- Home

- »

- Medical Devices

- »

-

Formulation Development Outsourcing Market Report, 2030GVR Report cover

![Formulation Development Outsourcing Market Size, Share & Trends Report]()

Formulation Development Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Preformulation, Formulation Development), By Formulation, By Therapeutic Area, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-948-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Formulation Development Outsourcing Market Summary

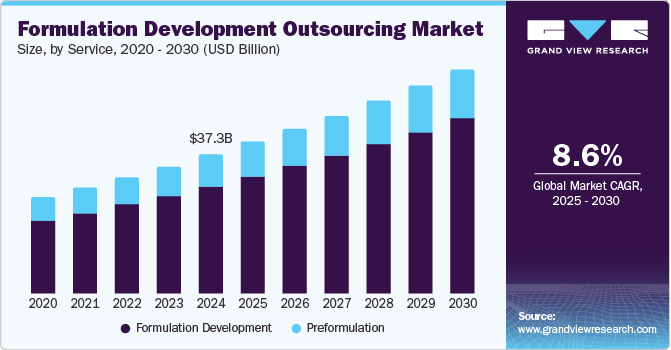

The global formulation development outsourcing market size was estimated at USD 37,269.8 million in 2024 and is projected to reach USD 60,658.1 million by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The market growth is driven by increased demand for new drug development, the growing prevalence of chronic diseases, the rising focus on regulatory requirements for high-quality products, and the emergence of specialty pharmaceuticals.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, formulation development accounted for a revenue of USD 31,015.1 million in 2024.

- Formulation Development is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 37,269.8 Million

- 2030 Projected Market Size: USD 60,658.1 Million

- CAGR (2025-2030): 8.6%

- Asia Pacific: Largest market in 2024

Besides, the rising need for oral medications, injectables, biologic active pharmaceutical ingredients (APIs), and viral vectors drives market growth. Moreover, the accelerating shift towards innovative biological cells and gene therapies is expected to boost the market growth over the estimated period.

Pharmaceutical and biotechnology firms are increasingly partnering with CDMOs and CMOs to accelerate drug development and reduce costs. The evolving regulatory landscape leads to the increasing complexity of drug formulations, which drives market growth. In addition, the demand for innovative drug delivery systems, techniques to enhance bioavailability, and an expanding pipeline of biologics and specialty drugs are expected to boost the market growth.

Furthermore, the utilization of AI in formulation design, advancements in nanotechnology for drug delivery, and the adoption of continuous manufacturing to improve both efficiency and scalability are boosting market growth. In addition, the growing demand for formulations that offer both high solubility and stability led to an increased focus on the development of lipid-based formulations, amorphous solid dispersions, and co-crystal engineering, thereby accelerating market demand. Furthermore, a growing number of strategic initiatives, product launches, and acquisitions among outsourcing service providers aiming to broaden service offerings and geographic presence further drive the market expansion. Regulatory agencies are also placing greater emphasis on Good Manufacturing Practices (GMP) and Quality-by-Design (QbD) methodologies, which are shaping formulation strategies. Such factors are expected to drive the market over the estimated time period.

Opportunity Analysis

The formulation development outsourcing industry is anticipated to witness enormous growth opportunities due to increasing demand for specialized delivery systems, the rising complexity of drug molecules, and cost pressures facing pharmaceutical companies. Besides, the trend toward biologics, biosimilars, active pharmaceutical ingredients (APIs), and personalized medicine is enhancing the need for customized formulation development outsourcing services, resulting in lucrative opportunities for pharmaceutical firms.

Besides, regulatory compliance, especially concerning Quality by Design (QbD) principles and strict ICH/FDA guidelines, is further propelling the demand for outsourcing among pharmaceutical companies with robust technical expertise. Moreover, emerging markets like Asia-Pacific and Europe are attracting attention for their cost-effective formulation services, which contribute to the growing outsourcing landscape. Furthermore, advancements in digitalization, modular automation, and AI-driven formulation modeling are expected to drive the market. Besides, most of the companies strive to expand their research and development processes and reduce time-to-market. This is expected to enhance strategic partnerships with specialized formulation providers to gain a competitive advantage.

Technological Advancements

Technological innovations in formulation development outsourcing are transforming the drug development landscape by enhancing efficiency, scalability, and product performance. Several pharmaceutical and biopharmaceutical companies are increasingly outsourcing to Contract Development and Manufacturing Organizations (CDMOs) that incorporate predictive modeling, AI and machine learning algorithms, and computational fluid dynamics (CFD). These technologies help streamline pre-formulation screening processes and optimize excipient compatibility, thereby supporting market growth.

Moreover, the integration of continuous manufacturing platforms and advanced process analytical technologies is facilitating real-time quality control and reducing time-to-market. In addition, growing focus on nanotechnology-based drug delivery systems and lipid-based formulations, which improve the bioavailability of poorly soluble drugs. This trend is driving the demand for specialized outsourcing partners with expertise in formulation development, serving as a strategic approach to managing R&D costs and expediting drug commercialization timelines. In addition, the adoption of modular automation, digital twin technologies, and smart data capture systems is enhancing process design, risk management, and scale-up efficiency. These advancements further reinforce the importance of outsourcing partners in providing comprehensive formulation development solutions.

Pricing Model Analysis

Formulation development outsourcing operates under various pricing models to balance cost efficiency, quality, and regulatory compliance while enhancing manufacturers' profitability and affordability. The pricing models include milestone-based pricing, value-based pricing, fixed-fee pricing, and subscription/retainer pricing.

The value-based pricing aligns with the therapeutic and commercial impact of the formulation, where Contract Development and Manufacturing Organizations charge based on achieved innovations, enhancements in bioavailability, or accelerated regulatory processes. For high-value biologics and specialty drugs, pricing may vary from USD 5 million to 500 million, reflecting unique formulation challenges and differentiated delivery technologies. Besides, fixed-fee models provide predictable costs for formulation development by encompassing specific deliverables such as pre-formulation studies, optimization processes, and analytical testing.

Pricing in this model typically ranges from USD 2 million to 100 million, based on complexity and scope. This model is preferred for well-defined projects with minimal variability in formulation parameters. Moreover, a subscription or retainer model offers continuous formulation support, fostering long-term collaboration. Pharmaceutical companies pay a monthly or annual fee, typically USD 1 million to 250 million per year, ensuring access to expertise, analytical testing, and regulatory guidance. This model benefits companies needing continuous formulation optimization and rapid response to development challenges.

Market Concentration & Characteristics

The formulation development outsourcing industry growth stage is medium, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, product expansion, and regional expansion.

The formulation development outsourcing industry is experiencing significant innovation, driven by the emergence of complex drug delivery systems, nanotechnology-based formulations, and 3D printing techniques for personalized medicine. Furthermore, the integration of continuous manufacturing and advanced excipient technologies is essential to address changing client demands, enhance drug stability, and improve bioavailability, thus opening up new opportunities within the market.

Regulatory frameworks established by organizations such as the FDA and EMA have heightened the demand for GMP-compliant formulation development. These regulations prioritize data integrity, Quality by Design (QbD), and adherence to ICH guidelines, compelling Contract Research Organizations (CROs) to upgrade their processes. Such regulation has led to the adoption of more advanced formulation practices and rigorous documentation standards. Thus, the impact of regulations is a significant factor that has created a rise in demand for market production.

The competition among market players is due to growing CDMOs and CROs acquiring specialized formulation experts to expand their service offerings and strengthen their comprehensive drug development capabilities. The availability of advanced technologies, unique dosage forms, and opportunities for regional expansion reflects a trend toward integrated development platforms and an increasing need for complex formulations, which in turn is driving higher levels of M&A activities.

The market remains moderately fragmented due to the presence of CDMOs, CROs, and specialized formulation providers. As the demand for delivery systems and biologic formulations increases, the service providers are witnessing competitive advantages, leading to increased fragmentation within this outsourcing space.

Regional expansion is increasing, with CROs/CDMOs setting up formulation development hubs in Asia-Pacific, Eastern Europe, and Latin America to capitalize on lower costs and talent availability. In addition, the U.S. and Western Europe continue to serve as innovation centers, while India and China are emerging as key outsourcing destinations due to supportive policies, growing expertise, and strong demand for cost-effective development solutions.

Service Insights

Based on service, the market is segmented into pre-formulation and formulation development. The formulation development segment led the market with the largest revenue share of 77.15% in 2024. This growth can be attributed to the high complexity of drug formulations, rising R&D costs, and the demand for accelerated time-to-market. In addition, an increasing number of pharmaceutical and biopharmaceutical firms are shifting towards outsourcing to witness specialized expertise and innovative technologies. Besides, an expanding pipeline of biologics, high-potency medications, and novel drug delivery methods is expected to propel market growth. Furthermore, growing regulatory demands and the trend toward personalized medicine are stimulating manufacturers to partner with outsourcing providers that possess strong compliance capabilities.

The preformulation segment is expected to grow at the fastest CAGR during the forecast period. Preformulation significantly contributes to formulation development, which focuses on evaluating the key properties of an API, including solubility, stability, particle size, polymorphism, and compatibility with excipients. This phase helps identify potential challenges early on and informs the choice of appropriate formulation strategies. This formulation is essential for improving bioavailability, ensuring product stability, and fulfilling regulatory requirements. Thus, preformulation reduces risks throughout development and facilitates a more efficient transition to clinical trials. As the complexity of molecules increases and the need for optimized drug delivery systems grows, the importance of preformulation is expected to drive the market over the estimated time period.

Formulation Insights

Based on formulation, the market is segmented into oral, injectable, topical, and others. The oral segment accounted for the largest market revenue share in 2024. Oral formulations are a primary focus in development due to their high acceptance among patients, ease of use, and cost efficiency. In the pharmaceutical and biopharmaceutical industry, the rising need for new medications for the generic population and the expiration of patents for exclusive small-molecule drugs are driving growth in the segment growth. Besides, it emphasizes the optimization of the drug's release characteristics, bioavailability, and stability while accounting for factors such as solubility, permeability, and first-pass metabolism. Moreover, oral formulations encompass various forms, including tablets, capsules, and liquid suspensions, each designed to meet therapeutic requirements and patient demographics. In addition, recent advancements in controlled-release technologies and taste-masking techniques have further enhanced patient adherence, solidifying oral delivery as a method in pharmaceutical development.

The drug product segment is expected to grow at a significant CAGR during the forecast period. The rising demand for outsourcing the development of injectable formulations is fueled by the expansion of biologics, biosimilars, and gene therapies, which has increased the need for sterile formulations. Furthermore, a growing focus on aseptic processing, adherence to regulatory standards, and innovation in drug delivery methods are expected to enhance development efficiency and expedite market entry, further market growth.

Therapeutic Area Insights

Based on therapeutic area, the market includes oncology, infectious disease, neurology, hematology, respiratory, cardiovascular, dermatology, and others. The oncology segment accounted for the largest market revenue share in 2024. The oral administration route is the preferred method for delivering treatments. The rising need for anticancer drug formulations, a growing pipeline of biologics, and the demand for targeted drug delivery systems drives the increasing demand for formulation development outsourcing in oncology. Furthermore, strict regulatory requirements and heightened research and development spending are expected to boost the need for outsourcing services that provide expertise, scalability, and compliance. These factors are expected to enhance the demand for the market.

The cardiovascular segment is anticipated to register at the fastest CAGR during the forecast period. The shifting trend toward formulation development outsourcing is gaining increased attention due to the rising incidence of heart-related diseases and the growing demand for combination formulations & patient-centric drug delivery solutions. In addition, outsourcing partners offer specialized capabilities, regulatory guidance, and scalability, accelerating development timelines with advanced research and development teams. Such factors are expected to drive the market over the estimated time period.

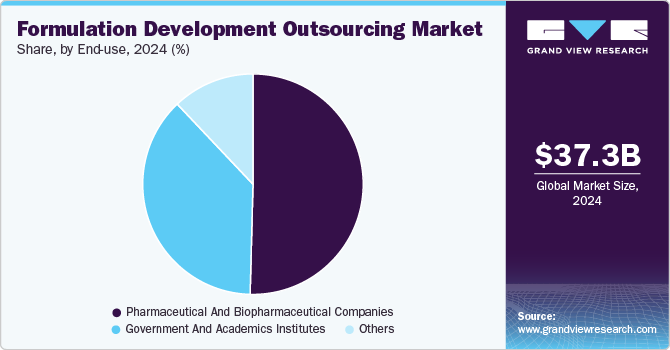

End-use Insights

Based on end use, the market includes pharmaceutical and biopharmaceutical companies, government and academic institutes, and others. The pharmaceutical and biopharmaceutical companies segment accounted for the largest market revenue share in 2024. This growth can be attributed to increasing demand for biologics, increased cost pressures, and a growing need for specialized formulation R&D as well as commercialization efforts. In addition, these services facilitate advanced formulation technologies, scalability, and development processes that adhere to good manufacturing practice (GMP) standards.

The government and academic institutes segment is anticipated to register at the fastest CAGR during the forecast period. Currently, several government and academic institutes are opting for formulation development outsourcing to address infrastructure requirements, expertise, and regulatory compliance. This trend is influenced by an increased focus on research, the need for cost efficiency, and the urgency to advance early-stage drug candidates to clinical evaluation. Moreover, outsourcing service providers are aiding institutions in translating laboratory research into viable therapeutic candidates through optimized outsourcing models. Such factors are anticipated to drive the market over the estimated time period.

Regional Insights

The formulation development outsourcing market in North America is expected to grow at the fastest CAGR of 8.10% during the forecast period, attributed to the growing expansion of the pharmaceutical sectors in the U.S. and Canada. The rising demand for complex formulations and sustained-release medications is expected to drive market growth during the forecast period. Furthermore, numerous pharmaceutical companies are seeking to outsource formulation development, as it reduces project timelines and minimizes associated risks, which is appealing to biotech firms globally looking to collaborate with outsourcing service providers. In addition, stringent regulations of the FDA and Health Canada have led pharmaceutical firms to engage with experienced outsourcing partners to ensure compliance and quality oversight. The integration of AI-driven technologies for formulation optimization and automation is also expected to propel market growth in the coming years.

U.S. Formulation Development Outsourcing Market Trends

The formulation development outsourcing market in the U.S. accounted for the largest market revenue share in North America in 2024, due to the presence of well-established companies and a rising demand for complex drug formulations. Regulatory requirements and the increasing need for personalized medications are anticipated to fuel market growth during the forecast period. Moreover, the rising utilization of AI-driven formulation technologies is positively impacting market growth. Furthermore, the increasing number of startups in the pharmaceutical and biotechnology sectors is enhancing the industry's ability to innovate cost-effectively and accelerate drug development processes.

The China formulation development outsourcing market is driven by expanding drug formulations and an increasing emphasis on the pharmaceutical drug development process. In addition, there is an increased focus on designing formulations and optimizing the composition of drug products to ensure their stability, effectiveness, and acceptability by patients. These factors are expected to support market growth.

Asia Pacific Formulation Development Outsourcing Market Trends

Asia Pacific dominated the formulation development outsourcing market with the largest revenue share at 45.50% in 2024. The region’s growth is driven by increasing pharmaceutical spending, improved healthcare infrastructure, the growing burden of diseases, and the low manufacturing costs that attract many pharmaceutical companies from developed nations to outsource their manufacturing to the Asia Pacific. In addition, countries such as India, China, and South Korea are emerging as centers for formulation R&D owing to advanced skilled workforce and alignment with global regulatory standards. Furthermore, the demand for complex generics and biosimilars is driving investments in advanced formulation technologies. Moreover, the presence of local and established CDMOs expanding their capabilities in the global market is expected to drive market growth.

The formulation development outsourcing market in China is driven by the booming biopharma sector, favorable regulatory reforms, and increasing demand for complex generics and innovative therapies. Furthermore, the expanding presence of local and established companies enhancing their capabilities in injectables, oral solids, and biologics is expected to drive market growth. Besides, the advantage of cost benefits and quicker market entry is one of the major factors driving market growth.

The Japan formulation development outsourcing market is driven by increased demand for high-generics, growing drug innovations, and the rising requirement for cost efficiency. In addition, the growing adoption of advanced drug delivery systems and QbD methodologies, alongside collaborations with global CDMOs to access specialized expertise and expedite time-to-market, drives the market growth.

The formulation development outsourcing market in India is driven by the presence of key players providing outsourcing services and a robust generic drug industry that is increasingly focusing on complex formulations. This has led to a rising demand for various outsourcing services to produce generics, thereby enhancing the need for formulation development capabilities that meet global quality standards and attract international partnerships.

Europe Formulation Development Outsourcing Market Trends

The formulation development outsourcing market in Europe is driven by a growing pharmaceutical pipeline, demand for outsourcing services, and emerging R&D activities focused on formulation. This increasing need for more specialized formulation methods is expected to support market growth. In addition, formulation development is a specialized area within Europe pharmaceutical drug development that requires dedicated resources, including skilled scientists, high-quality ingredients, and advanced instrumentation, further drives the market growth. The rising requirement for innovative drugs to address chronic and life-threatening conditions also contributes to market growth.

The Germany formulation development outsourcing market accounted for the largest market revenue share in Europe in 2024. This growth can be attributed to enhanced expertise in formulations throughout various development stages. Besides, an increasing number of clinical trials and a rising need for outsourcing services to ensure stable manufacturing, storage, handling, and patient management are expected to drive the market growth.

The formulation development outsourcing market in the UK is anticipated to grow at a significant CAGR over the forecast period. Advanced knowledge, innovative technologies, and cost-effective research services primarily boost market expansion. In addition, the rising need for efficient drug delivery systems that help clients reach the ideal dosage form for faster commercialization is anticipated to boost market growth.

Key Formulation Development Outsourcing Company Insights

The key players operating across the market are adopting in-organic strategic initiatives such as partnerships, mergers, acquisitions, service launches, partnerships & agreements, and expansions to gain a competitive edge in the market.

For instance, in April 2024, Baxter International Inc. expanded its pharmaceutical portfolio with five injectable product launches in the U.S. market. The new products include Vasopressin in 0.9% Sodium Chloride Injection, Norepinephrine Bitartrate in 5% Dextrose Injection, Vancomycin Injection, Regadenoson Injection pre-filled syringe and Ropivacaine Hydrochloride Injection.

Key Formulation Development Outsourcing Companies:

The following are the leading companies in the formulation development outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS S.A.

- Intertek Group plc

- Recipharm

- Lonza

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Element

- Labcorp

- Thermo Fisher Scientific, Inc.

- Catalent Inc.

Recent Developments

-

In April 2024, CoreRx Inc. acquired Societal CDMO Inc. for USD 130 million. Societal CDMO specializes in addressing complex formulation and manufacturing challenges, particularly for small molecule therapeutics. This acquisition enhanced CoreRx's capabilities in formulation development, early-stage production, clinical trial services, commercial-scale manufacturing, and various packaging solutions, benefiting both existing and new clients.

-

In July 2023, Aenova Group and Galvita announced a collaboration to improve the formulation, manufacturing, and development of oral dosage forms.

Formulation Development Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.12 billion

Revenue forecast in 2030

USD 60.66 billion

Growth rate

CAGR of 8.62% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, formulation, therapeutic area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

SGS S.A.; Intertek Group plc; Recipharm; Lonza; Charles River Laboratories International, Inc.; Eurofins Scientific SE; Element; LabCorp; Thermo Fisher Scientific, Inc.; Catalent Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Formulation Development Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global formulation development outsourcing market report based on service,formulation, therapeutic area, end-use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Preformulation

-

Formulation Development

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease

-

Neurology

-

Hematology

-

Respiratory

-

Cardiovascular

-

Dermatology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Government and Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherland

-

Switzerland

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global formulation development outsourcing market size was estimated at USD 37.27 billion in 2024 and is expected to reach USD 40.12 billion in 2025.

b. The global formulation development outsourcing market is expected to grow at a compound annual growth rate of 8.62% from 2025 to 2030 to reach USD 60.66 billion by 2030.

b. The Asia Pacific dominated the formulation development outsourcing market with a share of 45.50% in 2024. The presence of a significant number of CROs offering cost-effective formulation development, growing pharmaceutical spending, improved healthcare infrastructure, and the growing burden of diseases are expected to drive market growth. In addition, CROs offering low manufacturing costs attract many pharmaceutical companies from developed nations to outsource their manufacturing, further contributing to market growth.

b. Some key players operating in the formulation development outsourcing market include SGS S.A., Intertek Group plc, Recipharm, Lonza, Charles River Laboratories International, Inc., Eurofins Scientific SE, Element, Labcorp, Thermo Fisher Scientific, Inc., Catalent Inc.

b. The increased demand for new drug development, the growing prevalence of chronic diseases, the rising focus on regulatory requirements for high-quality products, and the emergence of specialty pharmaceuticals are contributing to the demand for formulation development services globally. Besides, significant investments in research and development (R & D) to develop therapeutics contribute to market growth. Moreover, rising need for oral medications, injectables, biologic active pharmaceutical ingredients (APIs), and viral vectors drives the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.