- Home

- »

- Homecare & Decor

- »

-

Floor Cleaner Market Size & Share, Industry Report, 2033GVR Report cover

![Floor Cleaner Market Size, Share & Trends Report]()

Floor Cleaner Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Multisurface Floor Cleaner, Ceramic And Tile Cleaner), By Application (Commercial, Residential), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-692-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Floor Cleaner Market Summary

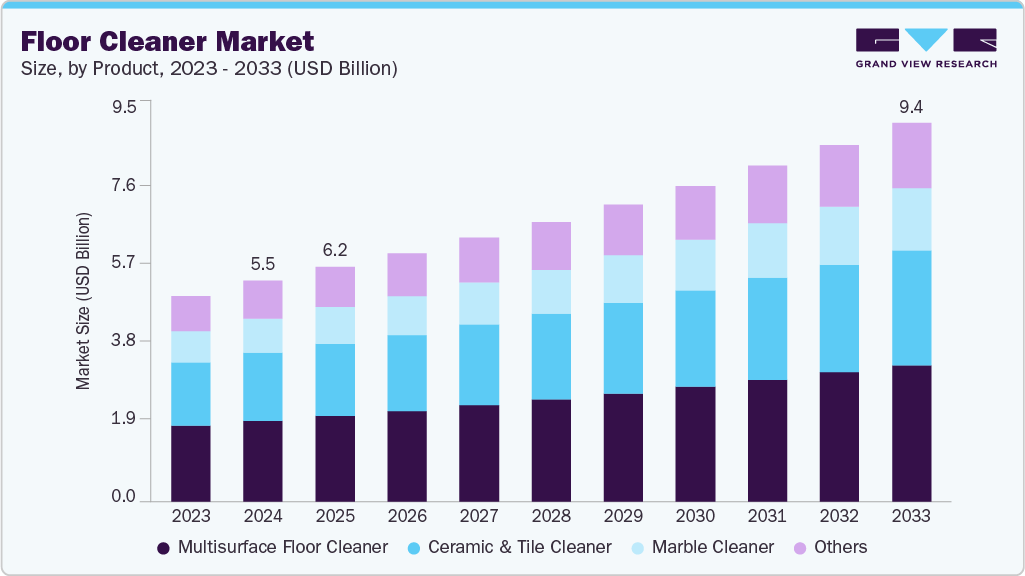

The global floor cleaner market size was estimated at USD 5.49 billion in 2024 and is projected to reach USD 9.41 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The primary growth drivers are the increasing awareness of hygiene and sanitation, especially heightened by global health concerns such as the COVID-19 pandemic.

Key Market Trends & Insights

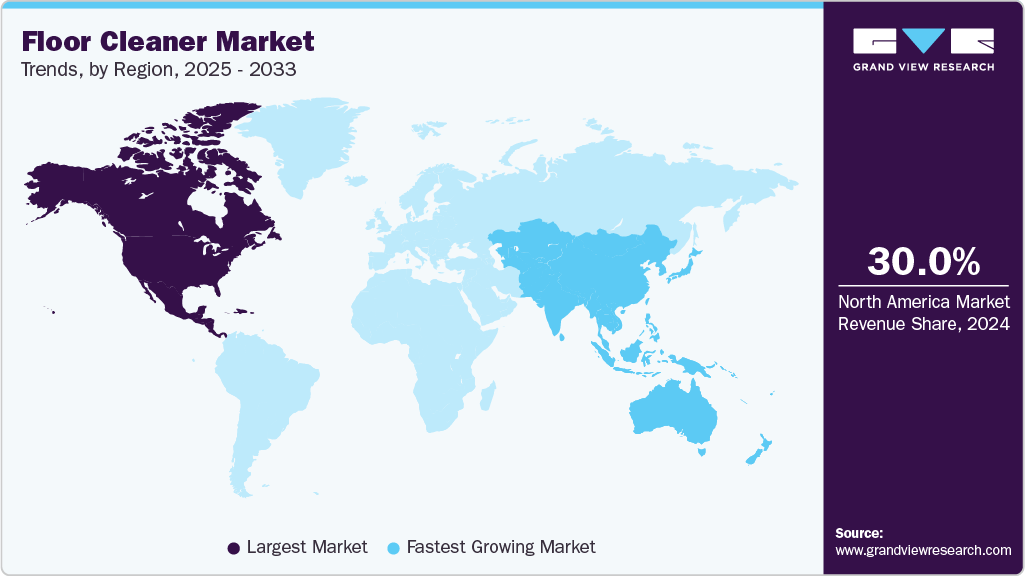

- North America held the largest regional share in the floor cleaner market, accounting for over 30% of the global market in 2024.

- The U.S floor cleaner industry dominated the North American region, accounting for over 70% of the region’s floor cleaner consumption.

- By product, multisurface floor cleaners held the largest revenue share, accounting for over 35% of the market in 2024.

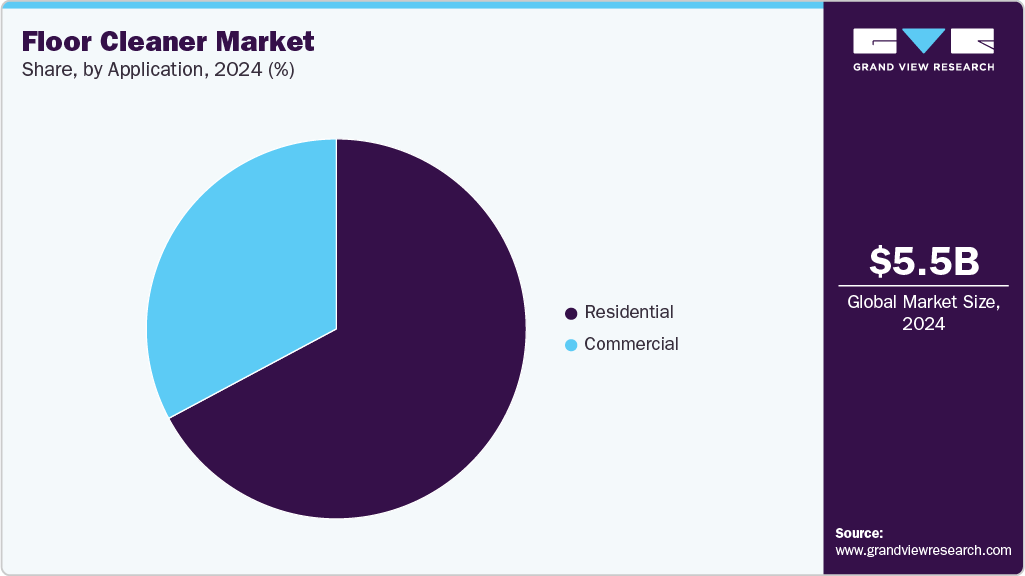

- Based on application, residential held the largest share in 2024.

- By distribution channel, supermarkets and hypermarkets were the most widely used distribution channels for floor cleaners, accounting for over USD 2.0 billion in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.49 Billion

- 2033 Projected Market Size: USD 9.41 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers and businesses alike are prioritizing cleanliness to maintain safer environments, which has led to a surge in demand for effective floor cleaning products that not only remove dirt but also disinfect and sanitize surfaces. This trend is particularly pronounced in commercial sectors such as hospitals, hotels, and offices, where maintaining high hygiene standards is crucial.Urbanization and rising disposable incomes, especially in developing regions such as Asia-Pacific, are further fueling market expansion. As more people move into urban areas and adopt modern lifestyles, there is a growing preference for convenient and efficient cleaning solutions. Additionally, the proliferation of hard flooring materials such as tiles, vinyl, and hardwood in both residential and commercial spaces necessitates frequent cleaning, thereby boosting demand for specialized floor cleaners designed for these surfaces. The rapid growth of real estate, hospitality, and healthcare infrastructure in emerging economies is also a significant contributor to this trend.

Technological advancements are transforming the market by introducing innovative products that enhance cleaning efficiency and user convenience. The rise of automated and robotic floor cleaners, smart cleaning devices, and ergonomic designs has made floor cleaning less labor-intensive and more effective. These innovations appeal to tech-savvy consumers and commercial users seeking time-saving solutions. Moreover, product formulations are continually evolving to enhance cleaning performance while minimizing environmental impact, incorporating features such as quick-dry technology, streak-free finishes, and multi-surface compatibility.

Environmental sustainability is becoming a critical factor shaping the market. There is a growing consumer preference for eco-friendly and biodegradable products that minimize environmental harm. Manufacturers are responding by developing green cleaning solutions with natural ingredients, reduced chemical content, and recyclable packaging. This shift aligns with stricter environmental regulations and increasing corporate social responsibility initiatives, creating opportunities for companies to differentiate their offerings and capture environmentally conscious market segments.

The expansion of e-commerce and digital retail platforms has broadened market accessibility and consumer choice. Online channels enable consumers to explore a wide variety of floor cleaners, including premium, niche, and eco-friendly products, often with home delivery and subscription options. This increased accessibility supports impulse buying and repeat purchases, further driving market growth. The combination of evolving consumer preferences, technological innovation, a focus on sustainability, and expanding commercial infrastructure sets a strong foundation for market growth.

A major challenge is the environmental and regulatory pressures related to chemical formulations and packaging waste. Traditional floor cleaners often contain harsh chemicals that can harm ecosystems through soil and water contamination. Increasing consumer awareness and stricter environmental regulations are pushing manufacturers to reformulate products with biodegradable, non-toxic ingredients and to reduce plastic packaging. Compliance with these evolving regulations requires a significant investment in research and development, as well as adjustments to manufacturing processes and supply chain changes, which can be both costly and complex.

The market also faces intense price competition and the prevalence of low-cost, unbranded alternatives, particularly in emerging economies. Many consumers opt for cheaper locally made floor cleaners that provide basic cleaning at a fraction of the cost of premium brands. These unregulated products often bypass safety and quality standards, making it difficult for established players to compete on both price and trust. This dynamic limits the market share growth potential for higher-end and eco-friendly products, constraining profitability for leading manufacturers.

Product Insights

Multisurface floor cleaners held the largest revenue share, accounting for over 35% of the market in 2024, due to their versatility and convenience. These products are designed to clean a variety of surfaces, including tile, wood, marble, and vinyl, making them highly attractive to both households and institutions that feature multiple flooring types. The demand for all-in-one cleaning solutions is driven by increasing urbanization, busy lifestyles, and the need for efficient products that simplify cleaning routines. In addition, the rise of e-commerce and digital retail platforms has made these products more accessible, further boosting their popularity. The ongoing innovation in eco-friendly formulations and packaging also appeals to environmentally conscious consumers, reinforcing the segment’s dominance.

Several factors contribute to the growth of the ceramic and tile cleaner segment. A primary driver is the widespread adoption of ceramic and porcelain tiles in both residential and commercial spaces, due to their durability and aesthetic appeal. While these surfaces are popular, they can be challenging to clean effectively, especially when it comes to stubborn stains, grime, and dirt in grout lines. This necessity creates a sustained demand for specialized cleaning solutions.

Increasing urbanization and significant growth in the global construction industry, particularly in emerging economies, further fuel this market. As more structures are built and renovated, the installation of ceramic and other tile surfaces increases, subsequently boosting the need for effective cleaning and maintenance products. Government initiatives supporting affordable housing and infrastructure development also indirectly benefit the ceramic tile market, and by extension, the demand for tile cleaners.

The use of marble floor cleaners is expected to grow at a CAGR of 7% from 2025 to 2033. This rapid growth is primarily fueled by the expansion of luxury real estate, premium commercial properties, and the hospitality sector, where marble flooring is favored for its aesthetic appeal and status. The increasing demand for restoration and maintenance services, coupled with the need for specialized, pH-neutral, and non-abrasive cleaning solutions to preserve marble’s integrity, further accelerates this segment. Technological advancements in eco-friendly and high-performance formulations are also contributing to the segment’s robust growth, as consumers and businesses seek products that combine effective cleaning with environmental responsibility.

Distribution Channel Insights

Supermarkets and hypermarkets were the most widely used distribution channels for floor cleaners, accounting for over USD 2.0 billion in 2024. These traditional retail outlets benefit from their extensive physical presence, offering consumers the convenience of one-stop shopping where they can compare multiple brands and product types in person. The ability to physically inspect products, avail of in-store promotions, and access trusted brands makes supermarkets and hypermarkets the preferred choice for many consumers. Their dominance is also supported by established supply chains and strategic partnerships with manufacturers, ensuring consistent product availability. This channel remains especially strong in urban and suburban areas where consumers combine grocery and household shopping, reinforcing its role as the primary source for floor cleaners.

The online distribution channel is the fastest-growing segment, growing at a CAGR of 6.6% from 2025 to 2033, driven by increasing consumer preference for convenience, wider product variety, and competitive pricing. E-commerce platforms such as Amazon, Walmart, and Alibaba enable consumers to shop from home, access detailed product information, read customer reviews, and benefit from quick delivery services. The pandemic accelerated this shift by highlighting the safety and convenience of online shopping, resulting in a surge in digital retail adoption for household cleaning products. Online sales also allow brands to offer exclusive promotions, subscription models, and bundled deals that foster customer loyalty. The growth of online channels is particularly strong in regions with high internet penetration and among younger, tech-savvy consumers seeking time-saving solutions. As digital infrastructure improves globally, the online channel’s market share is expected to expand rapidly, complementing and gradually reshaping the traditional retail landscape.

Application Insights

The residential sector was the largest application for floor cleaner and accounted for a market revenue of over USD 3.5 billion in 2024. The residential segment is propelled by rising urbanization, increasing disposable incomes, and heightened awareness of hygiene and cleanliness. As more people migrate to urban areas and lifestyles become busier, homeowners seek convenient and effective cleaning solutions that simplify household chores. The growth of multi-surface flooring in homes-such as tiles, hardwood, and vinyl-drives demand for specialized and multipurpose floor cleaners that can address a variety of surfaces. The COVID-19 pandemic and subsequent global health concerns have further intensified the focus on home hygiene, leading to greater adoption of floor cleaning products that offer both cleaning and disinfecting capabilities.

Product innovation and accessibility are key factors supporting growth in the residential market. Manufacturers are introducing user-friendly, high-performance, and eco-friendly formulations that appeal to health-conscious and environmentally aware consumers. The proliferation of e-commerce and digital retail platforms has made a wide range of floor cleaners readily available, allowing consumers to choose from premium, niche, and sustainable products. As consumers increasingly prioritize convenience, safety, and sustainability in their purchasing decisions, the residential floor cleaner segment is expected to continue its upward trajectory, especially in fast-growing regions like Asia-Pacific.

The commercial segment of the market encompasses applications in offices, hospitals, schools, shopping malls, hotels, and other large-scale facilities. Growth in this segment is primarily driven by the expansion of commercial infrastructure and the increasing need for efficient, large-area cleaning solutions. Commercial spaces experience high foot traffic, making hygiene and cleanliness critical for both health and aesthetic reasons. The adoption of advanced floor cleaning equipment-such as ride-on scrubbers and automated machines-enables businesses to maintain large areas with minimal manpower and time, reducing operational costs and boosting productivity. The healthcare sector, in particular, requires high standards of cleanliness to prevent hospital-acquired infections, thereby fueling the demand for high-performance, commercial-grade floor cleaners.

Technological innovation and regulatory standards also play a crucial role in driving the growth of the commercial segment. Many commercial establishments are transitioning to eco-friendly and sustainable cleaning products to comply with environmental regulations and meet corporate social responsibility goals. The integration of smart technologies, such as IoT-enabled cleaning machines and automated scheduling, enhances cleaning efficiency and reporting, making these solutions attractive for facility managers. As commercial real estate continues to expand globally, especially in emerging markets, demand for robust, reliable, and environmentally responsible floor cleaning solutions is expected to rise steadily.

Regional Insights

North America floor cleaner market was the largest globally, accounting for a market revenue of over 30.0% in 2024. This growth is largely driven by substantial infrastructural investments and the expansion of commercial spaces such as offices, hospitals, malls, and educational institutions that require efficient and effective cleaning solutions. High consumer awareness of hygiene and sanitation, particularly following the COVID-19 pandemic, has further driven demand for floor cleaners in both residential and commercial sectors. Additionally, the presence of established multinational corporations and continuous innovation in eco-friendly and multi-functional products support market expansion. The mature retail infrastructure, including supermarkets and growing e-commerce platforms, ensures wide product availability, contributing to the region’s market leadership. North America is also a leader in the adoption of advanced floor cleaning equipment, which complements chemical cleaner demand and enhances overall market growth.

U.S. Floor Cleaners Market Trends

The U.S floor cleaners industry dominated the North American region, accounting for over 70% of the region’s floor cleaner consumption. The U.S. market benefits from a large commercial base with stringent hygiene standards, driving demand for high-performance cleaning solutions. The country’s strong focus on health and sanitation, combined with rising disposable incomes and consumer preference for premium and eco-friendly products, fuels growth in both residential and commercial applications. Furthermore, technological advancements such as automated and robotic floor cleaning machines are gaining traction, supported by robust after-sales service networks and widespread retail availability. The U.S. also leads in regulatory frameworks that encourage the development of sustainable and safe cleaning formulations, prompting manufacturers to continually innovate.

Asia Pacific Floor Cleaners Market Trends

The Asia Pacific floor cleaner industry is expected to grow fastest at a CAGR of 7.6% from 2025 to 2033. The Asia-Pacific market is the fastest-growing globally, driven by rapid urbanization, industrialization, and rising disposable incomes in key countries, including China, India, Japan, and Southeast Asian nations. The region’s booming construction and real estate sectors, encompassing residential, commercial, and hospitality infrastructure, are driving demand for floor cleaning products. Increasing consumer awareness about hygiene and sanitation, especially post-pandemic, is accelerating adoption in both household and commercial segments. Additionally, the growing middle class is shifting preferences toward premium, multi-functional, and eco-friendly floor cleaners. The expansion of modern retail formats and the surge in e-commerce penetration further enhance accessibility and product variety, supporting rapid market growth.

Key Floor Cleaner Company Insights

The global floor cleaner industry is highly competitive, dominated by a mix of multinational giants and strong regional brands. Procter & Gamble (P&G) is one of the leading companies globally with an extensive reach across 120+ countries, along with others such as Reckitt Benckiser and Hindustan Unilever, which are powerful in Asia-Pacific markets. SC Johnson and industrial specialists such as Nilfisk, Alfred Kärcher, and Tennant excel in the commercial cleaning equipment segment. While global players drive innovation with eco-friendly, multipurpose products and strong online and offline distribution, local and low-cost manufacturers remain influential in emerging markets through affordability and regional product adaptations. Premiumization, sustainability, technological advancements, and broad distribution networks are central to ongoing competition, with brand strength, product innovation, and regulatory compliance shaping long-term leadership.

Key Floor Cleaner Companies:

The following are the leading companies in the floor cleaner market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble Co.

- Reckitt & Benckiser

- Unilever

- Babyganics

- C. Johnson & Son

- Church&Dwight

- Clorox Co.

- Henkel KGAA

- Kao Corporation

- Robert McBride

Floor Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.18 billion

Revenue forecast in 2033

USD 9.41 billion

Growth rate (Revenue)

CAGR of 6.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Procter & Gamble Co.; Reckitt & Benckiser; Unilever; Babyganics; C. Johnson & Son; Church&Dwight; Clorox Co.; Henkel KGAA; Kao Corporation; Robert McBride

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

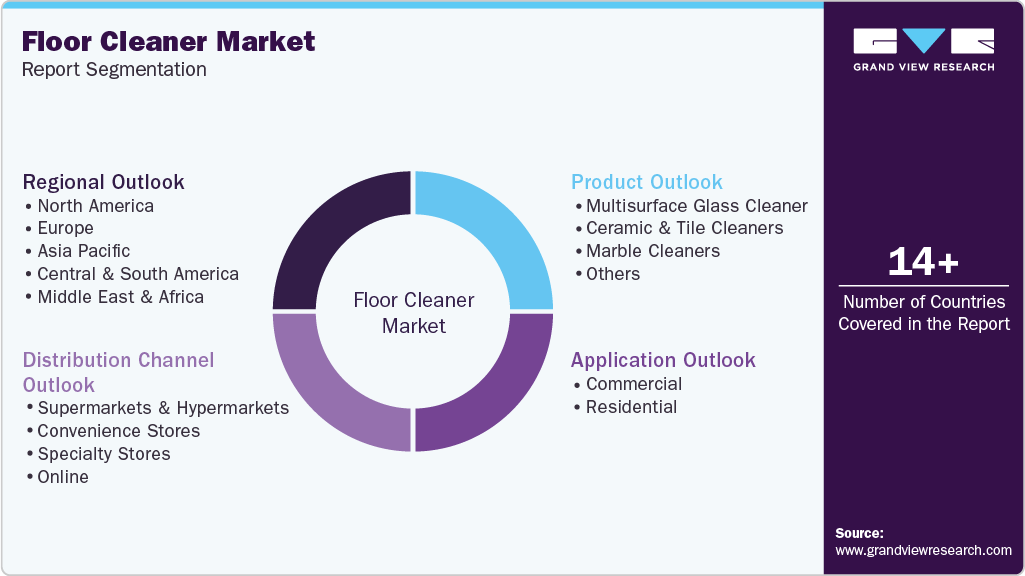

Global Floor Cleaner Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. Grand View Research has segmented the global floor cleaner market report by product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Multisurface Glass Cleaner

-

Ceramic & Tile Cleaners

-

Marble Cleaners

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.