- Home

- »

- Medical Devices

- »

-

U.S. Facial Injectable Market Size, Industry Report, 2030GVR Report cover

![U.S. Facial Injectable Market Size, Share & Trends Report]()

U.S. Facial Injectable Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Botulinum Toxin Type A, HA), By Application (Facial Line Correction, Lip Augmentation), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-284-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Facial Injectable Market Size & Trends

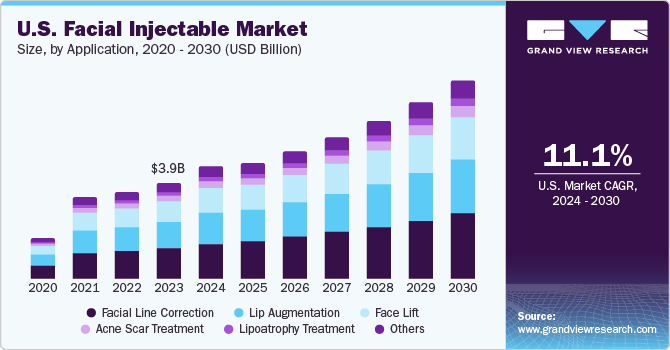

The U.S. facial injectable market size was estimated at USD 3.88 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030. Increasing focus on facial appearance and increasing acceptance of facial injectable are some of the major factors driving market growth. According to Plastic Surgery Statistics 2022 report by the American Society of Plastic Surgeons, neuromodulator injection procedures performed in the U.S. have increased by 73% from 5,043,057 in 2019 to 8,736,591 in 2022. This increasing acceptance of facial injectable in the country is expected to drive market growth over forecast period.

Facial injectable are primarily used as cosmetic products for enhancing facial structure and appearance. Moreover, facial injectable offer an effective solution to wrinkles and facial lines, which has increased their popularity among country’s geriatric population. According to the U.S. Census Bureau 2020 census, elderly population in the U.S. grew at growth rate of 38.6% from 40.3 million in 2010 to 55.8 million in 2020, which is the fastest growth rate since 1880-1890. This increasing geriatric population of the country is boosting demand for facial injectable, thereby contributing to the growth of the market.

The U.S. is one of the major contributors to cosmetic surgeries performed globally, owing to the country's high awareness of cosmetic surgeries and procedures. This awareness increases the number of cosmetic non-surgical procedures performed in the country. Facial injectable offer a non-surgical alternative to other aesthetic surgical procedures. According to Aesthetic Society’s 2022 report, total non-surgical aesthetic procedures in the U.S. witnessed a rise of 23% in 2022. This increasing popularity and acceptance of non-surgical aesthetic procedures is expected to drive market growth over the forecast period.

Moreover, market players are focused on developing advanced solutions to meet various customer demands. This increasing focus on developing new solutions increases demand for facial injectable in different customer bases. For instance, in March 2024, Allergan Aesthetics announced FDA approval of JUVÉDERM VOLUMA XC to improve temple hollowing in adults above 21 years. This Hyaluronic Acid (HA) filler addresses the needs of patients seeking a solution for temple hollowing. Such increasing focus of market players on developing demand-specific solutions is anticipated to drive market growth.

Market Concentration & Characteristics

The U.S. market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to increasing focus of market players on developing more effective and specialized solutions to treat specific conditions. Moreover, increasing focus on developing solutions with least allergic risk and larger impact duration significantly increases the scope for innovation in the market. For instance, in May 2023, Allergan Aesthetics announced the U.S. FDA approval of SKINVIVE by JUVÉDERM. This injectable helps in improving cheek and skin smoothness with a six-month lasting effect with optimal treatment.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This is due to the increasing efforts of market players to grab opportunities offered by the increasing demand for facial injectable in the country.

The regulatory framework has a significant impact on the U.S. facial injectable market. The FDA looks after safety and use of facial injectable in the country, and approves use of dermal filler for adults above 21 years. However, it recommends against use of these fillers for body contouring and enhancement of different body parts. Adoption of such a stringent regulatory framework by the FDA significantly impacts market growth.

There is a significant range of products available as facial injectable alternatives. For instance, topical creams, laser resurfacing, skin-tightening products, and facial implants. These alternatives can offer similar solutions delivered by the facial injectable.

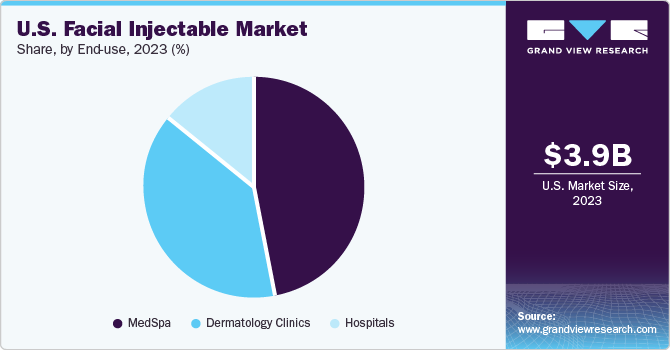

End-user concentration is a significant factor in the market as the customers opting for facial injectable have different alternatives, such as hospitals, med spas, and dermatology clinics. Thus, the end-user significantly depends on the customer preferences, demands, care, and results provided by these facilities.

Product Insights

Botulinum toxin type A dominated the market and accounted for a share of 55.4% in 2023. Botulinum toxin works by regulating the nerve signal to reach muscles, which restricts the muscles from contracting. It has a wide range of applications, such as the treatment of wrinkles, face lines, crow’s feet, lateral canthus, forehead, and glabellar lines. These applications of botulinum toxin A have significantly contributed to its demand for cosmetic procedures.

HA is expected to grow at the fastest over the forecast period. This can be attributed to the increasing demand for injectable Hyaluronic Acid (HA) owing to its several applications, such as reducing facial folds and face wrinkles and providing special structure and framework to lips and face. Moreover, several market players are developing hyaluronic fillers to address various conditions, which is expected to increase the demand for HA injectable over the forecast period. For instance, in June 2023, Galderma announced that the company had received FDA approval for Restylane Eyelight, a HA filler for the treatment of undereye hollows in adults over 21 years.

Application Insights

Facial line correction accounted for the largest revenue share in 2023. This can be attributed to the increasing acceptance of facial injectable in the elderly population for the treatment of facial lines or wrinkles. Facial injectable offer a fast, effective, and lasting solution to facial lines and wrinkles over other alternatives, such as topical creams and facial implants. This has increased the preference for facial injectable for face line correction in the aging population. For instance, according to the Plastic Surgery Statistics 2022 report by The American Society of Plastic Surgeons, Gen X (born between the mid-1960s and early 1980s) leads in the procedure of neuromodulator injections with a share of 57%, which is used for wrinkle relaxing.

Lip augmentation is expected to grow at a significant CAGR over the forecast period owing to the increasing societal emphasis on better physical appearance and beauty standards. Lip augmentation is a cosmetic procedure for enhancing the shape and size of lips for a better appearance. Moreover, the country has witnessed a surge in demand for lip enhancement surgery in the past few years. For instance, according to The Aesthetic Society statistics 2020-2021, the number of lip enhancement procedures in the U.S. increased by 51% from 7,099 procedures in 2020 to 10,691 in 2021. This increasing demand for lip enhancement procedures is expected to drive the segment growth over the forecast period.

End-use Insights

MedSpa accounted for the largest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing preference of patients to get treatment from specialized facilities such as med spas. According to the American Med Spa Association (AmSpa), the number of med spas in the U.S. has increased from 7,430 in 2021 to 8,841 in 2022. This increasing number of med spas in the country is further increasing the accessibility and availability of these centers, contributing to their growth.

Dermatology clinics are anticipated to grow at a significant CAGR over the forecast period. These clinics are specialized in providing treatment for skin diseases. These specialized centers offer proper consultation and care to the patients, which increases the patient's preference towards these centers. Moreover, dermatology clinics offer personalized care and treatment history-based injectable and fillers, which is expected to contribute to their growth over the forecast period.

Key U.S. Facial Injectable Company Insights

Some of the key players operating in the market include AbbVie, Inc., REVANCE AESTHETICS, and Merz North America, Inc.

-

AbbVie, Inc. is a research-based biopharmaceutical that operates in a diverse range of fields of aesthetics, immunology, oncology, neuroscience and eye care. It focuses on R&D to develop innovative solutions and products to meet the different demands of patients. Allergan Aesthetics, which is a company of AbbVie, Inc., focuses on the development of facial injectable and body contouring products.

-

REVANCE AESTHETICS is a biotechnology company that develops innovative therapeutic and aesthetic solutions. It offers a wide range of products through its RHA collection of derma fillers and DAXXIFY injections. The company is focused on providing patients and providers with innovative products.

Key U.S. Facial Injectable Companies:

- AbbVie, Inc.

- REVANCE AESTHETICS

- Merz North America, Inc.

- Galderma Laboratories, L.P.

- Suneva Medical Inc.

- Cytophil, Inc

- Prollenium Medical Technologies

Recent Developments

-

In February 2022, Merz Aesthetics announced the launch of Radiesse (+), an injectable jawline contour improvement in adults over 21. This launch offered patients a non-surgical and effective option to address jawline contour.

-

In December 2021, Teoxane, a REVANCE AESTHETICS partner, received the U.S. FDA approval for its RHA, Redensity’s first indication for treating perioral rhytids (lip lines) in adults over 21. This approval increases the company’s RHA collection of derma fillers.

-

In May 2020, Galderma announced the U.S. FDA approval for its Restylane Kysse, a hyaluronic acid (HA) filler for lip augmentation and upper perioral rhytids correction. Restylane Kysse offers consistent results, high satisfaction and proven clinical safety profile for both patients and providers.

U.S. Facial Injectable Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.02 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Key companies profiled

AbbVie, Inc.; REVANCE AESTHETICS; Merz North America, Inc.; Galderma Laboratories; L.P.; Suneva Medical Inc.; Cytophil, Inc.; Prollenium Medical Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Facial Injectable Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. facial injectable market report based on product, application, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagen & PMMA Microspheres

-

Botulinum Toxin Type A

-

HA

-

CaHA

-

PLLA

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Line Correction

-

Lip Augmentation

-

Face Lift

-

Acne Scar Treatment

-

Lipoatrophy Treatment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

MedSpa

-

Dermatology Clinics

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. facial injectable market size was valued at USD 3.88 billion in 2023.

b. The U.S. facial injectable market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.1% from 2024 to 2030 to reach USD 8.02 billion by 2030

b. Botulinum toxin type A dominated the market and accounted for a share of 55.4% in 2023 as it works by regulating the nerve signal to reach muscles, which restricts the muscles from contracting. It has a wide range of applications, such as the treatment of wrinkles, face lines, crow’s feet, lateral canthus, forehead, and glabellar lines. These applications of botulinum toxin A have significantly contributed to its demand for cosmetic procedures.

b. Some of the key players operating in the market include AbbVie, Inc., REVANCE AESTHETICS, Merz North America, Inc., Galderma Laboratories, L.P., Suneva Medical Inc., and Prollenium Medical Technologies.

b. The increasing focus on facial appearance and the increasing acceptance of facial injectable are some of the major factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.