- Home

- »

- Biotechnology

- »

-

U.S. Exosomes Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Exosomes Market Size, Share & Trends Report]()

U.S. Exosomes Market (2026 - 2033) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents, Services), By Application (Cancer, CVD, Infectious Diseases), By Workflow (Isolation Methods, Downstream Analysis), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-242-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Exosomes Market Summary

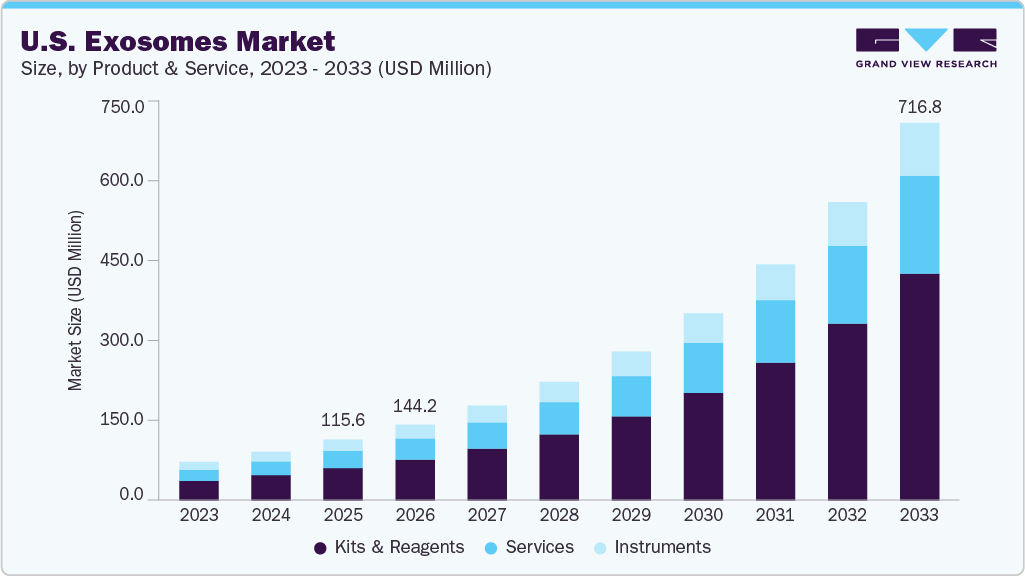

The U.S. exosomes market size was estimated at USD 115.6 million in 2025 and is projected to reach USD 716.8 million by 2033, growing at a CAGR of 25.75% from 2026 to 2033. Exosome applications are advancing, which is driving market growth. Technological advancements in exosome isolation and analytical procedures are contributing to market growth and are fueled by the increasing prevalence of cancer.

Key Market Trends & Insights

- By product & services, the kits & reagents segment dominated the market and accounted for the largest share of 52.99% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

- By workflow, the downstream analysis segment dominated the market with a 56.82% share in 2025.

- By applications, the cancer segment dominated the market with a revenue share of 45.95% in 2025 and is expected to grow at the highest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 115.6 Million

- 2033 Projected Market Size: USD 716.8 Million

- CAGR (2026-2033): 25.75%

Increasing Prevalence of Cancer

The increasing prevalence of cancer is one of the key factors contributing to market growth over the forecast period. In 2025, an estimated over 2 million new cancer cases were diagnosed in the U.S. alone. The table below demonstrates the new cancer cases and cancer-related deaths estimated in the U.S. in 2025.

Key Statistics and Determinants of the Global Cancer Burden

Category

Description

Impact / Significance

Cancer mortality

Nearly 10 million deaths globally in 2020

Represents approximately one in six deaths worldwide

High-incidence cancers

Breast, lung, colon & rectum, prostate

Most frequently diagnosed cancer types

Behavioral risk factors

Tobacco use, high BMI, alcohol intake, poor diet, and physical inactivity

Account for about one-third of cancer-related deaths

Environmental exposure

Air pollution

A major risk factor for lung cancer

Infection-linked cancers

HPV, hepatitis infections

Cause around 30% of cases in low- and lower-middle-income countries

Early diagnosis & treatment

Early detection and timely, effective therapy

Significantly improves cure rates and survival outcomes

Source: WHO, Secondary Research, Grand View Research

Exosomes have gained attention for their potential as biomarkers for early cancer detection, monitoring disease progression, and assessing therapeutic responses. With the global incidence of cancer on the rise, there is an increasing need for advanced diagnostic tools and targeted treatments, the development of which can be facilitated by exosome-based technologies.

Advanced applications of exosomes

The primary clinical applications of exosomes include their use as biomarkers, cell-free therapeutic agents, carriers for drug delivery, tools for studying exosome kinetics, and as components in cancer vaccines. However, an increasing number of ongoing exosome research projects have focused on expanding exosome applications to molecular medicine. Such activities have also helped shape techniques for genetic material analysis, such as the discovery of miRNAs in exosomes for miRNA analysis and for developing molecular medication.

Furthermore, exosomes can be used as an alternative to standard needle or excision biopsies due to reduced patient pain & inconvenience, faster analysis, and lower costs. They are useful in predicting the development or progression of several diseases, including cancer, neurological diseases, heart disease, pregnancy, and infectious diseases. Hence, propelling the market growth.

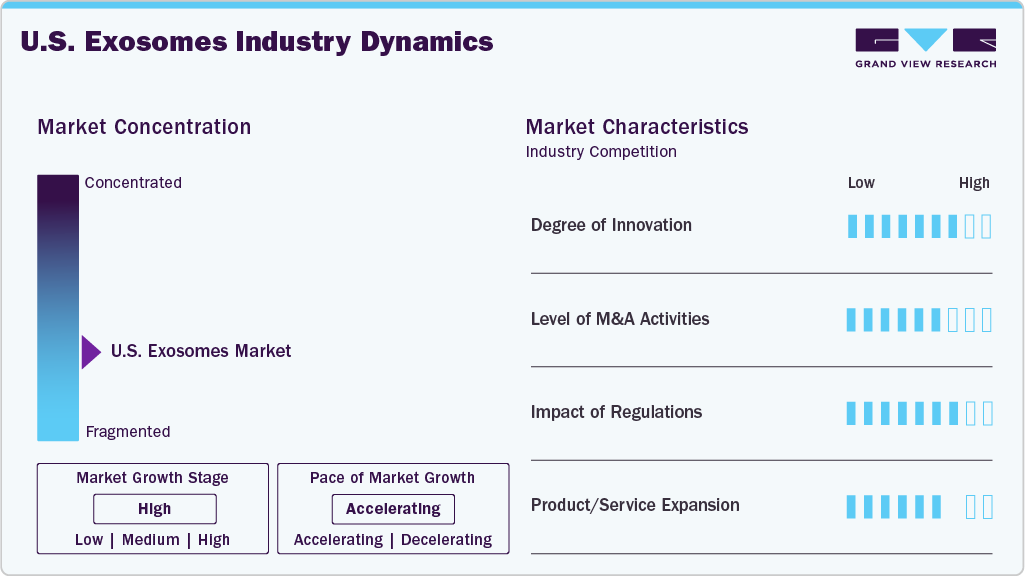

Industry Concentration & Characteristics

The U.S. exosome industry is concentrated due to the presence of leading exosome therapeutic manufacturers, workflow solutions providers, and reagent suppliers. Well-established companies with strong brand recognition, extensive product offerings, and widespread distribution networks drive intense competition.

Various companies are actively forming mergers and acquisitions to drive growth, innovation, and competitiveness by harnessing the knowledge and resources of multiple organizations. For instance, in June 2023, Evox Therapeutics announced the acquisition of Codiak's adeno-associated virus (AAV) technology with all intellectual property rights and manufacturing capabilities.

Regulatory frameworks significantly influence the U.S. exosomes industry, as the FDA’s evolving classification of exosome-based products as biologics, drugs, or cell-derived therapies drives strict requirements for manufacturing, characterization, safety, and clinical validation. While these regulations increase development time and costs, they strengthen product credibility and patient safety. Clear FDA guidance on GMP compliance, IND approvals, and clinical trial oversight is also supporting responsible innovation and enabling the commercialization of exosome-based therapies.

Product expansion in the U.S. exosomes industry is driven by the rising demand for advanced diagnostics and targeted therapeutics, particularly in oncology, neurology, and regenerative medicine. This growth is supported by increasing adoption of precision medicine, continuous advancements in exosome isolation and characterization technologies, strong R&D investments, and active collaborations between biotech firms and research institutions.

Product & Services Insights

The kits & reagents segment dominated the market and accounted for the largest share of 52.99% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. This leading position is fueled by substantial and recurrent demand in exosome isolation, characterization, and analysis workflows, which is backed by progress in research, increased applications in diagnostics development, and the regular introduction of new products by the major market players.

The services segment in the U.S. exosomes industry is growing significantly during the forecast period. Companies offer various services for extracting and analyzing exosomes to facilitate efficient research and therapeutic development. For instance, AMSBIO provides services including exosome isolation and quantification, exosome miRNA isolation and sequencing, exosome surface marker analysis, and proteomics. This diverse array of services offered by different companies is anticipated to stimulate growth in this segment.

Workflow Insights

The downstream analysis segment dominated the market with a 56.82% share in 2025 and is projected to record the highest CAGR from 2026 to 2033. This leadership is driven by extensive adoption of exosome characterization, molecular profiling, and biomarker validation tools across various research applications.

The isolation analysis segment in the U.S. exosomes industry is growing significantly during the forecast period, with techniques like ultracentrifugation, immunocapture on beads, precipitation, and filtration driving this expansion. Companies are introducing advanced isolation platforms to streamline workflows, reduce processing time, increase yield, and maintain exosome integrity, leading to the growth of this segment.

Applications Insights

The cancer segment dominated the market with a revenue share of 45.95% in 2025 and is expected to grow at the highest CAGR from 2026 to 2033. This growth is driven by the rapid adoption of exosome-based liquid biopsy platforms, increased oncological research funding, higher clinical trial activity, and expanding use of exosomes in cancer diagnostics.

The neurodegenerative diseases segment is expected to grow rapidly in the U.S. market due to the clinical advantages of exosomes as cell-free therapies. Their ability to deliver therapeutic components effectively for disease treatment and tissue repair, while minimizing immune rejection and cellular damage, is anticipated to drive market revenue growth.

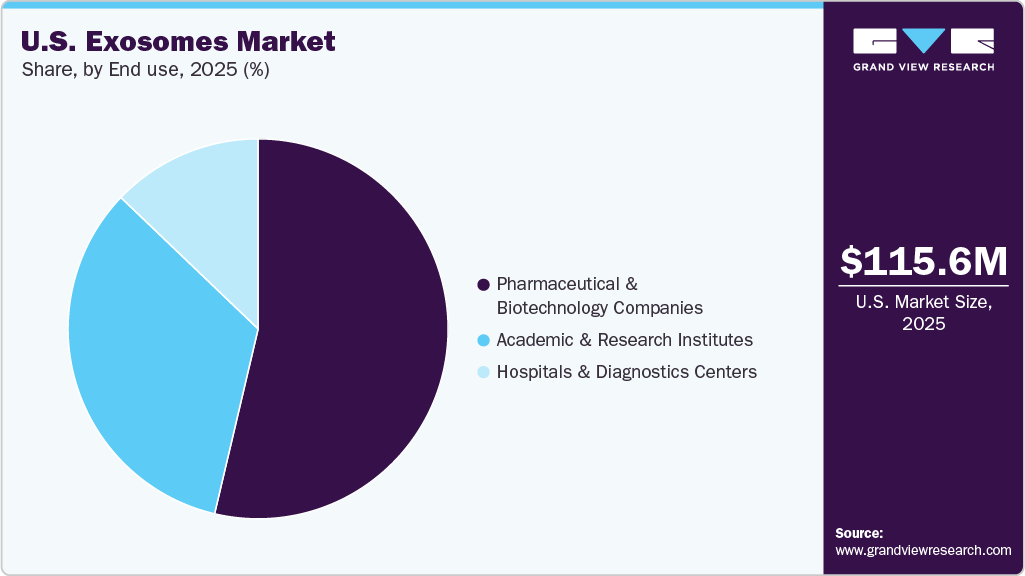

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the market with a revenue share of 53.68% in 2025 and is expected to grow at the highest CAGR from 2026 to 2033. This is attributed to increasing demand for scalable manufacturing solutions and strategic collaborations supporting translational research and commercialization.

The academic & research institutes segment is expected to grow significantly over the forecast period, driven by the rising emphasis of numerous research institutions on utilizing exosomes for innovative therapeutic discoveries. This research is expected to contribute to the growth of this field in the future.

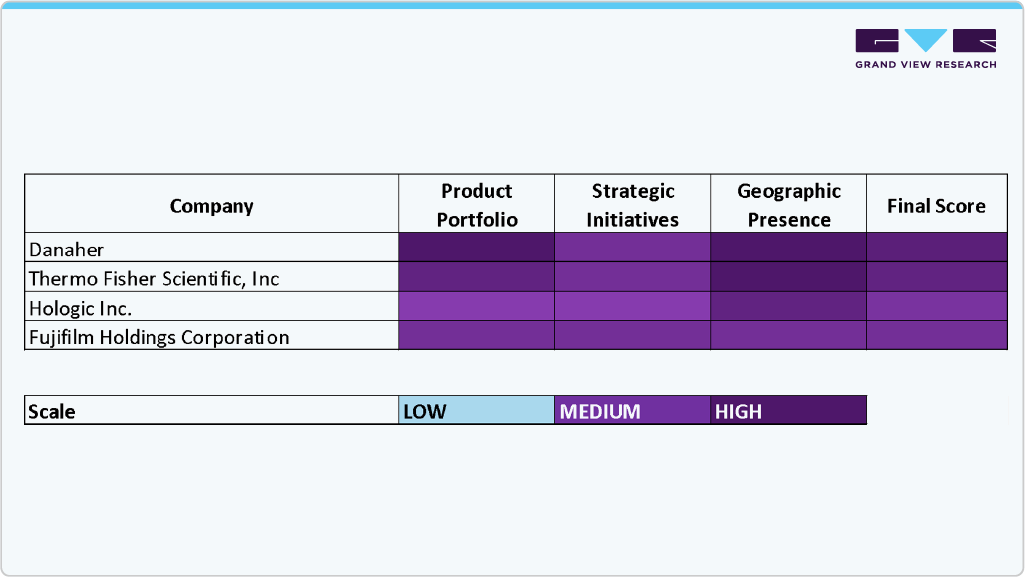

Key U.S. Exosomes Company Insights

Leading companies such as Danaher, Thermo Fisher Scientific, Inc., Lonza, Fujifilm Holdings Corporation, and QIAGEN dominate the market by offering comprehensive exosome isolation, characterization, and manufacturing solutions.

Companies including Miltenyi Biotec, Bio-Techne, Hologic Inc., CellBio Scientific, and RoosterBio, Inc. are strengthening their footprint by introducing innovative platforms, scalable manufacturing technologies, and application-specific exosome products. Strategic collaborations, mergers and acquisitions, and advancements in manufacturing and analytical technologies are intensifying competition, positioning companies that align scientific innovation with clinical and commercial needs to drive sustained growth in the evolving U.S. market.

Key U.S. Exosomes Companies:

- Danaher

- Thermo Fisher Scientific, Inc.

- Hologic Inc.

- Fujifilm Holdings Corporation

- Lonza

- Miltenyi Biotec

- Bio-Techne

- QIAGEN

- CellBio Scientific

- RoosterBio, Inc.

Recent Developments

-

In December 2025, Exousia Pro launched Maxasome, the first all‑natural exosome‑like nutraceutical supplement, targeting the high‑end wellness and longevity market with a monthly subscription offering.

-

In December 2025, Le‑Vel launched its XERA exosome‑powered skin technology system, an advanced skincare line designed to enhance skin repair and rejuvenation using proprietary exosome technology.

U.S. Exosomes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 144.2 million

Revenue forecast in 2033

USD 716.8 million

Growth rate

CAGR of 25.75% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, workflow, end use

Key companies profiled

Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; Fujifilm Holdings Corporation; Lonza; Miltenyi Biotec; Bio-Techne; QIAGEN; CellBio Scientific; RoosterBio, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Exosomes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. exosomes market based on product & service, application, workflow, and end use:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits & reagents

-

Instruments

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Isolation Methods

-

Ultracentrifugation

-

Immunocapture on beads

-

Precipitation

-

Filtration

-

Others

-

-

Downstream Analysis

-

Cell surface marker analysis using flow cytometry

-

Protein Analysis using blotting & ELISA

-

RNA analysis with NGS & PCR

-

Proteomic analysis using mass spectroscopy

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Neurodegenerative Diseases

-

Cardiovascular Diseases

-

Infectious Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostics Centers

-

Academic & Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. exosomes market size was estimated at USD 115.6 million in 2025 and is expected to reach USD 144.2 million in 2026.

b. The U.S. exosomes market is expected to grow at a compound annual growth rate (CAGR) of 25.75% from 2026 to 2033 to reach USD 716.83 million by 2033.

b. Downstream analysis accounted for the largest share in 2025. Technological advancements in exosome analysis have enhanced downstream workflows, encompassing detection, quantification, labeling, and modification of exosomes.

b. Key companies in the U.S. exosome market include Danaher, Thermo Fisher Scientific, Inc., Hologic, and RoosterBio, Inc., among others.

b. Technological advancements in exosome isolation and analytical procedures are contributing to market growth and fueled by the increasing prevalence of cancer. In addition, government and non-government grants for exosome research will likely offer growth opportunities in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.