- Home

- »

- Medical Devices

- »

-

U.S. Formulation Development Outsourcing Market Report 2030GVR Report cover

![U.S. Formulation Development Outsourcing Market Size, Share, & Trends Report]()

U.S. Formulation Development Outsourcing Market (2025 - 2030) Size, Share, & Trends Analysis Report By Service, By Formulation (Oral, Injectable), By Therapeutic Area (Oncology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-281-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

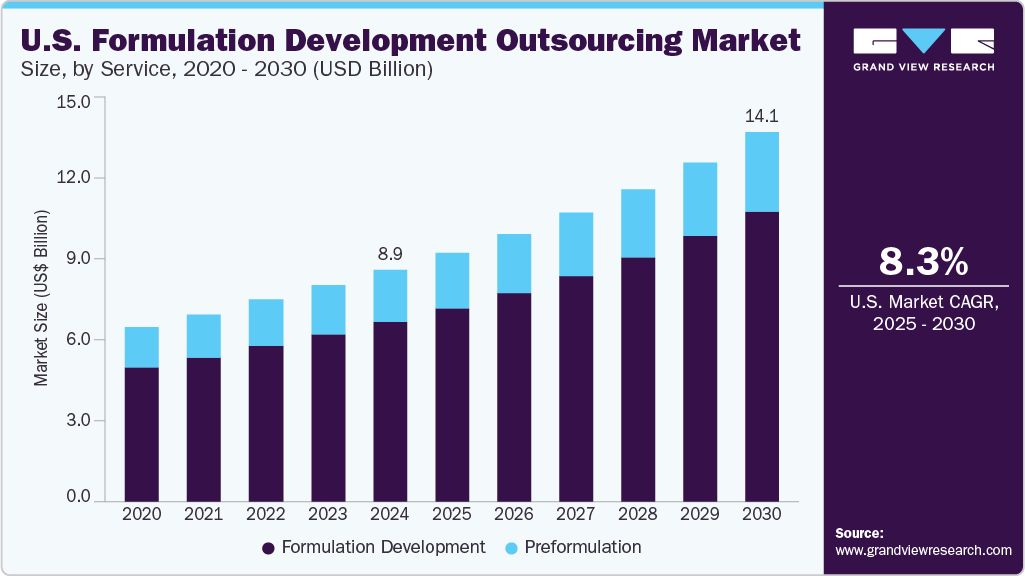

The U.S. formulation development outsourcing market size was estimated at USD 8.87 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. This growth is driven by increasing demand for innovative pharmaceutical and biotech products, rising R&D costs, and a need for specialized expertise. Outsourcing formulation development is an attractive option for companies looking to streamline their R&D processes, reduce costs, and access a wider range of resources.

The surge in R&D by pharmaceutical and biotechnology firms is a major driver propelling the demand for outsourced formulation development services. Over the past two decades, R&D spending and new drug launches have increased, leading to cost reduction and accelerated processes through outsourcing. This rising demand has prompted contract service providers to expand their capacities, fostering the growth of the U.S. formulation development outsourcing industry. Consequently, these factors substantially contribute to market expansion.

Drug formulation relies heavily on trial-and-error methods to predict optimal formulations, which can be costly, time-consuming, and labor-intensive. To address the need for reducing expenses on new Active Pharmaceutical Ingredients (APIs) and overall healthcare costs in the pharmaceuticals market, it is crucial to estimate preferred formulations. This helps the industry identify efficient drug development approaches. Consequently, the pharmaceutical and biotechnology sector extensively outsources these services to contract manufacturers to streamline costs and processes.

Advancements in technology drive innovations encourage companies to invest in discovering new compounds and developing blockbuster drugs. This leads to an increase in generic manufacturers and a growing pharmaceutical market, driven by unmet needs for various disorders and rising R&D activities for orphan therapies.

Market Concentration & Characteristics

The U.S. accounts for a major share of clinical trial recruitment globally, with over 20,000 trials being recruited within the country as of March 2023. Thus, the industry is characterized by a high degree of R&D and innovation in varied application areas.

Post-pandemic long-term capital-intensive mergers & acquisitions and expansions, coupled with government collaborations with pharmaceutical companies to vaccine manufacturers, are helping fuel the market growth. For example, Catalent, Inc. acquired Metrics Contract Services in August 2022 from Mayne Pharma Group Limited. The acquisition was intended to enhance the company's oral solid formulation development abilities.

The regulatory framework in this industry is impacted by the pharmaceutical industry, which sets regulations for clinical trials. For instance, notices such as a November 2023 amendment to the clinical trial requirement regulated by the NIH, CDC, and FDA indirectly impact the industry.

According to a Cardinal Health report, there were approximately 33 FDA-approved biosimilars in the U.S. in January 2022, with 21 commercially available. This growing number of approved biosimilars is anticipated to boost the demand for formulation development processes and outsourcing activities in the U.S., significantly impacting the industry’s growth.

The industry is expected to witness an increased emphasis on establishing new facilities, particularly vaccines, focusing on regional manufacturing and distribution of supplies and biopharmaceuticals. This may involve expanding equipment capacity in the U.S. industry to cater to domestic demand. For instance, in December 2022, Catalent, Inc. inaugurated a new biologics analytical center of excellence in Durham, U.S., expanding its facilities.

Service Insights

The formulation development services dominated the U.S. formulation development outsourcing industry and accounted for the largest revenue share of 77.5% in 2024. Major factors boosting the demand for formulation development services include improving the bioavailability of poorly water-soluble compounds, increasing the innovation of novel drugs due to patent expirations, and overcoming the risks associated with development. In 2022, the U.S. Food & Drug Administration (FDA) approved 37 new novel drugs that had never before been approved or marketed in the U.S.

The pre-formulation services are expected to grow at a significant CAGR of 7.5% over the forecast period. Optimizing formulations in the early phases speeds up development and reduces risk from the outset. These services will witness high demand due to the dynamics of the pharmaceutical industry. The pharma industry is anticipated to witness a high level of competition from generic drugs as more blockbuster drugs undergo patent expiry phase, and the development of biosimilars is expected to increase, thus boosting demand for pre-formulation services significantly.

Formulation Insights

Oral formulation led the U.S. formulation development outsourcing market with the largest revenue share in 2024. These formulations are commonly used for treating diseases such as fever, migraines, and infectious diseases. The convenience offered by oral formulations drives the segment growth further, as they are self-administering and do not require a trained physician for drug administration. According to the National Library of Medicine, the prevalence of migraine in the population has remained relatively stable for over 30 years, ranging from 11.7% to 14.7% overall, 17.1% to 19.2% in women, and 5.6% to 7.2% in men, according to reviewed studies.

Injectable formulation is expected to grow at the fastest CAGR over the forecast period. Rising demand for insulin, vaccines, and other drugs administered through the parenteral route, along with the technological advancements in injectables manufacturing, including the formulation complexities of long-lasting, advanced injectable devices, high-viscosity, and high-volume drug delivery systems, are anticipated to significantly fuel the expansion of the U.S. formulation development outsourcing industry.

Therapeutic Area Insights

The oncology segment dominated the U.S. formulation development outsourcing market with the largest revenue share in 2024. This can be attributed to the high prevalence of cancer, prompting the need for safe and effective treatment options. According to the 2023 American Association for Cancer Research Progress Report, despite the declining cancer mortality in the U.S. since the 1990s, rising number of cancer cases and the growing economic burden of cancer on both individuals and the U.S. healthcare system in the coming decades emphasize the urgent need for accelerated research progress to combat cancer more effectively.

The cardiovascular segment is expected to grow significantly over the forecast period. Advancements in cardiovascular treatments, such as biologics and personalized medicines, demand specialized formulation techniques. Outsourcing gives pharmaceutical companies access to expertise in complex drug delivery and bioavailability optimization. It also helps reduce infrastructure and operational costs, making resource allocation more efficient. In the U.S., heart disease has continuously remained the leading cause of death. On average, one person dies from cardiovascular disease every 33 seconds. In 2022, heart disease claimed 702,880 lives, accounting for 1 in every five deaths nationwide.

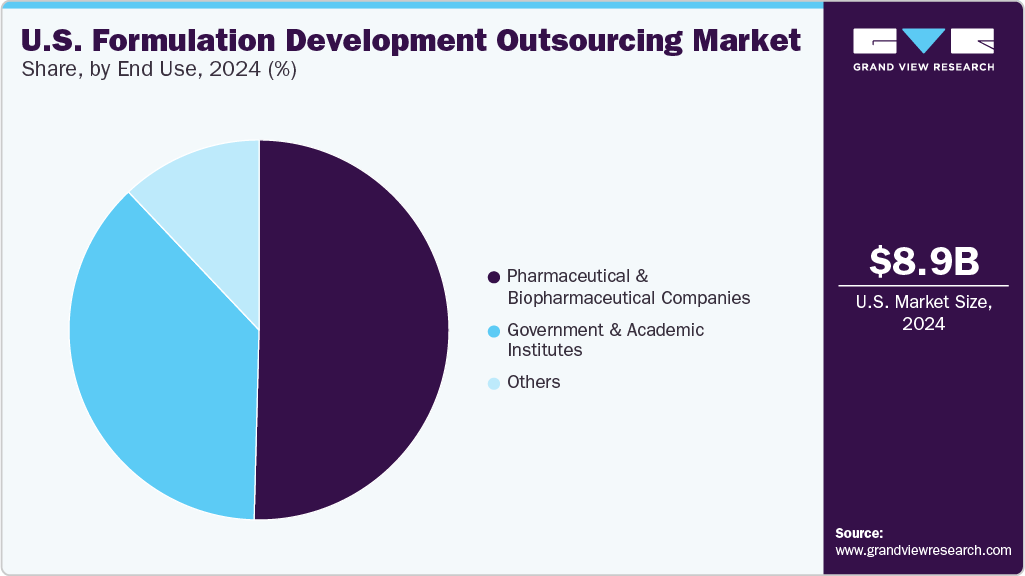

End Use Insights

Pharmaceutical and biopharmaceutical companies led the U.S. formulation development outsourcing industry with the largest revenue share in 2024. Their growth is attributed to the high R&D spending, growing need for complex drug formulations, and focus on biologics and personalized medicines. Outsourcing allows them to access specialized expertise, reduce costs, and streamline operations. It also helps accelerate time-to-market and ensure regulatory compliance, enabling companies to concentrate on core areas such as drug discovery and commercialization while improving development efficiency and outcomes. Charles River Laboratories expanded its biologics testing solutions to meet the rising demand for outsourced biologics and biosimilars services. These enhancements boost capacity and capabilities to support client needs better.

The government and academic institutes sector is expected to grow at a significant CAGR over the forecast period due to increased public funding for R&D, collaborative research initiatives, and the need for specialized expertise. These institutions play a vital role in early-stage drug development, especially for complex or innovative therapies. Outsourcing helps access advanced technologies and capabilities, accelerating progress while optimizing costs and expanding their impact in pharmaceutical innovation.

Key Companies & Market Share Insights

The U.S. formulation development outsourcing market is highly competitive. Some notable companies operating in the market include SGS S.A.; Intertek Group plc; Recipharm; Lonza; and Charles River Laboratories International, Inc. To gain market share, prominent organizations within this sector often pursue various acquisition strategies such as acquisitions, collaborations, and partnerships.

In April 2022, Recipharm AB announced the acquisition of Vibalogics, a virotherapy CDMO, and Arranta Bio, an advanced therapy CDMO, exemplifying strategic movements in the market, aiming to enhance Recipharm’s presence and capabilities in the rapidly growing biologics market, thereby boosting the company’s overall position within the competitive landscape.

-

SGS Société Générale de Surveillance SA is an inspection, verification, testing, and certification company. It provides independent services across various industries, including pharmaceuticals, food, environment, and consumer goods. It helps clients ensure quality, safety, and regulatory compliance throughout their supply chains and product development processes.

-

Intertek Group plc specializes in quality and safety solutions. It offers services such as testing, inspection, certification, and auditing across various industries, including chemicals, healthcare, and construction.

Key U.S. Formulation Development Outsourcing Companies:

- SGS Société Générale de Surveillance SA

- Intertek Group plc

- Recipharm AB

- Lonza

- Charles River Laboratories

- Eurofins Scientific

- Element

- Labcorp

- Thermo Fisher Scientific Inc.

- Catalent, Inc

Recent Developments

-

In January 2025, Spektus Pharma and Recipharm formed a strategic partnership to develop novel central nervous system products using Spektus’s Flexitab oral drug delivery platform.

-

In December 2024, Intertek teamed up with CrystecPharma to advance formulation science and expedite the development of dry powder inhaler products.

-

In October 2024, Lonza expanded its partnership with a global biopharmaceutical company for large-scale ADC manufacturing. The agreement included building a dedicated bio-conjugation suite at Lonza's Ibex Biopark in Visp, Switzerland, scheduled to open in 2027.

-

In January 2024, Charles River Laboratories International, Inc. introduced its ready-to-use Rep/Cap plasmid to simplify certain gene therapy programs, strengthening its presence in this specialized area.

-

In March 2023, Arranta Bio, a Recipharm company, expanded its RNA process development capacity by 50% at its Watertown, Massachusetts, facility to meet increased customer demand.

U.S. Formulation Development Outsourcing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.1 billion

Growth Rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, Formulation, Therapeutic Area, and End Use

Country scope

U.S.

Key companies profiled

SGS Société Générale de Surveillance SA; Intertek Group plc; Recipharm AB; Lonza; Charles River Laboratories; Eurofins Scientific; Element; Labcorp; Thermo Fisher Scientific Inc.; Catalent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Formulation Development Outsourcing Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. formulation development outsourcing market report based on service, formulation, therapeutic area, and end use:

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Pre-formulation

-

Formulation Development

-

-

Formulation Outlook (Revenue, USD Million; 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million; 2018 - 2030)

-

Oncology

-

Infectious Disease

-

Neurology

-

Hematology

-

Respiratory

-

Cardiovascular

-

Dermatology

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Government and Academic Institutes

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.