- Home

- »

- Consumer F&B

- »

-

U.S. Frozen Pizza Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. Frozen Pizza Market Size, Share & Trends Report]()

U.S. Frozen Pizza Market (2023 - 2030) Size, Share & Trends Analysis Report By Toppings (Margherita, Chicken, Pepperoni, Sicilian, Bacon, Breakfast), By Crust (Thin, Regular/Restaurant Style, Gluten-free), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-034-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

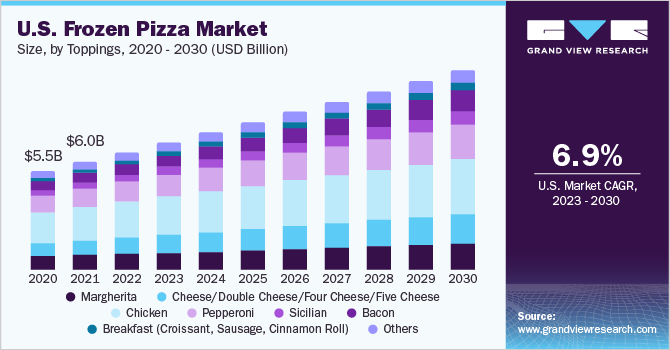

The U.S. frozen pizza market size was valued at USD 6.62 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Consumers have been compelled to seek convenient food options owing to hectic lifestyles, fueling the growth. The growth is further driven by factors such as a rise in the standard of living and increased disposable income. Different types of frozen pizzas are available. These include extra thin crust, regular thin crust, classic/thick crust, deep-dish, stuffed crust, and rising crust. Growing health consciousness among consumers and the rising prevalence of gluten allergy have contributed to the popularity of gluten-free frozen pizzas.

One of the main reasons people choose to buy these products is due to their quick and easy preparation. With busy schedules, many individuals do not have the time to cook from scratch, and frozen food offers a convenient solution. In addition to being convenient, these products also have a longer shelf life than fresh food, allowing people to stock up on these items and have them on hand when they need them.

In addition, the quality of the frozen pizza remains consistent as it is processed and packaged at its peak freshness. Owing to the constant quality of these products despite their storage in the freezer for a longer period it is a popular choice among a huge consumer base. Several market participants are also looking for new and innovative technologies to accelerate the production of frozen pizzas with a variety of flavors and toppings.

To improve the freshness and quality of frozen pizza, manufacturers have begun investing in R&D to develop innovative and new freezing technologies. Technological advancements have led to the development of the quickest freezing technologies, including impingement freezing, magnetic resonance-assisted freezing, hydro-fluidization freezing, and high-pressure-assisted freezing.

A significant opportunity for manufacturers is presented when freezing products with liquid nitrogen, thereby driving market expansion. Due to operational excellence, major players such as Nestlé and General Mills have enjoyed a cost advantage despite the rising cost of raw materials.

Hectic lifestyles have compelled consumers to seek out convenient solutions. The growth of the market for frozen food is driven by the rising demand for convenience foods. Today, frozen pizzas are regarded as premium foods. These include regular thin crust, extra thin crust, deep-dish, as well as stuffed crust, classic/thick crust, and rise crust. Other factors, such as an increase in disposable income, a rise in the standard of living, and the rapid expansion of the number of large retail chains, also contribute to the growth.

The growing popularity of vegan frozen or gluten-free foods has contributed to market growth. One of the most prominent food trends in the U.S. is plant-based food. Therefore, the traditional cheese, grease-laden, and meat pizzas are being replaced by cauliflower crust, vegan mozzarella, and plant-based pepperoni are replacing. People are now more conscious about what they eat and are seeking healthier alternatives to traditional ones that contain meat and wheat.

Vegan pizzas cater to the growing number of people who follow a plant-based diet and prefer to avoid animal-derived foods, while gluten-free pizzas cater to those with celiac disease or gluten intolerance, who cannot consume wheat. In addition, consumers are also looking for options that align with their ethical and environmental values, which is driving the demand for vegan and gluten-free pizza options. The increasing number of consumers with dietary restrictions and the growing popularity of plant-based diets have led to a surge in demand for these types of pizzas.

Gluten is a protein typically found in barley, wheat, and certain other foods. The crust of frozen pizza generally contains gluten. Approximately 1% of the population has been diagnosed with celiac disease, a disorder of the small intestine characterized by an inability to digest gluten-containing foods. Therefore, the demand for gluten-free frozen pizza has increased due to the rise in the number of people with celiac disease and health-conscious consumers. Manufacturers have begun to prioritize gluten-free organic and natural ingredients.

Toppings Insights

The chicken segment dominated the market with the highest share of over 30% in 2022. Chicken topping is more popular than other traditional toppings as it provides a new flavor option and adds protein to the meal. Chicken is a versatile topping that can be seasoned in many different ways to create unique flavor combinations.

Additionally, chicken is a lean protein source that is considered healthier than some other toppings like sausage or pepperoni. The popularity of chicken topping has also been driven by the growth of fast-casual restaurants and the trend toward healthier eating. With the rise of these trends, many people have come to view chicken topping as a more nutritious alternative to traditional toppings.

The bacon segment is anticipated to grow at the fastest CAGR of 9.5% over the forecast period. Bacon topping is popular because bacon has a savory, salty, and slightly smoky flavor that is well-liked by many people. It adds a unique taste to the pizza that many people find enjoyable, making it a common topping option. Additionally, the combination of bacon and melted cheese on top of a crispy crust is a popular and satisfying choice for many people.

Furthermore, bacon is a versatile ingredient that can be combined with a diverse topping profile, making it a popular option for customizing pizzas. It also appeals to different dietary preferences, as it can be used to add protein and flavor to vegetarian pizzas or as a topping for meat-based pizzas. The popularity of bacon topping is also due to cultural and regional differences, with some countries and regions having a strong tradition of using bacon as a pizza topping. Thus, the above-mentioned factors are contributing to the segment’s growth.

Crust Insights

The regular/restaurant style segment dominated the market with the highest share of over 55% in 2022. Regular or restaurant-style frozen pizza is widely popular among consumers due to its classic taste, large size, versatile toppings, convenience, and social aspect. Regular pizza's traditional flavor has been refined over the years in pizzerias and restaurants, making it the most delectable food option.

Additionally, the large size of restaurant-style pizzas makes it a good option for families or groups to share. The versatility of toppings allows customers to choose from a variety of ingredients to suit their tastes and preferences. Regular pizzas can also be easily ordered and delivered, making them a convenient food option for busy individuals. Furthermore, eating pizza is often a social activity, and restaurant-style pizza provides a familiar and enjoyable experience for customers. The combination of these factors makes regular or restaurant-style pizza a popular choice among consumers.

The gluten-free segment is anticipated to grow with the fastest CAGR of 9.2% over the forecast period. Demand for gluten-free frozen pizzas is increasing as more people are diagnosed with celiac disease, gluten intolerance, or follow a gluten-free diet for other health reasons. To maintain a balanced diet, people require gluten-free food options, including pizza.

As individuals become more conscious of the medical benefits of a gluten-free diet, more people are opting for gluten-free options, including pizza. Companies are investing in R&D to create gluten-free pizza crusts that taste and feel like traditional crusts, making them more appealing to a wider range of consumers. To reduce their environmental impact, companies are investing in sustainable sourcing of ingredients as well as sustainable packaging; this is becoming an increasingly important factor for consumers when selecting food products.

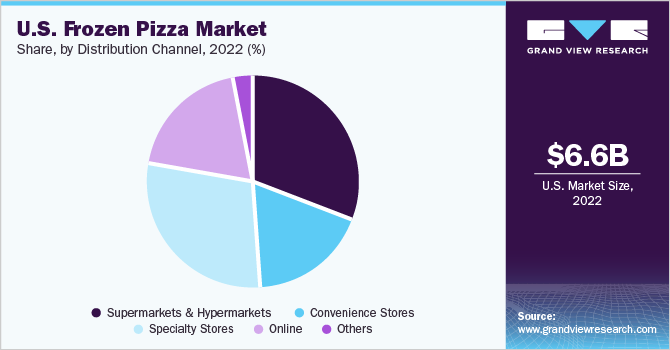

Distribution Channel Insights

The supermarkets & hypermarkets segment led the market with the highest share of over 30% in 2022. Shifting consumer preferences towards frozen food coupled with a rise in the working-age population have changed consumers’ buying patterns. Supermarkets offer a wide variety of frozen foods especially pizzas and other alternatives, which makes it easier for consumers to purchase the products.

The pandemic has shifted the landscape of frozen food through online stores and mobile applications. Furthermore, instant availability and changing lifestyles are the two major factors propelling the sales of products through this distribution channel. International players follow the consumer-centric model and offer products that are currently trending in the market through physical channels, including supermarkets/hypermarkets. This factor is likely to boost the sales of frozen food products through this segment over the forecast period.

The online segment is anticipated to grow at the fastest CAGR of 11.2% over the forecast period. Customers prefer to buy frozen food online as it allows them to shop for a variety of brands and products in one location. Furthermore, various online channels provide products at comparatively lower prices than traditional retail stores. These factors are likely to increase sales via the online channel.

Consumer engagement in the frozen pizza market has improved due to the online distribution channel. Furthermore, value-added services provided by e-retailers such as money-back policies, heavy discounts, free shipping, the availability of a wide range of international brands, and pay-after delivery are driving anti-aging product sales through this channel. Growing internet penetration and technical advances are also contributing to increased online sales of frozen pizzas.

Regional Insights

Southwest region dominated the market with a share of around 30% in 2022. The Southwest region of the U.S. is seeing a rising demand for frozen pizza, and this can be attributed to several factors. Frozen pizza is becoming more and more popular as a convenient option for busy families and individuals who are looking for quick and delicious meal options. As people's lifestyles become increasingly fast-paced, they are turning to frozen food as a simple and easy solution. The quality of frozen pizzas has also improved significantly in recent years, which has made them a more attractive option for consumers.

The Northeast region is estimated to grow at the highest CAGR of 8.3% over the forecast period. The increasing demand for frozen pizza in the U.S. can be attributed to a combination of convenience, variety, and affordability. With consumers becoming busier, there is a growing demand for quick and easy meals. Frozen pizza fits this requirement and offers a hot meal in a matter of minutes.

The market players also offer a wide range of flavors and dietary options for consumers to choose from. Their selections cater to the diverse tastes and needs of consumers. In addition, the rising demand for ready-to-eat and processed foods is a major growth driver. Frozen pizza is a budget-friendly option compared to restaurant or takeout pizza, making it an attractive choice for consumers looking to save money.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In November 2022, Dr. Oetker through its brand The Good Baker launched The Meat-Free Chicken Style pizza, which comes with its signature stone-baked crust, along with marinated chicken-style pieces, creamy mozzarella, and other toppings.

-

In October 2022, Schwan's Consumer Brands, Inc. launched 5 new pizzas and frozen pies aimed at increasing its home delivery product options.

-

In September 2022, Schwan's Consumer Brands, Inc. a new pizza brand called Hearth & Fire. The launch included digital ads on Vox Media and Kroger’s website, as well as content on the new brand's website and social channels

Some prominent players in the U.S. frozen pizza market include:

-

Nestlé

-

Amy's Kitchen, Inc.

-

Schwan's Consumer Brands, Inc.

-

Bellisio Foods, Inc.

-

Hansen Foods, LLC

-

One Planet Pizza

-

Dr. Oetker

-

Rich Products Corporation

-

Ajinomoto Foods North America

-

Frozen Specialties Inc.

-

Miracapo Pizza Company

-

Richelieu Foods, Inc.

-

K.T.'s Kitchens Inc.

-

Molinaro's Fine Italian Foods Limited

-

Champion Foods, LLC

-

Lucia’s Pizza

-

No Limit, LLC

-

Wegmans Food Markets

-

Screamin’ Sicilian Pizza

U.S. Frozen Pizza Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 11.33 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Toppings, crust, distribution channel, region

Regional scope

Northeast; Southeast; Southwest; West; Midwest

Key companies profiled

Nestlé; Amy's Kitchen, Inc.; Schwan's Consumer Brands, Inc.; Bellisio Foods, Inc.; Hansen Foods, LLC; One Planet Pizza; Dr. Oetker; Rich Products Corporation; Ajinomoto Foods North America; Frozen Specialties Inc.; Miracapo Pizza Company; Richelieu Foods, Inc.; K.T.'s Kitchens Inc.; Molinaro's Fine Italian Foods Limited; Champion Foods, LLC; Lucia’s Pizza; No Limit, LLC; Wegmans Food Markets; Screamin’ Sicilian Pizza

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Frozen Pizza Market Report Segmentation

This report forecasts growth at the country level and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the U.S. frozen pizza market report based on toppings, crust, distribution channel, and region:

-

Toppings Outlook (Revenue, USD Million, 2017 - 2030)

-

Margherita

-

Cheese/Double Cheese/Four Cheese/Five Cheese

-

Chicken

-

Pepperoni

-

Sicilian

-

Bacon

-

Breakfast (Croissant, Sausage, Cinnamon Roll)

-

Others

-

-

Crust Outlook (Revenue, USD Million, 2017 - 2030)

-

Thin

-

Regular/Restaurant Style

-

Gluten-free

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Northeast

-

Southeast

-

Southwest

-

West

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. frozen pizza market size was estimated at USD 6.62 billion in 2022 and is expected to reach USD 7.19 billion in 2023

b. The U.S. frozen pizza market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 11.33 billion by 2030.

b. Chicken toppings segment dominated the market with a share of 31.5% in 2022. Chicken pizza is more popular than traditional pizza as it provides a new flavor option and adds protein to the meal

b. Some key players operating in the U.S. frozen pizza market include Nestlé, Amy's Kitchen, Inc., Schwan's Consumer Brands, Inc, Bellisio Foods, Inc., Hansen Foods, LLC, One Planet Pizza, Dr. Oetker, Rich Products Corporation, Ajinomoto Foods North America, Frozen Specialties Inc., Miracapo Pizza Company

b. Key factors driving the market growth include convenience due to their quick and easy preparation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.