- Home

- »

- Medical Devices

- »

-

U.S. Eye Care Services Market Size, Industry Report, 2033GVR Report cover

![U.S. Eye Care Services Market Size, Share & Trends Report]()

U.S. Eye Care Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Vision Testing & Eye Exams, Surgical Interventions), By Indication (Dry Eye Disease), By Provider Type, And Segment Forecasts

- Report ID: GVR-4-68040-626-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Eye Care Services Market Trends

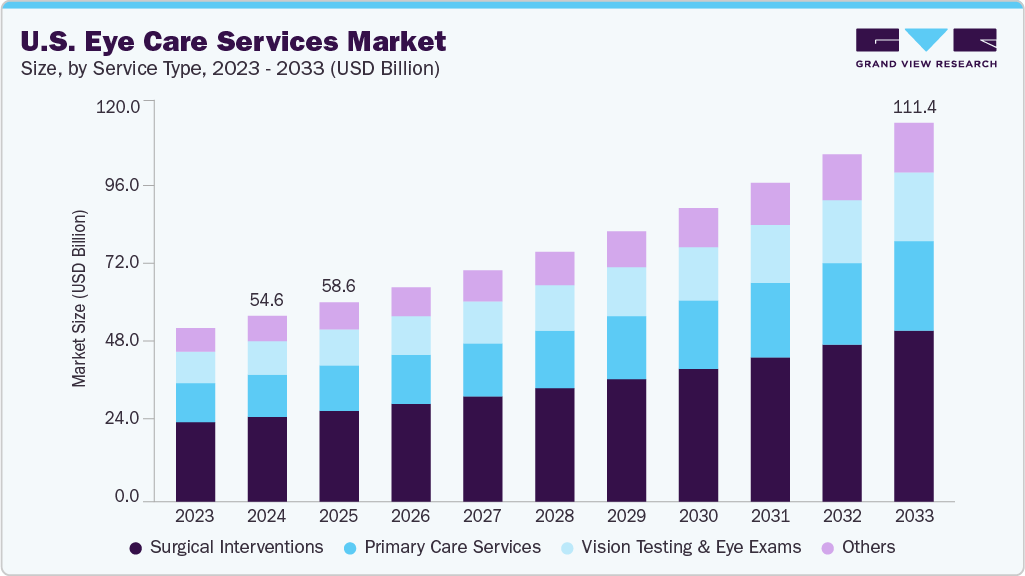

The U.S. eye care services market size was estimated at USD 54.57 billion in 2024 and is projected to grow at a CAGR of 8.37% from 2025 to 2033. Market growth is attributed to the increasing number of individuals experiencing eye-related issues, a rapidly increasing aging population, advancements in technology, and heightened awareness regarding eye care.

As per the U.S. Centers for Disease Control and Prevention (CDC) report published in May 2024, nearly 12 million people aged 40 years and over in the U.S. are suffering with vision impairment, which includes 1 million with blindness. Moreover, the rising occurrence of vision problems, particularly vision impairment and presbyopia, offers substantial opportunities for the industry.

The country is experiencing a rapid increase in the elderly population, particularly those over 65. Age-related eye conditions such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy are more prevalent in this group, driving the need for regular eye exams and treatments. According to a CDC report published in May 2024, approximately 93 million adults in the U.S. are at a high risk for significant vision loss, yet only about half of them have seen an eye doctor in the past year. This is crucial because early detection often prevents or postpones vision deterioration. By 2050, the economic burden of major vision issues is projected to escalate to USD 373 billion.

The widespread use of digital devices across all age groups has led to a surge in digital eye strain and related vision problems. This trend has created increased demand for blue light filtering lenses, regular eye checkups, and specialized care for digital eye strain.

Widespread Digital Device Use Contributing to Digital Eye Strain and Vision-Related Problems Across Different Age Groups:

Age Group

Digital Device Usage Scenario

Resulting Eye Strain Issues

Common Interventions

Children (5-12 yrs)

Online classes, gaming apps, video streaming

Headaches, blurred vision, dry eyes

Pediatric eye exams, blue light glasses, screen time limits

Teens (13-19 yrs)

Social media, texting, YouTube/TikTok, gaming

Eye fatigue, sleep disruption, focusing issues

Anti-glare screens, vision therapy, ergonomic awareness

Young Adults (20-39 yrs)

Remote work, online meetings, binge-watching

Computer Vision Syndrome (CVS), dry eye syndrome

Blue light filtering lenses, regular eye checkups, screen breaks

Middle-aged Adults (40-59 yrs)

Office work, email, streaming, e-books

Presbyopia, digital fatigue, eye strain

Progressive lenses, specialized computer glasses, lubricating drops

Seniors (60+ yrs)

Tablets, smartphones for news, video calls

Worsening of age-related issues due to screens

Routine eye exams, screen brightness adjustment, larger text settings

Growing Demand for Telehealth Services:

Telehealth services in eye care also known as teleophthalmology has a significant growth in the U.S., particularly accelerated by the COVID-19 pandemic. These services use digital platforms to deliver remote eye care, increasing accessibility and convenience for patients.

Overview of Key Aspects of Telehealth in Eye Care:

Service Type

Description

Platforms

Benefits

Virtual Eye Consultations

Video calls with optometrists/ophthalmologists for screening and follow-up care

EyeCare Live, Simple Contacts

Reduces travel, faster access to specialists

Digital Vision Testing

Online tools or apps to test visual acuity, refraction, or symptoms

Visibly (formerly Opternative), EyeQue

Offers rapid, affordable basic vision tests

Remote Monitoring of Chronic Eye Conditions

Monitoring diseases such as glaucoma or diabetic retinopathy using home-based imaging and data sharing

RetinaVue Network, Topcon Harmony

Enables timely intervention, especially in rural areas

AI-Powered Diagnostic Tools

AI analyzes retinal images for early disease detection

IDx-DR (FDA-approved for diabetic retinopathy)

Speeds up diagnosis, can be used by non-specialist staff

Prescription Renewals & Lens Ordering

Online renewals and delivery of contact lenses and glasses

Warby Parker, 1-800 Contacts

Convenience and continuity of care

School & Workplace Screenings

Remote screenings for children and employees using tablets or kiosks

Digital Optometry solutions, school health programs

Early detection in high-volume settings

Ease Access to Vision Insurance:

Vision insurance coverage through employers or Medicaid/Medicare has expanded access to preventative and corrective eye care. Regular vision screenings and affordable eyewear have become more accessible due to coverage improvements. For instance:

-

In February 2025, Renaissance established collaborations with various platforms to enhance the accessibility of dental and vision insurance:

-

Gig Economy Platforms: By integrating with platforms that support gig workers, Renaissance enables independent workers to access affordable vision plans.

-

Individual Coverage Health Reimbursement Arrangement (ICHRA) Platforms: These partnerships allow employers to provide employees with tax-free funds to purchase health insurance, including vision coverage, meeting ACA standards. These integrations facilitate seamless customer experiences, allowing individuals to find and enroll in coverage that suits their needs.

-

In March 2025, KITS Eyecare Ltd. announced the launch of integrated vision care insurance support for U.S. customers. This new functionality enables eligibility and benefits verification for all major U.S. vision insurance providers, offering a streamlined and simplified process to file claims electronically in minutes, now available on KITS.com.

Key Features of the Integration:

-

Real-Time Eligibility Verification: Customers can instantly verify their vision plan eligibility with major U.S. providers, including VSP, Eyemed, Superior, and Versant.

-

One-Click Digital Claims Submission: The platform allows for electronic claims filing, eliminating the need for paperwork and reducing processing times.

- User-Friendly Online Experience: The integration offers a seamless online vision insurance experience, simplifying the process of accessing and applying vision care benefits.

Technological Advancements:

AI-driven diagnostics, teleophthalmology, and minimally invasive surgical techniques are revolutionizing eye care. These innovations improve early detection and treatment outcomes, driving more individuals to seek professional eye care services.

Applications of AI in Eye Care Diagnostics:

AI Application

Function

Benefits

Examples

Diabetic Retinopathy Detection

Analyzes retinal images to detect early signs of damage from diabetes

Enables early intervention, reduces vision loss

IDx-DR (FDA-approved), EyeArt

Age-related Macular Degeneration (AMD)

Identifies AMD from optical coherence tomography (OCT) or fundus images

Supports timely treatment to slow progression

Google DeepMind's research on OCT

Glaucoma Detection

AI analyzes optic nerve structure and visual fields

Improves early detection before symptoms appear

Retina AI, iPredict

Cataract Grading & Screening

Classifies cataract severity from slit-lamp or fundus photos

Aids in prioritizing surgery and treatment

Research tools integrated into digital slit lamps

Teleophthalmology Integration

AI triages patients based on image severity and urgency

Streamlines remote diagnostics and referrals

Eyenuk, RetinaVue, Topcon Harmony

Pediatric Eye Screening

Uses facial recognition and vision cues to screen children for amblyopia or strabismus

Rapid, non-invasive, suitable for school settings

GoCheck Kids, DIVE Medical

Furthermore, increased awareness of the importance of eye health due to increasing campaigns and educational efforts which has encouraged more people to get routine vision screenings and early treatment. For instance, in September 2024, the American Optometric Association (AOA) launched a public awareness campaign titled “The Eye” as part of its ongoing “Eye Deserve More” initiative. This campaign aims to educate individual about the importance of eye health by comparing the human eye to advanced technology, emphasizing its complexity and value. Moreover, in May 2024, Prevent Blindness, launched the “It Started with an Eye Exam” campaign to encourage individuals to share personal stories about how eye care services and exams have improved their vision and daily lives. The campaign aims to increase awareness about the role of vision health in overall well-being and to educate the public on the importance of regular eye examinations.

Moreover, the growth of optical retail chains and online platforms for eyewear has made vision care more convenient and affordable, drawing in younger, tech-savvy consumers and expanding overall market demand. For instance, in October 2024, Bausch + Lomb launched Opal, a digital e-commerce marketplace in the U.S., designed to enhance efficiency for eye care practices and improve the patient experience. Opal offers a streamlined ordering process for Bausch + Lomb contact lenses, with plans to include select over the counter (OTC) products in the future. The platform offers:

-

Streamlined Ordering: Eye care professionals and patients can order Bausch + Lomb contact lenses directly through the platform, including brands such as INFUSE, ULTRA, and Biotrue ONEday.

-

Order Tracking and History: Users can track orders and access their purchase history, ensuring transparency and ease of reordering.

-

Appointment and Prescription Reminders: Automated reminders help patients stay up to date with their eye care requirements.

-

Free Shipping: All orders made through Opal come with free shipping, either to patients’ homes or directly to eye care practices.

- Loyalty Program Integration: Each patient purchase earns points toward the Bausch + Lomb Horizon Rewards loyalty program.

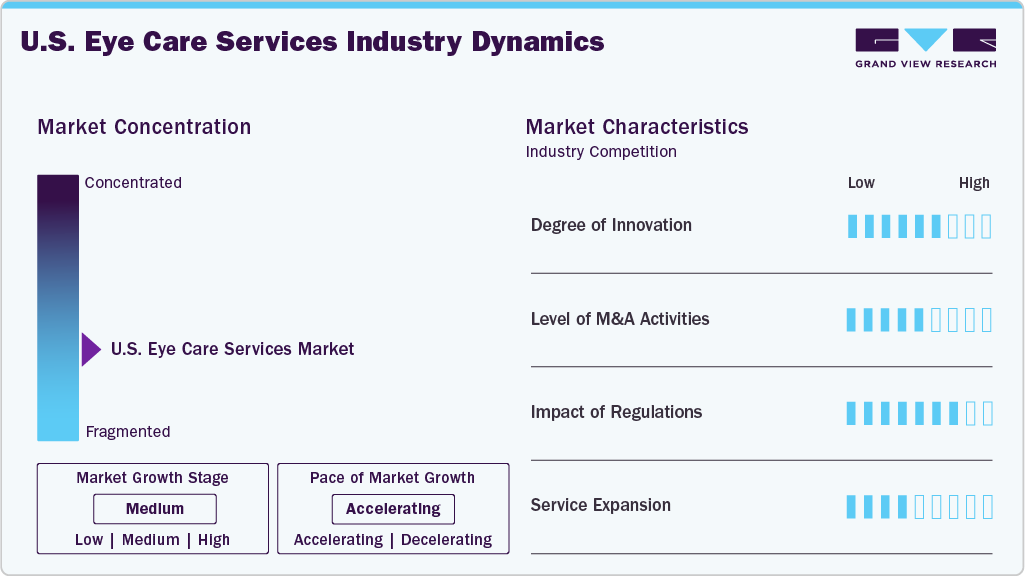

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The U.S. eye care services industry is fragmented, with many small players entering the market and launching new innovative facilities & services.

The U.S. eye care services industry is experiencing a high degree of innovation. The use of the eye as a diagnostic window into overall health, known as oculomics, combined with AI, is emerging as a powerful approach to identify diseases earlier and more accurately. For instance, in July 2024, Johnson & Johnson made a strategic investment in TECLens, a clinical-stage ophthalmic medical device pioneering non-invasive vision correction technology. TECLens is developing a novel, non-incisional refractive correction procedure that leverages corneal cross-linking (CXL) to reshape the cornea. Their proprietary technology, Quantitative Corneal Cross-Linking (qCXL), delivers a pre-calculated pattern and dose of ultraviolet (UV) light based on a computational biomechanics model of each patient’s eye.

Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2024, Eye Health America (EHA), a leading integrated eyecare platform in the Southeastern U.S., announced its acquisition of Loris Eye Associates (LEA). Sam Seltzer, MD, Medical Director at CCFS. Said; “Our partnership with Loris Eye Associates and Dr. Ray enhances our mission to make lives better with personalized eyecare. I have worked with Dr. Ray for almost two decades and have been thoroughly impressed with his dedication to excellent patient care. The LEA team is a fantastic addition to CCFS and Eye Health America.”

The regulatory framework for the U.S. eye care services industry involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. In April 2024, the Vision Council has launched PolicyWatch, an online regulatory monitoring service designed to assist the optical industry in navigating the evolving landscape of teleoptometry regulations across the U.S. This platform provides real-time updates on teleoptometry laws, regulations, and legislation in all 50 states and the District of Columbia.

The U.S. eye care services industry is experiencing a significant degree of service expansion as the demand for home-based care services continues to increase. Companies are expanding their services to include a broader range of healthcare services. For instance, in October 2024, ZEISS expanded its ophthalmic offerings by introducing advanced digital AI tools and innovative surgical solutions, aiming to enhance patient care and streamline clinical workflows. ZEISS continues to expand its digital ecosystem, integrating these innovations into comprehensive workflows across cataract, corneal refractive, retina, and glaucoma treatments. By fostering a digitally connected environment, ZEISS aims to support personalized patient care and advance clinical workflows.

Service Type Insights

The surgical interventions segment led the market with the largest revenue share of 45.68% in 2024. The aging population, especially in developed and middle-income families, is driving the demand for advanced ophthalmic surgical procedures. Technological advancements such as femtosecond lasers, minimally invasive glaucoma surgeries (MIGS), and robotic-assisted eye surgeries are making procedures safer, faster, and more effective, thereby increasing patient acceptance.

In addition, growing awareness of vision health, increased healthcare spending, and the expansion of ambulatory surgical centers specializing in ophthalmology are also contributing to the rising number of surgical procedures worldwide. For instance, in June 2024, AMSURG and Comprehensive EyeCare Partners (CompEye) jointly acquired Alta Rose Surgery Center in Las Vegas, Nevada, marking the fourth outpatient surgery center under their expanding partnership. This acquisition aligns with AMSURG's strategic focus on expanding its network of ambulatory surgery centers (ASCs) following its emergence as an independent entity after separating from Envision Healthcare.

The primary care services segment is anticipated to grow at the fastest CAGR over the forecast period, attributed to the rising awareness of preventive eye health, increasing prevalence of chronic conditions such as diabetes and hypertension that affect vision, and an aging global population prone to age-related eye diseases such as cataracts, macular degeneration, and glaucoma. Technological advancements in diagnostic tools and tele-optometry are expanding access to eye exams, especially in underserved or rural areas. In addition, the growing integration of eye care into general healthcare frameworks, especially in countries with universal health systems or expanding insurance coverage, is boosting demand for routine eye checkups, refractive error correction, and chronic disease monitoring.

Indication Insights

The refractive errors segment including myopia, hyperopia, astigmatism, presbyopia led the market with the largest revenue share of 38.67% in 2024. The growth in the demand for vision correction is due to aging populations experiencing more vision issues such as presbyopia and cataracts. In addition, there is a rise in myopia among children and teens, attributed to increased screen time and reduced outdoor activities. Advances in technology, such as the emergence of minimally invasive surgical methods such the incorporation of AI in diagnostic tools, have improved the accuracy and safety of refractive surgeries.

In April 2023, Johnson & Johnson Vision received FDA 510(k) clearance for its ELITA Femtosecond Laser System, designed for creating LASIK flaps in corneal refractive surgery. This advanced laser technology offers several enhancements aimed at improving surgical precision and patient outcomes. The ELITA system features a low energy per pulse combined with an ultra-fast laser repetition rate and a small spot size of 1 µm, resulting in a smooth stromal bed that facilitates effortless flap lifts. Its sub-micron precision positions it as an industry-leading device in terms of accuracy.

The glaucoma segment is expected to grow at the fastest CAGR during the forecast period. Glaucoma is a group of eye conditions that damage the optic nerve, and is increasingly affecting aging populations worldwide, particularly among individuals over 60. The rising geriatric population, along with increasing rates of diabetes and hypertension both risk factors for glaucoma have led to higher demand for early screening, diagnosis, and treatment. Advancements in diagnostic technologies, such as Optical Coherence Tomography (OCT) and AI-assisted imaging, have made detection more accurate and accessible, encouraging routine eye exams.

In February 2025, Alcon announced the U.S. launch of Voyager DSLT (Direct Selective Laser Trabeculoplasty), a groundbreaking treatment for patients with glaucoma and ocular hypertension. This novel technology represents a first-of-its-kind approach by offering a non-contact, automated laser therapy that targets the trabecular meshwork to reduce intraocular pressure (IOP), a key factor in managing glaucoma progression. Unlike traditional SLT (Selective Laser Trabeculoplasty), Voyager DSLT does not require a gonioscopy lens or direct contact with the eye, which enhances patient comfort and simplifies the procedure for ophthalmologists.

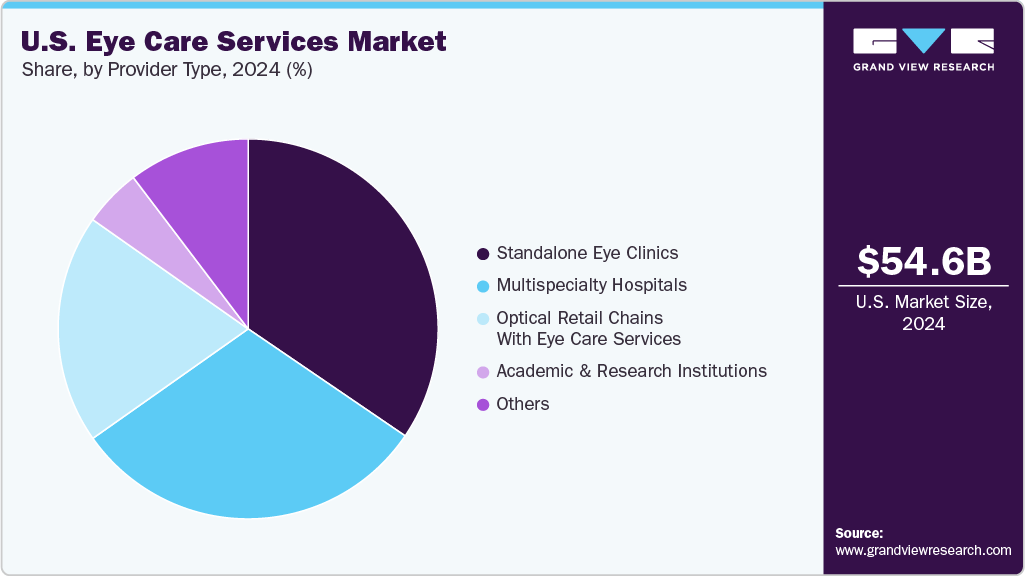

Provider Type Insights

The standalone eye clinics segment led the market with the largest revenue share of 34.52% in 2024 owing to increasing technological advancements in diagnostic and surgical equipment have enabled standalone clinics to offer high-quality, cost-effective, and convenient eye care services, attracting a broad patient base. Furthermore, the rising preference for outpatient care and shorter waiting times compared to hospitals, supports the growth of these clinics. Urbanization and increasing disposable incomes also empower more people to invest in specialized eye care services.

The academic & research institution segment is expected to grow at the fastest CAGR during the forecast period. This is driven by increasing investments in ophthalmic research, rising prevalence of eye disorders, and the growing demand for advanced diagnostic and treatment technologies. These institutions play a crucial role in pioneering innovative therapies, such as gene therapy, retinal implants, and minimally invasive surgical techniques, which enhance patient outcomes and expand treatment options. Moreover, government funding, public-private partnerships, and collaborations with pharmaceutical and medical device companies further stimulate academic research growth.

Country Insights

The Southeast segment dominated the U.S. eye care services market with the largest revenue share of 26.07% in 2024. The region has a high proportion of older adults, with states such as Florida having a large retirement population. This demographic trend is expected to continue, with the U.S. Census Bureau projecting that the population aged 65 and older will increase by 42.4% by 2030. Hence, there is a growing demand for eye care services, including cataract surgeries and treatments for age-related macular degeneration. Moreover, economic factors also play a crucial role in the growth of the eye care services market in the Southeast. The region has experienced significant economic growth, with many states having a strong healthcare infrastructure.

The West region of the U.S. eye care services market is expected to grow at the fastest CAGR during the forecast period. In 2024, the region's population stands at nearly 79 million, representing around 24% of the national demographic. This large population base inherently creates a substantial demand for eye care services and products. Furthermore, the West's diverse demographics, with a substantial Hispanic population (29%), contribute to varied eye care needs and market opportunities.

Key U.S. Eye Care Services Company Insights

The U.S. eye care services industry is fragmented, with the presence of many eye care services providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, service launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key U.S. Eye Care Services Companies:

- US Eye

- Alcon

- Topcon Corporation

- iCARE HEALTH SOLUTIONS

- Eye Associates of New Mexico

- St. Michaels Eye & Laser Institute

- Cleveland Clinic

- UC San Diego Health

- Eye Center of Northern Colorado

- UH Health

- Wills Eye Hospital

Recent Developments

-

In April 2025, EyeSouth Partners announced its 40th affiliation through a partnership with Community Eye Care Specialists, marking its first expansion into New York and third in Pennsylvania. This partnership enhances EyeSouth's network, which includes over 300 doctors providing medical and surgical eye care services at more than 180 locations, including 20 surgery centers across multiple states.

-

In May 2025, Curative Health Insurance Company launched Curative Telehealth, a USD 0 virtual care service designed to provide fast, seamless healthcare services to its members nationwide. This new offer reinforces Curative's commitment to transforming the healthcare experience through innovative solutions to streamline access to care so issues can be addressed earlier when they’re easier to treat at a lower cost.

-

In May 2025, Unifeye Vision Partners (UVP), a physician-led network of premier ophthalmology practices, announced a strategic partnership with Brooks Eye Associates, a leading eye care provider based in Plano, Texas. This collaboration is supported by growth capital investments from Morgan Stanley Private Credit and PGIM Private Capital, aiming to enhance UVP's expansion in Texas and beyond

-

In January 2024, VSP Vision partnered with AARP to offer exclusive individual vision insurance plans tailored specifically for AARP members. Launched on January 2, 2024, these plans aim to enhance access to affordable and personalized eye care for older adults, particularly those without employer-sponsored vision coverage. Recognizing that retirees are among the largest groups lacking such benefits, VSP Vision and AARP have collaborated to address this gap.

U.S. Eye Care Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58.56 billion

Revenue forecast in 2033

USD 111.36 billion

Growth rate

CAGR of 8.37% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, indication, provider type, region

Country scope

U.S.

Key companies profiled

US Eye; Alcon; Topcon Corporation; iCARE HEALTH SOLUTIONS; Eye Associates of New Mexico; St. Michael's Eye & Laser Institute; Cleveland Clinic; UC San Diego Health; Eye Center of Northern Colorado; UH Health; Wills Eye Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Eye Care Services Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. eye care services market report based on service type, indication, provider type, and country:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vision Testing & Eye Exams

-

Surgical Interventions

-

Cataract Surgery

-

Refractive Surgery

-

Glaucoma Surgery

-

Retinal Surgery

-

Corneal Surgery

-

Others

-

-

Primary care services

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Refractive Errors

-

Cataracts

-

Glaucoma

-

Age-related Macular Degeneration (AMD)

-

Diabetic Retinopathy

-

Dry Eye Syndrome

-

Others

-

-

Provider Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone Eye Clinics

-

Multispecialty Hospitals

-

Optical Retail Chains with Eye Care Services

-

Academic & Research Institutions

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Northeast

-

Southeast

-

Midwest

-

Southwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. eye care services market size was estimated at USD 54.57 billion in 2024 and is expected to reach USD 58.56 billion in 2025

b. The U.S. eye care services market is expected to grow at a compound annual growth rate of 8.37% from 2025 to 2033 to reach USD 111.36 billion by 2033.

b. Southeast dominated the U.S. eye care services market with a share of 26.07% in 2024. The region has a high proportion of older adults, with states such as Florida having a large retirement population. .

b. Some key players operating in the U.S. eye care services market include US Eye, Alcon, Topcon Corporation, iCARE HEALTH SOLUTIONS, Eye Associates of New Mexico, St. Michaels Eye & Laser Institute, Cleveland Clinic, UC San Diego Health, Eye Center of Northern Colorado, UH Health, Wills Eye Hospital

b. Market growth is attributed to the increasing number of individuals experiencing eye-related issues, a rapidly increasing aging population, advancements in technology, and heightened awareness regarding eye care

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.