- Home

- »

- Next Generation Technologies

- »

-

U.S. Fire Protection System Market, Industry Report, 2030GVR Report cover

![U.S. Fire Protection System Market Size, Share & Trends Report]()

U.S. Fire Protection System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fire Detection, Fire Analysis), By Service (Installation & Design Services, Maintenance Services), By Application (Commercial, Industrial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-196-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Fire Protection System Market Trends

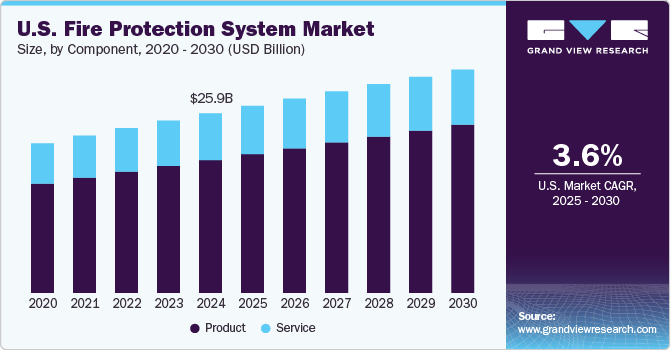

The U.S. fire protection system market size was estimated at USD 25.94 billion in 2024 and is projected to grow at a CAGR of 3.6% from 2025 to 2030. The ever-present dangers of fire hazards in large establishments such as supermarkets, offices, and stadiums have made it crucial to install warning systems to facilitate the evacuation of occupants easily. In the U.S., there are stringent safety protocols for both commercial and residential buildings to ensure the protection of life and property, necessitating the presence of a proper fire protection system.

Every modern structure in the country, including government offices, hospitals, and educational institutions, is required to have a warning and evacuation system in place for such situations. This is because failure to comply can lead to building owners facing legal procedures and heavy fines by lawmakers and authorities. This has led to a sustained demand for fire protection systems from homeowners and building developers, driving U.S. fire protection system market expansion.

There are several large building complexes in the U.S. owing to the fast pace of urbanization and industrialization in the country. Additionally, several leading global firms have their headquarters located in the U.S., leading to the increasing presence of high-rise buildings. Such buildings generally integrate fire protection solutions, such as sprinkler systems, so that a fire can be easily detected and suppressed. Thus, the growing emphasis on stringent fire safety regulations and building codes further drives the adoption of these systems, thereby propelling the growth of the U.S. fire protection system market.

Furthermore, Public Address and Voice Alarm (PAVA) systems, which combine the features of a public address system and voice evacuation system, have witnessed an increasing demand, especially in major supermarket chains such as Costco, Walmart, Target, and Kroger. These places witness a high footfall daily, making it necessary that efficient fire detection and suppression systems are in place. A PAVA system ensures that clear evacuation signals and instructions are given in case of fires, minimizing the risk of chaos and stampedes. Thus, businesses prioritizing comprehensive fire safety measures are driving U.S. fire protection system industry growth through the integration of PAVA systems, fire alarms, and suppression systems.

In recent years, the U.S. has seen an increase in residential property development, leading to an extensive demand for fire safety systems. According to a report by the NFPA (National Fire Protection Association) published in November 2023, although residential properties accounted for just 25% of all fire accidents in the country in 2022, they resulted in around 75% of civilian deaths and injuries. HVAC systems are considered to be a leading cause of fires in both commercial and residential buildings, highlighting the need for clear and stringent regulations. Standards such as the NFPA 90A necessitate the presence of smoke detectors in HVAC systems of buildings, so that they can shut down automatically during a fire breakout and avoid toxic fumes and smoke from spreading.

The U.S. fire protection system industry is well-established and mature, as a majority of buildings already follow national and state norms. As a result, the focus is on advancing the technology so that the current efficiency of these systems can be improved. For instance, with regards to fire suppression, water mist systems have emerged as a viable alternative to conventional sprinklers, as the mist rapidly cools and reduces the oxygen to suppress the fire rapidly without using large amounts of water. Another emerging solution is air sampling smoke detectors, which actively look for fire or smoke signs to suppress a fire even before it starts. Companies such as Johnson Controls, Pye-Barker Fire & Safety, and Sciens Building Solutions are launching innovative offerings for end-users, thus driving U.S. fire protection system industry growth.

Product Insights

The fire detection segment accounted for the largest revenue share of 58.2% in 2024. The strong demand for fire detection and alarm systems can be attributed to their property of detecting incidences of fire at the earliest and alerting homeowners and building occupants so that they have ample time to vacate the premises and alert authorities. According to a report by the National Fire Protection Association (NFPA), in the U.S., around 60% of deaths due to fire take place in homes that do not have functioning smoke detectors. Moreover, the NFPA states that almost 50% of deaths take place in homes where the fire broke out between 11 P.M. and 7 A.M. when occupants are generally asleep. The presence of advanced fire detectors and smoke alarms has been shown to greatly reduce incidences of life and property loss, making them the leading product segment.

The fire analysis segment is expected to grow at the highest CAGR during the forecast period. Fire response systems help prevent the spread of fire by triggering sirens and alarms in buildings, as well as sending emergency messages to the necessary authorities, such as ambulances, fire departments, and the police. Fire response systems are being developed with beneficial features such as real-time data provision that can result in faster response times and decision-making for firefighters. The introduction of drones has also helped firefighters understand the different angles of a fire so that they can be suppressed and extinguished more efficiently and quickly. Thus, the integration of technology has improved the control and management of fire incidents, helping reduce financial losses.

Service Insights

The installation & design services segment held the largest revenue share in 2024. A sizeable growth in the number of new housing projects, as well as modification of current structures to comply with current safety norms, has resulted in a healthy demand for advanced fire protection systems in the U.S. Complexities in modern structures have led to an increased emphasis on efficient designing of fire protection solutions so that any accident can be quickly detected. Companies provide professional installation of smoke detectors, fire alarms, fire suppression systems, and sprinkler systems as per requirements and norms. They work closely with architects and property owners while also leveraging 3D BIM modeling to achieve seamless installation.

The maintenance services segment is expected to register the highest CAGR during the forecast period. The maintenance of fire protection devices and solutions ensures that they keep functioning efficiently for a longer period, avoiding the need for replacements. Vendors provide timely maintenance services as well as warranties in order to retain and expand their customer base, driving segment expansion. Moreover, as local fire codes and regulations undergo modifications, building owners are required to comply with them, necessitating regular maintenance scheduling. For instance, fire sprinkler systems ideally should undergo quarterly and yearly inspections, while NFPA guidelines suggest semi-annual inspections for fire suppression systems.

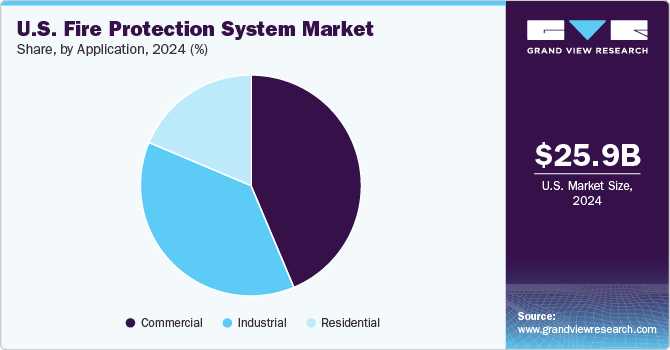

Application Insights

The commercial segment dominated the market in 2024. Commercial buildings such as hospitals, schools, and offices consist of a large number of occupants, making the presence of efficient fire detection, suppression, and response systems crucial. An article published by Blackmon Mooring & BMS CAT in August 2023 states that commercial fires cost building owners more than USD 2.4 billion annually. Agencies such as the NFPA, Occupational Safety and Health Administration (OSHA), and United States Fire Administration have established various guidelines to ensure the presence of optimal fire safety requirements to protect people and property.

The industrial segment is anticipated to grow rapidly during the forecast period. Industries such as manufacturing, food & beverage, automotive, and electronics include the presence of several systems that can fall prey to fire accidents, risking human lives also. This ultimately leads to increased expenses for the company and legal repurcussions, making it compulsory for them to have advanced fire protection solutions in place. The NFPA states that industrial and manufacturing facilities in the United States face 37,000 fires annually, leading to an average of 279 injuries and 18 deaths. The property damage is also significant, costing a total of around USD 1 billion. Proactive planning for identifying fire hazards and developing mitigation strategies are expected to aid segment expansion.

Key U.S. Fire Protection System Company Insights

Some key companies in the U.S. fire protection system industry include Honeywell International, Inc., Johnson Controls, and Eaton, among others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Honeywell International, based in North Carolina, is a major global provider of automotive products, sensing and security technologies, electronics and advanced materials, and energy-efficient solutions. The company offers fire alarm, sensor, and detector solutions under non-proprietary brands such as Fiplex, Silent Knight, US Digital Designs, and System Sensor; and proprietary brands including NOTIFIER and Farenhyt Series.

-

Johnson Controls International, with its North American headquarters in Wisconsin, is a leading international supplier of building control systems, building automation systems, HVAC equipment, seating and interior systems, and integrated facility management services. The company has various notable fire and security brands, including ANSUL, CHEMGUARD, Grinnell, sprinkCAD, AquaMist, Simplex, and Tyco Integrated Fire & Safety, among others.

Key U.S. Fire Protection System Companies:

- Eaton

- GENTEX CORPORATION

- Halma plc

- Hitachi Ltd.

- Honeywell International, Inc.

- Iteris, Inc.

- Johnson Controls

- Raytheon Technologies Corporation

- Robert Bosch GmbH

- Siemens AG

Recent Developments

-

In September 2024, Plumis, recognized for its advanced fire suppression systems, signed a new distribution agreement with Ferguson. This partnership is expected to introduce Plumis' Automist fire suppression system to the U.S. market. Automist features an electronically controlled water mist nozzle that consumes ten times less water than conventional fire suppression systems.

-

In December 2023, Siemens Smart Infrastructure announced that its Building X platform would receive additional fire safety offerings to allow for remote monitoring and intervention, as well as receive real-time notifications. The applications include Fire Manager and Fire Connect, along with Fire API, and would save resources and time while improving user convenience and safety

-

In March 2023, Halma Plc announced the acquisition of the Cyprus-based manufacturer of aerosol fire suppression systems, FirePro. The latter’s solutions leverage an environment-friendly, non-pressurised condensed aerosol technology that contains no fluorinated greenhouse gases or ozone depleting substances for extinguishing fire. The company’s products are used across 110 nations in several major industries, improving Halma’s offerings in its Safety segment.

U.S. Fire Protection System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.00 billion

Revenue forecast in 2030

USD 32.26 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, service, application

Country scope

U.S.

Key companies profiled

Eaton; GENTEX CORPORATION; Halma plc; Hitachi Ltd.; Honeywell International, Inc.; Iteris, Inc.; Johnson Controls; Raytheon Technologies Corporation; Robert Bosch GmbH; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fire Protection System Market Report Segmentation

This report forecasts revenue growth at a country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fire protection system market report based on product, service, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detection

-

Fire Suppression

-

Fire Response

-

Fire Analysis

-

Fire Sprinkler System

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Service

-

Installation and Design Service

-

Maintenance Service

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Frequently Asked Questions About This Report

b. The U.S. fire protection system market size was estimated at USD 25.94 billion in 2024 and is expected to reach USD 27.00 billion in 2025.

b. The U.S. fire protection system market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2030 to reach USD 32.26 billion by 2030

b. The fire detection segment led the market and accounted for 58.2% in 2023. The market players have engaged in upgrading their fire alarm systems to detect fire in minimal time.

b. Some key players operating in the U.S. fire protection systems market include Eaton, GENTEX CORPORATION, Halma plc, Hitachi Ltd., Honeywell International, Inc., Iteris, Inc., Johnson Controls, Raytheon Technologies Corporation, Robert Bosch GmbH, and Siemens AG.

b. In recent years, there has been a significant rise in notable fire incidents that have gained public attention across the country. This surge in incidents has led to increased awareness of fire hazards among individuals, businesses, and organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.