the intended mare, which appeals to owners investing heavily in high-value sports, racing, and show horses.

The growth is further driven by technological advancements such as semen freezing, ovum pick-up (OPU), and intracytoplasmic sperm injection (ICSI), which provide greater success rates and flexibility. Private AI arrangements also reduce disease transmission risks, improving animal welfare and offering peace of mind for owners handling elite breeding stock. Additionally, the segment benefits from the increasing demand for premium equestrian bloodlines in the U.S. and abroad, where private breeders play a critical role in maintaining genetic quality.

Country Insights

U.S. Equine Artificial Insemination Market Trends

The U.S. equine artificial insemination industry is expanding, driven by advancements in reproductive technologies, rising demand for high-value sport and racing horses, and the need to preserve elite genetics. AI enables safer breeding, better disease control, and access to superior stallions across geographies. Growing private ownership, increasing investments in equine sports, and advanced veterinary infrastructure further support adoption. With expanding services like semen freezing, embryo transfer, and genetic testing, the market is evolving as a key driver of equine breeding efficiency.

Key U.S. Equine Artificial Insemination Company Insights

The U.S. equine artificial insemination market features leading players such as Select Breeders Services, Equine Medical Services, and Colorado State University’s Equine Reproduction Laboratory. Market share remains fragmented, with private breeding centers and veterinary hospitals holding significant presence. Innovation in semen preservation, embryo transfer, and genetic testing strengthens competitive positioning.

Recent Developments

-

In November 2024, UC Davis researchers achieved the first successful equine IVF using frozen-thawed sperm, producing embryos comparable to ICSI, expanding reproductive options for distant, limited, or deceased stallions, while advancing genetic preservation and equine fertility research.

-

In May 2024, WSU’s Veterinary Teaching Hospital expanded equine reproductive services with a new facility, offering advanced techniques like AI, semen cryopreservation, and ovum pick-up with ICSI, enhancing care, infertility investigation, and long-term boarding for regional horse owners.

Key U.S. Equine Artificial Insemination Companies:

- Neogen Corporation

- Zoetis Services LLC

- HOFFMAN A.I. BREEDERS INC

- Nasco Healthcare.

- IMV Technologies

- Continental Genetics, LLC.

- Olympia Equine Veterinary Services PLLC

- Sarasota Equine Veterinary Services

- Montana Equine Medical and Surgical Center

- Select Breeders Services

- Equine Reproduction Concepts, LLC.

- Wisconsin Valley Veterinary Service

U.S. Equine Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 162.61 million

Revenue forecast in 2033

USD 247.83 million

Growth rate

CAGR of 5.41% from 2025 to 2033

Historical period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, equine, distribution channel

Key companies profiled

Neogen Corporation; Zoetis Services LLC; HOFFMAN A.I. BREEDERS INC.; Nasco Healthcare; IMV Technologies; Continental Genetics, LLC; Olympia Equine Veterinary Services PLLC; Sarasota Equine Veterinary Services; Montana Equine Medical and Surgical Center; Select Breeders Services; Equine Reproduction Concepts, LLC.; Wisconsin Valley Veterinary Service

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Equine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. equine artificial insemination market report based on solution, equine, and distribution channel:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment & Consumables

-

Semen

-

Normal Semen

-

Sexed Semen

-

-

Services

-

-

Equine Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports/Racing

-

Recreation

-

Other Type

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

Frequently Asked Questions About This Report

b. The U.S. Equine Artificial Insemination market size was estimated at USD 155.44 million in 2024 and is expected to reach USD 162.61 million in 2025.

b. The U.S. equine artificial insemination market is expected to grow at a compound annual growth rate of 5.41% from 2025 to 2033 to reach USD 247.83 million by 2033.

b. Services segment dominated the U.S. equine artificial insemination market with a share of 41.43% in 2024. This is driven by rising demand for specialized reproductive care, advanced diagnostic tools, and skilled veterinary expertise.

b. Some key players operating in the U.S. equine artificial insemination market include Neogen Corporation, Zoetis Services LLC, HOFFMAN A.I. BREEDERS INC, Nasco Healthcare, IMV Technologies, Continental Genetics, LLC, Olympia Equine Veterinary Services PLLC, Sarasota Equine Veterinary Services, Montana Equine Medical and Surgical Center, Select Breeders Services, Equine Reproduction Concepts, LLC., Wisconsin Valley Veterinary Service.

b. Key factors that are driving the market growth include rising popularity of performance and recreational horses, expanding equine veterinary infrastructure and supportive regulatory and breeding industry ecosystem.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.