- Home

- »

- Medical Devices

- »

-

U.S. ECMO Machine Market Size, Industry Report, 2030GVR Report cover

![U.S. ECMO Machine Market Size, Share, & Trends Report]()

U.S. ECMO Machine Market (2024 - 2030) Size, Share, & Trends Analysis Report By Component (Pumps, Oxygenator, Controllers), By Modality (VA, VV, AV), By Patient Type (Neonates, Pediatrics, Adults), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-280-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. ECMO Machine Market Size & Trends

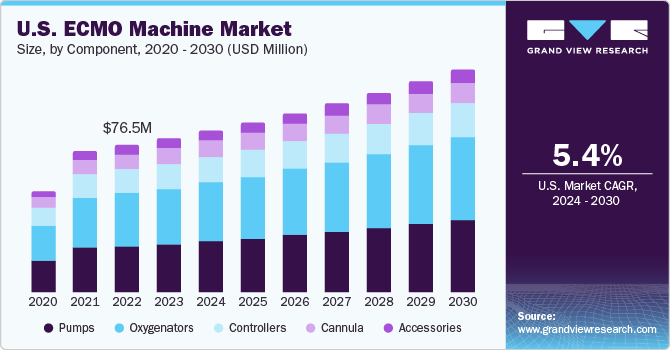

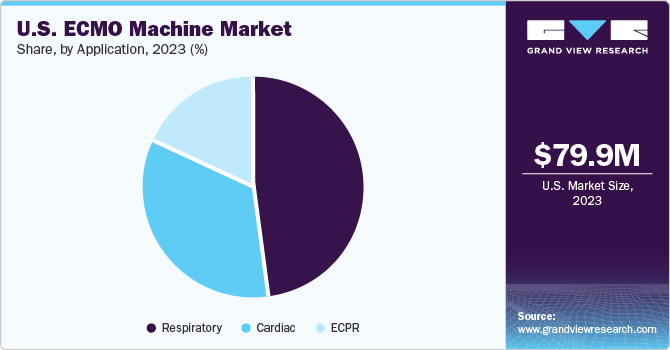

The U.S. ECMO machine market size was estimated at USD 79.9 million in 2023 and is estimated to grow at a CAGR of 5.40% from 2024 to 2030. This growth can be attributed to the rising incidence of cardiopulmonary and respiratory diseases along with a rising number of patients suffering from chronic obstructive pulmonary disease (COPD). Furthermore, technological advances in extracorporeal membrane oxygenation (ECMO) machines increase its adoption among healthcare professionals, fueling market growth.

The U.S. ECMO machine accounted for a 26.0% share in the global extracorporeal membrane oxygenation machine market. The rise in respiratory diseases is expected to boost the market growth. Several respiratory diseases affect individuals, such as bronchiectasis, hypersensitivity pneumonitis, lung fibrosis, asthma, Chronic Obstructive Pulmonary Disease (COPD), and lung cancer. COPD is known to be the third most common cause of death in the United States, following cancer and cardiac diseases. According to the American Lung Association, over 11 million people are diagnosed with COPD in the US every year. The high incidence of COPD has caused a greater demand for ECMO in the market than currently available.

The ECMO market has experienced significant growth due to the rapid integration of ECMO machines in healthcare facilities and the implementation of awareness initiatives. Technological progressions like oxygenators, hollow pumps, and heparin-coated cannula have broadened the scope of ECMO applications in surgical procedures. Moreover, the evolution of smaller, portable ECMO machines has enhanced their versatility and usage. Introducing portable adapters and compact ECMO machine systems has simplified the transport of critically ill patients, fueling market expansion.

Moreover, the rising geriatric population, along with the growing incidence of coronary heart disease, is bolstering the adoption of ECMO machines. As per the Population Statistics Bureau 2022, the number of Americans 65 years of age and older is expected to increase from 58 million to 82 million by 2050, accounting for a 47% increase. This demographic shift, along with the strong association of coronary heart disease with age, is one of the leading causes of death worldwide and is driving the need for advanced life support technologies like ECMO machines. However, potential challenges such as infections, technical failures, bleeding, and the prohibitive cost of treatment may pose barriers to the market's growth.

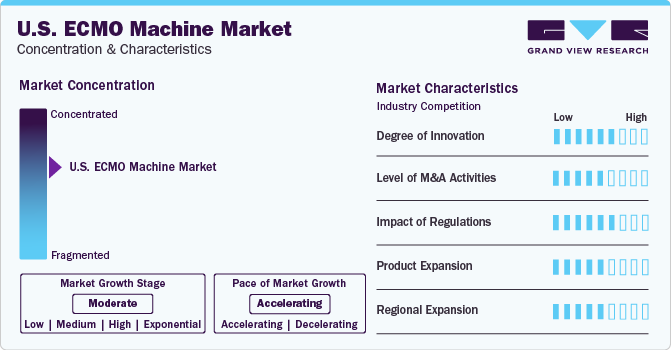

Market Concentration & Characteristics

The U.S. extracorporeal membrane oxygenation machine market is concentrated due to the presence of dominant ECMO machine manufacturers. Furthermore, companies consistently invest in research and development to enhance their technologies, resulting in a wider range of applications for these systems in treating cardiac and respiratory disorders. This strategic focus on innovation drives advancements in ECMO technology and expands the market growth trajectory.

The U.S. extracorporeal membrane oxygenation machine industry is undergoing notable innovation propelled by technological advancements and the uptake of advanced products, particularly in home care environments. Companies investing in these technologies are securing a competitive advantage, fueling the sector's expansion.

Major companies are forming partnerships and collaborations to drive growth, innovation, and competitiveness by utilizing the knowledge and resources of various organizations. These joint initiatives strengthen connections and improve the implementation of clinical programs focused on delivering improved patient results.

Companies in the U.S. extracorporeal membrane oxygenation machine industry are expanding regionally to boost their competitive edge and extend market reach. This approach includes forming partnerships, acquiring enterprises, and deploying targeted marketing strategies to reinforce their position in crucial geographic regions.

The Center for Medicare Services (CMS) in the U.S. has introduced modifications in coding and DRG reimbursement related to extracorporeal membrane oxygenation (ECMO). These changes involve coding ECMO procedures based on indication (cardiac or respiratory) and vascular cannulation (peripheral or central), with distinct reimbursements allocated for each specific code. Consequently, varying ECMO procedures are expected to receive different reimbursement rates.

The U.S. extracorporeal membrane oxygenation machine industry is notably impacted by rigorous quality standards and regulatory requirements. The U.S. FDA plays a crucial role in supervising the approval processes for these devices and therapies to safeguard patient well-being and uphold data accuracy.

Component Insights

Oxygenators dominated the market with a share of 36% in 2023 and are expected to remain dominant over the forecast period. The high prevalence of lung diseases and the growing popularity of ECMO machines drive the segment’s growth. According to CDC statistics, 4.6% of US adults have been diagnosed with COPD, emphysema, or chronic bronchitis in 2022. Such respiratory disorders further lead to increased demand for oxygenators in the market.

The blood pump component is expected to grow significantly from 2024 to 2030. The significant expansion of this segment is mainly due to its extensive utilization in ECMO processes and the presence of multiple pump varieties like roller, impeller, and centrifugal pumps. These pumps are applied in different ECMO procedures according to their specific needs.

Modality Insights

Veno-arterial ECMO modality held the largest share in 2023 and is expected to grow at the fastest CAGR over the forecast period, owing to an increased need for cardiac support in cardiac arrest incidences. Moreover, the veno-arterial ECMO machine is used to treat patients suffering from pulmonary embolism and pulmonary hypertension, especially in the case of acute decompensation. This modality performs the dual function of providing hemodynamic support and gaseous exchange. It pumps the blood toward the arterial side. VA-ECMO configuration helps pump the patient’s lungs, heart, and blood through the ECMO circuit.

The veno-venous segment is expected to witness growth from 2024 to 2030. The increasing incidence of chronic obstructive pulmonary disease (COPD) drives this market segment significantly. The veno-venous ECMO supports the lungs and allows blood oxygenation for all the time needed for the failing lung to recover.

Patient Type Insights

The adult patient segment dominated the market with a share of 59.0% in 2023. The high prevalence of cardiac and respiratory conditions in the geriatric population accelerates the growth of this segment. Recent CDC data from 2021 reveals that a significant percentage of adults in different age groups are susceptible to cardiac diseases in the U.S. Specifically, the data shows that around 1.0% of adults aged 18 to 44, 3.6% of adults aged 45 to 54, 9.0% of adults aged 55 to 64, 14.3% of adults aged 65 to 74, and 24.2% of adults aged 75 and over are affected, thereby contributing to the market growth.

Neonates’ patients' segment is accelerating with a significant CAGR from 2024 to 2030 owing to high dominance of heart diseases within the neonatal population. As per CDC statistics, approximately 16,800 babies are born each year in the United States with a ventricular septal defect. Similarly, 40,000 babies are born with congenital heart diseases annually in the U.S. These cardiac disorders boost the demand for ECMO, thereby fueling the segment’s growth.

Application Insights

Respiratory applications dominated the market with a 48.0% share in 2023. The significance of ECMO and the high prevalence of respiratory conditions will likely enhance the segment’s growth. ECMO serves as pulmonary support to perform efficient respiratory function in patients. This feature increases its demand and thereby boosts market growth.

Extracorporeal cardiopulmonary resuscitation (ECPR) is projected to grow at the fastest CAGR of 5.8% over the forecast period. An increasing number of cardiac arrests is driving the growth trajectory of this segment. ECPR is considered rescue therapy for patients suffering from in-hospital cardiac arrest as well as out-of-hospital cardiac arrest. Such applications of ECPR are likely to expand the growth opportunities of ECPR in the forecast period.

Key U.S. ECMO Machine Company Insights

The U.S. Extracorporeal Membrane Oxygenation Machine industry competition is expected to intensify due new product development, advancement in existing products, and the implementation of price reduction strategies. Companies are likely to focus on increasing their market share by enhancing marketing efforts through the sales teams of respective players. Additionally, collaborations and partnerships among key industry players are anticipated to drive aggressive competition in the market over the forecast period.

Key U.S. ECMO Machine Companies:

- Inspira

- Abbott

- Terumo Cardiovascular Systems Corporation

- CytoSorbents Corporation

- Cyberonics, Inc

- OriGen

- GOHIBIC™

- Agilent Technologies

- Soma Tech Intl

- Mott Corporation

Recent Developments

- In 2023, Abbott obtained two new clearances from the U.S. Food and Drug Administration (FDA) for its renowned life support system, notably the CentriMag Blood Pump. These FDA approvals enable longer-term use in adults requiring extracorporeal membrane oxygenation (ECMO), a crucial life support technique for individuals experiencing heart and lung complications.

- In July 2022, Inspira Technologies OXY B.H.N Ltd. introduced the "Liby" System, an innovative life support system aimed at addressing life-threatening heart and lung failure in patients. This advanced technology represents a significant development in the field of life support and is designed to cater to individuals facing critical heart and lung issues.

U.S. ECMO Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 79.9 million

Revenue forecast for 2030

USD 114.7 million

Growth rate

CAGR of 5.40% from 2024 to 2030

Actual estimates

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, modality, patient type, application

Country Scope

U.S.

Key companies profiled

Inspira; Abbott; Terumo Cardiovascular Systems Corporation CytoSorbents Corporation; Cyberonics, Inc; OriGenGOHIBIC™; Agilent Technologies; Soma Tech Intl; Mott Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. ECMO Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. ECMO machine market reportbased on component, modality, patient type, and application:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Pumps

-

Oxygenators

-

Controllers

-

Cannula

-

Accessories

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Veno-Arterial

-

Veno-Venous

-

Arterio-Venous

-

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neonates

-

Pediatric

-

Adult

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Neonates

-

Pediatric

-

Adult

-

-

Cardiac

-

Neonates

-

Pediatric

-

Adult

-

-

ECPR

-

Neonates

-

Pediatric

-

Adult

-

-

Frequently Asked Questions About This Report

b. The U.S. extracorporeal membrane oxygenation machine market size was estimated at USD 79.9 million in 2023 and is expected to reach USD 83.71 million in 2024.

b. The U.S. ECMO machine market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 114.7 million by 2030.

b. Veno-arterial dominated the ECMO machine market with a share of 41.8% in 2023. This is attributable to rising product demand and adoption rate

b. Some key players operating in the U.S. ECMO machine market include Medtronic plc, Sorin Group, Terumo Cardiovascular Systems Corporation, MAQUET Holding B.V. & Co. KG, Medos Medizintechnik AG, Nipro Medical Corporation, and Microport Scientific Corporation.

b. Key factors that are driving the U.S. ECMO machine market growth include the rising prevalence of cardiopulmonary and respiratory diseases, increasing adoption of ECMO machines in hospitals, technological advancement in ECMO machines, and growing awareness towards the application of ECMO.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.