- Home

- »

- Homecare & Decor

- »

-

U.S. Floor Cleaner Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Floor Cleaner Market Size, Share & Trends Report]()

U.S. Floor Cleaner Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Multisurface Glass Cleaner, Ceramic & Tile Cleaners, Marble Cleaners), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-698-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Floor Cleaner Market Size & Trends

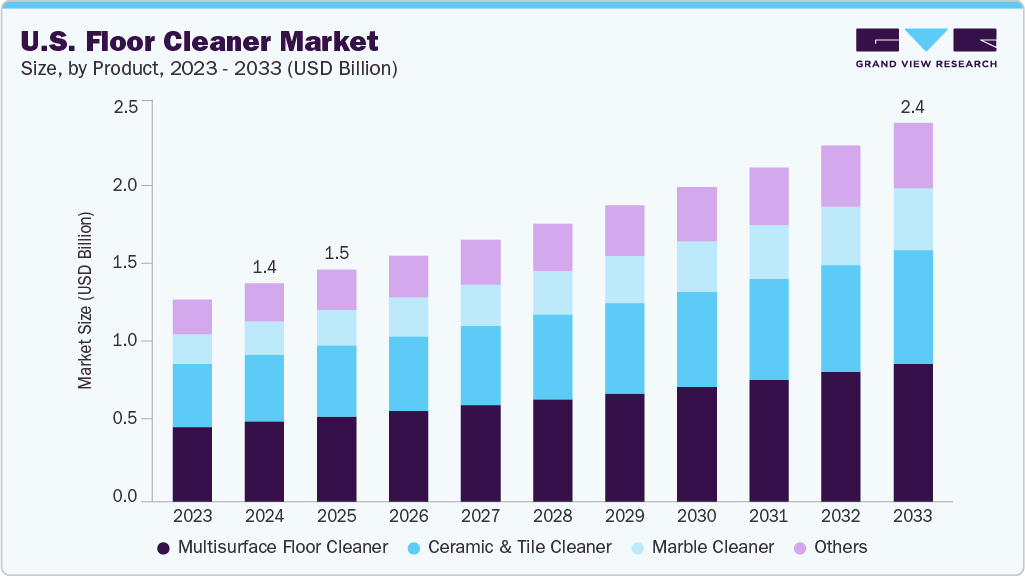

The U.S. floor cleaner market size was estimated at USD 1389.5 million in 2024 and is projected to reach USD 2417.9 million by 2033, with a CAGR of 6.4% from 2025 to 2033. A key driver is the growing emphasis on hygiene and sanitation across the U.S., especially since the COVID-19 pandemic. American consumers and businesses, particularly in densely populated urban areas and high-traffic public venues like hospitals, airports, offices, and hotels, now require higher cleanliness standards. This has caused a rise in the use of both residential and commercial floor cleaning products that offer thorough sanitization, reflecting U.S. concerns about health and public safety.

The ongoing expansion in U.S. commercial infrastructure is another engine for growth. New office complexes, healthcare facilities, universities, and malls are rapidly being built or renovated nationwide. These U.S.-specific capital investments necessitate efficient, large-scale floor cleaning solutions, including high-performance machines and advanced chemical formulations, to uphold productivity standards while minimizing labor costs-a crucial concern given the tight American labor market.

Technological advancements play a major role in the U.S. market, where there is a strong appetite for innovation. Growing numbers of American households and businesses are adopting robotic and automated floor cleaners, many of which are produced or marketed by leading U.S. brands. The focus on eco-friendliness, IoT integration, and smart home compatibility appeals to U.S. consumers’ demand for convenience and sustainability, aligning with broader American tech adoption trends.

The U.S. boasts one of the world’s largest e-commerce sectors, making online access to a variety of floor cleaning products exceptionally easy. American consumers, especially urbanites and younger households, increasingly prefer direct-to-doorstep delivery. U.S.-based e-commerce giants feature expansive cleaning product selections, supporting intense market competition and providing opportunities for both large brands and niche, eco-friendly American startups.

Urbanization and rising disposable incomes also underpin American market growth. As more people gravitate to cities across the U.S., the prevalence of hard flooring surfaces (e.g., tile, hardwood, luxury vinyl) in American homes and commercial properties rises, creating a greater need for specialized cleaning solutions. Higher U.S. household incomes further enable frequent purchases of premium floor cleaner products, promising advanced features and benefits.

The U.S. regulatory landscape and environmental awareness drive innovation in the domestic market. Stricter American standards on chemical safety and environmental friendliness are pushing manufacturers to introduce biodegradable, non-toxic, and U.S.-certified products. As sustainability becomes central to American purchasing decisions, U.S.-based manufacturers and retailers actively promote green claims and product transparency to meet both regulatory requirements and evolving consumer expectations.

The U.S. floor cleaner market, despite its robust growth, faces several key challenges that constrain innovation, profitability, and sustainability. Regulatory demands around chemical formulations and packaging waste increasingly challenge manufacturers. Traditional cleaners often contain harsh chemicals that can harm ecosystems if not properly managed, and plastic packaging exacerbates the problem of landfill waste. Adhering to evolving U.S. environmental standards requires ongoing innovation-such as developing biodegradable ingredients and sustainable packaging-which can be costly and technologically demanding. The market is highly competitive, with both established brands and unbranded, low-cost alternatives readily available. Many price-sensitive consumers opt for cheaper floor cleaners that may lack safety certifications, making it difficult for established and eco-friendly brands to grow their market share without sacrificing profitability. This intense competition drives down prices and compresses margins, especially for premium or sustainable products.

Product Insights

The multisurface floor product was the most used item in the market, generating over USD 500 million in revenue in 2024. Its widespread popularity comes from its versatility: these products are designed to safely and effectively clean a variety of surfaces-including tile, hardwood, vinyl, and stone-making them a convenient choice for both residential and commercial settings. The increased focus on hygiene across American homes, offices, and public spaces, especially since the pandemic, has boosted demand for easy-to-use, reliable products that deliver a streak-free finish and work on multiple floor types.

Besides convenience, consumer choices are increasingly influenced by factors like eco-friendliness, streak-free results, and compatibility with current flooring trends. The strong growth of American e-commerce and retail networks makes multisurface floor cleaners widely available, strengthening their market presence. U.S. consumers now prefer brands that offer transparency and environmentally friendly credentials, leading to a rise in eco-labeled multisurface products. The combination of shifting consumer habits, nationwide construction and renovation activity, and ongoing product innovation solidifies multisurface floor cleaners as leaders in the floor care market.

The U.S. ceramic and tile cleaner market is growing in response to the increasing use of hard surface flooring in new homes, commercial buildings, and renovation projects-especially in kitchens, bathrooms, and high-traffic areas. As ceramic tile is popular for its durability and moisture resistance, the demand for specialized cleaners has risen. Modern tile cleaners are designed to tackle tough stains, bacteria, and environmental issues, supporting trends in home improvement and healthy living. Driven by innovation in stain removal and eco-friendly formulas, this segment is boosted by nationwide building and renovation booms.

The market for marble floor cleaners in the U.S. is projected to grow at a CAGR of 7.2% from 2025 to 2033. This growth is driven by the expansion of luxury real estate, upscale commercial properties, and the hospitality industry-sectors that often rely on marble for its elegance and status. Preserving marble’s appearance and condition requires pH-neutral, non-abrasive, and specialized cleaners, leading to continual innovation and a strong emphasis on green chemistry. The rise in restoration and maintenance services, along with stricter regulations on the use of safer chemicals, further increases the demand for advanced marble cleaning solutions.

Application Insights

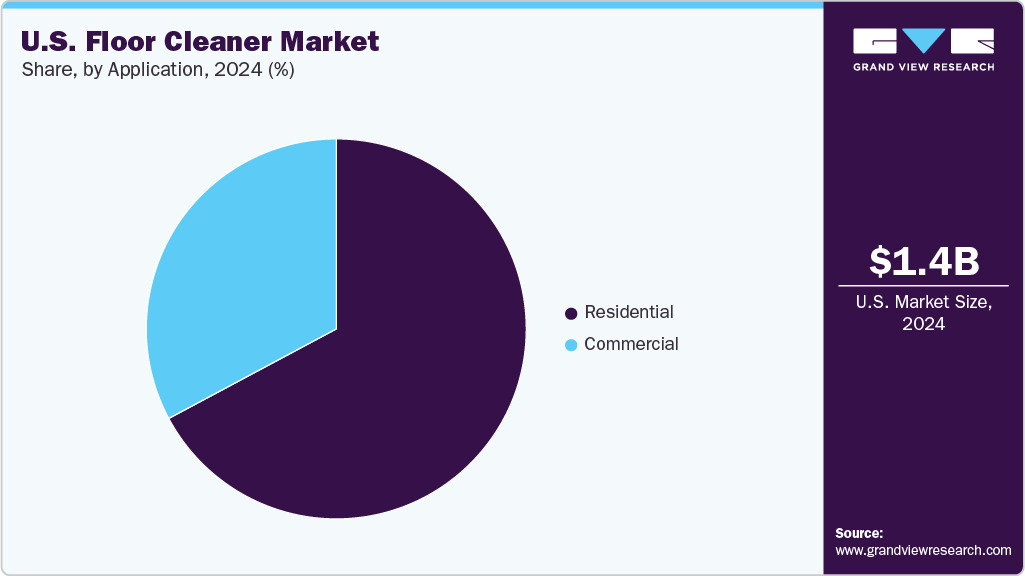

The residential sector in the U.S. was the largest market for floor cleaners, accounting for over 60% of revenue in 2024. Growth in this area is mainly driven by increased consumer awareness of hygiene, a trend sped up by the pandemic and ongoing public health education. U.S. households are increasingly adopting advanced, efficient cleaning solutions, such as robotic vacuums and multi-surface cleaners, which provide greater convenience and save time. Rising disposable incomes, urbanization, and the spread of hard flooring materials like tile, vinyl, and hardwood in American homes also boost this growth.

Manufacturers are responding to consumer demand for safer, more sustainable products by developing eco-friendly formulas and biodegradable packaging. The ease of access to a wide range of cleaning products-enabled by strong U.S. e-commerce and retail distribution networks-has also made it easier for consumers to explore, compare, and buy premium or specialized floor care options. Convenience, product transparency, and the wish for cleaner, healthier living spaces are key drivers of residential market growth. Additionally, increased real estate activity and home improvement trends are raising the demand for advanced cleaning agents and innovative household cleaning equipment.

The commercial applications are expected to grow the fastest during the forecast period, gaining strong momentum in the healthcare, hospitality, and retail sectors. The commercial segment, which includes offices, hospitals, schools, malls, hotels, and other large-scale facilities, is expanding quickly and accounts for a significant portion of the market. This growth is driven by increased focus on hygiene and sanitation in public and work environments after the COVID-19 pandemic. Maintaining strict cleanliness standards has become essential for employee, customer, and patient safety, as well as for regulatory compliance.

Investments in new commercial infrastructure across the U.S., such as building hospitals, shopping centers, and educational institutions, are further increasing demand. Companies are adopting advanced cleaning technologies, like ride-on and robotic floor scrubbers, to efficiently cover large floor areas, reduce labor costs, and boost productivity. Sustainability is also a key factor: organizations are actively choosing eco-friendly cleaning solutions to meet environmental regulations and corporate responsibility goals. Innovations in automated cleaning, smart scheduling, and IoT-enabled equipment improve efficiency for facility managers. Outsourcing cleaning services to specialized contractors has also strengthened the demand for large-scale, high-performance cleaning products and equipment.

Distribution Channel Insights

Supermarkets and hypermarkets are the most widely used distribution channels for floor cleaners in the U.S., and market revenue is projected to surpass USD 900 million by 2024. These retail outlets continue to dominate as the primary sales channels for floor cleaner products, thanks to their extensive reach, wide product selection, and competitive pricing. They offer consumers the convenience of buying floor cleaning products alongside their regular grocery and household shopping. The ability to physically inspect products, assess packaging, and take advantage of in-store promotions and loyalty programs makes these channels appealing and trustworthy. Additionally, large national chains with a broad presence in urban and suburban areas ensure high availability, making supermarkets and hypermarkets key drivers of volume sales. The mature retail infrastructure, coupled with consumer habits of one-stop shopping, results in strong performance in these channels.

Additionally, these traditional retail formats benefit from well-established logistics and supply chain systems optimized for regular and bulk restocking, ensuring consistent product availability and variety. Seasonal promotions and private-label floor cleaner products also help supermarkets and hypermarkets maintain customer loyalty and margin advantages. The resilience of supermarkets and hypermarkets endures despite increasing online competition because many consumers prefer the immediate access and tactile shopping experience these formats provide, especially for household staples like floor cleaners. This channel’s growth remains steady, supported by ongoing consumer preference for physical shopping while offering opportunities to introduce new, eco-friendly, and premium product variants tailored to meet changing market demands.

The online channel is currently the fastest-growing segment in the U.S. floor cleaner market, driven by rising consumer demand for convenience, a wide variety of products, and time-saving shopping experiences. Digital retail platforms, including major e-commerce sites like Amazon, Walmart.com, and smaller direct-to-consumer brand websites, offer consumers a broad selection of floor cleaning products-ranging from budget-friendly to niche and eco-conscious options-that are not always available through physical retail stores. Online shopping makes it easy for consumers to compare features, read reviews, and access detailed information, helping them make informed purchasing decisions. The growth of subscription services and direct deliveries supports regular replenishment, boosts brand loyalty, and expands overall market reach, especially among younger, tech-savvy consumers.

The growth of e-commerce during the COVID-19 pandemic has kept its momentum, with many consumers now used to the convenience of home delivery and avoiding in-person contact. Innovations like same-day delivery, seamless mobile shopping, digital payment options, and personalized marketing continue to boost online growth. Additionally, brands are actively using online platforms to introduce and promote sustainable and premium product lines, responding to consumers' growing preference for transparency and environmentally friendly credentials. As e-commerce expands its market share in the U.S., the online channel is expected to remain a key opportunity for floor cleaner manufacturers, offering access to a broader customer base, including those in remote and underserved areas.

Key U.S. Floor Cleaner Company Insights

Competition is driven by a combination of premiumization (offering higher-performance or specialized products), sustainability (development of biodegradable, non-toxic, and low-emission products), and technological advancement (integration of IoT, robotics, and automation). The largest companies leverage robust R&D to innovate while also focusing on compliance with stringent U.S. health and environmental standards. Distribution forms a strategic focus, with leading brands securing wide access through supermarkets, hypermarkets, and rapidly expanding e-commerce channels, enabling consumers to compare and purchase a variety of products easily. Smaller and niche brands compete by focusing on natural or specialty formulas, direct-to-consumer online models, and targeting environmentally conscious consumers.

Key U.S. Floor Cleaner Companies:

- Procter & Gamble

- The Clorox Company

- SC Johnson

- Ecolab Inc.

- Reckitt Benckiser

- Unilever

- Church & Dwight Co., Inc.

- Henkel

- Kao Corporation

- Zep

- Tennant Company

- Nilfisk Group

- Tomcat Equipment

- Factory Cat

- Hako Group

U.S. Floor Cleaner Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 2417.9 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

U.S.

Key companies profiled

Procter & Gamble; The Clorox Company; SC Johnson; Ecolab Inc.; Reckitt Benckiser; Unilever; Church & Dwight Co., Inc.; Henkel; Kao Corporation; Zep; Tennant Company; Nilfisk Group; Tomcat Equipment; Factory Cat; Hako Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Floor Cleaner Market Report Segmentation

This report forecasts revenue growth in the U.S. and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. Grand View Research has segmented the U.S. floor cleaner market report by product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Multisurface Glass Cleaner

-

Ceramic & Tile Cleaners

-

Marble Cleaners

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.