- Home

- »

- Medical Devices

- »

-

Extracorporeal Membrane Oxygenation Machine Market Report 2030GVR Report cover

![Extracorporeal Membrane Oxygenation Machine Market Size, Share & Trends Report]()

Extracorporeal Membrane Oxygenation Machine Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Pumps, Oxygenator, Controllers), By Modality (VA, VV, AV), By Patient Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-001-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extracorporeal Membrane Oxygenation Machine Market Summary

The global extracorporeal membrane oxygenation machine market size was estimated at USD 307.9 million in 2023 and is projected to reach USD 445.7 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. This growth is driven by an increase in the incidence of cardiopulmonary diseases and respiratory failures.

Key Market Trends & Insights

- North America dominated the overall market in 2023 with a revenue share of 39.5%.

- The U.S. accounted for North America's largest share of the market in 2023.

- By component, the oxygenators segment accounted for the largest market share of 34.61% in 2023 and shows the fastest CAGR over the forecast period.

- By modality, the veno-arterial segment accounted for the largest revenue share of 42.2% in 2023.

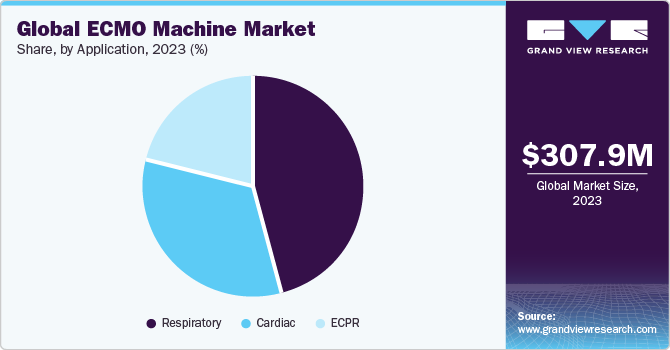

- By application, the respiratory segment accounted for the largest revenue share of 44.10% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 307.9 Million

- 2030 Projected Market Size: USD 445.7 Million

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, according to the Centers for Disease Control and Prevention (CDC), a person dies every 37 seconds due to cardiovascular disease in the U.S., underscoring the need for advanced medical technologies like extracorporeal membrane oxygenation (ECMO) machines. COPD, a leading cause of death in the U.S in 2020, has significantly influenced the growth of the market. As per the American Lung Association report for 2022, 4.6% of adults, or 11.7 million people, reported a diagnosis of COPD, underscoring the rising prevalence of this condition. This rise in COPD cases has necessitated advanced life support technologies, sparking remarkable technological innovations within ECMO systems. Recently, advancements in this field have included the integration of hollow pumps, state-of-the-art oxygenators, and heparin-coated cannula. These improvements have enhanced the efficiency and applicability of ECMO systems across a range of surgical procedures.

The growing adoption of Extracorporeal Membrane Oxygenation (ECMO) machines in hospitals and the proliferation of awareness programs have been instrumental in driving the growth of the ECMO machine market. In the U.S. alone, more than one hundred new ECMO programs have been established in the past 3-5 years, increasing the total number of ECMO programs to about 300 to 400. This growth is evident in the increasing number of procedures performed worldwide, reflecting the growing acceptance of these machines in healthcare settings. In recent times, Inspira Technologies OXY B.H.N. Ltd. introduced the "Liby" System in July 2022, an advanced life support system designed to treat patients with life-threatening heart and lung failure. This development marks a significant milestone in the evolution of ECMO technology, further propelling the market forward.

The rapid adoption of ECMO machines in hospitals and the spread of awareness programs have been key catalysts for the growth of the market. Technological advancements in these systems, such as the incorporation of oxygenators, hollow pumps, and heparin-coated cannula, have allowed for various applications in surgeries. Furthermore, the development of smaller, more portable ECMO machines has expanded their usability and applications. The creation of portable adapters and compact ECMO machine circuits has facilitated the transportation of critically ill patients, further driving the market growth.

Moreover, the increasing geriatric population coupled with the rising incidence of coronary heart disease is bolstering the adoption of ECMO machines. As per the Population Reference Bureau's 2022 facts sheet, a 47% increase in the number of Americans 65 and older is expected by 2050, from fifty-eight million in 2022 to 82 million. This demographic shift, along with the strong association of coronary heart disease with age, is one of the leading causes of death worldwide, is driving the need for advanced life support technologies like ECMO machines. However, potential challenges such as infections, technical failures, bleeding, and the prohibitive cost of treatment may pose barriers to the market's growth.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating due to the increasing prevalence of cardiopulmonary and respiratory diseases, necessitating the use of advanced life support technologies like ECMO machines. ECMO machine manufacturers, are continually investing in research and development to improve their technologies, which has led to a broader application of these systems in various surgeries. Technological advancements in these systems, such as the introduction of oxygenators, hollow pumps, and heparin-coated cannula, have expanded their applications and have resulted in a significant increase in the market size

Key strategies implemented by players in ECMO machine market are new product launches, expansion, acquisitions, partnerships, and other strategies. Companies are seeking to consolidate their position in the market, access modern technologies, and expand their customer base. For instance, in May 2020 Abiomed, known for producing the Impella heart pump, announced the acquisition of Breethe, a developer of a unique extracorporeal membrane oxygenation (ECMO) system. This acquisition is expected to enhance Abiomed's capability to provide comprehensive care for patients with severe respiratory conditions.

Degree of Innovation

The market has seen a high degree of innovation, with leading manufacturers constantly developing advanced products to aid in the treatment of heart or lung failures. For instance, in 2020, INTEGRIS Health and EMSA created a groundbreaking ECMO ambulance designed to offer specialized care in critical medical situations. This innovative vehicle marks a notable advancement in emergency medical services, guaranteeing prompt and advanced care for patients requiring immediate attention.

Impact of Regulations

Food and Drug Administration (FDA) in the U.S. and Health Canada in Canada. In Europe, the European Medicines Agency (EMA) oversees the regulatory landscape. Meanwhile, in the Asia Pacific region, the National Medical Products Administration (NMPA) in China plays a significant role in regulating ECMO machines. These regulatory bodies ensure the safety and efficacy of ECMO machines before they are approved for use in clinical settings.

Level of M&A Activities

Mergers and acquisitions in the ECMO machine market are on the rise and are expected to continue growing during the analysis period. Many companies are acquiring development-stage firms to expand their product portfolios and cater to a larger patient base. For instance, in October 2021 MicroPort Surgical, a critical care subsidiary of MicroPort Scientific, enhances emergency and critical care capabilities by acquiring Hemovent, a German ECLS technology specialist, for strategic ECMO market expansion, by integrating CPB with Hemovent's ECMO product development. These firms are also integrating advanced facilities and forming strategic alliances to leverage synergies in capabilities and resources, thereby enhancing their competitiveness in the market.

Service Substitute

The main substitutes for ECMO machines in the market are traditional ventilators and other mechanical ventilation methods. However, these alternatives often fall short in providing the necessary level of oxygenation and are typically reserved for less severe conditions.

Consolidate market

Major players like Medtronic, Getinge, and Maquet dominate the market with established brands, extensive distribution networks, and significant market share.

Regional Expansion

The market is experiencing robust global expansion. North America holds the largest market share, followed by Europe and China. The increasing prevalence of chronic diseases and a surge in heart and lung transplants are key factors driving this expansion. Additionally, advancements in lung pulmonary airway disease treatment, favorable reimbursement policies, and the expansion of the healthcare industry across developing regions of Asia and Africa are further contributing to the market's growth.Moreover, ECMO machine manufacturers in India are capitalizing on these opportunities to strengthen their market presence and contribute to the global market.

Component Insights

The oxygenators segment accounted for the largest market share of 34.61% in 2023 and shows the fastest CAGR over the forecast period. This can be attributed to their escalating prevalence of chronic diseases such as Chronic Obstructive Pulmonary Disease (COPD) and the increasing demand for heart and lung transplantation procedures. According to the World Health Organization (WHO ), COPD was the third leading cause of death globally, and resulting in approximately 3.23 million deaths. This alarming rise in the mortality rate due to respiratory and cardiovascular diseases is fueling the growth of the extracorporeal membrane oxygenation machine market.

The pumps segment has a considerable market share owing to excessive cost and usage. The pumps of ECMO machines are essential for moving blood from a patient to artificial lungs, which oxygenate the blood and return it to the patient. The growth of this segment is primarily attributed to its high usage in ECMO procedures and the availability of several types of pumps, including roller, impeller, and centrifugal pumps. These pumps are used in various applications of ECMO procedures based on their requirements. For instance , in 2020, INTEGRIS Health and EMSA unveiled a unique specialty care ECMO ambulance, demonstrating the practical application of these pumps.

Modality Insights

The veno-arterial segment accounted for the largest revenue share of 42.2% in 2023 and is expected to grow at a healthy CAGR during the forecast period. This growth can be attributed to its high usage in treating patients with cardiac arrest, where it assists with algorithm life support strategies to restore blood circulation. Additionally, the increasing incidence of chronic obstructive pulmonary disease (COPD) is also a key driver of this market segment. For instance, a research paper published by BMC Pulmonary Medicine in July 2022] stated that approximately 300 million people have COPD globally, with a prevalence of approximately 12.2%, indicating a significant need for advanced life support technologies like ECMO machines.

The veno-venous segment in the market captured a significant share in 2023 and is expected to witness lucrative growth during the forecast period.This segment's primary function is to simplify the exchange of oxygen and carbon dioxide, making it a prominent application in cases requiring lung support. The increasing incidence of chronic obstructive pulmonary disease (COPD) is a significant driver of this market segment. For instance, a study published by BMC Pulmonary Medicine in July 2022 revealed that approximately three hundred million people have COPD globally. Furthermore, recent industry developments, such as LivaNova PLC receiving FDA clearance for ECMO for LifeSPARC in November 2022, illustrate the continued innovation and growth in this sector.

Application Insights

The respiratory segment accounted for the largest revenue share of 44.10% in 2023 and is expected to grow at a fastest CAGR during the forecast period. This can be attributed to the high prevalence of respiratory disorders among patients, making ECMO machines a crucial tool for providing prolonged respiratory support. The increasing incidence of chronic diseases such as Chronic Obstructive Pulmonary Disease (COPD) is also a key driver of this market segment. The World Health Organization (WHO) estimates that 3.23 million people died from COPD in 2019, making it the third most common cause of death globally. This rise in the mortality rate of respiratory diseases is providing a significant impetus to the market growth.

The cardiac surgery segment in the ECMO market accounted for a considerable market share in 2023, owing to the increasing incidence of cardiac surgery and growing awareness about the use of ECMO machines in cardiac surgery. According to the American Heart Association 2022, the average age at the first heart attack was 65.6 years for males and 72.0 years for females. Every 40 seconds, someone in the U.S. experiences a myocardial infarction. Moreover, the rising cost of ECMO procedures, especially in cardiac surgery, is expected to drive the market growth.

Patient Type Insights

The adult patient segment accounted for the largest market revenue share of59.38% in 2023 and is also expected to grow at a fastest rate during the forecast period. This dominance can be attributed to the increasing prevalence of diseases such as coronary heart disease and the growing geriatric population. Cardiovascular diseases (CVDs) are the leading cause of death globally, accounting for up to 17.9 million deaths each year. India bears over 60% of the global burden of heart disease, per a study conducted by the Registrar General of India and the Indian Council of Medical Research. This demographic shift is driving the need for advanced life support technologies like ECMO machines. Moreover, the increasing global burden of cardiac and respiratory diseases in adults due to consumption of alcohol, tobacco, and smoking coupled with a sedentary lifestyle drives the market.

The pediatric segment also accounted for the considerable market share and is expected to grow at a robust pace during the forecast period due to the increasing incidence of pediatric diseases that require advanced life support technologies, such as ECMO machines. The Registrar General of India and the Indian Council of Medical Research issued research indicating that the country's pediatric population is quickly expanding, necessitating the use of such innovative medical technologies.

Regional Insights

North America dominated the overall market in 2023 with a revenue share of 39.5%. This can be attributed due to government support for quality healthcare, high purchasing power parity, and the increasing prevalence of diseases such as chronic obstructive pulmonary disease in the U.S. and Canada. The presence of sophisticated healthcare facilities and favorable reimbursement policies has led to increased hospital admission rates which in turn is expected to boost the usage rates in this region.

The U.S. accounted for North America's largest share of the market in 2023. Country's well-developed healthcare infrastructure and a large patient population requiring ECMO machines, given the prevalence of chronic diseases and a high incidence of cardiac and respiratory failures. Additionally, the U.S. has consistently been a global leader in medical device innovation, attracting top manufacturers of ECMO machines. For instance, Medtronic, a leading global provider of medical technology solutions, has made significant strides in the ECMO machine market. Furthermore, the active involvement of the U.S. in the development and approval of ECMO machines has resulted in increased adoption and growth of this market segment.

The Asia Pacific region is expected to grow fastest during the forecast period. This progress is driven by are increase in healthcare expenditure by the government and private agencies to improve healthcare facilities. Economic development in countries such as Japan, India, and China coupled with rising government initiatives related to the development of healthcare infrastructure and reimbursement policies are further expected to augment the market growth.

The Japan accounted for Asia Pacific largest share of ECMO machine market in 2023. Japan has a highly developed healthcare infrastructure, which allows for early detection and treatment of diseases, increasing the demand for ECMO machines. In addition, the rising geriatric population and increasing healthcare spending in Japan have led to a surge in chronic disease cases, creating a demand for advanced life support technologies like ECMO machines.

Key Extracorporeal Membrane Oxygenation Machine Company Insights

The competitive scenario in the ECMO machine market is driven by both established players and new entrants, with innovation, market expansion, and niche specialization being key strategies. Emerging trends like portable systems, telemedicine, and AI are further shaping the landscape. Leading players invest heavily in R&D for portable, miniaturized, and AI-powered ECMO systems to cater to diverse patient needs and improve clinical outcomes. Established companies are looking to penetrate into new markets, particularly in developing regions with rising demand for ECMO therapy.

Key Extracorporeal Membrane Oxygenation Machine Companies:

The following are the leading companies in the extracorporeal membrane oxygenation machine market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these extracorporeal membrane oxygenation machine companies are analyzed to map the supply network.

- Medtronic Plc

- Maquet Holding

- Microport Scientific Corporation

- Terumo Cardiovascular System Corporation

- Medos Medizintechnik

- Nipro Medical Corporation

- LivaNova PLC

- CytoSorbents Corporation

- EUROSETS S.R.L

Recent Developments

-

In July 2023, BreathMo, a state-of-the-art ECMO system, was introduced at the ASAIO Conference, representing China's homegrown innovation in medical technology. This cutting-edge maglev technology addresses the unique medical needs of patients in China, marking a notable advancement in the field.

-

In April 2023, Abbott secured two new clearances from the U.S. Food and Drug Administration (FDA) for its acclaimed life support system, particularly the CentriMag Blood Pump. The extended FDA indication allows for longer-term use in adults depending on extracorporeal membrane oxygenation (ECMO), a vital life support method for those with heart and lung issues.

-

In November 2022, LivaNova PLC, the company announced the receipt of 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its next-generation advanced circulatory support system, LifeSPARC. This approval signifies that the LifeSPARC system meets the criteria set forth by the FDA, and it can now be used in the U.S. market.

-

In July 2022 , Inspira Technologies OXY B.H.N Ltd., a pioneer in life support technology, introduced the "Liby" System. This advanced life support system is designed to treat patients with life-threatening heart and lung failure.

-

In July 2021, Xenios AG, a subsidiary of Fresenius Medical Care, received approval from the National Medical Products Administration (NMPA) in China for the use of its Xenios Console and patient kits in ECMO therapy. This approval comes following the successful registration of two patient kits in China.

Extracorporeal Membrane Oxygenation Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 322.9 million

Revenue forecast in 2030

USD 445.7 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Modality, Application, Patient Type

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic Plc; Maquet Holding; Microport Scientific Corporation; Terumo Cardiovascular System Corporation; Medos Medizintechnik; Nipro Medical Corporation; LivaNova PLC; CytoSorbents Corporation; and EUROSETS S.R.L

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extracorporeal Membrane Oxygenation Machine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global extracorporeal membrane oxygenation machine market report based on component, modality, patient type, application, and region

-

Extracorporeal Membrane Oxygenation (ECMO) Machine Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Pumps

-

Oxygenator

-

Controllers

-

Cannula

-

Accessories

-

-

Extracorporeal Membrane Oxygenation (ECMO) Machine Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Veno-Arterial

-

Veno-Venous

-

Arterio-Venous

-

-

Extracorporeal Membrane Oxygenation (ECMO) Machine Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neonates

-

Pediatric

-

Adult

-

-

Extracorporeal Membrane Oxygenation (ECMO) Machine Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Neonates

-

Pediatric

-

Adult

-

-

Cardiac

-

Neonates

-

Pediatric

-

Adult

-

-

ECPR

-

Neonates

-

Pediatric

-

Adult

-

-

-

Extracorporeal Membrane Oxygenation (ECMO) Machine Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global extracorporeal membrane oxygenation machine market size was estimated at USD 307.9 million in 2023 and is expected to reach USD 322.9 million in 2024.

b. The global extracorporeal membrane oxygenation machine market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 445.7 million by 2030.

b. North America dominated the ECMO machine market with a share of 39.5% in 2023. This is attributable to government support for quality healthcare, high purchasing power parity of patients, and increasing prevalence of diseases such as chronic obstructive pulmonary disease (COPD).

b. Some key players operating in the ECMO machine market include Medtronic plc, Sorin Group, Terumo Cardiovascular Systems Corporation, MAQUET Holding B.V. & Co. KG, Medos Medizintechnik AG, Nipro Medical Corporation, and Microport Scientific Corporation.

b. Key factors that are driving the extracorporeal membrane oxygenation machine market growth include the rising prevalence of cardiopulmonary and respiratory diseases, increasing adoption of ECMO machines in hospitals, technological advancement in ECMO machines, and growing awareness towards the application of ECMO.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.