- Home

- »

- Advanced Interior Materials

- »

-

U.S. Filters Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Filters Market Size, Share & Trends Report]()

U.S. Filters Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (ICE, Air, Fluid Filters), By Application (Motor Vehicles, Consumer Applications, Industrial & Manufacturing, Utilities), And Segment Forecasts

- Report ID: GVR-4-68040-237-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Filters Market Size & Trends

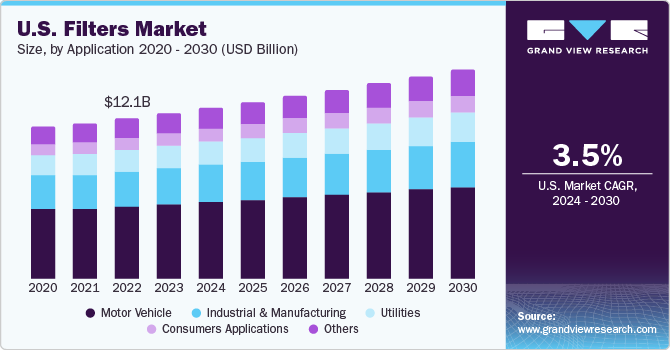

The U.S. filters market size was valued at USD 12.5 billion in 2023 and is expected to grow at a CAGR of 3.5% from 2024 to 2030. This growth can be attributed to the increasing demand for clean and safe water, coupled with stringent environmental regulations, which is propelling the need for advanced filtration solutions. In the automotive sector, rising vehicle production and stringent emission norms are driving the demand for automotive filters. Furthermore, the rapid advancements in technology and the growing need for energy-efficient HVAC systems are also contributing to the market growth.

Regulations significantly influence the U.S. filter market. For instance, the automotive industry is guided by the U.S. Environmental Protection Agency's (EPA) stringent emission norms, which have increased the demand for high-quality automotive filters to control air pollution. Similarly, the Safe Drinking Water Act (SDWA) enforced by the EPA has led to a surge in the demand for advanced water filtration systems, thereby stimulating the growth of the water filters market. The Clean Air Act (CAA) mandates the control of air pollution at its source, increasing the demand for air filters in various industries and households. Hence, these regulations create demand in the U.S. filters market.

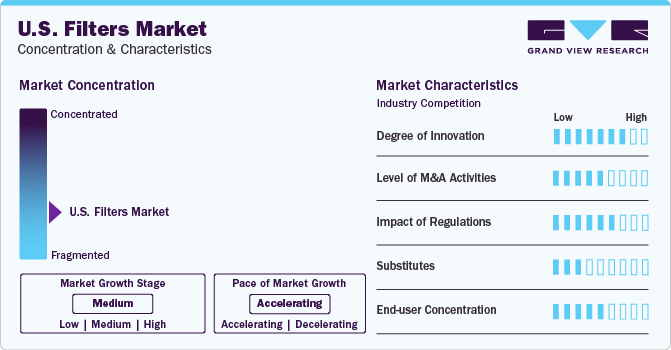

Market Concentration & Characteristics

The U.S. filters market growth stage is medium, and the pace of growth is accelerating. The industry exhibits a high degree of innovation. Technological advancements focus on creating products with improved cleaning properties, extended operational lifespan, and minimal maintenance requirements. These innovations are anticipated to significantly contribute to market growth during the forecast period.

While there are no direct substitutes for filters in the market, however, advancements in related technologies could potentially affect the demand for filters. For example, the development of advanced air purifiers and water treatment technologies could impact the demand for air and water filters, respectively.

The end-user concentration in the U.S. filters market is significant. The demand for filters is driven by various industries such as automotive, consumer goods, industrial & manufacturing, and utilities. The growth of these sectors is likely to positively affect the market growth.

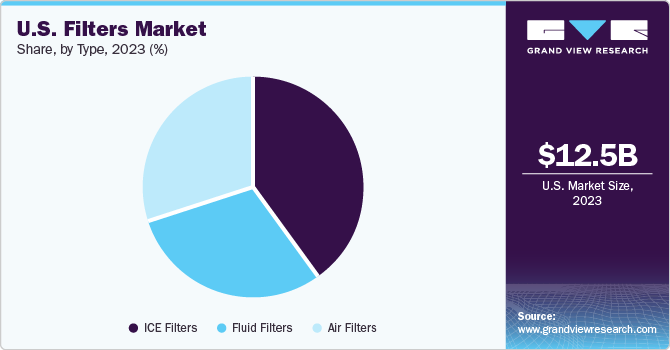

Type Insights

The fluid filters dominated the U.S. market in 2023 with more than 40% revenue share. These filters are integral to a multitude of industries beyond water treatment plants, including manufacturing, beverage, chemical processing, cosmetic, food processing, metalworking, paint, pharmaceutical, and oil & gas sectors. Their critical role in removing impurities from liquids makes them essential in processes where purity is paramount.

The surge in demand for these filtration solutions is propelled by the necessity for clean and safe water. This need is further amplified by stringent environmental regulations aimed at curbing pollutants and ensuring the quality of water and air. Moreover, the increasing focus on the construction of water treatment facilities due to factors such as the scarcity of quality drinking water, growing population, and contamination of ground and surface water bodies has been contributing to the growth of the fluid filters market.

Internal Combustion Engine (ICE) filters are another significant segment of the U.S. filters market. These filters have a primary application in the automotive industry, serving functions such as oil intake, cabin air filtration, and emission filtration. The growth in the automobile industry, mainly in regions like Asia Pacific, Europe, and North America, has been a key driver for the ICE filters market. Furthermore, stringent emission norms laid down by the Environmental Protection Agency (EPA) for the installation of air emission control solutions in vehicles have led to an increased demand for high-quality ICE filters.

Air filters represent the fastest-growing segment in the U.S. filters market, with a projected CAGR of 4.8% from 2024 to 2030.Air filtration devices are indispensable in the optimization of heating, ventilation, and air conditioning (HVAC) systems, playing a critical role in the enhancement of indoor air quality and the efficacy of system operations. Additionally, the increased demand for fresh indoor air quality coupled with the growing awareness of energy savings and environmental protection have driven stringent environmental regulations, further propelling the growth of the air filters market in the U.S.

Application Insights

The motor vehicle segment dominated the U.S. market in 2023 with around 44.7% revenue share. This segment’s dominance can be attributed to the critical role of filters in ensuring the efficient operation of vehicles and compliance with automotive standards. Moreover, the trend towards cleaner and more fuel-efficient vehicles has led to the development of sophisticated filtration systems that can handle the demands of modern engines.

The consumer applications is the fastest-growing product segment in the U.S. filters market with a CAGR of 4.6% from 2024 to 2030. This growth can be attributed to the increasing usage of filters in various consumer products, such as air purifiers, water purifiers, and other household appliances. Furthermore. the growing adoption of these products in homes, hotels, restaurants, airplanes, and train compartments for killing harmful microbes, such as bacteria and viruses, is expected to open new opportunities for market growth.

Key U.S. Filters Company Insights

The U.S. filters market is characterized by a moderate level of concentration. Key industry players are consistently broadening their portfolios with advanced technological offerings to meet end-user demands and expand their clientele. Some key players operating in this market include SPX Corporation, Johnson Controls Inc., and Baltimore Aircoil Company:

-

3M is a key player in the U.S. filters market, offering a wide range of filtration products for various applications in several consumer goods, such as air and water purifiers.

-

Koch Filter is a leading manufacturer in the U.S. filters market, offering a comprehensive line of air quality solutions for commercial, industrial, and residential applications.

Key U.S. Filters Companies:

- 3M

- Airex Filter Corporation

- Koch Filter

- Freudenberg Filtration Technologies SE & Co. KG

- Donaldson Company, Inc.

- Camfil AB

- Parker Hannifin Corporation

- MANN+HUMMEL

- K&N Engineering, Inc.

- MAHLE GmbH

Recent Developments

-

In August 2023, Camfil signed an agreement with Avendra, LLC, designating it as a preferred supplier for HVAC air filters, further reinforcing its HVAC air filter supply chain.

-

In August 2023, Parker showcased hydrogen purification solutions, including ion exchangers, cathode air filtration, and membrane technology at Hyvolution 2024. These solutions will enable Parker to play a role in the complete value chain of hydrogen.

-

In October 2023, MANN+HUMMEL Group acquired a majority stake in Suzhou U-Air Environmental Technology (“U-Air”). The acquisition strengthens Mann+Hummel’s presence in China and Southeast Asia, and will also serve customers globally. The acquisition will strengthen Mann+Hummel’s presence in China and Southeast Asia.

U.S. Filters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.9 billion

Revenue forecast in 2030

USD 15.8 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application

Key companies profiled

3M; Airex Filter Corporation; Koch Filter; Freudenberg Filtration Technologies SE & Co. KG; Donaldson Company, Inc.; Camfil AB; Parker Hannifin Corporation; MANN+HUMMEL; K&N Engineering, Inc.; MAHLE GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Filters Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. filters market report based on type and application:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fluid Filters

-

ICE Filters

-

Air Filters

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Motor Vehicle

-

Consumers Applications

-

Utilities

-

Industrial & Manufacturing

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. filters market size was estimated at USD 12.5 billion in 2023 and is expected to be USD 12.9 billion in 2024.

b. The U.S. filters market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 15.8 billion by 2030.

b. The motor vehicles segment dominated the U.S. filters market with a revenue share of 44% in 2023, on account of several factors including growth in the automobile industry, particularly in North America.

b. Some of the key players operating in the U.S. filters market include 3M; Airex Filter Corporation; Koch Filter; Freudenberg Filtration Technologies SE & Co. KG; Donaldson Company, Inc.; Camfil AB; Parker Hannifin Corporation; MANN+HUMMEL; K&N Engineering, Inc.; MAHLE GmbH

b. Key factors that are driving the U.S. filters market growth include the increasing demand for clean and safe water, coupled with stringent environmental regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.